Prospect Revision of PRC Tax Collection and Administration Law – Key Changes to Taxpayers

On 28 March 2025, the State Taxation Administration (STA) of the People’s Republic of China (PRC) and the PRC Ministry of Finance (MoF) jointly published a prospect revision draft of the PRC Tax Collection and Administration Law (the Draft Revision), for the purpose of public consultation. The public consultation will run through 27 April 2025.[1]

As an important procedural law for adjusting the behaviour of tax collection, the Tax Collection and Administration Law is an essential legal framework for administering taxation in China. The current prevailing Tax Collection and Administration Law came into effect in 1993. It was then amended in 1995, comprehensively revised in 2001 and further amended through several articles in 2013 and 2015 in conjunction with the reform of the commercial system. The main topics covered by the PRC Tax Collection and Administration Law include taxpayer’s obligations, dispute resolutions, tax noncompliance liabilities, etc.

Key Changes and Impact of the Draft Revision

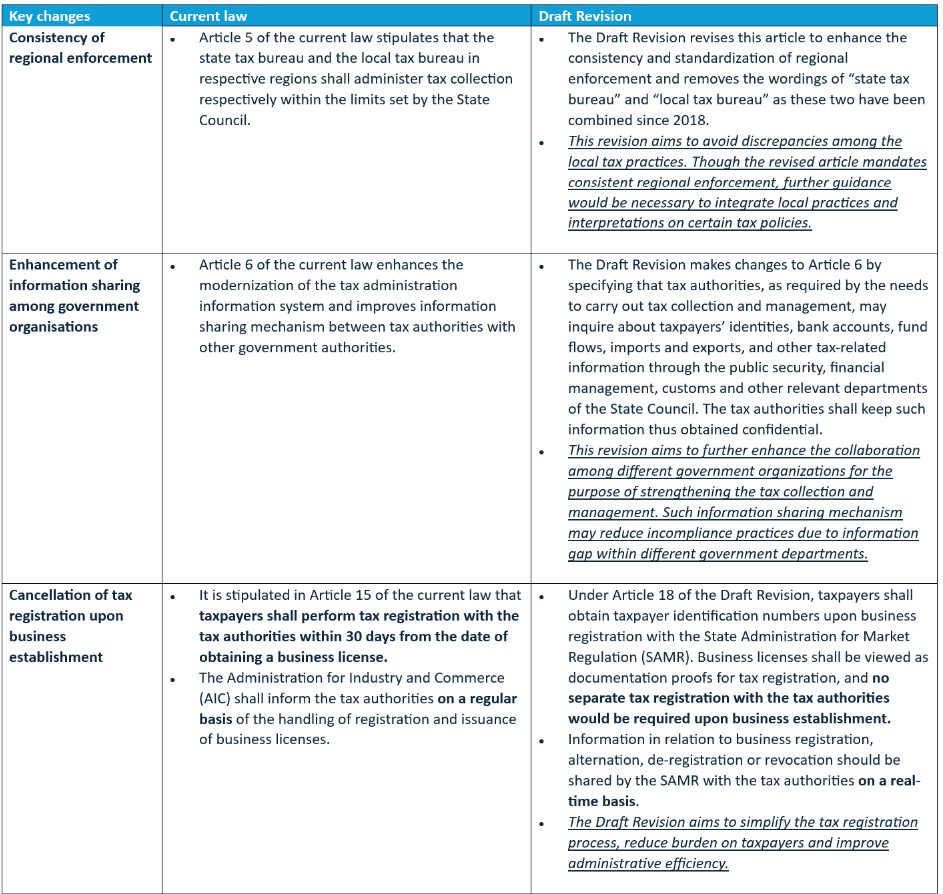

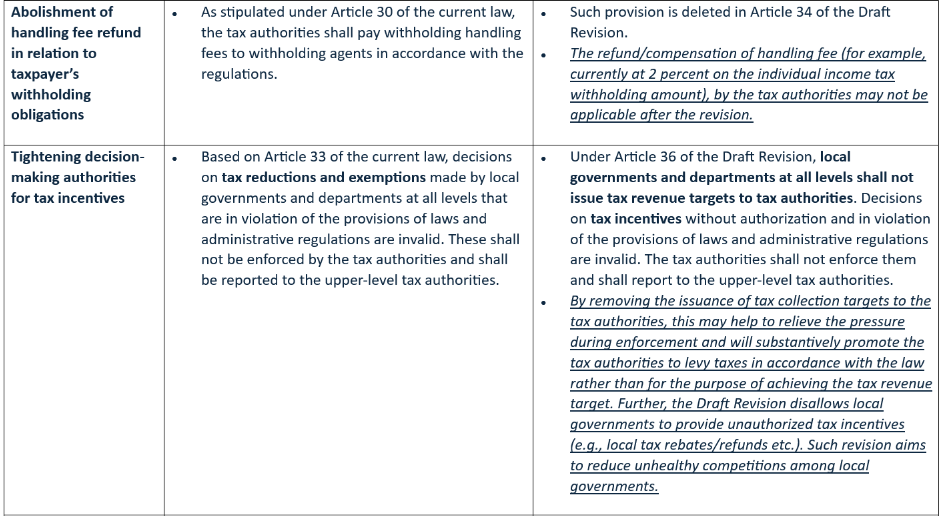

