An Introduction to the World of Bankruptcy Compensation

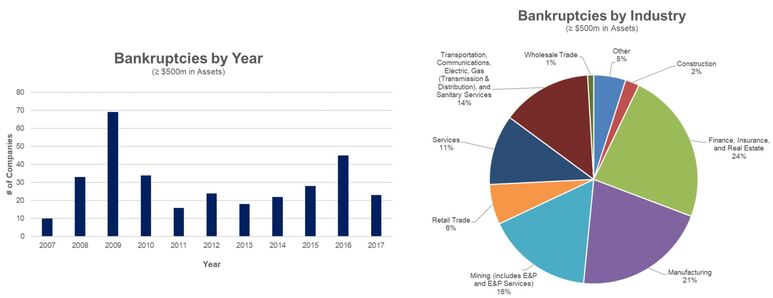

The U.S. economy has picked up momentum in the last decade and has maintained a steady growth rate. As a result, the number of companies filing for bankruptcy has declined. Despite these more favorable economic conditions, some industries such as the retail and energy sectors have seen an increase in bankruptcy filings. Bankruptcy protection remains a critical option for some players in these industries. It is critical that organizations entering a restructuring retain key executive talent in order to maximize the likelihood of a successful emergence from the bankruptcy process.

To assist companies entering bankruptcy with their key executive and employee compensation program designs, Alvarez & Marsal has developed a database containing detailed bankruptcy compensation information from the last 14 years. This article describes the methodology utilized in populating the database, addresses relevant bankruptcy rules and presents our general findings.

Bankruptcy Database Overview

Each of these 322 companies possesses different characteristics in terms of company structure and bankruptcy type, detailed as follows:

- Filing Type: Approximately 88 percent of the bankruptcies reviewed filed for Chapter 11 (reorganization) bankruptcy protection, 6.5 percent filed for Chapter 7 (liquidation) bankruptcy protection, 4 percent converted from a Chapter 11 to a Chapter 7 proceeding, and 1 percent filed for Chapter 15 (ancillary to international bankruptcy filing) bankruptcy protection.

- Type of Company: Of the 322 bankruptcy cases reviewed, roughly 71 percent were publicly held upon entering bankruptcy, and the remaining 29 percent were privately held companies. Of the 185 companies that emerged from bankruptcy, roughly 57 percent emerged as private companies, and the remaining 43 percent emerged as publicly held companies.

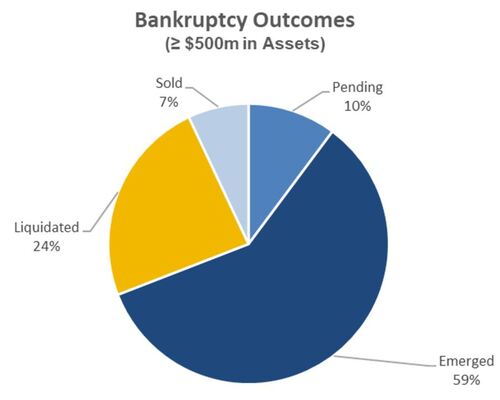

- Bankruptcy Period: Of the 262 companies that have completed bankruptcy proceedings, the average time in bankruptcy was 413 days. The shortest amount of time in bankruptcy was approximately two weeks and the longest was approximately 13 years.

- Outcomes: The chart below summarizes the outcomes of the bankruptcies reviewed.

Bankruptcy Compensation Plans

Executives may find little motivation to remain employed at a company that is entering, or in, bankruptcy, as annual bonus plans become compromised and long-term incentive vehicles (e.g. stock options, restricted stock) become virtually worthless. As a result, it is imperative that an organization contemplating or filing bankruptcy implement alternative compensation arrangements to retain key executive talent and incentivize them toward the level of performance necessary to achieve a successful restructuring. We will summarize some of the different types of plans below, but first we will summarize some of the bankruptcy laws that impact the design of such plans.

Overview of Bankruptcy Law

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) imposed the most significant changes to American bankruptcy law in 35 years, having an impact on both consumer and business bankruptcies.

