Deferred No Longer — Here Come Deferred Compensation Audits

2014-Issue 34—Just before summer, the IRS spoke unofficially about a new audit initiative covering Section 409A compliance for deferred compensation. This appears to be the first organized audit initiative specifically geared at Section 409A compliance since the legislation was enacted nearly a decade ago as a result of several corporate scandals and perceived abuses by executives in the early 2000s. Although this audit initiative is limited in scope, the IRS will use this practice round to hone its skills and identify common areas of non-compliance. Accordingly, other companies should take some time now to clean house before the IRS expands its audit focus. This edition of Tax Advisor Weekly provides an overview of Section 409A and the IRS audit initiative, discusses some of the errors we commonly see in deferred compensation arrangements, and details what companies can do now to fix mistakes before it is too late.

Overview of Section 409A

Section 409A applies to nonqualified deferred compensation plans, which are defined as any plan that provides for the deferral of compensation other than a qualified employer plan, any bona fide vacation leave, sick leave, compensatory time, disability pay or death benefit plan. This definition is broad and can be complex to apply in practice. Arrangements potentially subject to Section 409A include everything from severance plans to equity arrangements to reimbursement programs, just to name a few. A plan must provide for compensation deferred to be paid only upon one (or the earlier/later of several) of the following events:

- A fixed date;

- Separation from service;

- A change in ownership or control;

- Disability;

- Death; or

- An unforeseeable emergency.

Non-compliant deferrals will become immediately taxable once vested and hit with an additional tax of 20 percent plus interest. Accordingly, it is important for companies to correct deferred compensation plans with form or operational failures to avoid having their employees face these stiff consequences.

IRS Audit Initiative

The IRS limited the scope of this recently announced audit initiative to no more than 50 large corporate taxpayers that were already selected for a general employment tax audit. Within these select companies, the IRS will only review nonqualified deferred compensation of the 10 highest-paid individuals at each company. The three main areas of focus for this IRS audit initiative will include initial deferral elections, subsequent deferral elections and plan distributions. The following section summarizes the general rules for each of these focus areas as well as common mistakes companies make with these rules.

Initial Deferral Elections

General Rule:

A service provider (i.e., an employee or an independent contractor) must make an initial deferral election to defer compensation in the service provider’s taxable year before the year in which the services are performed. An election is not considered made until it becomes irrevocable. Service providers can elect different times and forms of payments for compensation earned in different years (i.e., no need to be consistent between years).

For performance-based compensation, service providers have a little longer to make deferral elections. Generally, the deferral election must be made on or before six months prior to the end of the performance period, provided that:

1. The performance period is at least 12 months;

2. The service provider performs services continuously from the later of (a) the beginning of the performance period or (b) the date on which performance criteria are established, through the date of election; and

3. The performance-based compensation is not “readily ascertainable” at the time of election.

Common Errors:

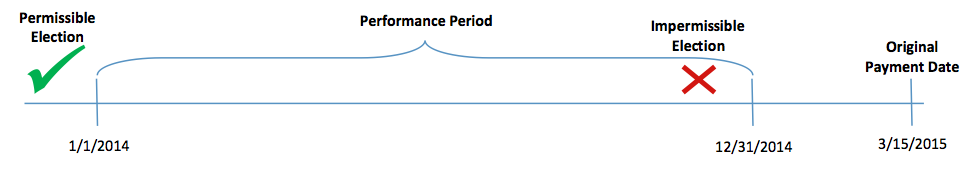

- Sometimes when a discretionary bonus is earned in one year but paid in the next, executives think they can make a valid deferral election by the end of the year in which the bonus is earned since they will not receive the funds until the following year. However, this runs afoul of Section 409A because such deferral elections must be made prior to the year in which the bonus is earned. The chart below summarizes this concept:

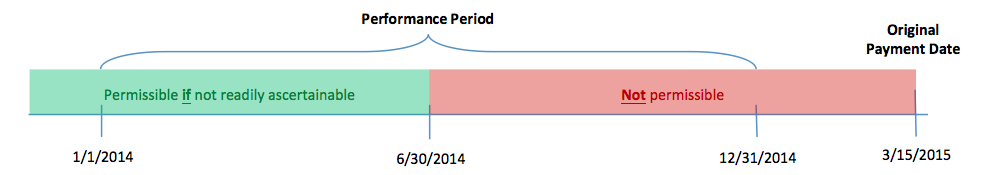

In a similar manner, companies sometimes forget about the requirement for deferrals on performance-based compensation to be made before the compensation is readily ascertainable. For example, if a bonus is based on selling 1,000,000 widgets during the calendar year and the company has already done so as of June 30, then the compensation is readily ascertainable and a deferral election cannot be made at that time. The chart below summarizes this concept:

Subsequent Deferral Elections

General Rule:

Subsequent elections to delay a payment to a later date or to change the form of payment (e.g., from an annuity to a lump sum) are only allowed if the following strict conditions are met:

1. Any subsequent election may not take effect until at least 12 months after the date of election;

2. Any subsequent election must be made at least 12 months before the originally scheduled payment date; and

3. The deferred payment has to be made at least five years from the date the payment would have otherwise been paid.

For example, if deferred compensation was going to be paid at age 65, then the executive would have to make a subsequent election by age 64 and not receive the payments until at least age 70 as shown below.

Common Errors:

- Many times, executives are not aware of the requirement to make a subsequent deferral election at least 12 months prior to the originally scheduled payment date. Accordingly, we often hear of executives trying to make a subsequent deferral election just a few months prior to payments. If a company does not keep up with these timing details, it is easy to run afoul of this requirement.