The current prevailing Tax Collection and Administration Law is organized across six chapters, comprising 94 articles. With the chapter setting structured as the current Tax Collection and Administration Law, the Draft Revision consists of 106 articles, with 16 new articles added, four deleted and 69 amended. Below is a summary of the key changes and their implications as outlined by the Draft Revision.

Summary of key changes:

- Mandating Consistent Local Enforcement (Article 5)

- While mandating "consistent" regional enforcement, further detailed enforcement guidance on the respective tax policies would be needed to unify fragmented local interpretations and practices.

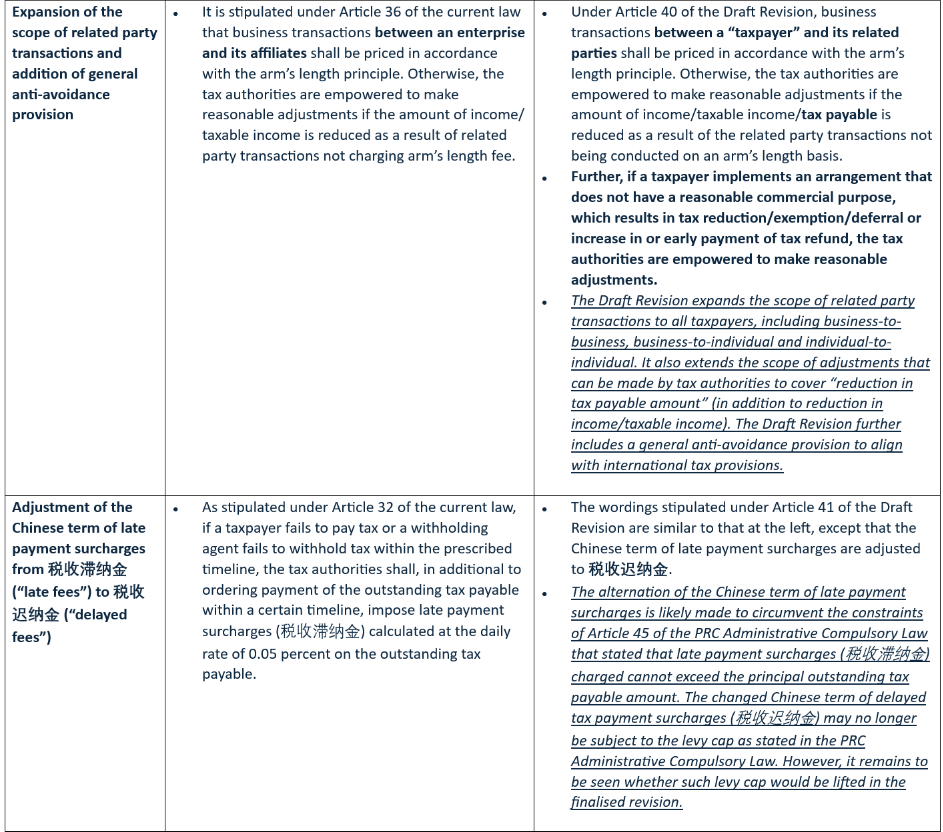

- Expanded Anti-Avoidance Scope (Article 40)

- The Draft Revision broadens transfer pricing rules from enterprise-to-enterprise transactions to include transactions among natural persons and all "businesses,” including trust.

- Uncapped Late Payment Surcharge (Article 41)

- The Chinese term of late payment surcharge is renamed from 税收滞纳金 ("late fees") to 税收迟纳金 ("delayed fees") to circumvent legal caps.

- Late payment surcharge is maintained at a daily rate of 0.05 (18.25 percent on an annual basis) with no upper limit.

