A Matter of Interest: To Elect or Not to Elect the CARES Act Modifications to Section 163(j)

As a result of the TCJA, taxpayers’ ability to deduct their business interest expense (BIE) is now subject to a limitation. In an effort to provide liquidity to taxpayers, the CARES Act generally allows taxpayers to temporarily increase the limitation on the BIE deduction for taxable years beginning 2019 and 2020. Although the changes are intended to be beneficial, taxpayers should analyze their specific tax fact pattern to determine whether adoption of the changes will be beneficial or disadvantageous in their particular fact situation. In this alert we discuss:

- The rules governing the deduction of BIE under the TCJA,

- The related adjustments to those rules by the CARES Act,

- What should a taxpayer consider in determining whether to apply the adjustments provided by the CARES Act, and

- If a taxpayer chooses to apply the adjustments, the mechanics of doing so

Deduction of BIE under the TCJA

Prior to the TCJA, most taxpayers were able to deduct their BIE without any limitation. The TCJA changed that with the imposition of an entirely new limitation on the deduction for business interest for taxable years beginning after December 31, 2017. Specifically, a taxpayer’s deduction for BIE is limited (the section 163(j) limitation) to the sum of:

- Its business interest income for the taxable year,

- 30% of its adjusted taxable income (ATI) for the taxable year, and

- Its floor plan financing interest for the taxable year.

For taxable years beginning after December 31, 2021, ATI is equal to the taxpayer’s Tax EBIT, which is the taxpayer’s taxable income computed without regard to:

- Items of income, gain, deduction, or loss which are not properly allocable to a trade or business,

- Any BIE or business interest income,

- The net operating loss (NOL) deduction,

- Any deduction for under section 199A for qualified business income, and

- Other adjustments that are prescribed by Treasury Regulations.

For taxable years beginning before January 1, 2022, ATI is equal to the taxpayer’s Tax EBITDA, which is the taxpayer’s Tax EBIT without regard to any deduction allowable for depreciation, amortization, or depletion. Taxpayers for whom depreciation and amortization are significant expenses will, all other things being equal, have a materially lower Section 163(j) limitation in taxable years beginning after 2021.

Any BIE that exceeds the taxpayer’s section 163(j) limitation (disallowed business interest expense) is carried forward indefinitely and can be used in future years to the extent the taxpayer’s BIE for a year is less than its section 163(j) limitation for that year (section 163(j) carryforward). For a partnership, the section 163(j) limitation is applied at the partnership level. To the extent that the partnership is able to deduct its BIE, it includes the deduction in its computation of ordinary business income (or loss). To the extent the partnership has disallowed business interest, it is allocated among the partners, in the same manner as the non-separately stated taxable income or loss of the partnership (the amount allocated is excess business interest expense or EBIE). There are complex rules governing the deductibility of EBIE.

On November 26, 2018, the Treasury Department and the IRS released proposed regulations under section 163(j), which were published in the Federal Register on December 28, 2018. Our client alert on the proposed regulations can be found here.

Adjustment to Rules Governing BIE by the CARES Act

The CARES Act made changes to the calculation of the section 163(j) limitation for taxable years beginning in 2019 and 2020. The exact nature of the changes depends on whether the taxpayer is a partnership. It is important to be aware of which of these changes are the default rules, which require an election in, and which allow an election out. Also, the taxpayer is able to make different choices with respect to 2019 and 2020, which may enable it to truly maximize the benefits of the provisions. In addition, the choice to use 50% of ATI, the election to use 2019 ATI in 2020, and the choice to deduce 50% of EBIE, if applicable, are independent choices and the taxpayer can make one without the others.

Taxpayers Other Than Partnerships

For taxpayers other than partnerships, the CARES Act made the following changes:

- For taxable years beginning in 2019 and 2020, a taxpayer can calculate their section 163(j) limitation using 50% of ATI, instead of 30%, unless they elect out of this change.

- For taxable years beginning in 2020, a taxpayer can elect to calculate their section 163(j) limitation using their 2019 ATI (prorated if the 2020 taxable year is a short taxable year) instead of their 2020 ATI.

Partnerships

For partnerships, the CARES Act made the following changes:

- For taxable years beginning in 2020, a partnership can calculate its section 163(j) limitation using 50% of ATI, instead of 30%, unless they elect out of this change.

- For taxable years beginning in 2020, a partnership can elect to calculate its section 163(j) limitation using its 2019 ATI (prorated if the 2020 taxable year is a short taxable year) instead of its 2020 ATI.

Partners in Partnerships

For partners in partnerships, the CARES Act made the following changes:

- Partners who were allocated EBIE for taxable years of the partnership that began in 2019, can deduct 50% of that excess BIE in their first taxable year beginning in 2020 without subjecting it to the section 163(j) limitation unless they elect out of this change.

