What the “Families First Coronavirus Response Act” Means for Employers

On March 18, 2020, President Trump signed the Families First Coronavirus Response Act into law (the “Act”). The Act covers a range of emergency relief items ranging from coverage of COVID-19 testing to paid sick leave to budgetary effects. The purpose of this Special Tax Alert is to summarize the employer-related impacts of the Act and provide readers with A&M’s additional insight.

Emergency Family and Medical Leave Expansion

The Act provides 12 weeks of leave for an employee that is unable to work (or telework) due to a need to care for employee’s son or daughter under the age of 18 if the school or place of care has been closed, or the child care provider of such child is unavailable, due to a public health emergency (with respect to COVID-19).

- This provision applies to employees that have been employed for at least 30 calendar days and to employers who have fewer than 500 employees.

- The Secretary of Labor is authorized to issue regulations that exclude employers who have fewer than 50 employees when the imposition of the paid leave would jeopardize the business as a going concern.

- The first 10 days of such leave are unpaid, however the remaining leave is paid by the employer. This section of the Act provides a formula to calculate the amount that needs to be paid to the employee, but generally provides that it is at least 2/3 of the employee’s regular pay with a cap of $200 per day and $10,000 in the aggregate.

- An employee may elect to substitute the first 10 days of unpaid leave with accrued vacation, personal leave, or medical or sick leave.

- The employee is generally entitled to return to his or her job, unless the employer has fewer than 25 employees and meets other requirements.

- For the benefit of employees, each employer is required to post a notice of the requirements described in this section of the Act. The Secretary of Labor is required to provide a model notice no later than 7 days after enactment (i.e., March 25, 2020).

Emergency Paid Sick Leave

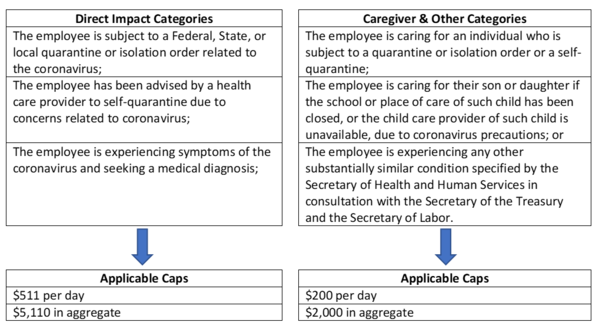

Furthermore, the Act provides up to 80 hours of paid sick leave to employees that are unable to work (or telework) due to a need for leave because of the following:

- The amount of paid sick time is 80 hours for full-time employees and a number of hours equal to the number of hours that such employee works on average over a 2-week period for part-time employees. This section of the Act provides a formula to calculate the amount that needs to be paid to the employee subject to the applicable caps listed above by category.

- This paid sick time does not carryover to another year and an employer cannot require an employee to use other sick time prior to using this sick time (i.e., this requirement is on top of other sick leave that is granted).

- Employers cannot require employees as a condition of taking such leave to find replacement employees for their hours and discrimination of employees who utilize leave is prohibited (subject to penalties under the Fair Labor Standards Act).

- There are specific rules regarding who is an “employee” and “employer,” but generally this provision is applicable for private employers of fewer than 500 employees and public agencies (i.e., government employers).

- For the benefit of employees, each employer is required to post a notice of the requirements described in this section of the Act. The Secretary of Labor is required to provide a model notice no later than 7 days after enactment (i.e., March 25, 2020).

Tax Credits for Paid Sick and Paid Family and Medical Leave

Additionally, the Act provides for payroll tax credits with respect to the employer-paid Family and Medical Leave Act (FMLA) and sick leave.

- FMLA: Employers are eligible for a credit against payroll taxes equal to 100% of FMLA leave paid by the employer with respect to such quarter.

- Sick Leave: Employers are eligible for a credit against payroll taxes equal to 100% of the sick leave described above paid by the employer with respect to such quarter. The credit is increased by the certain of the employer’s health plan expenses properly allocable to the qualified sick leave wages.

- To the extent the amount of the credit exceeds the payroll taxes due/paid, the employer is entitled to a refund.

- To the extent the credit is taken, there are anti-duplication provisions.

Emergency Unemployment Insurance Stabilization and Access

The Act also provides that the Federal government will make additional funds available for state unemployment programs and ease the eligibility requirements for individuals to receive unemployment compensation.

- The main onus on employers from this provision is a notification requirement.

- Employers are required to provide notification of the availability of unemployment compensation to employees at the time of separation from employment. Such notification may be based on model notification language issued by the Secretary of Labor.

- Additionally, states are required to non-charge employers directly impacted by COVID–19 due to an illness in the workplace or direction from a public health official to isolate or quarantine workers.

Overarching Provisions & Key Dates for the Act:

- The Act is effective no later than 15 days after enactment (i.e., April 2, 2020).

- The provisions of the Act expire December 31, 2020.

- Certain health care providers and emergency responders are generally excluded from the definition of eligible employee in this Act.

Alvarez & Marsal Taxand Says

It is important for employers to understand this new law and be prepared to comply with it. As this Act was drafted and signed into law at warp-speed, there will undoubtedly be areas of confusion and ambiguity. Also, the Senate has just recently proposed a new act (the CARES Act) that could possibly modify certain provisions contained in this Act. Below are some additional insights from A&M:

- Although the requirements of this Act are generally only applicable to employers with 500 or fewer employees, many larger employers may feel pressure to follow suit. If so, it appears this Act will provide a payroll tax credit to smaller employers, without having to provide a similar tax break to larger employers.

- The Act has many employer notice requirements, so employers will need to be careful about what is and is not communicated to employees during this uncertain time.

- We still need guidance around what certain terms mean or how they will be interpreted.

Stay tuned and do not hesitate to reach out to A&M for additional guidance and clarity as this emerging topic evolves.