Federal Budget Reconciliation Bill Proposals and Medicaid Provider Taxes

Federal Budget Reconciliation Bill Proposals and Medicaid Provider Taxes

Under the House Republican budget reconciliation plan, the House Energy and Commerce (E&C) Committee, which has jurisdiction over the Medicaid program, has been tasked with identifying spending reductions totaling $880 billion over 10 years.[1] Federal Medicaid expenditures and Medicaid financing mechanisms are therefore under intense scrutiny. This includes a state’s ability to finance the nonfederal share of Medicaid costs through healthcare-related taxes, often referred to as “provider taxes.”

Background

Medicaid is set up as a federal/state “matching” program. Generally, the federal government funds a percentage of state Medicaid expenditures. The percentage is different based upon a state’s poverty levels, but on average the federal government pays 60 percent of state Medicaid expenditures.[2]

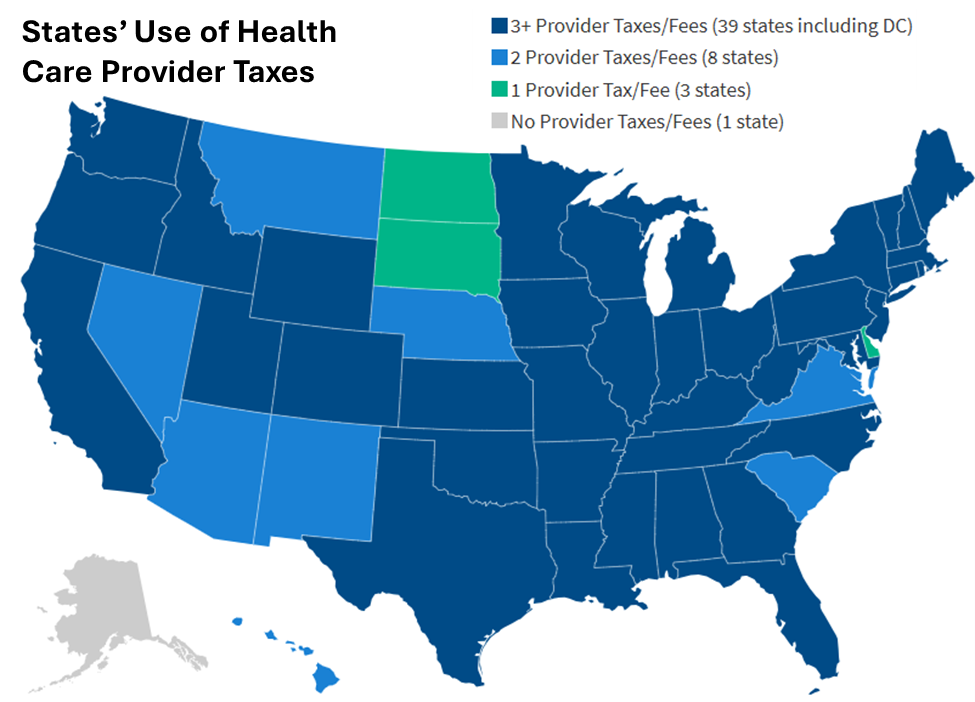

In order to increase the federal “match,” states have increasingly levied health care provider taxes to support and fund state efforts to enhance provider reimbursement. These are special state taxes, imposed on healthcare providers, such as hospitals and nursing homes and increasingly upon managed care organizations that cover Medicaid beneficiaries. These provider taxes are used to increase and maintain Medicaid patient access to providers, support quality improvement through value-based arrangements, and provide state budget relief. Provider taxes are generally used to offset part of the state portion of the state-federal financial partnership that is at the heart of Medicaid.[3] Every state except for Alaska relies on these provider tax generated revenues to some degree to finance the state portion of total Medicaid spending. Forty-six states utilize a provider tax on nursing facility providers and 45 states utilize a tax on hospitals.[4]

Often, provider tax revenues help fund state-directed payment programs (SDPs). SDPs can increase provider reimbursement levels to make them comparable to commercial rates, as permitted by the 2024 Managed Care Rule.[5]

Figure 1 – Source: Kaiser Family Foundation, 5 Key Facts About Medicaid and Provider Taxes, March 26, 2025

Federal regulations have allowed hospitals and other providers to fund state provider taxes if the tax is broad-based, uniformly applied, and does not guarantee that the tax-paying provider will get back all or a portion of the taxes they pay (that is, is “redistributive”). Any tax revenue that exceeds 6 percent of net patient revenue falls outside the so-called safe harbor. [6]

