Risk Assessment in Business Valuation: The Impact of COVID-19. Issues and Guidance for Corporations

Click here to download the article.

As companies deal with financial reporting under the impact of COVID-19, the assessment of the risk embedded in the company’s projected financial information (PFI) has become a critical area both in business valuation and in estimating the enterprise’s ability to weather the current storm. The U.S. Securities and Exchange Commission has provided certain targeted regulatory relief on mandatory reporting requirements on the effect of COVID-19 on corporate financial statements for listed companies[1] however, businesses, quoted or private, may still need to produce financial reports with appropriate COVID-19 disclosures in a timely manner to respond to the needs of their investors, lenders and their wider marketplace such as customers and suppliers.

The discounted cash flow (DCF) method can be especially helpful as a valuation technique when market transactions cannot be relied upon as a basis for a fair value assessment. A DCF analysis is an income-based approach that views the value of a company as the present value of its expected future cash flows. In a DCF analysis, a financial analyst:

- Analyzes and incorporates forecasted cash flows, based on PFI

- Estimates a discount rate that is consistent with the forecasted cash flows

- Discounts the forecasted cash flows to present value.

COVID-19 is likely to have an impact on all three steps, with a magnitude dependent on the company’s industry and on company-specific factors. Let’s look at these three steps in greater detail.

Step 1 – Analyze Forecasted Cash Flows

Most companies are currently in the process of reassessing forecasts and adjusting their PFIs for the impact of COVID-19. Over the short term, for many companies, COVID-19 has had the effect at a minimum of shifting projected revenue from the first and second quarter of 2020 into later quarters. As more data is gathered on first quarter performance and as management gains more visibility into the impact of COVID-19 in overall operations, we expect that financial projections may require further and perhaps more significant adjustments. Here are some observations on key risk areas in the current market:

- Quality of Revenue and Earnings: In the current environment, it is important to consider the composition, as well as the amount, of revenue and earnings. What is the percentage of revenue that comes from subscriptions or long-term contracts (recurring v. non-recurring)? Who are the customers and what is their financial / operational exposure to COVID-19? What has been the attrition rate (loss of customers) for the company historically and how likely it is that the company will be able to at least maintain its historical churn rate? How much of the company’s current revenue is tied to physical points of sale / delivery versus online sales / delivery? Non-GAAP financial information can help gain insight into the company’s operations beyond the standard financial statement disclosures.

- Cash Burn: Metrics such as cash at hand, cash burn rate, and the company’s liquidity ratios are very relevant in a situation of market stress, particularly for early stage companies that are still generating operating losses, and as indicator of the company’s probability of survival.

- Long-Term Real Estate Leases: In a strong real estate market with rising lease prices, a company would have been likely to benefit from long-term lease contracts which would allow some cushion for future needs in the case of company growth. COVID-19 is rapidly changing the long-term lease scenario to a situation in which some of these leases are now seen as a true “liability” for the company. To the extent long-term leases are a significant component of the balance sheet, there is an enhanced risk associated with liquidity requirements related to these contracts to consider in the analysis.

- Net Operating Losses (NOLs): The ability of companies to take advantage of NOLs is highly dependent on the amount and timing of expected operating profits, the fiscal environment, and/or the levels of the merger and acquisition activity. In the current market, an analyst may want to take a close look to the current NOLs and any related deferred tax provision to verify if they are reasonable in light of the most recent developments.

- Operational Leverage and Use of Technology: The ability of the company to adopt a flexible work environment, including remote work arrangements, is already turning out to be critical for managing the current “social distancing” challenges. Companies that have relatively higher fixed workplace costs and less flexibility in managing their workforce are likely to have greater challenges and a higher risk profile than more nimble companies with a more efficient use of resources.

A significant component of company’s value in a DCF model is provided by the terminal value of the company, which is often calculated based on either a multiple of revenue or earnings before interest, taxes, depreciation and amortization (EBITDA) or a terminal growth rate to the last projected year. In view of the impact of COVID-19, an analyst may want to consider whether an adjustment to the multiples is needed in view of the changes in the market multiples of comparable public companies (which have generally declined). It may be argued that the multiples used in the calculation of terminal value should not be adjusted as the effects of COVID-19 are short-term in nature. In some cases, management may want to extend the projection period (for instance, from 2020-2026 instead of 2020-2025) and apply the multiples from prior periods or a terminal growth rate to a higher level of revenue or EBITDA after one extra year of growth in the terminal value calculation. A forecast extension or a multiple adjustment that affects the overall terminal value of the company should be closely reviewed by the analyst and may require a compensating discount rate adjustment to reflect higher forecast risk.

