Human Capital Focused Legislation: Key Payroll Provisions of the CARES and FFCRA Acts

Over the past two months, the federal government has enacted several measures to provide support and relief to individuals and companies impacted by the unprecedented COVID-19 pandemic. Two of the most impactful pieces of legislation to date are the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) and the Families First Coronavirus Response Act (the “FFCRA”) (together, the “Acts”). The Acts cover a range of emergency relief items ranging from coverage of COVID-19 testing to paid sick leave and tax credits for retaining employees to small business loans. The purpose of this article is to summarize key payroll-related provisions of the Acts that are impacting employers today and provide readers with A&M’s additional insight.

Paycheck Protection Program

The Paycheck Protection Program (the “Program” or “PPP”) provides an unprecedented forgivable loan program for certain “small businesses and organizations.” The purpose of the PPP is to provide liquidity to small businesses (generally those with no more than 500 employees) in order to cover the costs of payroll and various other overhead costs during this economic downturn. The PPP turned out to be so popular that the initial $349 billion funding was depleted within the first week, and $310 billion of additional funding was subsequently added to the Program.

During the “covered period” between February 15, 2020, and June 30, 2020, an eligible recipient may apply for a covered loan equal to the lesser of:

- 2.5 x average monthly payroll costs, or

- $10 million.

For this purpose, average monthly payroll costs are determined based on the 12-month period prior to the loan issuance, as opposed to the 2019 calendar year. Certain adjustments and elections may be made for seasonal employers that were not in operation between February 15, 2019 and June 30, 2019, and for new businesses (provided they were in business by February 15, 2020 at the latest).

While a narrow reading of “payroll costs” might lead employers to look specifically to Internal Revenue Code (“IRC”) Section 3121 Wages (what we all know as “W-2 wages”), the CARES Act definition includes the following amounts:

- Salary, wages, commissions, or tips (capped at $100,000 on an annualized basis for each employee);

- Employee benefits costs, including:

- Leave costs;

- Separation pay;

- Payments required for the provision of group health care benefits, including insurance premiums; and

- Payment of any retirement benefits.

- Employer share of state and local taxes assessed on compensation; and

However, expressly excluded from the payroll cost base are the following:

- Independent contractor payments,

- Wages to employees or self-employed payees in excess of $100,000 annualized for each employee,

- Any form of compensation paid to non-resident taxpayers,

- Payroll tax withholding, and

- Paid leave benefits and compensation under other COVID-19 relief programs.

Provided payroll and employment levels are maintained through the covered period and the covered loan proceeds are used for allowable uses (payroll costs, mortgage interest, rent, and utilities), the amounts spent on those categories may be forgiven (with the amount forgiven for non-payroll costs is limited to 25% of the total amount forgiven).

If an employer reduces their employee headcount or payroll during the covered period (as compared to prior periods), then the amount eligible for forgiveness may be reduced in certain circumstances. However, employers can avoid any reduction in the amount eligible for forgiveness by re-hiring employees that have been recently fired at their previous pay rate.

Employee Retention Credit

Any business that is not receiving a PPP loan should consider whether they are eligible for the Employer Retention Credit (ERC), which may provide relief for businesses that have been impacted by the COVID-19 crisis. The CARES Act provides that an employer that operates a trade or business (except those receiving a Small Business Act loan under the PPP (a “Small Business Interruption Loan”)) is entitled to a refundable credit equal to 50% of the qualified wages of each employee (maximum credit of $5,000) that are paid with respect to any calendar quarter:

- For which the employer’s operations are fully or partially suspended due to the impact of COVID-19, or

- That is within the period beginning with the first quarter in 2020 in which the employer experienced gross receipts less than 50% of the gross receipts for the same calendar quarter of the prior year and ending with the calendar quarter after the calendar quarter in which gross receipts are greater than 80% of the same calendar quarter of the prior year.

Qualified wages are limited to those paid after March 12, 2020 and before January 1, 2021 plus certain qualified health plan expenses (capped at $10,000 per employee) and the amount of qualified wages differs based on the employer’s number of employees as follows:

- Employers that averaged over 100 employees in 2019:

- Wages paid to an employee while the employee is unable to provide services during a governmental shutdown or calendar quarter with significantly lower gross receipts.

- Employers that averaged 100 or fewer employees in 2019:

- Wages paid during a governmental shutdown or calendar quarter with significantly lower gross receipts.

Qualified wages will not include any wages paid with respect to paid sick leave or family leave provided in the FFCRA, as discussed below.

Please see the section titled “Claiming Payroll Tax Credits” at the end of this article for an overview of how to claim the ERC.

Delayed Payment of Employer Payroll Taxes

In addition to the PPP and ERC, businesses should also immediately consider another key provision of the CARES Act: deferring the employer’s portion of their Social Security taxes that are due from March 27, 2020 through the end of the year.

Employers and self-employed individuals can generally defer the employer’s portion of Social Security taxes that are due from March 27, 2020 through December 31, 2020 to the following dates:

- 50% deferred until December 31, 2021; and

- 50% deferred until December 31, 2022

However, the amount eligible for deferral is cut off once an employer receives notice that any loan amounts under the PPP will be forgiven. If an employer deferred amounts prior to receiving such notice, such amounts retain its deferred status and will be payable on the dates stated above.

It is important to note that this benefit will be reduced with respect to employers who utilize certain refundable payroll tax credits, since the offsets operate to reduce the employer’s Social Security tax liability. Please see the section titled “Claiming Payroll Tax Credits” for additional detail.

