UK Executive Compensation Services

Helping clients navigate a complex landscape

We act as an independent, strategic partner that will assist in developing executive compensation policies that will enable your company to attract, motivate and retain key talent. Our seasoned team of professionals have extensive experience providing executive compensation consulting services to publicly-traded, privately-held and not-for-profit organisations. Working together, our objective is to ensure executive remuneration helps companies to achieve their goals and objectives by aligning the interests of management with the interests of stakeholders. As a strategic advisor, we provide the resources, experience and support to help our clients make informed decisions about executive compensation matters.

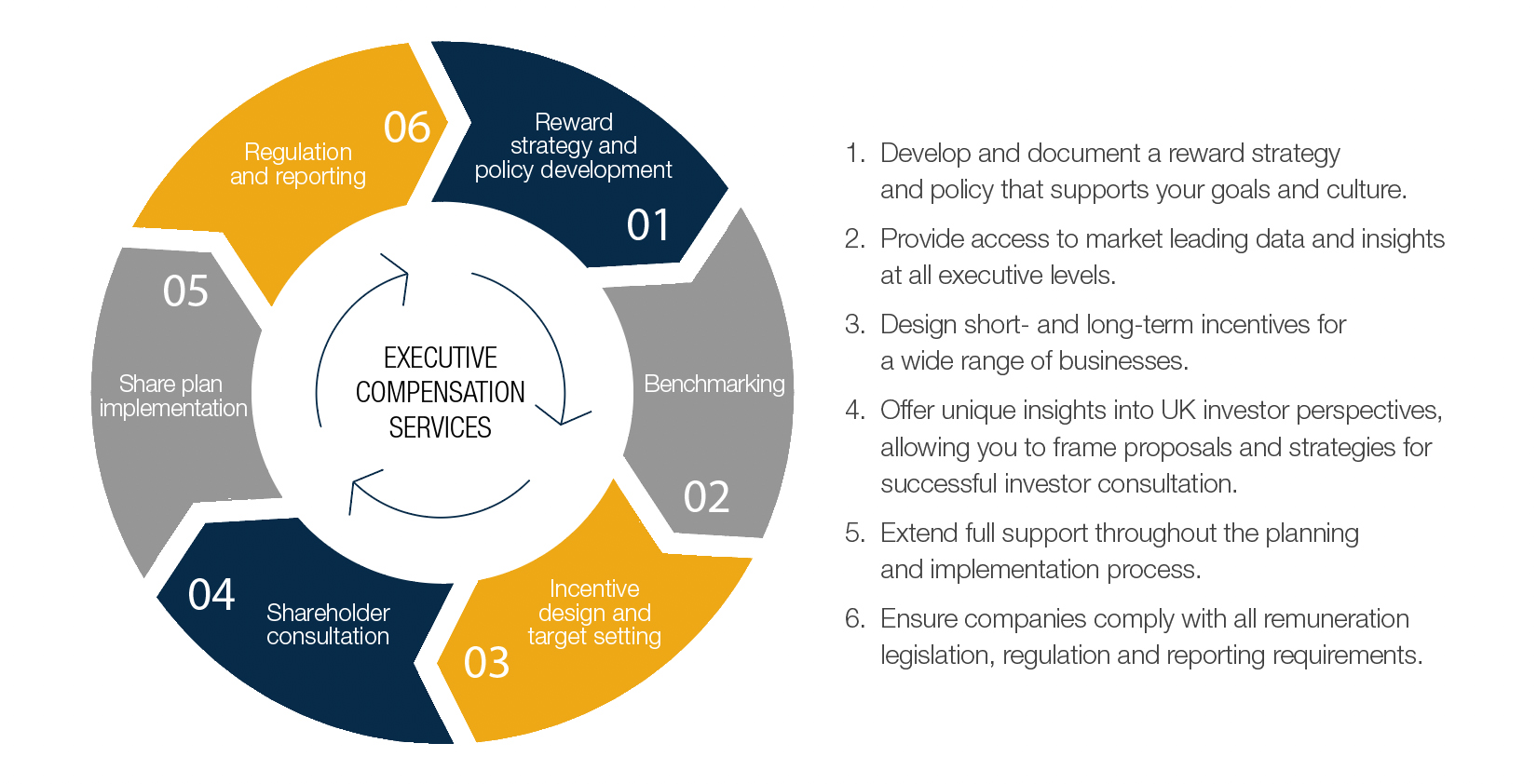

Our Services

As marketplace volatility continues, boards and management teams will look to re-evaluate their business strategy. Ensuring that changes to strategy are supported by the executive remuneration policy is an important factor in success.

Executive remuneration is under ever greater scrutiny and subject to an increasingly constraining governance framework. Effecting changes requires clear advice and effective action in order to quickly adapt to changing needs and strategies, especially at the most turbulent times.

At A&M, we assist companies and their Remuneration Committees and management teams to develop remuneration strategies and policies that align with business goals and culture while supporting the interests of their stakeholders.

|

|

Our Clients

We support a variety of different businesses, listed and unlisted:

Our Methodology

- Senior resource at every stage of delivery

All engagements are led by a senior member of A&M’s Executive Compensation Services practice who attends all meetings and is actively involved in all deliverables. This ensures you always have access to the right level of advice, particularly when making critical decisions under time pressure. Our Managing and Senior Directors have a combined 100+ years of experience in advising on executive remuneration matters.

- Independent and conflict-free

As A&M does not provide audit services, we are free of most conflicts and independence restrictions faced by accounting and actuarial firms.

- Integrated approach across a breadth of services

A&M’s broad professional services offering enables us to bring in specific expertise to help address the client’s issues. We draw upon firm-wide capabilities in tax, accounting advisory, performance improvement and transactional diligence to provide comprehensive and robust advice on all aspects of executive pay. As we are one team working cohesively, the client has one point of contact for all their needs.

- Leadership. Action. Results.™

A&M’s approach has a bias towards action and the willingness to say what we think is needed. Our restructuring heritage sharpens our ability to act decisively, whilst embracing the toughest issues within the most challenging environments.

Our Expertise

The senior members of A&M’s executive compensation team have a combined 100+ years of experience. A&M’s team ensures that clients can meet regulatory and compliance obligations while looking ahead to anticipate and mitigate potential shareholder or investor concerns with decisive action.

Being free of audit conflicts means A&M can draw on decades of business consulting and restructuring expertise in providing advice to clients that moves the needle and uplifts performance.

Learn More

| Executive Compensation | Contact Us |