Indirect Procurement : Biggest Untapped Value Driver in Health & Life Sciences Companies

As the healthcare sector continues to respond to COVID-19, the pandemic is prompting serious questions about managing costs and spending.

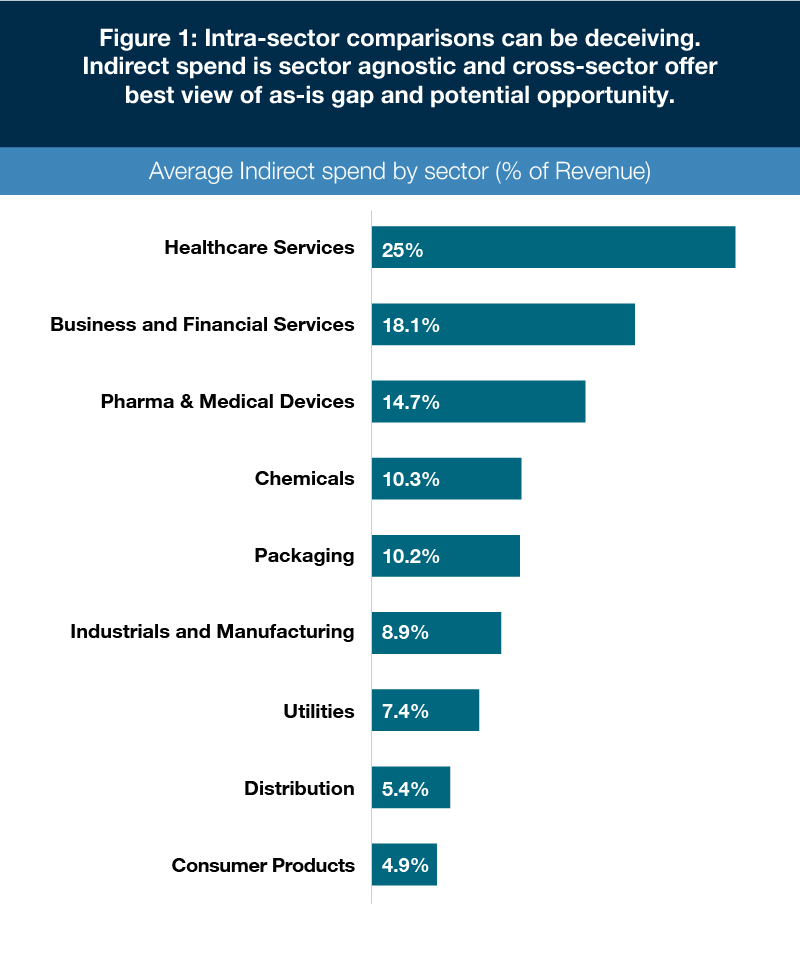

As a proportion of revenue, indirect spend (i.e., products and services procured externally, such as IT and facilities) is higher in the healthcare sector than any other industry (see Figure 1). Why do healthcare services companies stand out here? Firstly, it may well be an inevitable consequence of a healthcare organisation’s purpose: success is principally defined by patient outcomes, with revenue and earnings being evidence of efficient and successful medical care.

Additionally, closeness to the ‘customer’ is not optional: there is a limit to the number of processes that can be outsourced to low-cost countries given healthcare depends on people caring for other people.

Meanwhile, highly centralised healthcare systems in Europe have potentially contributed to a lack of institutional knowledge on procurement best practices within organisations. If negotiating power is reduced by a dependence on one overarching body, the value added by seasoned in-house professionals is inevitably reduced.

Healthcare is one of several industries adapting to spend management challenges with

collaborative buying programmes. Group Purchasing Organisations (GPOs) like CoreTrust have leveraged scale to help improve margins for companies and PE investors alike, optimising spend on clinical items such as sutures and consumables, for instance. However, when it comes to indirect procurement, GPO structures simply do not exist in the same fashion.

In good times, these issues are not necessarily major causes for concern. After all, years of reliable growth in the healthcare sector has allowed executives to focus on generating revenues rather than trimming costs. But COVID-19 means the economic logic of patient care is changing. Increased expenditure on health and safety is a reality for the foreseeable future and extended social distancing measures will affect the number of achievable daily interactions. In this context, investors and management teams are seeking to preserve margins by reorienting to focus on operational improvements.

In our view, indirect procurement should sit at the core of these operational improvements. A few key action points could arm enable healthcare services organisations to enhance the effectiveness and maturity of indirect procurement functions.

Focus on the people

Procurement depends on people, and when it comes to indirect procurement the shop floor and the boardroom need to be aligned. Because developing more in-house expertise means taking more end-to-end ownership of indirect procurement processes, it is vital to get real leadership buy-in on the proposed changes. Boosting in-house knowledge requires investment: procurement cannot be anyone’s part-time responsibility. What might seem like small amounts to a local budget-holder can quickly add up even for mid-size providers. Companies need professional procurement experts to drive maximum value from these purchasing decisions.