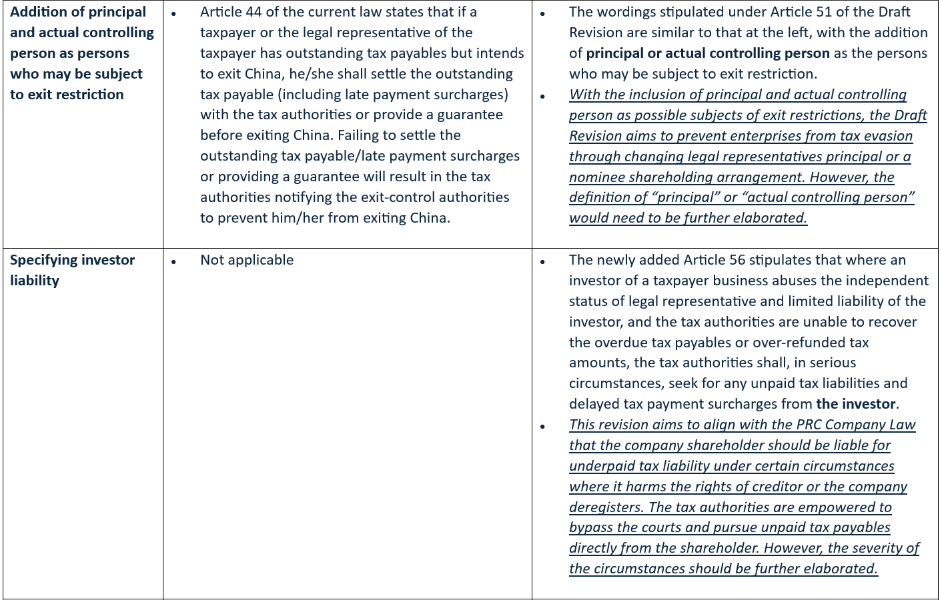

- Direct Shareholder Liability (Article 56)

- Tax authorities gain power to bypass courts and directly pursue shareholders for unpaid taxes under several scenarios.

- Barred Tax Refunds Due to Strategic Overpayments (Article59)

- The Draft Revision permanently bars refunds for taxes overpaid to enhance financial statements, secure IPOs/loans, and obtain qualifications.

- Eliminated Withholding Agent Fee (Article 34)

- Compensation for tax withholding services (including individual income tax) is canceled, which will impact payroll-intensive businesses.

What are not included in the Draft Revision?

- Binding Advance Rulings

- Preclearance system for complex transactions (e.g., cross-border restructuring, indirect share transfers, deferral tax treatment, etc.) is not included in the Draft Revision. While advance rulings are currently being piloted in several cities (e., Beijing, Shanghai and Shenzhen), a national legislative framework would significantly help to enhance tax certainties.

- Clearing "Commercial Purpose" Standards

- Objective benchmarks are suggested to be included in the Draft Revision to prevent arbitrary application of Article 40's anti-avoidance rules.

- Reasonable Caps for Late Payment Surcharge

- Late payment surcharge levied at the daily rate of 0.05 percent is suggested to be aligned with judicial precedents, capping at the principal outstanding tax amount.

- Shareholder Due Process

- Required evidentiary standards and appeal rights are suggested to be clarified before the enforcement of Article 56.

