Navigating Q3 2025: Essential Income Tax Accounting Insights

As we move through the third quarter of 2025, several important developments under ASC 740 and IAS 12 are shaping the global tax accounting landscape. In the United States, recent regulatory activity, including implementation guidance tied to the One Big Beautiful Bill (OBBBA) and the FASB’s new income tax disclosure standard (ASU 2023-09), is prompting companies to revisit both their provision processes and footnote transparency. At the same time, international developments ranging from OECD Pillar Two implementation to jurisdiction-specific changes in corporate tax regimes are creating new challenges for multinational groups. In this article, we summarize the most significant Q3 developments and their implications for tax accounting and financial reporting.

Legislative Environment

During the third quarter, the OBBBA was signed into law by President Trump. Please refer to our recent article for more details on the OBBBA provisions.[1]

Below are the key tax provision impacts of the OBBBA:

| Provision | Before (Prior Law) | After (OBBBA) | Tax Accounting Considerations |

| Bonus depreciation | 60% in 2024; 40% in 2025; 20% in 2026; 0% from 2027; Qualified Production Property – no bonus depreciation | 100% bonus depreciation for qualified property acquired on or after Jan 19, 2025; permanent (expires 2031 for Qualified Production Property) | Larger taxable temporary differences (DTLs). If the 100% write-off drives a tax loss, new NOL-related DTAs arise. State decoupling may create additional current tax expense; model separately. |

| Sec. 179 expensing | Up to $1.25M expensing per year; lower phase-out threshold | Limit raised to $2.5M; phase-out starts $4M; indexed for inflation from 2026 | Immediate deduction increases DTLs. State decoupling from §179 may create additional current tax expense; model separately. |

| R&D expensing | Capitalized and amortized over 5 yrs (US)/15 yrs (foreign) | Immediate expensing for US R&D (from 2025); election for accelerated recovery of prior year capitalized R&D; foreign R&D remains 15 yrs | Catch‑up of prior year capitalized costs creates potential discrete current benefit and offsetting deferred tax expense. Foreign R&D continues to generate DTAs. |

| Interest expense limit | Deduction capped at 30% of EBIT | EBITDA-based limit reinstated (effective 2025) and made permanent; capitalized interest limited starting in 2026 | Higher ATI may free up §163(j) carry-forward DTAs. Capital-intensive filers may see reduced benefit under capitalized interest rules. Remeasure related deferreds in the enactment period. Potential VA release depending on projected usage. |

| Charitable deduction (C-corps) | Capped at 10 % of taxable income | Deductible for amounts > 1% and ≤ 10% | New 1% floor can defer deductions, boosting charitable carryforward DTAs. Reassess realizability of new or enlarged DTAs each period, given 5-year carryforward. |

| Qualified Opportunity Zones | Preferential gain treatment due to sunset 12-31-25 | Program renewed; new zones designated on rolling 10-year basis; rules modified | Overall ASC 740 mechanics unchanged by OBBBA. |

| Sec. 162(m) compensation-deduction limit | Deduction limited to $1 M per covered employee (public filers) | Applies to the entire controlled group; broader employee coverage (effective 2026) | Larger potential nondeductible cost – permanent difference. Write off any related DTAs, update ETR for impact. |

| IRA/ energy-credit phase-outs | Multiple clean-energy credits (e.g., 30C, 30D, 45V, 48) available through 2032/34 | Terminates or accelerates phase-outs (30C ends 6-30-26; 30D ends 9-30-25; 45V ends 12-31-27, etc.); §48D credit rate increased to 35%; foreign-entity restrictions added | Fewer future credits may raise AETR. Adjust subsequent year tax models. |

| GILTI (NCTI) | 50% (§250) deduction (ETR 10.5%), dropping to 37.5% (ETR 13.125%) after 2025 | Deduction cut to 40% (ETR 12.6%); QBAI exclusion removed; GILTI FTC allowance increased to 90%; effective after 2025 | Likely lower tax period cost in future years. Revise valuation allowances due to changes in §250 deduction, if applicable. Adjust subsequent year tax models. |

| FDII (FDDEI) | 37.5% deduction (ETR 13.125%), falling to 21.875% (ETR 16.4%) after 2025 | Deduction cut to 33.34 % (ETR 14%); QBAI exclusion removed; effective after 2025 | Likely lower tax period cost in future years. Adjust subsequent year tax models. |

| BEAT | 10% rate – 12.5% after 2025; full general business credits offset BEAT from 2026 | 10.5% rate after 2025 | Lower future BEAT tax expense, recorded as period cost. Adjust subsequent year tax models. |

| One-month deferral election (SFCs) | Specified foreign corps could elect a tax year one month earlier than U.S. shareholder | Election repealed | Accelerates Subpart F/GILTI inclusions for affected filers. May create new tax period costs in the enactment period. |

| Downward-attribution limitation restored | Post-2017 repeal allowed foreign-parent stock to be attributed to U.S. subsidiaries (creating “surprise” CFCs) | Limitation on downward attribution reinstated | Potential release of DTLs tied to previously “surprise” CFCs. Disclose impacts and monitor future ownership changes. |