Trap for the Unwary

While the application of the options described above appears straightforward, the use of the taxpayer’s 2019 ATI to calculate its 2020 section 163(j) limitation can pose a trap for the unwary. If a taxpayer has a short taxable year in 2020, then they are able to prorate their 2019 ATI to reflect the portion of a 12-month period that the short taxable year reflects. However, if a taxpayer has a short taxable year in 2019, then for purposes of applying its 2019 ATI to 2020, they can only use the ATI from the last taxable year that began in 2019. For example, assume X has two taxable years in 2019: January 1 – October 31 and November 1 – December 31. For purposes of using its 2019 ATI to calculate its 2020 163(j) limitation, it can only use the ATI from November 1 – December 31, even though both taxable years began and ended in 2019 and combined only reflect 12 months.

What Should a Taxpayer Consider Regarding Its BIE Deduction?

If a taxpayer is presented with a choice between tax rules, they will generally make the choice that provides the greatest current cash tax benefit, all other things being equal, taking into account past, present, and future benefits and detriments, as well as present value considerations. In other words, cash in hand today is preferable to the same cash in hand tomorrow, unless the choice to take cash today involves giving up some other benefit or suffering some detriment.

In general, if a taxpayer wants to maximize its deduction of BIE, then it should:

- Calculate its section 163(j) limitation using 50% of its ATI (for partnership taxable years beginning in 2020 and years beginning in 2019 and 2020 for all other taxpayers),

- Elect to use its 2019 ATI for purposes of calculating its 2020 section 163(j) limitation (prorated if the 2020 taxable year is a short taxable year), and

- Deduct 50% of EBIE that was allocated to a partner from a partnership for its taxable year beginning in 2019.

However, maximizing the business interest deduction does not necessarily mean maximizing cash in hand, and can have unintended and unanticipated consequences in both the current and future taxable years. The determination of which options are best for a particular taxpayer may require sophisticated modeling. The following discussion is intended only to point out some of the considerations that should be taken into account.

Effect on Current Taxable Year

An increase in the taxpayer’s BIE deduction will generally decrease the taxpayer’s taxable income for the year, which could either decrease the amount of tax the taxpayer owes or increase the NOL it generated for that year. In essence, applying these options could convert a potential section 163(j) carryforward into an NOL (the potential carryback or carryforward is discussed below).

However, it is important to note that certain deductions in the current taxable year are subject to taxable income limitations, which could minimize or eliminate the benefit of the increased BIE deduction. For example, the section 250 deduction, which is based on the taxpayer’s foreign-derived intangible income (FDII) and global intangible low-taxed income (GILTI) inclusion, is subject to a limitation based on the taxpayer’s taxable income. (A discussion of the proposed section 250 regulations can be found here.) As a result, maximizing the taxpayer’s BIE deduction could reduce the amount of its section 250 deduction. Unlike the section 163(j) carryforward, any amount of section 250 deduction that is disallowed due to the taxable income limitation is permanently lost. Therefore, a taxpayer may be better off applying a lower section 163(j) limitation for a taxable year, which will generate a greater section 163(j) carryforward, in order to maximize its other current deductions.

Similarly, an increased BIE deduction could have a detrimental effect on the amount of foreign tax credits that can be claimed. An increased BIE deduction has to be apportioned among the various foreign tax credit baskets, which will reduce the amount of income in each basket for foreign tax credit purposes. The reduced income within a basket reduces the maximum amount of foreign tax credits that can be claimed with respect to that basket. As a result, it is possible that the increased BIE deduction will displace foreign tax credits that would otherwise be claimed. While excess foreign tax credits generally can be carried forward (except in the GILTI basket), the ability to use the credits in subsequent years is dependent on generating excess foreign source income in the appropriate basket. Therefore, taxpayers should consider how the interest would be allocated for foreign tax credit purposes in determining whether to choose options that increase their BIE deduction.

Another possible adverse effect of an increased BIE deduction is that it could subject the taxpayer to base erosion and anti-abuse tax (“BEAT”) or increase its BEAT liability. BEAT, which was enacted in the TCJA, operates as a minimum tax on corporations that make substantial deductible outbound payments to foreign related parties. As discussed in our prior alert, a taxpayer’s BEAT liability is equal to the excess, if any, of the product of the BEAT tax rate (currently 10%) and the taxpayer’s modified taxable income (MTI) over the taxpayer’s regular tax liability. MTI is calculated without regard to any “base erosion tax benefit” with respect to any “base erosion payment” or the “base erosion percentage” of any NOL deduction. For this purpose, interest paid to a foreign related party is a base erosion payment and gives rise to base erosion tax benefit. As a result, an additional BIE deduction attributable to interest paid to a foreign related party would be a base erosion payment. If that is the case, then it would reduce the taxpayer’s regular tax liability but leave the taxpayer’s MTI unchanged. This could increase the taxpayer’s BEAT liability. Therefore, a taxpayer should consider whether they will be subject to the BEAT in the current or subsequent years in determining which choices they want to make with respect to their BIE deduction.

