U.K. retailers face "profit crisis” as consumers refuse to compromise

U.K. consumers primarily driven by price in purchasing decisions

But they are unwilling to compromise on quality and ethics

Retailer profit margins to slip to 5.1% as a result

London, 14 June 2022 – A new report by global professional services firm Alvarez & Marsal (A&M), in partnership with Retail Economics, has found that as inflation hits a 40-year high, consumers are increasingly driven by price, yet they remain unwilling to compromise on quality and ethics.

Nearly 3 in 5 (57%) consumers in the U.K. say the cost-of-living crisis will have the biggest impact on their expectations of retailers and brands in the next 12 months – the highest in Europe. Price is now the most important driver of purchasing behaviour, with more than a third (37%) of British consumers primarily driven by price.

Nevertheless, nearly the same number (36%) say that quality is the most important factor, and 83% of consumers are unwilling to sacrifice quality for lower prices.

In the U.K., an even higher proportion of consumers – 85% - are unwilling to compromise on a brand’s ethical credentials. Almost half of consumers are prepared to pay more for sustainable products (48%). However, over a third (37%) of consumers expect high ethical standards and are unwilling to pay for them, heaping pressure on retailers and consumer brands.

Erin Brookes, Managing Director and Head of Retail, Europe, A&M, said: “The U.K. is already the most digitally advanced and competitive market in Europe, and so there are no easy fixes for retailers and brands. They are going to have to work even harder to drive efficiencies and appeal to an ever changing and more demanding consumer. To be successful, they need to align themselves with the new realities consumers are facing, whether that’s expanding value ranges or offering products and services which help to address issues like energy usage.”

The looming "profit crisis" for retailers

The cost-of-living crisis and the emergence of a cost-conscious consumer is leading to a “profit crisis” within the retail sector. This comes against a backdrop of supply chain issues, rising labour costs, rising utility bills, shipping costs and the cost of goods sold. And the long-term trend shows consistently declining margins. Over the last decade, U.K. retail sales have risen by 35.7% but profits have fallen by 10.9%.

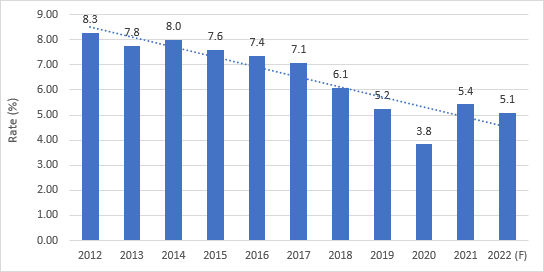

A&M is forecasting that retail profit margins will slip to 5.1% in 2022, down from 8.3% in 2012 – excluding the initial impact of the Covid-19 pandemic, this will be the lowest level in 10 years.

Erin Brookes said: “As costs rise and competition intensifies, consumer-facing companies are having to transform in order to stave off a profit crisis. Investing in digital to drive automation efficiencies, as well as building in more agility will be critical. In these volatile times, supply chains must also be adapted to become more flexible, with simplification and diversification being the priorities. Without these changes, margins and profitability will continue to be hit hard.”

Focus on ethics and sustainability

The pandemic has influenced how shoppers see sustainability, with nearly one in ten (9%) U.K. consumers saying they now consider the environmental impact of their purchases more. Younger consumers are most likely to prioritise sustainability and ethics, with 12% saying it was the most important factor when making purchasing decisions – compared to an average of 9% across all generations.

The most important ethical practices for U.K. consumers are knowing the company or brand pays a fair wage to its employees (33%), followed by sustainable sourcing of products and materials (21%). Among Gen Z, a commitment to reducing their carbon footprint was also a key priority, with one-in-five (21%) expecting this.

Ethics and sustainability are most important for consumers when shopping for apparel (13%) and groceries (11%), although they are still seen as less important than price, quality, and convenience.

Erin Brookes added: “While price and quality are key factors when making purchasing decisions, the expectation from consumers that retailers act in an ethical and sustainable way continues to grow. Although investment in sustainability will be required, innovations in the industry, such as upcycled or pre-loved ranges, demonstrate that ethics and sustainability can also create commercial opportunities.”

-ENDS-

Figure 1 – Weighted pre-tax profit margin from 2012-2022 – UK consumer businesses

Notes to Editors

Methodology

A nationally representative consumer panel was undertaken by Retail Economics across seven countries including the U.K., Spain, Italy, France, Germany, Switzerland, and UAE. The sample comprised more than 5,250 consumers with survey data collected in April 2022.

The analysis of retailers’ profitability covers a sample of 49 UK publicly listed companies. Average pre-tax profit margins are weighted by market capitalisation using data from annual financial reports from 2012 to 2022. The sample covers companies with a combined market cap of over £100 billion.

About Alvarez & Marsal

Companies, investors, and government entities around the world turn to Alvarez & Marsal (A&M) for leadership, action, and results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services. When conventional approaches are not enough to create transformation and drive change, clients seek our deep expertise and ability to deliver practical solutions to their unique problems.

With over 6,000 people across five continents, we deliver tangible results for corporates, boards, creditors, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, leverage A&M’s restructuring heritage to help companies act decisively, catapult growth and accelerate results. We are experienced operators, world-class consultants, former regulators, and industry authorities with a shared commitment to telling clients what’s really needed for turning change into a strategic business asset, managing risk, and unlocking value at every stage of growth.

To learn more, visit: AlvarezandMarsal.com. Follow A&M on LinkedIn, Twitter, and Facebook.

Ellen Johnson, Headland Consultancy, +44 (0)203 805 4816

###