- Errors often arise around subsequent deferral elections in the merger and acquisition context. Many times, payment of a bonus or other type of deferred compensation is triggered upon a change in control of the company. Sometimes executives want to further defer these payments into the future. Only in very specific situations is it possible to do so without violating Section 409A. However, companies are often not aware of these complicated rules and therefore allow executives to make improper subsequent deferrals around a transaction.

Plan Distributions

General Rule:

As mentioned above, deferred compensation can only be paid upon one of six triggering events: (1) a fixed date; (2) separation from service; (3) a change in control; (4) disability; (5) death; and (6) an unforeseeable emergency. Section 409A recognizes that it may not be administratively feasible to pay amounts precisely on the date specified in the plan. Accordingly, it is acceptable for deferred compensation to be paid 30 days prior to the specified date and for the rest of the service provider’s taxable year after the specified date. However, it is a Section 409A violation if the service provider may directly or indirectly designate the taxable year. For public companies, payments made upon separation from service to specified employees are also subject to a six-month delay. If a specified employee dies during the six-month delayed period, then the employer may make an immediate payment to the employee’s beneficiary. Generally, a specified employee is a service provider who, as of the date of separation from service, is a key employee under Section 416.

Common Errors:

- Payment contingent on signing a release: As previously mentioned, a service provider cannot directly or indirectly designate the taxable year of the payment. One way this sometimes inadvertently occurs is with releases of claims upon termination. Oftentimes severance or deferred compensation is contingent upon an employee executing a release of claims against the company. If termination occurs toward the end of the year, sometimes the employee can determine the year of taxation by either delivering the executed release immediately or waiting until the next year to sign the release. It is important for companies to tighten up the release language in arrangements to avoid situations where the employee can pick the year of taxation.

- Six-month delay: Specified employees (as defined in Section 409A) are subject to a six-month delay of their deferred compensation that was to be paid upon separation from service. Who is considered a specified employee at a company usually changes each year. Accordingly, it is important for companies to keep an updated list of specified employees to be sure early distributions are not made to specified employees. The six-month delay rule was specified as an area of focus within plan distributions for the audit initiative.

Correction Programs

The IRS has issued the following correction programs, which companies can use in certain circumstances within limited time periods after the error is made:

- IRS Notices 2010-6 and 2010-80 are aimed at correcting errors regarding document or “form” failures such as bad provisions in deferred compensation agreements. These correction programs are not available if the service provider’s tax return is under IRS examination or the company is under IRS examination with written notification citing nonqualified deferred compensation as an issue.

- IRS Notice 2008-113 is directed towards correcting errors regarding “operational” failures (i.e., not doing what the plan documents say to do in certain circumstances). This correction program is not available if the service provider’s tax return is under IRS examination.

The programs offer varying degrees of administrative complexity and relief from tax penalties. However, not all errors can be corrected under these programs. In certain circumstances, it is possible to correct errors outside of the correction programs.

Alvarez & Marsal Taxand Says:

Now is the time to perform a self-assessment of your deferred compensation arrangements before you are next on the IRS’s audit list. Here are a few tips to keep in mind:

- Complete an inventory of deferred compensation plans to gain an overview of compliance with Section 409A requirements. As a result of the aggregation rules in Section 409A, changes in one plan can impact another plan, so beware.

- Re-evaluate “grandfathered plans.” Sometimes small changes can ruin grandfathered status and have huge repercussions.

- Perform a systematic review of each deferred compensation plan for form compliance, but also discuss with HR, legal, accounting and any other departments involved in the administration of deferred compensation to see if the company has any operationalfailures.

- If failures are identified, evaluate if you are eligible for any of the correction programs, and if so, start taking the necessary steps to clean up the failures now before an audit commences.

Disclaimer

As provided in Treasury Department Circular 230, this publication is not intended or written by Alvarez & Marsal Taxand, LLC, (or any Taxand member firm) to be used, and cannot be used, by a client or any other person or entity for the purpose of avoiding tax penalties that may be imposed on any taxpayer.

The information contained herein is of a general nature and based on authorities that are subject to change. Readers are reminded that they should not consider this publication to be a recommendation to undertake any tax position, nor consider the information contained herein to be complete. Before any item or treatment is reported or excluded from reporting on tax returns, financial statements or any other document, for any reason, readers should thoroughly evaluate their specific facts and circumstances, and obtain the advice and assistance of qualified tax advisors. The information reported in this publication may not continue to apply to a reader's situation as a result of changing laws and associated authoritative literature, and readers are reminded to consult with their tax or other professional advisors before determining if any information contained herein remains applicable to their facts and circumstances.

About Alvarez & Marsal Taxand

Alvarez & Marsal Taxand, an affiliate of Alvarez & Marsal (A&M), a leading global professional services firm, is an independent tax group made up of experienced tax professionals dedicated to providing customized tax advice to clients and investors across a broad range of industries. Its professionals extend A&M's commitment to offering clients a choice in advisors who are free from audit-based conflicts of interest, and bring an unyielding commitment to delivering responsive client service. A&M Taxand has offices in major metropolitan markets throughout the U.S., and serves the U.K. from its base in London.

Alvarez & Marsal Taxand is a founder of Taxand, the world's largest independent tax organization, which provides high quality, integrated tax advice worldwide. Taxand professionals, including almost 400 partners and more than 2,000 advisors in 50 countries, grasp both the fine points of tax and the broader strategic implications, helping you mitigate risk, manage your tax burden and drive the performance of your business.

To learn more, visit www.alvarezandmarsal.com or www.taxand.com