Budget Reconciliation and Proposed Rule

The House E&C-proposed provision would immediately prohibit states from increasing any current provider taxes or creating new taxes. It would also cap SDP payment amounts at Medicare’s rates for the same services. And it would impose new, tighter tests for whether taxes are “generally redistributive.”[7]

Simultaneous to potential House E&C action, on May 12, 2025, the Centers for Medicare and Medicaid Services (CMS) issued a proposed rule that is intended to close a loophole in a regulatory statistical test applied to state proposals for provider taxes.[8] As required by statute, the test is designed to ensure that nonuniform or non-broad-based healthcare-related taxes are generally redistributive. The existing loophole currently allows some healthcare-related taxes, especially taxes on managed care organizations (MCOs), to be imposed at higher tax rates on Medicaid MCOs than non-Medicaid MCOs.

How A&M Can Help

As with other contemplated federal Medicaid program reforms (e.g., work requirements and increased eligibility standards) the Medicaid provider tax provisions proposed in the House legislation will leave most states with less federal funding for their Medicaid programs. States will have to make programmatic and financial decisions that may affect providers, MCOs, beneficiaries, other state-funded programs and taxpayers. Alvarez & Marsal (A&M) can assist states in navigating the potential financial and operational impacts of changes in federal Medicaid funding in several ways:

- Financial, Programmatic and Operational Assessment: Our experts routinely conduct assessments for public assistance programs to identify opportunities to reduce administrative and public benefit costs, address operational inefficiencies, maximize program outcomes, and enhance fraud, waste and abuse prevention efforts.

- Revenue Enhancement: Our team supports states in exploring new or enhanced revenue sources to help offset the loss of federal funds. This could include public-private partnerships, potential grants or other innovative funding mechanisms.

- Regulatory and Compliance Support: A&M has helped state clients navigate the regulatory landscape, ensuring that Medicaid programs comply with federal and state laws even as public policy undergoes significant changes.

- Strategic Advisory: A&M supports states as they weigh the implications of federal initiatives and state policy decisions. This includes constructing scenario planning and impact assessments tools to quickly assess various policy options, and developing 1115, 1915, and other waiver strategies to address specific state policy initiatives.

By leveraging A&M's expertise in financial management, strategic planning, value-based arrangements, stakeholder engagements, and healthcare operations, states can make informed decisions and develop sustainable solutions to address the challenges posed by potential changes in Medicaid provider taxes and federal Medicaid funding overall.

Connect with us today to explore how A&M can support your state's response.

[1] Energy and Commerce Committee, “Chairman Guthrie Delivers Opening Statement at Full Committee Markup of Budget Reconciliation Text,” May 13, 2025, https://energycommerce.house.gov/posts/chairman-guthrie-delivers-opening-statement-at-full-committee-markup-of-budget-reconciliation-text

[2] Elizabeth Williams et al., “Medicaid Financing: The Basics,” Kaiser Family Foundation, January 29, 2025, https://www.kff.org/medicaid/state-indicator/federal-matching-rate-and-multiplier/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

[3] Andrew Patzman and Andrew Lautz, “Paying the 2025 Tax Bill: Medicaid Provider Taxes,” Bipartisan Policy Center, April 11, 2025, https://bipartisanpolicy.org/explainer/paying-the-2025-tax-bill-medicaid-provider-taxes/

[4] Alice Burns et al., “5 Key Facts About Medicaid and Provider Taxes,” Kaiser Family Foundation, March 26, 2025, https://www.kff.org/medicaid/issue-brief/5-key-facts-about-medicaid-and-provider-taxes/

[5] Nick Hut, “Medicaid provider payments take a hit in budget reconciliation bill,” HFMA, May 12, 2025, https://www.hfma.org/payment-reimbursement-and-managed-care/house-budget-reconciliation-bill-would-limit-medicaid-supplemental-payments-to-providers/

[6] “5 Key Facts About Medicaid and Provider Taxes,” Kaiser Family Foundation

[7] Ibid.

[8] “Preserving Medicaid Funding for Vulnerable Populations – Closing a Health Care-Related Tax Loophole Proposed Rule,” CMS, May 12, 2025, https://www.cms.gov/newsroom/fact-sheets/preserving-medicaid-funding-vulnerable-populations-closing-health-care-related-tax-loophole-proposed