Medical Technology Carve-Outs: A Corporate to Private Equity Opportunity

The medical technology and medical devices sector boasts many small businesses and a few very large businesses. ‘MedTech’ is unusual for its lack of mid-size companies that are so common in other industries. This void in the market, combined with the macro-economic impacts of the COVID-19 recession, present a unique opportunity for large corporates and private equity (PE) firms to find common ground with carve-outs.

It is not unusual for individual units within multinational MedTech businesses to be underperforming. Specific examples include Danaher’s dental platform, Bayer’s MEDRAD radiology business and Medtronic’s diabetes unit. Any organization in a similar situation must decide whether it has the capabilities and focus to turn these business units around within a strategic timeframe. If resources and bandwidth are not sufficient, and if dilutive revenue growth and shrinking profitability are the reality, we believe that corporates should shift from passively identifying these business units as ‘non-core’ and turn their attention to strengthening total shareholder value. This is where the PE carve-out opportunity comes into play.

The global private equity market is currently sitting on an estimated $1.7 trillion of ‘dry powder’ ready for deployment. This cash stems from a backlog of deals delayed due to the pandemic in 2020, as well as an influx of private funds looking for resilient and recession-proof returns. These types of assets are not easy to come by, and because of the competitive nature of the market, valuation multiples have increased significantly. PE investors looking for a more reasonable entry-point for an asset should look beyond the fund-to-fund deals and team up with corporate M&A departments for proactive partnerships. Be in no doubt: MedTech carve-outs can create win-win results.

Here, we discuss how PE ownership can re-energize these businesses, looking at the issue from the perspectives of the corporation, the business unit itself, and the PE funds.

The Corporation Perspective

Large MedTech corporations carefully select investments over three- to five-year strategic timelines. When a business unit is not delivering value as expected, senior management must choose between devoting the energy and resources to turn the unit around; accepting underperformance as simply part of a business cycle; winding the business unit down entirely; or exiting the unit through a merger, sale or IPO. In taking this last path, the company thereby accesses the cash to accelerate other parts of the organization. Danaher’s management decided to list its dental platform because it was not prepared to invest in turning around the unit, for example.

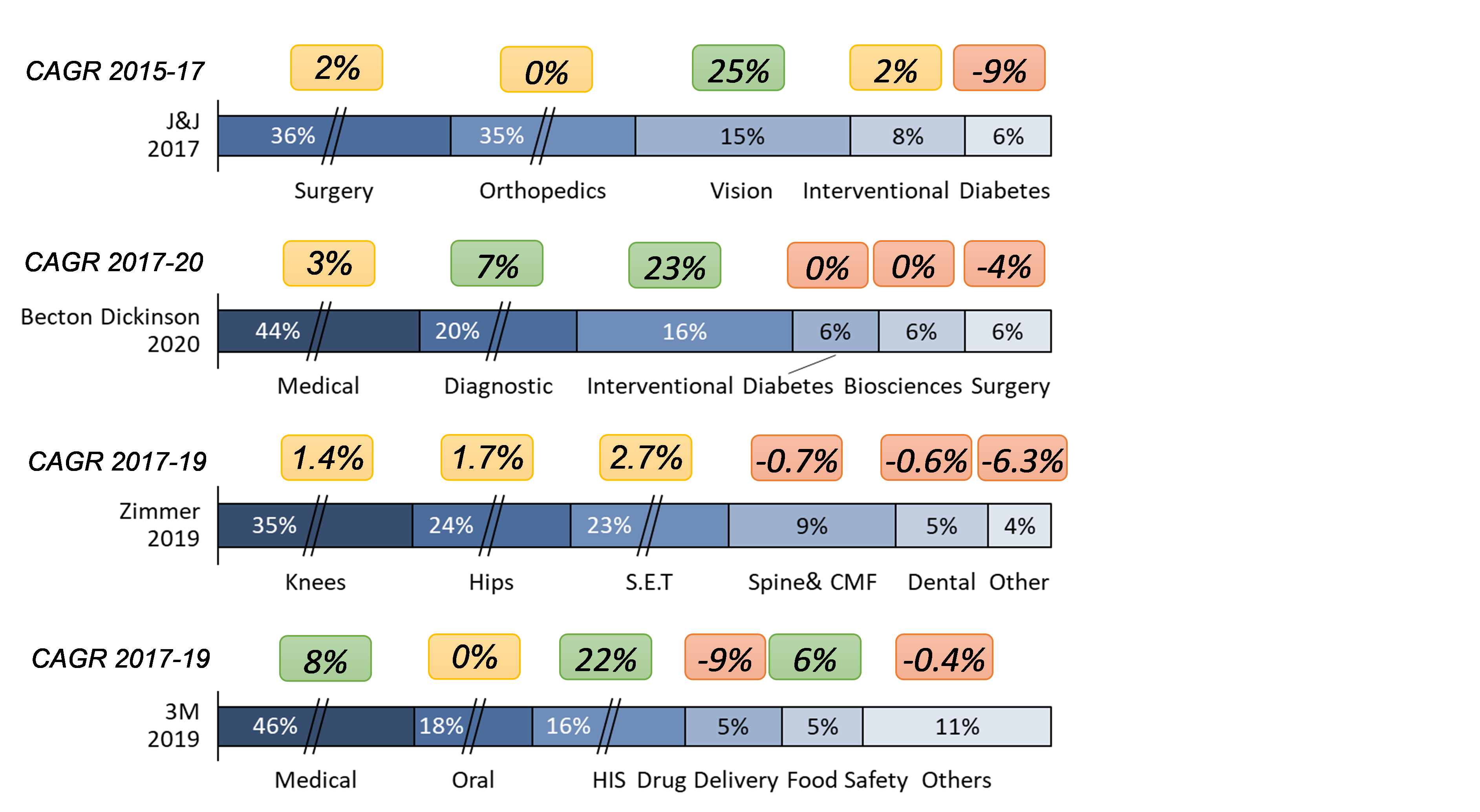

A quick overview of four well-known global MedTech organizations points to the fact that at different points in time, each business carried in its portfolio one or more units that are dilutive to growth and the overall performance of the corporation.