Section 503(c) of the revised law imposed several restrictions on the use of retention plans in the context of a bankruptcy proceeding. If a company’s retention plan is solely based on the employees’ retention and does not have any performance-based features, it is subject to the restrictions under Section 503(c)(1). This section prohibits retention payments to “insiders” unless the following criteria are met:

- The services provided by the employee are vital to sustaining the business;

- The payment is essential to the retention of the employee due to a bona fide job offer from another company of equal or greater compensation (e.g. inclusive of commissions, benefits, equity and all wage equivalents or supplements); and

- The amount of the payment is no greater than 10 times the average payment to similar non-management employees in the same calendar year or,in the case the previous, similar payments do not exist, no greater than 25 percent of any similar payment made to the “insider” during the previous calendar year.

- Because of these onerous restrictions, retention programs are no longer utilized for “insiders.”

The BAPCPA also placed restrictions on severance payments to “insiders.” Section 503(c)(2) prohibits severance payments to “insiders” unless the following criteria are met:

- The severance payment is part of a program that is generally available to all full-time employees; and

- The severance amount is not greater than 10 times the average severance payment to non-management employees during the same calendar year.

- As a result of these limitations, the value of severance programs to “insiders” is extremely limited or non-existent.

Finally, Section 503(c)(3) serves as a catch-all provision prohibiting any other payments that are outside the ordinary course of business that are not justified by the facts and circumstances presented in the case.

The BAPCPA restrictions noted above apply only to “insiders.” An “insider” is defined by Section 101(31)(B) of the Bankruptcy Code as a director, officer or individual in control of the corporation, or a relative of such individual.

Key Employee Retention Plans (KERPs)

To incentivize “non-insider” employees to remain with the company during a bankruptcy period, “stay” bonuses are implemented through a Key Employee Retention Plan (KERP). These bonuses are often expressed as a percentage of the employee’s base salary and distributed throughout the corporate transition period, generally, with the final (typically largest) payment linked to the process resolution (e.g. emergence, liquidation). Compensation under a KERP is typically in the form of cash.

For “insiders” the BAPCPA prohibits the use of retention programs, as a result companies must generally adopt alternative bankruptcy protection plans.

Key Employee Incentive Plans (KEIPs)

The increased restrictions imposed by the BAPCPA required that companies transition away from KERPs for “insiders” and instead utilize performance-based incentive plans, known as Key Executive Incentive Plans (KEIPs). This approach is not subject to the limitations imposed by Section 503(c)(1) as explained below, and rather, applies more liberal judgment standards to determine if the plan is appropriate for a debtor company. This determination can generally be made through ordinary business sense, and an evaluation of the facts and circumstances of a given case.

The performance metrics under these plans should coincide with the company’s goals and objectives and provide incentive payments to key employees who achieve these goals. Generally, these goals tend to be tied to financial metrics, restructuring goals, or a combination of both. The performance goals must not be a lay-up, so to speak, but instead must be a challenge to achieve.

In 2012, Chapter 11 debtors Hawker Beechcraft, Inc. (“Hawker”) and Residential Capital, LLC (“ResCap”) each filed motions seeking approval of KEIPs both of which were denied. In each case, the court found that the KEIPs were essentially disguised retention programs. The court in Dana Corporation’s bankruptcy case (“Dana II”) approved its modified executive compensation plan after finding that the debtors’ second attempt at formulating a compensation plan was a true incentivizing plan for senior management and was wholly different than its initial proposed compensation plan.

In In re Hawker Beechcraft, Inc., 479 B.R. 308 (Bankr. S.D.N.Y. 2012), the proposed KEIP offered to pay bonuses of up to 200% of annual base salary ($5.3 million) to 8 senior management employees upon the occurrence of a standalone restructuring or a third-party sale transaction. The judge concluded that while “the KEIP includes elements of incentive compensation, when viewed as a whole, it sets the minimum bonus bar too low to qualify as anything other than a retention program for insiders.” It was determined that the minimum financial targets set in the KEIP were based on the current business plan and did not constitute stretch goals. This finding was supported by testimony that Hawker would certainly achieve its business plan projections unless there is a “whoopsie.” Additionally, the court concluded that the time-based goals were not challenging, as the debtors were on track to achieve several of the deadlines and the deadlines could be extended with proper consent.

