Biosimilars: where will the market be in five years?

Marking 15 years of biosimilars: will consolidation define the next few years?

In healthcare and life sciences, ‘birthdays’ are always worth celebrating. This April, we will reflect on the 15th anniversary of the first biosimilar to be approved in Europe.

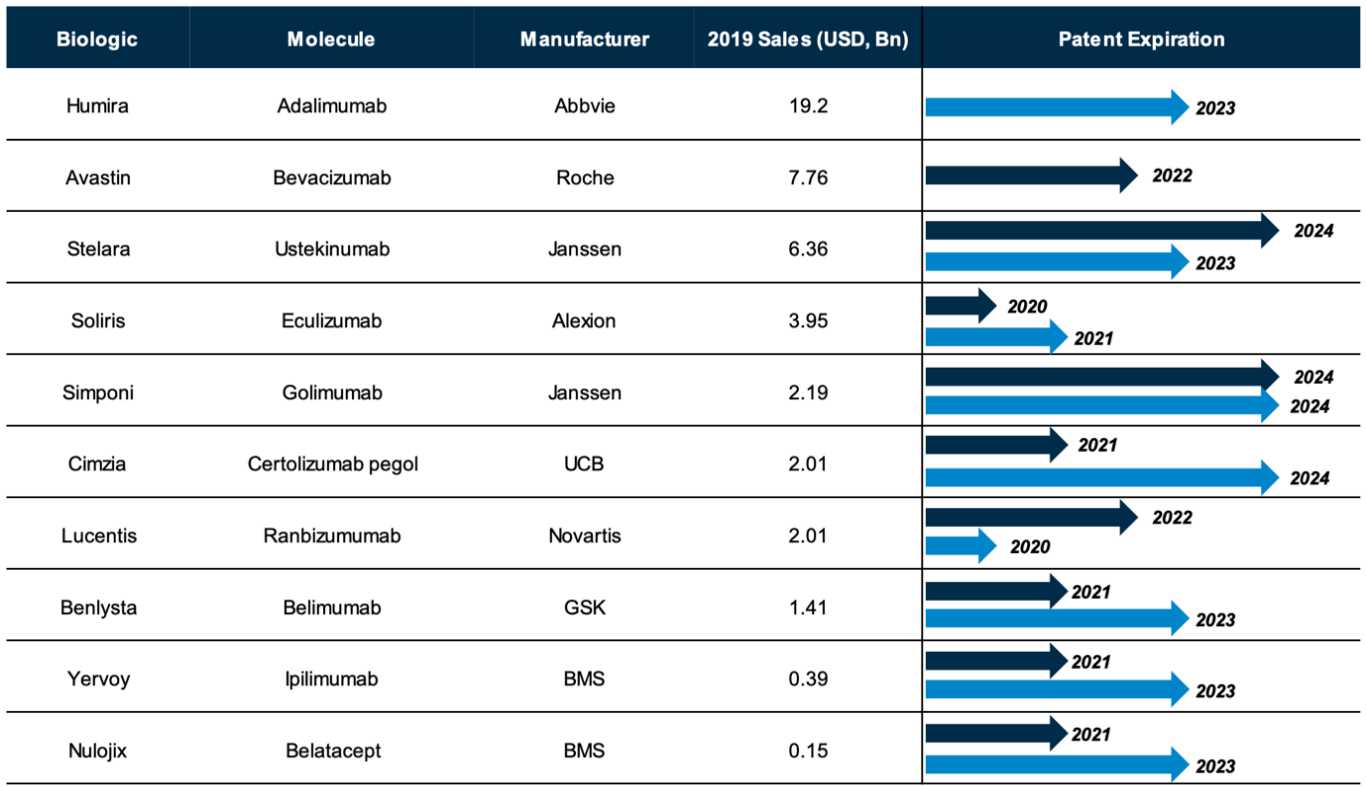

Since 2006, when Sandoz’s omnitrope was approved for use, healthcare systems around the world have continued to innovate and evolve. The biosimilars market is still changing quickly, of course, and developments are unlikely to slow down any time soon. In the next four years, 10 significant biologics drugs will lose their patent protection (see Figure 1).[1] This is an unprecedented shift in a high-potential space that could lead to a substantial amount of investment and consolidation in the next few years.