Effect on Other Taxable Years

As discussed above, the increased BIE deduction has the potential to generate or increase an NOL, instead of a section 163(j) carryforward. Taxpayers will want to compare the effects of an NOL carryforward (or carryback) with the effects of a business interest carryforward. In determining the potential use of a section 163(j) carryforward, it is imperative that the change in the calculation of ATI from Tax EBITDA to Tax EBIT for taxable years beginning after December 31, 2021 is factored into the analysis.

It is also important to appreciate the implications of generating or increasing an NOL. Pursuant to the TCJA (as modified by the CARES Act):

- Taxpayers are allowed to carry back NOLs arising in taxable years beginning after December 31, 2017, and before January 1, 2021 to the five preceding taxable years.

- The NOL carryforward period is indefinite.

- The deduction for NOL carryforwards is limited to 80% of the taxpayer’s taxable income in taxable years beginning after December 31, 2020.

As a result, the increased BIE deduction could be carried back to generate liquidity if it generates or increases an NOL for a taxable year. However, as discussed in a prior alert, it may be beneficial not to carry back an NOL. In that case, the NOL generated would be carried forward. Therefore, the ability to take advantage of the increased NOL may be subsequently limited (due to the 80% of taxable income limitation that applies for taxable years beginning after December 31, 2020), possibly including situations where a section 163(j) carryforward would not be limited.

Now That You Have Decided Which Options Are Optimal…Now What?

Once a taxpayer decides which options it wants to implement with respect to its BIE deduction, it must appropriately apply the default rules or elect alternative treatment.

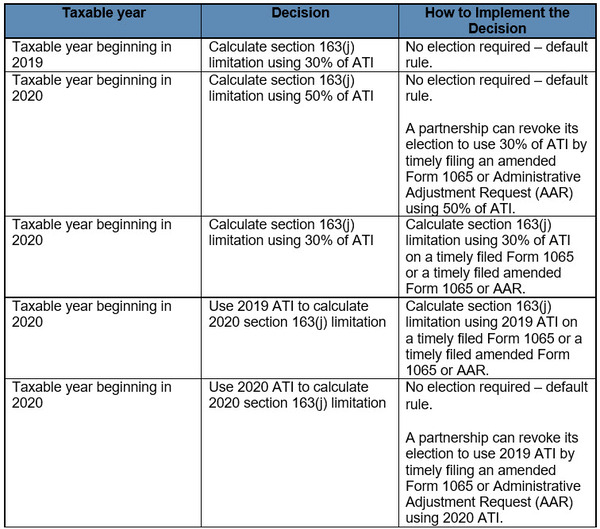

For a partnership, the following table summarizes the manner in which decisions are implemented:

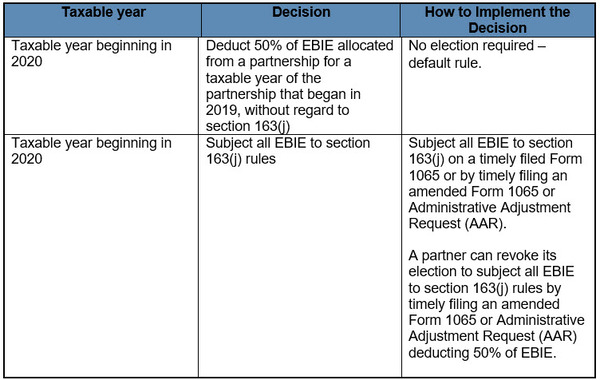

For taxpayers that are partners, these actions are available:

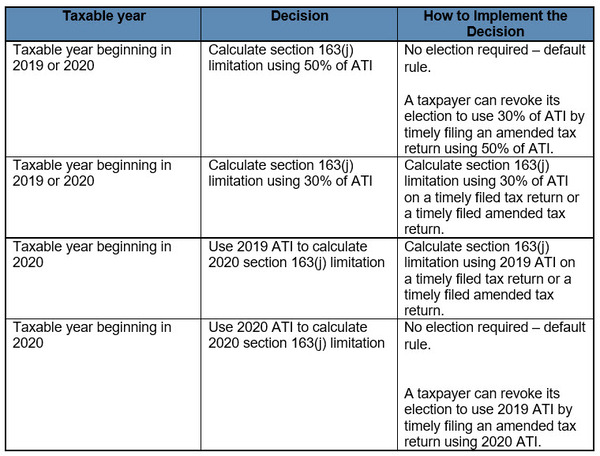

For a taxpayer other than a partnership, the following table summarizes the manner in which decisions are implemented:

A&M Taxand Says

As evidenced by the discussion above, a taxpayer should consider carefully the effects of electing either to apply, or not to apply, each of the CARES Act modifications to section 163(j) in computing its tax liability for 2019 and 2020. A taxpayer should take into account all of its current and projected tax attributes, its yearly ATI and taxable income forecasts, and potential BEAT liability. Therefore, like most elections, the CARES Act rules may require sophisticated modeling in order for a taxpayer to make an informed choice. A&M is ready to assist clients in any and all aspects of this exercise.