We recognise these are difficult times, and even with the economic support measures announced on 8th July 2020 by the Chancellor, the reality is that widespread job cuts are now taking place in the UK and with this comes the onerous and complex task of calculating termination payments.

If employers take timely and accurate advice, they can:

Alvarez and Marsal are experts in restructuring and within A&M Taxand, we have developed a

number of tools to help clients with the complexities of calculating the cost of severance arrangements and optimising the tax efficiencies available. Whether you are a large organisation that needs to perform multiple calculations, or a family owned business making difficult strategic decisions for the future, we have the tools and knowledge to help. With so much going on at the moment the result is internal finance and HR teams are stretched to the max whilst potentially also being under consultation themselves.

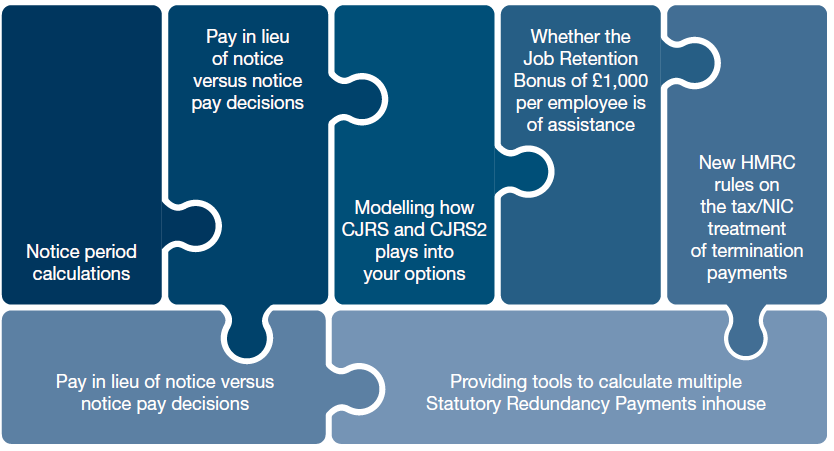

Our team can provide support and practical help with:

The assurance and comfort this provides, along with an independent eye across very difficult decisions, can add real value, support and insight.

Download this full report

here.

OBBBA and Financial Reporting: The Enactment Date Issue You Can’t Ignore

February 17, 2026

Apply ASC 740 enactment date rules to OBBBA changes. See retroactive impacts on M&A, DTAs/DTLs, examples, and 2026 modeling considerations.

From Tax Benefits to Growth Potential: Why the United Arab Emirates Is the Ideal Hub for Asset Managers

February 16, 2026

The United Arab Emirates (UAE) stands as one of the world's premier business hubs, distinguished by its strategic location, forward-thinking policies, economic resilience, and digital innovation.

Decoding Singapore Budget 2026: Spotlight on Key Tax Measures

February 13, 2026

See the latest commentary from our team of tax experts in relation to the Singapore Budget 2026.

DTA TP Working Group Clarifies Approach to Transfer Pricing Risk Analysis

February 12, 2026

The Transfer Pricing (TP) coordination group of the Dutch Tax Authorities (DTA) recently published an internal note, Opzet en aandachtspunten TP analyse, explaining how inspectors are expected to prepare and structure transfer pricing risk assessments.