Step 2 – Estimate of Discount Rate

As the risk of the cash flow projections in Step 1 increases as a result of COVID-19, we can expect the discount rate to increase as well. From the company’s perspective, the discount rate in a DCF analysis represents the cost of capital (cost of debt + cost of equity) that the company is required to provide to its investors to be able to access their capital resources. Here are some notes:

In spite of the general increase in risk for most companies, some of the market-driven components within the discount rate have actually decreased, pushing the discount rate down. For instance:

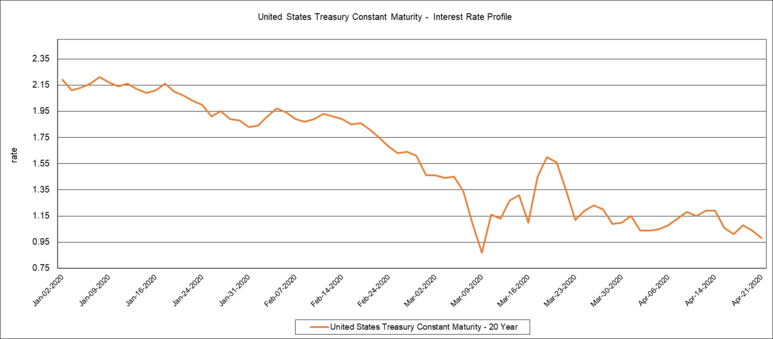

20Y U.S. Treasury Constant Maturity Interest Rate Profile from January 2, 2020 to April 21, 2020; Source: S&P Capital IQ.

- The risk-free rate as represented by the 20 Year U.S. Treasury Constant Maturity Interest Rate has declined from 2.25 percent as of December 31, 2019 to 0.98 percent as of April 21, 2020.

- For some companies, we observe that Beta as a measure of the volatility of the company’s equity value relative to the market has decreased. This reflects an increase in correlation between the company’s equity return and that of the overall market.

To the extent an analyst believes the cost of equity should have increased to reflect a higher risk in the PFI, an offsetting adjustment can be made to the company-specific risk premium that compensates for the change in the risk-free rate and a possible beta decline. The order of magnitude of any adjustments to the company-specific premium will depend on the company’s specific risk profile in terms of factors such as profitability relative to its peers, financial and operating leverage, liquidity, operational efficiencies to name a few.

- In a DCF analysis, the cost of capital is calculated as the weighted average of the cost of debt + cost of equity, with weights representing the estimated value of debt / total capital (debt+equity) and equity / total capital (debt + equity) in the company’s capital structure. For a going concern enterprise, the cost of debt will typically be lower than the cost of equity. For a company that estimates its debt-to-total capital weight based on the current capital structure of comparable public market companies, the ratio may have increased due to a decline in the market capitalization (namely, the equity component of the ratio). In such circumstances, there is an argument for maintaining the D / total capital ratio in the company’s capital structure unchanged to reflect a target ratio for the company that is independent from short-term market fluctuations.

- It is important to keep in mind that there is a strict conceptual relationship between the risk profile of the PFIs and the discount rate used in a DCF analysis. The discount rate should be developed so it is consistent and balanced with the risk profile of the PFI. However, avoid “double dipping” with respect to valuation inputs. If future cash flows have been adjusted the increase in the discount rate may be less than the increase in the discount rate if cash flows have not been adjusted for the impact of the crisis.

Step 3 – Discount to Present Value

It is common to use a “midperiod” convention to discount the projected stream of cash flows to present value. Under the midperiod convention, cash flows are considered earned evenly over the course of the year and are discounted at the midpoint in the year. For instance, a year two cash flow would be discounted using a term of one and a half , rather than a term of two under the end-of-period convention. For many companies, one of the most immediate effects of COVID-19 has been the shift of revenue and profits from the first and second quarters into later quarters. In this situation, using an end-of-period convention, at least for 2020, may be more appropriate.

Evidential and Self-Skepticism

Under the fair value standard for financial reporting, professional skepticism requires that the analyst should have an attitude that emphasizes:

- Evidential skepticism, based on the potential for bias within the information and data. For example, an analyst may want to compare revenue growth rates and operating margin estimates as generated by management to those of comparable companies for reasonableness. In a situation of market dislocation, the analyst may turn to historical evidence of downturns to assess the reasonableness of changes in forecast and the expected timing of recovery.

- Self-skepticism, based on the analyst’s own familiarity with the client, the industry or both.

Alvarez & Marsal Valuation Services

Alvarez & Marsal Valuation Services’ clients include public and private companies across a wide range of industries. We build integrity and accuracy into fair value and fair market value estimates while developing and implementing controls to reduce reporting risks. We help businesses accurately report fair / fair market values for business combinations, equity-based compensation, investment reporting, impairment testing and measurement, fresh-start accounting, and many other purposes.

[1] U.S. Securities and Exchange Commission, Division of Corporation Finance, “Coronavirus (COVID-19)” CF Disclosure Guidance Topic No.9, March 25, 2020.