In In re Residential Capital, LLC, 478 B.R. 154 (Bankr. S.D.N.Y. 2012), the proposed KEIP would pay up to $7 million in bonuses to 17 members of the senior leadership team. The court denied the debtor’s motion to approve the KEIP, finding that the program rewarded work that took place prior to the bankruptcy, and was structured to reward employees for simply remaining in employment instead of incentivizing them to meet performance goals. The judge noted that 63% of the KEIP bonuses were linked solely to closing the sale transactions that had been substantially negotiated pre-petition.

In In re Dana Corp., 358 B.R. 567 (Bankr. S.D.N.Y. 2006), after the debtor had its initial compensation program rejected by the court because it was essentially a retention plan disguised as an incentive plan and could not pass muster under Section 503(c)(3), the program was modified as a true incentive plan. The court approved the revised plan, noting that the compensation plan was similar to incentive programs offered by the debtor prior to filing for bankruptcy, and therefore they were within Dana’s ordinary course of business. In order to evaluate whether the revised plan could survive the strict scrutiny necessitated by Section 503(c), the court applied the following factors:

- Whether there is a reasonable relationship between the plan proposed and the results to be obtained—i.e., will the key employee stay for as long as it takes for the debtor to reorganize or market its assets, or, in the case of a performance incentive, is the plan calculated to achieve the desired performance?

- Whether the cost of the plan is reasonable within the context of the debtor’s assets, liabilities and earning potential.

- Whether the scope of the plan is fair and reasonable—does it apply to all employees? Does it discriminate unfairly?

- Is the plan consistent with industry standards?

- Is the the debtor engaged in due diligence related to the need for the plan, the employees that needed to be incentivized and the types of plans that are generally applicable in a particular industry?

- Did the debtor received independent counsel in performing due diligence and in creating and authorizing the incentive compensation?

Similarly, in re Hawker Beechcraft, Inc., 479 B.R. 308 (Bankr. S.D.N.Y. 2012) and re Residential Capital, LLC, 478 B.R. 154 (Bankr. S.D.N.Y. 2012, each Debtor filed motions seeking approval of KEIPs, both of which were denied. In each case, the court found that the proposed KEIP was essentially a disguised retention program. Not surprisingly, bankruptcy courts will most often deny a motion to approve a KEIP where most of the work required to earn payments is performed prior to the bankruptcy filing date and the business goals are not difficult to achieve. As a result, companies considering the use of KEIPs should utilize performance metrics that are challenging to attain.

Pre-filing Retention Plans

A recent trend has been the use of a pre-filing retention plan for “insiders” and “non-insiders.” The pre-filing retention plan is generally subject to a claw back provision whereby the employees must repay the amounts if they do not provide certain specified services for the required time period. Although the claw back provision could incorporate certain performance metrics, retention bonuses are typically only time-based. The time period for which services must be performed to retain the bonus is typically at least six months but is oftentimes multiple years, depending on the company’s circumstances.

One potential concern is that payments under a pre-filing retention plan are a fraudulent transfer or a preference. The argument in favor of these plans is that the estate is receiving value—the retention of key employees during a time of financial distress.

More companies are utilizing such plans due to their many advantages over using plans developed under the watchful eye of bankruptcy courts. Some of those advantages include:

- Eliminating the need for negotiations with courts and creditors;

- Focusing on employees who may be contemplating leaving the company; and

- Having the flexibility to either broadly or narrowly focus the plan, depending on the organization’s needs.

As with all retention plans, companies will need to consider the length of the retention period, the effect on employee pay expectations once the retention period ends and the overall retention award amount. Balancing those concepts effectively can help organizations better deal with employee attrition.

