2017/2018 Executive Change in Control Report

In recent years, external forces have continued to advocate for more transparency and executive compensation changes. Recent examples are the tax reform bills, which contain several provisions aimed at curbing (or at least further taxing) executive compensation. Change in control provisions for executives are often easy targets for criticism; however, many business reasons support the need for companies to maintain these types of plans. Now more than ever, it is important to ensure that your change in control arrangements are in line with the market and strike the appropriate balance of furthering the company’s strategic goals without resulting in an unwarranted windfall to executives.

To assist companies in understanding the current environment regarding executive change in control arrangements, Alvarez & Marsal analyzed the pay practices of the top 200 public companies across 10 different industries for the seventh edition of the Executive Change in Control Report. This year, Alvarez & Marsal is happy to partner with Equilar, which has added additional commentary on recent actual transactions in the U.S.

This edition of Tax Advisory Weekly explores the key findings of the analysis. Find the comprehensive report with the full study results, including industry-specific analysis here. [1]

Key Findings

The analysis focused on change in control protections provided to the chief executive officer (CEO) and other named executive officers (Other NEOs). Below is a summary of some of our key findings.

Average Total Value of Change in Control Benefits

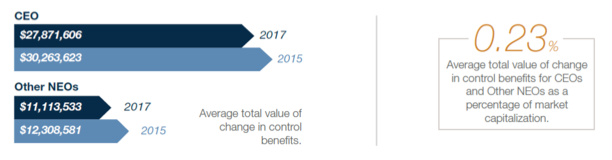

Although the amount of change in control benefits is sizeable, these benefits represent only a small fraction of the overall deal value as shown below:

For five notable deals in 2017, the average amounts paid to the top five executives exceeded $60 million.

Excise Tax Gross-ups

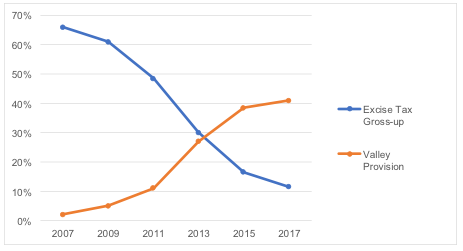

As shown in the chart below for CEOs, excise tax gross-ups have fallen out of favor and have significantly declined in prevalence over the past several years. Meanwhile, “valley provisions” or “best net,” which cut back amounts to avoid excise tax if it is more financially advantageous to the executive, are on the rise.

However, recent research by Equilar observed a trend in companies implementing an excise tax gross-up on the eve of an actual transaction. Equilar found that while some companies got pushback on this practice, few consequences materialized for this action at the 11th hour before a transaction.

Equity Awards

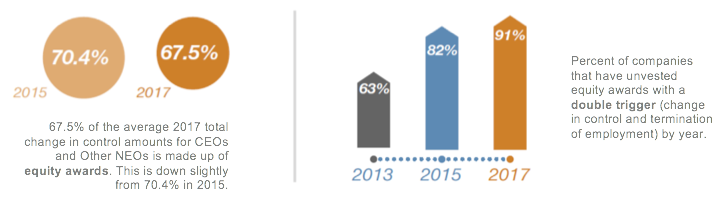

Long-term incentives make up about 67.5% of the average total change in control amounts for CEOs and Other NEOs. Over the last several years, we’ve observed a substantial increase in double-trigger vesting (change of control and termination of employment required to accelerate vesting of equity awards) as shown below:

Alvarez & Marsal Taxand Says:

Companies face pressure from shareholders, shareholder advisory firms and regulators to market-align change in control benefits provided to executives. At the same time, change in control benefits can assure that executives act in the best interest of shareholders. Boards of directors and compensation committees need to remain attentive to changing market trends and be ready to respond when challenges arise regarding the benefits provided to executives.

Disclaimer

The information contained herein is of a general nature and based on authorities that are subject to change. Readers are reminded that they should not consider this publication to be a recommendation to undertake any tax position, nor consider the information contained herein to be complete. Before any item or treatment is reported or excluded from reporting on tax returns, financial statements or any other document, for any reason, readers should thoroughly evaluate their specific facts and circumstances, and obtain the advice and assistance of qualified tax advisers. The information reported in this publication may not continue to apply to a reader's situation as a result of changing laws and associated authoritative literature, and readers are reminded to consult with their tax or other professional advisers before determining if any information contained herein remains applicable to their facts and circumstances.

About Alvarez & Marsal Taxand

Alvarez & Marsal Taxand, an affiliate of Alvarez & Marsal (A&M), a leading global professional services firm, is an independent tax group made up of experienced tax professionals dedicated to providing customized tax advice to clients and investors across a broad range of industries. Its professionals extend A&M's commitment to offering clients a choice in advisers who are free from audit-based conflicts of interest and bring an unyielding commitment to delivering responsive client service. A&M Taxand has offices in major metropolitan markets throughout the United States and serves the United Kingdom from its base in London.

Alvarez & Marsal Taxand is a founder of Taxand, the world's largest independent tax organization, which provides high quality, integrated tax advice worldwide. Taxand professionals, including almost 400 partners and more than 2,000 advisers in 50 countries, grasp both the fine points of tax and the broader strategic implications, helping you mitigate risk, manage your tax burden and drive the performance of your business.

To learn more, visit www.alvarezandmarsal.com or www.taxand.com