Emergency Paid Sick Leave

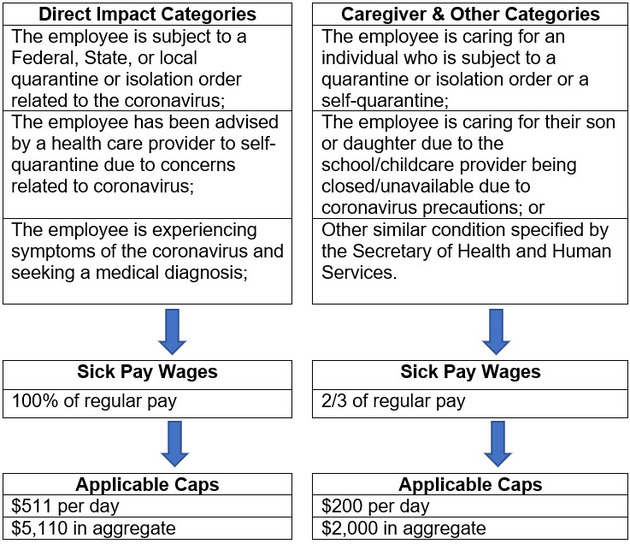

The Families First Coronavirus Response Act expands federal paid and protected leave. For paid leave, the FFCRA provides up to 80 hours of paid sick leave to full-time employees (and the number of hours generally worked on average during a 2-week period for part-time employees) that are unable to work (or telework) due to a need for leave because of the following:

- An employer cannot require an employee to use other sick time prior to using this sick time (i.e., this requirement is on top of other sick leave that is granted).

- Generally, this provision is applicable for private employers of fewer than 500 U.S. employees and public agencies (i.e., government employers). Small employers with fewer than 50 employees may qualify for an exemption if the leave payments would jeopardize the viability of the business as a going concern.

- For the benefit of employees, each employer is required to post a notice of these requirements (the Secretary of Labor has provided a model notice here).

Please see the section titled “Claiming Payroll Tax Credits” for an overview of how to claim the credit for paid sick leave.

Emergency Family and Medical Leave (EFMLA) Expansion

Additionally, the FFCRA provides 12 weeks of leave for an employee that is unable to work (or telework) due to a need to care for that employee’s son or daughter under the age of 18 if the school or place of care has been closed, or the child care provider of such child is unavailable, due to COVID-19 measures.

- Generally, this provision applies to employees that have been employed for at least 30 calendar days and to employers who have fewer than 500 U.S. employees. Small employers with fewer than 50 employees may qualify for an exemption if the leave payments would jeopardize the viability of the business as a going concern.

- The first 10 days of such leave are unpaid; however, the remaining leave is paid by the employer (for the first 10 days, an employee may take the paid sick leave relief mentioned in the section above, or use any accrued vacation, personal leave, or medical or sick leave).

- Employees are generally entitled to receive at least 2/3 of the employee’s regular pay with a cap of $200 per day and $10,000 in the aggregate.

- For the benefit of employees, each employer is required to post a notice of these requirements (the Secretary of Labor has provided a model notice here).

Please see the next section for an overview of how to claim the EFMLA credit.

Claiming Payroll Tax Credits

As part of the CARES Act and FFRCA, certain payroll tax credits are available to help offset employers’ costs under the Acts. The sick pay provision, EFMLA wages, and retention credits are reimbursable through a refundable payroll tax credit against Social Security taxes. Employers paying such qualifying wages can claim the applicable credit on their Form 941, and may offset the amount of the credit against all taxes that they would otherwise deposit with the IRS. Taxes that may be offset include the employer and employee portions of Social Security and Medicare taxes, as well as the amount withheld for the employees’ federal income tax.

If the credit exceeds the amount of taxes that would otherwise be deposited in any given pay period —so that the employer is unable to receive the benefit of the full credit using only this offset mechanism—then the employer may offset against future employment and withholding tax deposits during that quarter, or may file a claim for immediate payment of the excess credit (or even an advance on a future credit) on Form 7200. In either case, the employer will need to reconcile the offsets, advancements, and withholdings on the applicable Form 941 at the end of the quarter.

The IRS has issued guidance providing that employers will not be subject to penalties for failure to deposit taxes to the extent the amount of taxes offset by the credit, and retained by the employer, do not exceed the anticipated credits claimed by the employer.

Note that these credits will permanently reduce an employer’s Social Security tax liability, and therefore, the benefit of payroll tax deferral may be reduced or eliminated for employers receiving such credits.

Conclusion:

With the country in a state of uncertainty as to when the economy will reopen, businesses are looking for any viable positive cash flow opportunities and means to ease the distress of employees.

- The 12 month look back for payroll costs to determine the maximum PPP loan amount will require utilizing non-standard reporting (i.e., non-calendar year reporting) and as such we recommend working with your payroll provider to make sure you are using the correct payroll snapshot to substantiate your loan amount. With the finite amount of loan funding and anticipated high demand, we recommend acting fast concerning the PPP; as we have seen with the initial round, the secondary funding is anticipated to run out just as quick.

- The ERC provides partial relief for businesses that choose to keep employees on payroll and do not avail themselves of a PPP loan.

- The paid sick leave and EFMLA provisions of the FFCRA provides employees with much needed pay that’s government-funded when sick or caring for others due to the COVID crisis.

- With different types of relief and tax credits available, employers should weigh their options to see what makes the most sense for their particular circumstances.

In light of these challenging times, companies should act quickly to take advantage of the relief provided by these Acts. As new guidance is being provided on a daily basis, employers should stay tuned for additional insight.