Post-OBBBA Guidance

In the wake of the passing of the law, the IRS issued guidance in Rev. Proc. 2025-28 on August 28, 2025, to provide procedural options for taxpayers evaluating accounting method changes related to research and experimental expenditures previously capitalized. Companies will need to consider the impact of these options over several years to determine the best strategy for their respective profiles.

The IRS also issued guidance on beginning construction for purposes of renewable energy tax credits under Notice 2025-42, given the hard cutoff dates set for facilities to qualify for these credits. Meeting safe harbor requirements will be crucial for companies seeking to qualify for credits if the physical work test cannot be met.

Other guidance released in Q3 includes Notice 2025-45 easing FIRPTA rules for foreign companies redomiciling in the US. The notice addresses a niche but important area for multinational M&A by expanding the exception to gain recognition to include F-type reorganizations.

A&M TAS Says:

The financial statement impact of the OBBBA should be accounted for in Q3, or the period enacted into law. The effect on current income taxes payable or receivable should be included in the annual effective tax rate (AETR), while provisions that impact prior periods should be recognized as a discrete item.

Companies should also remeasure DTAs and DTLs to account for the impacts of the OBBBA, recognizing changes to DTAs and DTLs that existed as of the law’s enactment date as a discrete item, and as an adjustment to the AETR for temporary differences originating afterwards.

Valuation allowance assumptions will need to be reevaluated for changes in reversal patterns that will affect scheduling analysis and for any corresponding revaluation of DTAs. For example, the changes to 163(j) may impact the realizability of interest expense carryforward DTAs and should be considered in scheduling analysis. Changes in the valuation allowance with respect to the remeasurement of existing DTAs will be recognized as a discrete item, while adjustments to the valuation allowance for differences after the enactment date will be incorporated as an adjustment to the AETR.

Disclosures should include the overall impact of the new law as well as discussion of the material impacts.

Tax Accounting and Reporting

ASU 2023-09

In December 2023, the Financial Accounting Standards Board (FASB) released Accounting Standards Update (ASU) 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures,” which seeks to enhance income tax disclosures in financial statements. As discussed in our previous publication on this topic,[2] the ASU provides greater transparency into entities’ global operations and provides users with crucial information that help investors.

Most significantly, the update introduces new quantitative and qualitative disclosure requirements. Reconciliations of effective tax rates will be required to report both percentages and reporting currency amounts for eight specific categories. Furthermore, some reconciling items would be required to be broken out to the extent the impact is greater than or equal to 5% of the amount computed by multiplying income (or loss) by the applicable statutory federal income tax rate. For entities parented in the US, this amount is effectively any item with an effect of 1.05% (21% US federal corporate tax rate x 5%) or greater.

Public companies will be required to adopt the new standard for reporting periods beginning after December 15, 2024 (e.g., calendar year end 2025).

A&M TAS Says:

With public company adoption rapidly approaching, SEC registrants should currently be assessing their reporting processes to ensure that there are proper systems in place to gather the required information in preparation for the first reporting year in which it is applicable. Additionally, companies must decide whether to provide for the optional retroactive application of the rules.

State

Legislation Enacted in the Third Quarter

California: On August 27, 2025, the California Office of Administrative Law approved amendments to the California Code of Regulations, Title 18, Section 25136-2. These amendments concern the assignment of sales, other than sales of tangible personal property (e.g., services and intangible property), for the purpose of apportioning business income. The updated regulations stipulate that the primary evidence for assignment should be based on information within the taxpayer’s contracts or their books and records maintained in the ordinary course of business. For any service, the location of the benefit must first be presumed before substantiating the actual location of the receipt of the benefit. The regulations detail a hierarchical order for substantiating the location of the benefit:

- By the taxpayer’s contracts or books and records kept in the normal course of business

- By all other sources that can reasonably substantiate the location

- By reasonable approximation

- If none of the above methods work, the benefit is presumed to be received in California if the customer's billing address in the taxpayer’s records is in California.