For Johnson & Johnson (J&J), diabetes care was a non-core business unrelated to its strengths in surgery, orthopedics and vision. It was suboptimal in terms of revenue contribution and overall growth. In 2018, J&J sold off LifeScan, its diabetes business, to Platinum Equity Partners. Platinum Equity saw tremendous opportunity for LifeScan to grow and evolve on the back of its focus on innovation and its established ‘One Touch’ brand. It also promised to augment their healthcare portfolio, making a compelling investment case for the PE firm.

Becton Dickinson (BD) also has under-performing units in diabetes, biosciences and surgery. BD has already shown willingness to carve out units in recent years, carving out its respiratory solutions business to Apax Partners in 2016, and some of these other units may present carve-out opportunities.

Similarly, global behemoths Zimmer and 3M also carry non-performing units in their portfolios, dragging down overall performance. Interestingly, Zimmer announced in February that it would put its spine and dental business units on the stock market. And a couple of months later, it was revealed that Siemens is considering putting its $1 billion ultrasound business up for sale. PE carve-outs are absolutely part of the picture for these companies and business units, and the pace of new announcements appears to be increasing.

The Business Unit Perspective

An underperforming business unit doesn’t just drain management attention and cash from the organization. It also affects the energy and creativity of the workforce. Carving these businesses out can generate positive momentum in four ways:

- Innovation velocity

- Local market responsiveness

- Rationalized product portfolios

- Entrepreneurial spirit

Innovation velocity represents the speed at which research and development investments begin to generate returns. Outside of a corporate setting there is ample opportunity to speed up innovation processes. The carved-out business will have a singular focus on its current and future opportunities, without being burdened by the competition for scarce corporate resources. Put simply, a PE-owned business can generate more products, services and solutions more quickly.

Better local market responsiveness is a result of improved management and global product organizations that bring a specialized and focused skillset to a specific market segment. The business will have more freedom to choose where it wants to compete, and which local requirements it should prioritize. Go-to-market initiatives are delivered faster compared to slower-moving global competitors.

Rationalizing product portfolios is a prime opportunity within carved-out businesses. It is both practically and psychologically difficult to rationalize a product portfolio, and in a corporate setting it can be difficult to make bold decisions. Becoming a focused standalone entity can catalyze the tough decisions that should have been made before to streamline and refocus the portfolio offerings.

Finally, unleashing the entrepreneurial spirit of an organization can be a key result of the carve-out. To unleash the creative and innovative spirit of an under-funded and potentially mismanaged business is a win for the employees and the customer base alike.

In A&M’s own experience helping organizations plan and execute carve-outs we have seen first-hand the revitalizing effect these deals can have for businesses and staff. We assisted a large healthcare corporation in carving out its women’s health business. The carved-out unit only had a fraction of the required headcount, lacking general and administrative staff and a full sales force as well as important IT infrastructure. To make matters worse, a sense of drive and urgency was missing across the business.

A&M supported the PE investor in providing a robust week-one estimate of cross-functional savings opportunities and establishing a detailed NewCo target operating model. A&M worked closely with the PE firm and the carved-out organization to develop country-specific go-to-market approaches and a structured sales force model with appropriate KPIs. While applying a disciplined approach to costs, the carve-out organization was still able to expand into four new markets, with plans for an additional six markets and other global launches in the works.

The Private Equity Perspective

‘Sleeping beauty’ MedTech carve-outs can be re-energized with a meaningful value creation plan. After realigning the investment plan, setting a strong management team in place, and making the tough decisions to streamline the business to return it to growth, a five-year exit plan at increased value is absolutely possible. One of the core missions for private equity firms is to take on abandoned and under-invested non-core businesses and to turn them around. The good news is that there are many such opportunities in the MedTech industry.

It is important to acknowledge that there are also a list of tactics to avoid in MedTech carve-outs. Based on our experience of working on these transactions, we want to highlight the need for stable and experienced leadership as well as conducting appropriate cost-out and cost reallocation exercises. While benchmarking is important, companies that let benchmarks drive the business model risk missing the inevitable factors that are unique to individual companies, from the product portfolio to manufacturing complexity.

PE investors must ensure a few key objectives are met in the course of executing a carve-out from a corporate. This includes:

- Establishing a standalone view of the asset (specifically the cost base);

- Negotiating transition service agreements; and

- Establishing the cadence of an orderly transition.

These steps help the carved-out unit quickly separate from the parent corporation and rapidly begin the journey of turnaround and growth. By unleashing the internal drive and urgency from within the carved-out business, the PE firm can create long-term value for all stakeholders.

In Summary

The conditions are right for Medical Technology carve-outs. Corporations must respond and focus their strategies on long-term growth post-pandemic. Private Equity must deploy the capital invested in them, and there are many business units with patient and therapeutic innovations that are awaiting the opportunity to shine.

A&M: Leadership. Action. Results.

A&M’s Healthcare Industry Group practice combines deep experience across life sciences including pharmaceuticals, medical technology and healthcare systems (payers and providers), as well as private equity stakeholders. If you have any questions regarding the content covered in this article, please contact one of our experts.