Look at core cost drivers

- Low spend transparency in terms of unit prices, volumes and specifications

- A disconnect between individual spending decisions and the overall strategic plan

- The inability to challenge spend drivers because of existing organisational dynamics and hierarchies

Learn from the best - no matter the sector

Healthcare is an extremely diverse industry, and there is no one playbook that will work for a pharmaceuticals business, a surgical device manufacturer and a care home operator. However, every agile and responsive business understands that great ideas and best practices can come from anywhere.

In sectors like digital and technology, for example, forward-thinking companies (Microsoft is a good example) have adopted business process outsourcing (BPO) of non-core services as a ‘default’ from the very start. BPO enables leadership and staff to focus only on building and optimising critical functions. In addition, leveraging timely and actionable data represents a tangible step forward from running monthly or quarterly internal reviews.

The adoption of digital platforms and ‘analytics as a service’ providers can also help internal and external stakeholders collaborate effectively and optimise spend. The design principles underlying these initiatives apply to healthcare businesses too, and should not be forgotten as management teams embark on indirect procurement transformations.

When scoping these opportunities, it is important to remember not to be seduced by benchmarks. Benchmarks can be helpful guides, but theory and reality are always different. Companies should take pains to understand the operating context on the ground and work from empirical fact bases first and and foremost.

Case studies: What to expect from an A&M procurement engagement

Our operating expertise helps investors and management teams rapidly build procurement capability and deliver sustainable savings, in and outside M&A contexts. Our restructuring DNA helps us size the prize, prepare actionable value creation plans and deliver rapid results. Key to our success is small but impactful teams of hybrid ‘operator / advisor’ practitioners with proven operating credentials as procurement leaders and P&L budget-holders.

A&M practitioners also undertake interim CPO roles, simultaneously shaping the performance improvement agenda while providing day-to-day 'executive' leadership. This structure helps our clients realise tangible P&L value at pace while their teams build long-term capability by learning on the job.

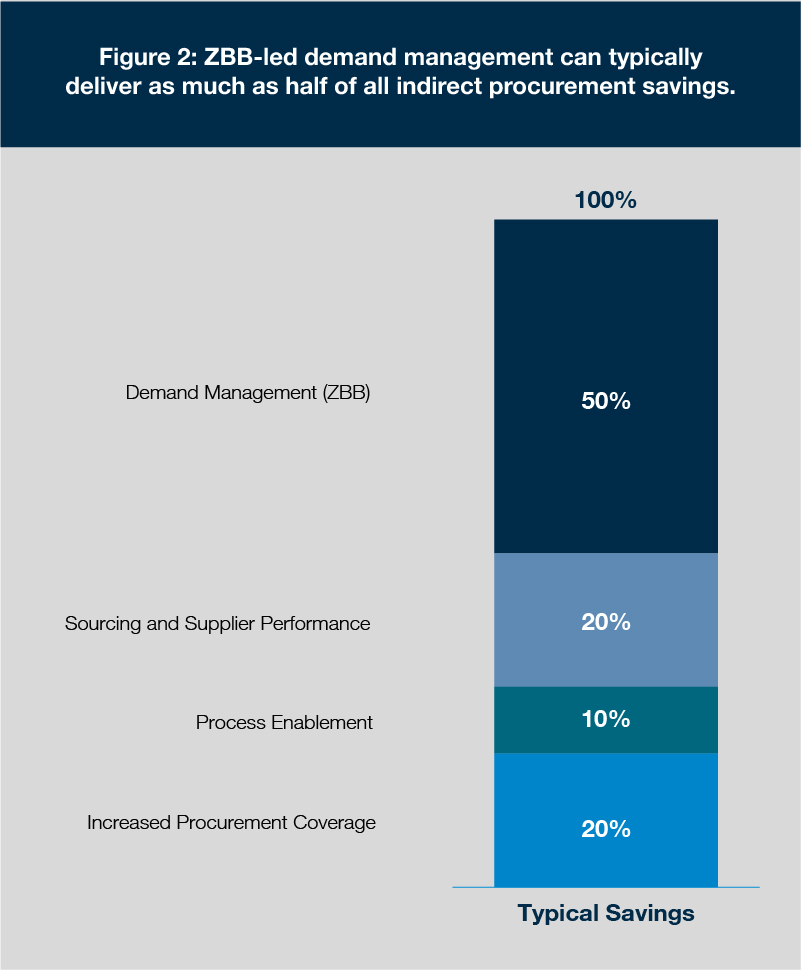

A&M has road-tested toolkits to size company-specific levers and rapidly optimise spend across categories and sub-categories. We use Zero-Based Budgeting methodologies not as a one-off exercise but as a core component of a sustainable transformation. We always seek to connect savings and performance improvement measures (see below). Click here to expand the below table.

Two effective transformations leveraging indirect procurement

Two effective transformations leveraging indirect procurement

|

Procurement organisation design and process controls |

Procurement spend optimisation and improvement |

|

Context:

A&M Role:

Result:

|

Context:

A&M Role:

Result:

|

If you are interested in discussing how we could help you through indirect procurement implementation, please get in touch with one of our experts Raymond Berglund, David Jones and Naresh Kumar.

Those interested in learning more about A&M’s Pragmatic-ZBB and procurement playbooks can read our full reports on these issues: