Tax Accounting Services

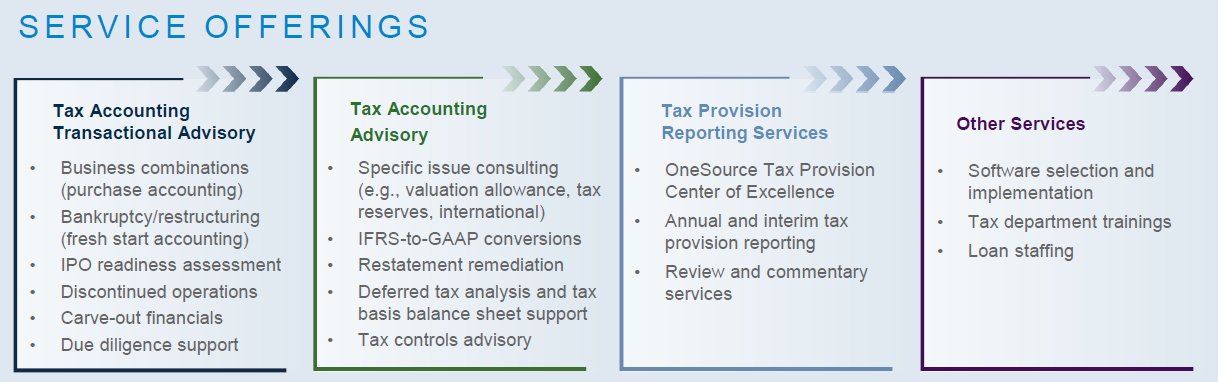

A&M’s Tax Accounting Services (TAS) practice provides global income tax accounting solutions under both U.S. (GAAP - ASC 740) and International (IFRS - IAS 12) standards. As an independent firm free of audit conflict, our advice and services are unbiased and solely focused on your best interests. Our team of seasoned professionals is adept at navigating the complexities of tax provisions, ensuring compliance while identifying opportunities for tax planning and process optimization. Whether a VC funded pre-IPO company in need of foundational tax provision support or a large enterprise requiring sophisticated tax strategies, we offer tailored solutions that evolve with you every step of the way.