Colorado: On August 28, 2025, Colorado enacted several bills to amend the state's business tax regulations during a special legislative session, prompted by OBBBA. Effective for tax years starting on or before January 1, 2026, these new laws indefinitely extend existing requirements for certain taxpayers to add back qualified business income (QBI) deductions and grant expanded authority to tax income from foreign subsidiaries. Specifically, House Bill 1002:

- Requires corporations to add back the federal deduction for foreign-derived income (FDDEI) to their Colorado taxable income

- Adds Hong Kong, Ireland, Liechtenstein, Netherlands, and Singapore to the list of foreign jurisdictions presumed to be used for tax avoidance

- Allows the executive director of the Colorado Department of Revenue to use the economic substance doctrine to determine if a corporation is incorporated in a listed jurisdiction for tax avoidance

- Repeals the exclusion that prevented corporations from subtracting federal dividends from specified foreign jurisdictions presumed to be used for tax

New Jersey: On August 13, 2025, New Jersey Assembly Bill 5687 (A.B. 5687) was enacted into law, establishing the Next New Jersey Manufacturing Program (Program). The Program is designed to encourage in-state manufacturing investment and job creation. The Program amends certain provisions of the New Jersey Economic Recovery Act of 2020 to facilitate the awarding of tax credits to eligible manufacturers and clean energy product manufacturers for capital investments in qualified business facilities.

The Program establishes a tax credit for new or expanded manufacturing in the state equal to the lesser of:

- 0.1% of a qualifying company’s total capital investment times the number of new full-time jobs created

- 25% of the total qualifying investment

- $150,000,000

To qualify for the Program, a company must invest at least $10 million in capital in a New Jersey facility and create a minimum of 20 full-time jobs with salaries at least 120% of the county's median manufacturing wage. Additionally, the company must pay prevailing wages for construction work, primarily engage in manufacturing or clean energy activities, and collaborate with educational and workforce development organizations. The company must also comply with state requirements including environmental and sustainability standards.

A&M TAS Says:

Companies must reflect the state law change (and related federal state deduction) impact on their current tax provision in the period in which it becomes effective, and the deferred tax provision in the period of enactment. This requires adjusting the tax provision to account for the new rates or rules for taxable income generated post-effective date. Companies should ensure that their systems and processes capture these law changes promptly and that financial statement disclosures clearly explain the impact on current period tax expense and overall tax positions.

State Corporate Income Tax Implications of OBBBA

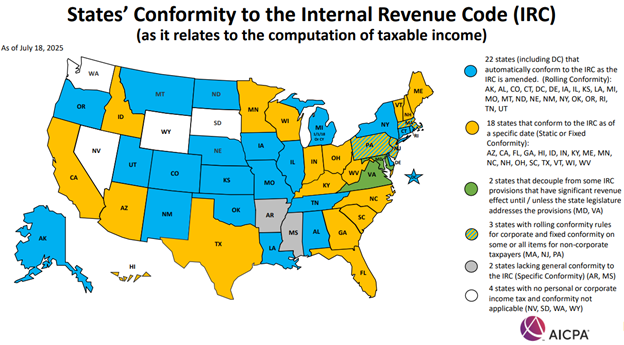

As mentioned in our previous publications, many states’ corporate income tax regimes are affected by federal tax law changes because states conform to the Internal Revenue Code (IRC) for purposes of administrative ease by either incorporating the IRC in whole or in part, or by using federal taxable income as the starting point. Generally, states that incorporate the IRC either: (1) conform to the IRC as of a specific date (Fixed Date Conformity); or (2) automatically follow the version of the IRC in effect for the current tax year (Rolling Conformity). However, some states, like California, only selectively conform to specific IRC provisions (Selective Conformity).

Below are examples of the federal tax reform provisions that corporate taxpayers should consider for state purposes:

IRC Changes | Rolling Conformity | Static Conformity | A&M TAS Comments |

|---|---|---|---|

IRC 163(J) | Returning to an EBITDA-based limitation could significantly reduce taxable income in states that conform to section 163(j). However, under the revised section 163(j), the exclusion of Subpart F income, (GILTI, and Section 78 gross-up amounts from ATI may lower the capacity for interest deductions for multinational taxpayers. | These states will likely continue to calculate interest expense limitations using EBIT as provided in version of Section 163(j) under the TCJA. | States may opt not to conform or selectively decouple from the favorable changes in section 163(j). Selective decoupling has been prevalent, especially when Congress temporarily increased the limitation to 50% of EBITDA for the 2019 and 2020 tax years as part of the CARES Act. States with rolling conformity might decide to decouple from the latest OBBBA version of section 163(j), which could otherwise lead to significant revenue loss, and revert to the previous version. |

NCTI (fka GILTI) | The changes to the NCTI regime are likely to significantly expand the state income tax base. Specifically, the reduced NCTI deduction percentage, coupled with increases in the NCTI base and the section 78 gross-up amount, will lead conforming states to recognize a broader tax base. Since states lack a foreign tax credit like the federal FTC, this could result in higher taxable income starting in 2026. | These states are likely to retain the original deduction percentages specified in section 250 for the year 2026 and beyond, rather than implementing the revised 40% for NCTI and 33.34% for FDDEI. | In the next legislative session, states may perceive the federal changes to NCTI (formerly GILTI) as a revenue-generating opportunity. Static conformity states are likely to update their rules to align with the OBBBA. Additionally, states that currently tax only a small portion of GILTI, such as Connecticut at 5%, might seize this opportunity to enact laws that tax a larger portion of NCTI, thereby expanding their tax base and potentially increasing revenue. |

Section 174 | States with rolling conformity should adopt the new Section 174A. his change will likely lead to a lower taxable income for taxpayers in the short term. | These states currently conform to Section 174 as it was operative for the tax years 2022 through 2024. | A tricky aspect of this provision is the fact that under the OBBBA, new Section 174A was created to apply policy for the 2025 tax year and beyond, with Section 174 remaining in the IRC but applicable only through the 2024 tax year. Additionally, states adopting a mechanical conformity approach to tax treatment of domestic and foreign R&E activities might encounter challenges related to the Commerce Clause. Therefore, we believe states would be cautious with their tax policies to ensure that they do not discriminate against foreign commerce (e.g., foreign R&E activities). |

Section 168(k) | Changes in depreciation methods and asset classifications are adopted immediately. However, through state legislation, the majority of states historically have decoupled from the preferential federal income tax treatment of bonus depreciation, in part because states have been reticent to adopt the front-loaded nature of this deduction. | Depreciation continues under pre-OBBBA rules until legislative action. In other words, for those states that have not specifically decouple from bonus depreciation, they should only be allowed bonus depreciation of 40 percent for 2025. | As mentioned, the impact is complex as many states historically have explicitly decouple from section 168(k), requiring taxpayers to add back the federal deduction and depreciate the asset over a longer period using state-specific methods. As a result, the permanence of full expensing at the federal level may create new timing differences between federal and state taxable income. Taxpayers operating in multiple jurisdictions will need to carefully track these differences and monitor state legislative responses. |

Section 168(n) | States should adopt the new provision enacted in the OBBBA of Section 168(n), which provides for a full deduction for qualified production property expenses. States with rolling conformity which have specifically decouple from Section 168(k) will likely need to amend their rules to decouple from Section 168(n) in their upcoming legislative session if they want to remove the state from this regime and/or align to their position regarding Section 168(k). | Corporations continue with previous methods, maintaining consistency in tax treatment. | Taxpayers should closely review how that state has treated similarly styled accelerated depreciation provisions and track legislative developments to see whether Section 168(n) ultimately will be followed. |

A&M TAS Says:

With the significant business and individual tax changes included in OBBBA, it is important that taxpayers do not assume these changes will automatically be followed by the states. It is crucial for businesses to review each state's conformity rules to understand how federal tax reforms will influence their state tax obligations. Additionally, with significant changes in federal tax and the potential for increased state corporate income tax liabilities, taxpayers must monitor state legislative developments and consider the impact of federal tax elections on state tax posture, particularly in states with substantial physical or market presence. The upcoming months, including next year’s state legislative session, will be pivotal as states determine their alignment with federal policy. Businesses must review state conformity rules, monitor legislative changes, and determine the timing of these impacts on state income tax accounting.

Other Developments

California: On July 30, 2025, the California Franchise Tax Board (FTB) issued Legal Ruling 2025-1 (Ruling), providing important guidance on the treatment of Deferred Intercompany Stock Accounts (DISAs) in the context of nonrecognition transactions under IRC Section 355. Under Ruling 2025-1, the FTB clarified that the deferred income in DISA is not recognized solely due to a stock transfer within a controlled group in a nonrecognition transaction under IRC Section 355. When the stock with an associated DISA is distributed, the distributing corporation must allocate its basis between the distributing and controlled corporations based on their relative fair market values (FMV), which reduces the DISA balance dollar-for-dollar with respect to the controlled corporation stock.

It is important to note that the balance of each DISA must be disclosed annually on the California tax return, and failure to do so may lead the FTB to mandate that undisclosed DISA amounts be considered in the year of such failure, as per California Code of Regulations (CCR) 25106.5-1.

Oregon: The Oregon Tax Court revised its earlier decision, determining that Microsoft is eligible for a partial refund of corporate income taxes paid for the 2018 tax year related to the deemed repatriation of foreign earnings under IRC Section 965. The court decided that the 20% repatriation amount, which included accumulated deferred foreign income deemed distributed to Microsoft's Water’s Edge Group under the 2017 Tax Cuts and Jobs Act, must be included in the sales factor denominator for apportionment purposes under ORS 314.665(6)(a). This inclusion is because the income was derived from Microsoft's main business activities conducted in conjunction with its controlled foreign corporations (CFCs) as a unified operation. [Microsoft Corp. v. Department of Revenue, No. TC 5413 (Or. T.C. Apr. 29, 2025).

Texas: The Texas Comptroller of Public Accounts issued Letter Ruling No. 20221114152021 clarifying that the sale of bitcoin (BTC) is considered the sale of intangible property, rather than tangible personal property or securities, for franchise tax purposes. The ruling states that the costs associated with acquiring BTC cannot be deducted from taxable income as cost of goods sold. The determination underscores that BTC, as a digital asset, is not perceptible to the senses and does not meet the qualifications for tangible personal property under Texas tax law.

[1] Kevin M. Jacobs et al., “The OBBBA Passed … Now What?” Alvarez & Marsal, July 8, 2025, https://www.alvarezandmarsal.com/thought-leadership/the-obbba-passed-now-what

[2] Michael Noreman et al., “FASB Issues Income Tax Disclosure Standard,” Alvarez & Marsal, December 21, 2023, https://www.alvarezandmarsal.com/insights/fasb-issues-income-tax-disclosure-standard

In the third quarter of 2025, no major developments in the German tax landscape related to tax accounting occurred. However, the draft “Act for a Tax Investment Program” (introduced in A&M’s Q2 Tax Accounting Newsletter)[3] has been enacted in the meantime. A central element of the program is the gradual reduction of the corporate income tax rate from the current 15% to 10% beginning in 2028 by 1% in each fiscal year.

A&M TAS Says:

The enacted reduction of the corporate tax rate represents a significant change with immediate implications for accounting and tax reporting. Companies are required to carefully schedule when temporary differences are expected to reverse, in order to apply the appropriate tax rate for deferred tax calculations. Since the tax rate reduction has been enacted, deferred tax assets and liabilities must now be measured using the new corporate tax rate that will apply in the period when the related temporary differences are expected to reverse (or when loss/interest carryforwards are utilized). For balance sheet dates prior to July 11, 2025, the new tax rate must not be applied for the measurement of deferred taxes. Instead, the effects of the tax rate change must be disclosed in the notes as a post-balance sheet event.

[3] Douglas Sayuk et al., “Navigating Q2 2025: Essential Income Tax Accounting Insights,” Alvarez & Marsal, July 22, 2025.

On September 8, 2025, the President sent to Congress the bill for the Federal Revenue Law for Fiscal Year 2026 (Iniciativa de Ley de Ingresos de la Federación para el Ejercicio Fiscal de 2026) for the mandatory legislative process.

According to the Constitutional process, the bill that was sent to the Congress will be reviewed and if the case changes are made by the Congress, it should be approved by October 31, 2025, then sent for final publication and should enter into force by January 1, 2026. The bill comprises changes regarding the Corporate Income Tax Law, VAT Law, and the Federal Fiscal Code. We will comment on this section about some of the proposed changes regarding the Corporate Income Tax Law.

As part of the proposed bill, we consider these three proposed changes as most likely to have an impact on deferred taxes:

a) New requirements for the financial institutions to deduct uncollectible accounts: As of today, financial institutions are not subject to specific tax requirements to deduct its bad debts. However, if the proposed bill is enacted, financial institutions will be subject to comply with general tax requisites to deduct any amount of bad debts.

b) Nondeductibility of payments to the IPAB: Banking institutions are obliged to pay a fee to the Institute for the Protection of Bank Savings (Instituto de Protección al Ahorro Bancario, IPAB). According to the proposed bill, only 25% of these payments will be tax-deductible for banking institutions.

c) Repatriation of capital: As part of the proposed bill, a new program would allow individuals and businesses to repatriate capital into Mexico and pay a preferential income tax rate of 15% rather than the standard 30% corporate income tax rate.

As of today, the above proposed changes have not been enacted nor approved. We will continue updating you as the discussions in the Congress continue.

A&M TAS Says:

Because the bill is not yet enacted into law, there are no current changes to income tax accounting this quarter. Once the bill is enacted, companies will need to assess the law’s impact on income tax accounting.

Tax Audit Trends in Thailand: FY25 Developments

Thailand’s Ministry of Finance reported that revenue collection for the first ten months of FY25 (October 2024 to July 2025) fell short of its target by 1.6%, equivalent to US$1.175 billion. Among the key agencies, the Revenue Department recorded the second-largest shortfall, collecting US$372 million (0.6%) below its target. This underperformance has prompted heightened scrutiny of taxpayers as authorities seek to close the gap.

Key Developments

In response, the Revenue Department is intensifying its audit strategies to safeguard fiscal targets in a number of areas, including transfer pricing, as noted below.

- Strengthening transfer pricing (TP) audits: This is supported by internal training rolled out across all Area Revenue Offices. Advanced AI-driven analytics are being deployed to identify high-risk related-party transactions, enabling more precise and efficient audit selection. This could lead to uncertainty on lower income or deductibility of related-party transactions.

A&M TAS Says:

In light of the Revenue Department’s intensified audit strategies and the FY25 revenue shortfall, businesses should take proactive measures to mitigate tax audit risks and ensure compliance. Companies should reassess the documentation of intercompany charges and ensure that their transfer pricing policies are well-supported to withstand audit scrutiny and uncertain tax positions.

Additional Tax Deduction for Commercial EV Investment

The Royal Decree on Tax Exemption (No. 798) B.E. 2568 was issued to promote the investment and use of electric vehicles (EVs) in Thailand. It offers additional deductions to companies and juristic partnerships that invest in large commercial electric vehicles.

Key Provisions:

- Eligible Entities: Applies to companies and juristic partnerships operating in Thailand.

- Tax Benefits:

- 100% additional deduction on the investment cost of large commercial EVs that are manufactured or assembled in Thailand.

- 50% additional deduction on the investment cost of imported large commercial EVs.

- Applicable Period: Qualifying expenditures must be incurred between March 27, 2025, and December 31, 2025.

- Eligible Vehicles:

- They must be newly manufactured battery-powered passenger cars or trucks.

- Vehicles must be legally registered for commercial use, qualify as depreciable assets under Section 65 bis (2) of the Revenue Code, and be ready for use by December 31, 2025.

- Conditions for Claiming:

- Companies must submit an investment and expenditure project plan to the Director-General of the Revenue Department.

- Vehicles benefiting from this decree cannot simultaneously claim other tax privileges under different royal decrees.

A&M TAS Says:

Based on our observations, this tax privilege should align with prior tax deduction incentives granted for qualifying capital expenditures. Accordingly, the related tax deduction would typically be utilized over the useful life of such capital expenditures.

However, as detailed implementation guidelines are still pending, companies should:

- Monitor regulatory updates to ensure accurate recognition and compliance

- Exercise caution when assessing the impact on deferred tax provisions on local STAT accounts and Group GAAP reporting

- Review documentation and reporting requirements to mitigate risks of future adjustments or penalties, and uncertain tax position contingencies.

Emergency Decree on Top-Up Tax B.E. 2567 (2024)

Thailand implemented the OECD's BEPS 2.0 Pillar Two framework through the Emergency Decree on Top-Up Tax B.E. 2567 (2024), enacted on December 26, 2024, and effective from January 1, 2025. This decree introduces a 15% global minimum tax rate, known as the "top-up tax," for multinational enterprises (MNEs) with consolidated revenues reaching EUR 750 million (approximately THB 28 billion) in at least two of the preceding four fiscal years.

Key Provisions of the Decree

- Tax Mechanisms: The decree incorporates three primary charging mechanisms:

1. Qualified Domestic Minimum Top-up Tax (QDMTT): Applies to Thai constituent entities (CEs) whose effective tax rate (ETR) falls below 15%.

2. Income Inclusion Rule (IIR): Imposes top-up tax on the ultimate parent entity (UPE) in Thailand, or other Thai parent or shareholder entities if applicable, when any foreign constituent entity in the group is subject to an ETR below 15%.

3. Undertaxed Payment Rule (UTPR): Allocates top-up tax to Thai CEs if the top-up tax on the low-tax foreign jurisdictions has not been fully collected under QDMTT or IIR.

Filing Obligation and Deadlines:

Entities subject to Thailand’s Pillar Two rules are required to submit the following returns to the Thai Revenue Department (TRD):

1. Notification Form – To inform the TRD whether the entity is part of a large MNE group subject to the GloBE rules, and to indicate which entity will file the GloBE Information Return (GIR)

2. GloBE Information Return (GIR) – To provide detailed disclosures in according with OECD standards, including ETR, top-up tax computation, constituent entity details, and any elections made

3. Top-Up Tax Return – To be filed by Thai CEs if they are liable to pay top-up taxAll returns must be submitted within 18 months after the end of the UPE’s first reporting year and within 15 months for subsequent periods.

Specific details on adjustments to the numerator and denominator for calculating the ETR, as well as safe harbor provisions, are expected to be outlined in future ministerial regulations.

Thailand’s Cabinet has approved a draft National Competitiveness Enhancement for Targeted Industries Act to mitigate the impact of the Top-Up Tax under the OECD’s Pillar 2 framework by offering Board of Investment-promoted companies refundable tax credits for qualifying expenditures such as R&D, skills development, production efficiency, and sustainability investments, subject to further approval and periodic legislative review.

A&M TAS Says:

Organizations should assess their Pillar Two impact and evaluate any potential top-up tax exposure. They must prepare for compliance that is integrated into their IFRS provisioning process, ensuring data availability for top-up tax calculations. Pillar 2 disclosure requirements under accounting standards should be reviewed for IFRS (Group Reporting) and Thai Financial Reporting Standards (TFRS) for statutory reporting.

Entities should also monitor regulatory updates, especially regarding safe harbors and calculation methods. Existing tax privileges like BOI or IBC incentives must be reassessed for impact under the GloBe rules and M&A planning, due to potential effects on group structure and tax liabilities.

Dutch Tax Plan 2026

On September 16, 2025, the Dutch Ministry of Finance published the government’s tax plan for 2026. As expected, the caretaker status of the government led to a tax plan with limited proposals, whereby, for instance, no amendments were announced in relation to the Dutch corporate income tax rates. Nevertheless, there are several notable developments:

- Amendments to the Dutch Minimum Taxation Act (Pillar Two)

The Dutch government has introduced a second amendment to the Dutch minimum taxation act 2024, which proposes several technical adjustments to align the existing minimum taxation law with the OECD Inclusive Framework administrative guidelines agreed upon in December 2023, June 2024, and January 2025. Most amendments should have retroactive effects from December 31, 2023, while some are expected to take effect from December 31, 2025.

- Implementation of the EU Directive on Exchange of Information for Pillar Two

Multinational and domestic groups that fall within the scope of Pillar Two must file a top-up tax information return in each of the member states where group entities are established. The top-up tax information returns should include details that allow those member states to determine whether a top-up tax is due.

Based on the proposed legislation—which is the implementation of the EU directive of administrative cooperation known as DAC9—such multinational and domestic groups are allowed to file a return in one member state only, which in turn is responsible for exchanging that information with the relevant other member states.

- Transitional Regime for Transparent Funds for Joint Account

The government acknowledges that the Dutch entity tax classification rules that come into force as of January 1, 2025, have led to practical issues due to the new definition of a fund for joint account. The mainly relates to funds classifying as tax transparent under the old rules, which, under the new rules, classify as tax opaque from January 1, 2025, onward.

To mitigate the practical issues, the government is considering a new fund for joint account definition. However, as this definition is not expected before January 1, 2027, the caretaker government has now proposed a transitional regime. Under this transitional regime, funds that were considered tax transparent until December 31, 2024, can opt-out of their classification as funds for joint account if certain criteria are met.

A&M TAS Says:

Multinational and domestic groups that fall within the scope of Pillar Two should carefully assess if the proposed amendments to the Dutch minimum taxation impacts and affects their Pillar Two position. Furthermore, organizations with a Dutch presence should carefully assess and monitor the impact of the Dutch tax entity classification rules and determine whether to proposed transitional regime could provide any relief (if required).

Upcoming Changes to FRS102 (UK GAAP) For accounting periods beginning on or after January 1, 2026, there are changes to FRS 102 (UK GAAP) to bring the standards more closely in line with IFRS. There are a number of key changes that businesses will need to prepare for.

Lease Accounting

Lessees will now be required to recognize a lease liability to reflect the present value of future rental payments, and at the same time, a corresponding right-of-use (ROU) asset to reflect the right to use the leased asset. Although these changes (specifically, IFRS 16) have been in effect for businesses reporting under IFRS/IAS since January 1, 2019, this may represent a significant change for companies and groups that report solely under FRS 102. However, there are simplifications provided under FRS 102 when compared to IFRS 16 to reduce compliance burden.

Operating leases that would have previously been recognized as rental or lease expenses in the P&L will instead have a corresponding depreciation charge and finance cost on the unwinding of the ROU asset and lease liability, which should have a positive impact on EBITDA.

Tax deductions remain available on amounts recognised in the P&L where the lease would have been recognized as an operating lease under current standards (pre-January 1, 2026); therefore, depreciation and finance costs would be deductible. Tax deductions would likely be accelerated due to front loading of financing costs resulting from a higher initial lease liability, which will be of benefit for profitable companies with significant lease commitments. Costs in respect of capital expenditure (such as lease premiums and SDLT) remain nondeductible.

In addition, the distinction between operating leases and finance leases will remain relevant for corporate interest restriction (CIR) calculations.

No restatement of comparatives is required as FRS 102 requires the application of the modified retrospective approach on transition such that the ROU asset equals the lease liability. However, groups whose parent consolidates under IFRS may elect to use IFRS 16 numbers. Where the approach results in a difference in the ROU asset and lease liability, the impact must be spread across multiple accounting periods for tax purposes, and deferred tax asset or liability would need to be recognized.

A&M TAS Says:

The change to lease accounting brings UK GAAP more closely in line with IFRS 16. Although the latter has been in effect since 2019, the amendments can still present significant complexity where lease agreements involve capital expenditure or where a sale and leaseback transaction is involved. Lease agreements will require careful review and there will be a need for appropriate record keeping and documentation to support tax deductions and CIR calculations.

Revenue Recognition

Revenue/turnover will now involve a five-step approach to determine the timing and amount to be recognized in a relevant accounting period. The recognition will depend on criteria based on performance obligations being met at certain points in time.

The change in policy will either result in the acceleration or deferral of revenue recognized in the accounts. Businesses can either apply a full retrospective approach which requires restatement of comparatives or a modified retrospective approach which does not require restatement of prior period, but the cumulative effect is instead presented as an adjustment to opening balances at the start of the first accounting period in which the change takes effect.

Revenue is generally taxed in line with accounts; therefore, changes to opening balances or restatement of comparatives will need to be included in the tax computations of the first period of transition to ensure amounts are taxed or deducted as appropriate.

A positive adjustment (increase in opening reserves or comparative period revenue) will be treated as taxable income arising on the first day of the first period of account that applies the new policy. Similarly, a negative adjustment will be an allowable deduction as an expense arising on the first day of the first period of account.

The adjustments may impact whether a company would be required to pay in quarterly installments (or would fall under the very large company installment regime).

Depending on materiality, auditors may also require the restatement of comparative tax balances and tax charges/credits where the full retrospective approach is adopted. Alternatively, it may be acceptable to recognize the impact as an adjustment in respect of prior periods in the tax reconciliation.

A&M TAS Says:

The impact of these adjustments on taxable profits should be quantified to ensure companies meet tax payment deadlines and mitigate late payment interest and, more widely, to ensure companies have sufficient cash to meet accelerated tax payments where this is needed.

Uncertain Tax Treatments

FRS 102 will now also require recognition of uncertain tax treatment, providing guidance in line with IFRIC 23 (which has been applicable to IFRS since 2019). Where there is uncertainty over whether a tax authority will accept a tax treatment adopted, a company must consider whether it is probable that the tax authority will accept an uncertain tax treatment or not, assuming that the tax authority has full knowledge of all related information when examining an amount.

If the company concludes that it is probable (i.e., more likely than not) that the tax authority will accept an uncertain tax treatment, the entity should determine taxable profits (or losses), tax bases, or rates consistent with the tax treatment used or planned to be used in its tax return filings.

If the company concludes that it is not probable that a tax treatment will be accepted (keeping the assumptions mentioned above), the company should reflect the result in determining taxable profits (or losses), tax bases, or rates using the most likely amount or the expected value (the sum of the probability-weighted amounts in a range of possible outcomes).

The above must be applied retrospectively, restating comparative periods or, alternatively, apply the cumulative effect as an adjustment to opening retained earnings. Discussing uncertain tax treatments with tax advisors is essential to evaluate likely outcomes based on recent or similar cases.

A&M TAS Says:

Assessing the likelihood of a tax outcome in respect of uncertain tax treatments will require discussions with tax risk experts in determining the approach which would be taken by tax authorities based on recent or similar cases. The change adds a layer of consideration when accounting for tax provisions and presents a significant area of judgment and complexity where the tax treatment is untested. A&M can assist with assessments and calculations and provide insight on the likelihood of specific tax treatments being challenged.

About A&M’s Tax Accounting Services (TAS)

A&M’s TAS practice[4] specializes in providing comprehensive income tax accounting solutions under US (GAAP – ASC 740) and international (IFRS – IAS 12) standards. Our team combines deep technical expertise with innovative tools to deliver efficient, tailored solutions to meet client needs. If your business is looking for expert guidance on tax accounting, please do not hesitate to reach out to us.