When all this activity still ahead, where will the biosimilars market be a few years from now? Which companies will be the key drivers of market movements? And which themes are likely to drive decision-making along the way?

Consolidation themes

Biosimilars are derivatives of biologic products where manufacturers aim to produce close copies of the original biologic molecule. Unlike with generics, which are replicas of small and less complex molecules, companies investing in biosimilars will face very high fixed costs and capital expenditure. Developing a typical biosimilar product can cost anywhere from $150 million to north of $200 million – and regulatory, manufacturing and commercial support costs also need to be factored in. All this investment creates a product that sells at a ‘discount’ of between 10% and 30% compared to the originator biologic.

[1] Source: A&M analysis.

The biosimilars market is anticipated to grow to $24.5bn by 2025 at a CAGR of 29.9%. Although the space is currently quite fragmented, we have begun to see more consolidation conversations happening. As the overall pool of biosimilars expands in the coming years, this trend promises to pick up pace.

We believe that consolidation will have a positive effect on the market as a whole. Competitive innovation in a consolidating market should help to drive prices lower, which we expect in turn to generate increased demand. Companies will also benefit from lower costs as a result of post-consolidation synergies. As more drugs go off-patent in the years ahead, these dynamics will help biosimilars embed further into the global healthcare system.

In our view, the market leaders five years from now are likelier to be pharmaceutical and life sciences incumbents rather than totally new players. Certainly, each pharmaceutical company has a strategic choice to make: will they treat biosimilars as a core growth pillar in the years to come, or will market share and innovation lie elsewhere?

These decisions will lead to significant transaction activity. Biosimilar divisions of big pharmaceuticals companies may be targets for carve-outs or acquisitions. Strategic assets within biotech companies and generics specialists may also prove worthwhile targets.We expect that this will create many opportunities for private equity interest in the space. A buy-and-build strategy that ‘rolls up’ smaller and mid-size pharmaceutical assets could create significant value if management and investors are able to capitalise on economies of scale while reducing overheads in sourcing and supply chain. The investment thesis behind M&A matters too: are deals designed to competitively differentiate around a particular geographic focus, for instance, or highlighting a high-potential therapeutic area such as oncology? Private equity may well play a critical role in stimulating further consolidation and innovation in the years ahead.

Timing activity: wait and see or drive the market?

Another key question for executives is how to time a programme of activity that moves the needle on biosimilar market share and growth. The stakeholders that can move quickly have the opportunity to drive the market and cement positions at the front of the pack. In the U.S., for example, which is a few years behind Europe in terms of biosimilar maturity, Amgen and Allergan have partnered to develop market-leading oncology products. Amgen sees biosimilars as complementary to its existing portfolio of biologics, providing additional portfolio diversity at competitive price points.

However, there is always a chance that market developments will work against early movers: big movements in the biosimilars space may attract the attention of competition authorities and regulators. For more on this subject, read this analysis created by our Disputes & Investigations team. This could favour stakeholders that want or need to take a ‘wait and see’ approach.

The biosimilars market will change at a rapid rate over the next five years. Europe is still the market leader, and the coming years should see North American and Asian markets becoming more relevant. Despite high barriers to entry and a fragmented market, new products coming to market promise to revolutionise the space in the next five years. We hope that by the 20th anniversary of the first biosimilar, the space is playing an even more active role in solving global healthcare challenges.

A&M: Leadership. Action. Results.

A&M has worked with some of the largest European and global organisations to transform operations and accelerate growth through decisive action. A&M’s Health and Life Sciences team brings decades of experience and fact-based, action-oriented leadership to create value and drive rapid results for healthcare businesses. To learn more, reach out to our key contacts Ray Berglund, Schellion Horn, and Diana Wong.