Bankruptcy Compensation Plans Database Observations

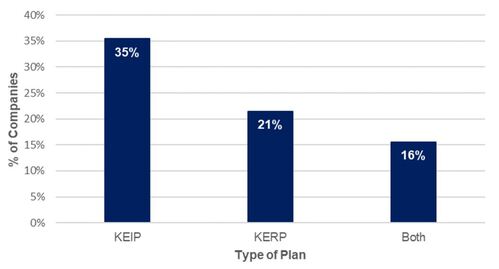

During our review of the companies in our bankruptcy database, we focused on compensation plans used to retain and incentivize executives.

The chart below shows the prevalence of approved compensation plans for the bankruptcies reviewed for this article.

Utilization by Industry

We also observed the breakout of compensation plans by industry:

- KEIPs: Among the companies we reviewed, the prevalence of KEIPs was highest in the retail industry at 62.5 percent, followed by the manufacturing industry and mining industry at 45 percent and 38 percent, respectively.

- KERPs: Among the companies we reviewed, the prevalence of KERPs was the highest in the retail industry at 44 percent, followed by the mining industry at 36 percent and manufacturing industry at 24 percent.

- Both: The leading industry with both KEIPs and KERPs was the retail industry at 31 percent, followed by mining industry at 26 percent and the manufacturing industry at 18 percent.

As indicated in the chart above, KEIPs were the most common compensation plans implemented during bankruptcy. Among companies that emerged from bankruptcy, the most common performance metrics included in KEIPs were:

- Financial metrics (EBITDA, cash flow, operating income, liquidity);

- Asset sales;

- Confirmation of plan of reorganization/emergence from bankruptcy (usually by a specified date);

- Creditor recovery; and

- Product sales.

Among companies that liquidated, the most common performance metrics included in KEIPs were:

- Asset sales;

- Cost reduction / expense control; and

- Financial metrics.

Common Objections

The U.S. Trustee, a component of the Department of Justice responsible for overseeing the administration of bankruptcy cases, has increased its scrutiny of bankruptcy plans and has objected to various components of the compensation plans. The most common U.S. Trustee objections we observed were:

- Questioning whether the company “insiders” had been appropriately identified (making sure no “insiders” are included in a KERP);

- For KEIPs, questioning whether the plan was performance-based as opposed to a hidden retention plan; and

- Questioning whether the plan’s potential payout was scaled appropriately (i.e., was the plan too rich).

Post-Bankruptcy Incentive and Retention

The battle to retain and motivate key employees does not simply end upon exit from bankruptcy. When emerging from bankruptcy, most pre-bankruptcy company stock, (along with unvested equity awards) have lost their value. Lack of meaningful equity ownership in the go-forward entity, coupled with an uncertain company future, can lead to post-bankruptcy retention and motivation difficulties. Post-bankruptcy equity grants ensure that companies retain motivated personnel vital to a successful post-bankruptcy existence.

Some important considerations for post-bankruptcy grants include:

- What percentage of the new company’s equity should be reserved for employee equity awards?

- What portion of the equity pool should be granted post-bankruptcy?

- Who should be eligible for post-bankruptcy grants (officers, middle management, all employees)?

- How will the post-bankruptcy grants be structured (i.e., size and type of award, vesting, etc.)?

Most companies emerging from bankruptcy will reserve a portion of the new company’s shares to provide equity to employees. The typical share reserve depends on the size of the company. Depending on the company’s needs post-bankruptcy, awards can be structured as a retention vehicle (full-value equity vehicle with vesting based on time), an incentive vehicle (vesting based on performance) or a combination of the two.

Alvarez & Marsal Says:

BAPCPA has created a structure by which bankruptcy courts can evaluate compensation plans. However, the courts still retain the discretion to accept or reject such plans, especially for incentive plans designed to escape treatment under Section 503(c)(1). Therefore, in designing incentive and retention plans, companies should make every effort to create plans that are “fair and reasonable.” Not only is it best practice but doing so demonstrates the company’s commitment to management and its accountability to stakeholders.

Companies should also be aware of the possible ways to motivate and retain its employees in a distressed company environment. Companies should review the plans they have in place and evaluate the potential ongoing impact of those plans should the company enter bankruptcy protection. Lastly, they should carefully examine any compensation plans implemented at or near the time the company files for bankruptcy to ensure they meet the requirements under BAPCPA.