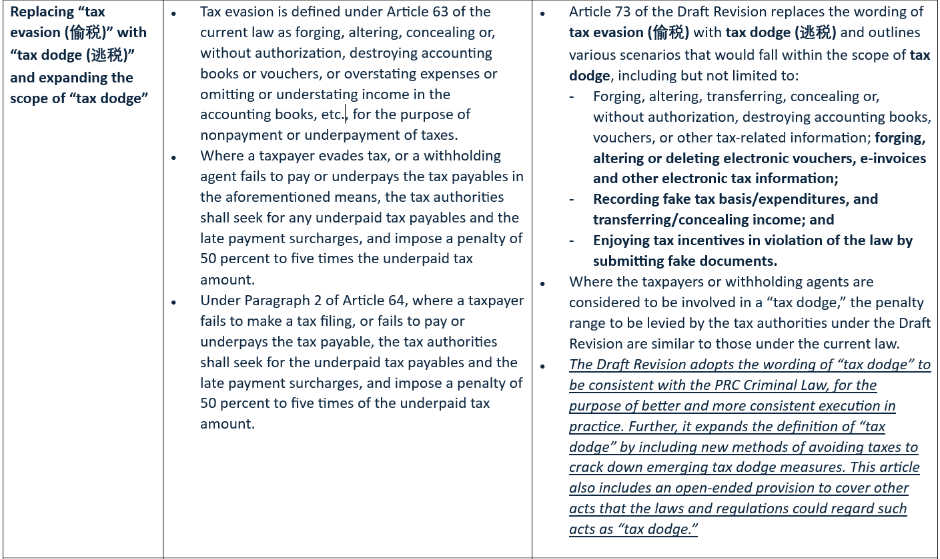

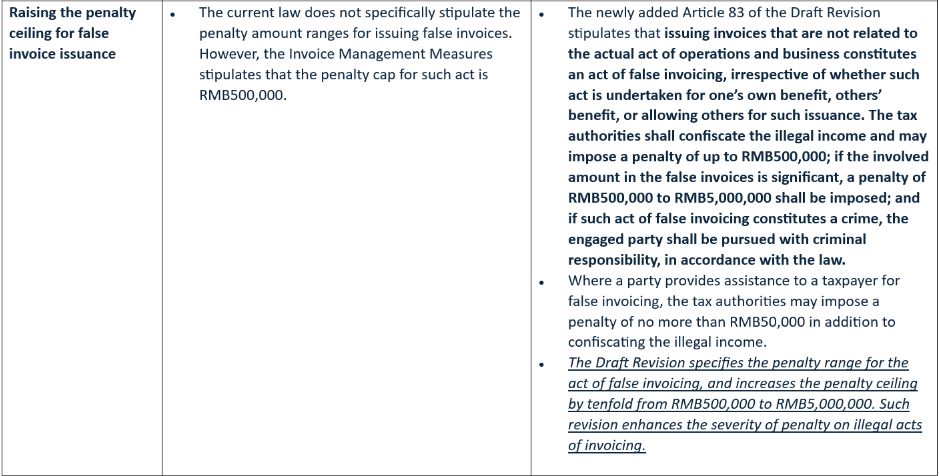

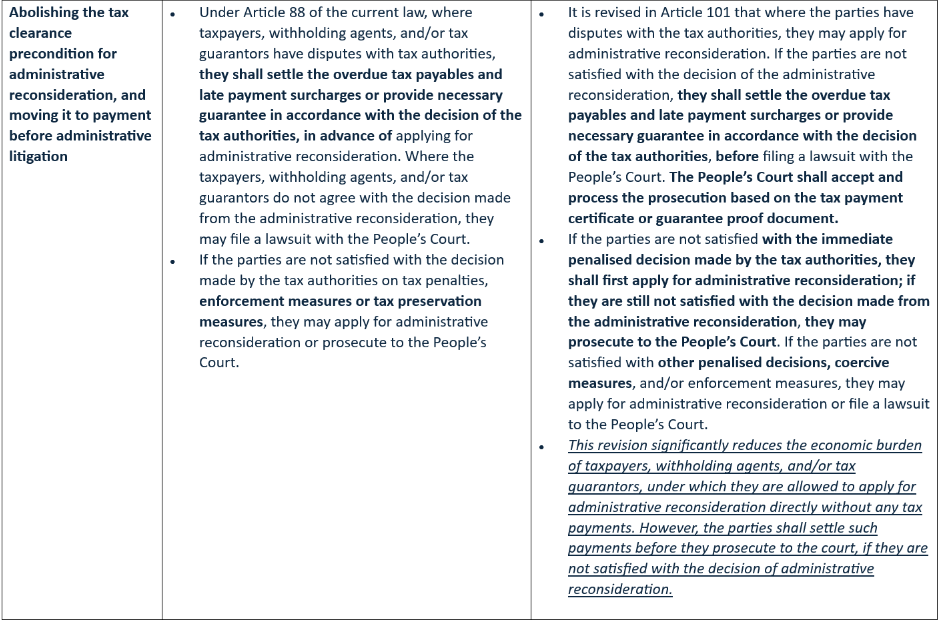

A comparison of the wordings of the key articles between the current law and the Draft Revision with our commentary is also set out in the table below.

Note: Please note that the above English version of the PRC Tax Collection and Administration Law and the Draft Revision is based on our translation, which is unofficial and for informational purposes only. It should not be used for any commercial activities by any other party.

In light of the key changes above, the Draft Revision aims to construct a more regulated and competitive taxation environment for businesses, by making efforts to improve the determination and confirmation of responsibility for illegal tax actions, providing more clarity on penalised measures, enforcing the protection of taxpayers’ rights, as well as accommodating the new trends of digital economy transition. However, certain highly demanded practical aspects, as aforementioned, are not included in the Draft Revision. Public comments are welcome, and more thoughtful amendments may need to be considered before the Draft Revision is finalised.

Alvarez & Marsal, a global professional services advisor, is committed to staying at the forefront of developments in tax legislation and sharing insights with businesses. With a team of experienced professionals, we assist businesses throughout every step of operation and transactions in identifying tax risks, negotiating with tax authorities, and improving compliance with the local tax practices in China and global market. If you have any opinion or feedback in respect of the proposed PRC Tax Collection and Administration Law, you may submit through the STA (https://www.chinatax.gov.cn) or MoF (http://fgk.mof.gov.cn) websites, or consult our team for assistance and coordination.

[1] “Law of the People's Republic of China on the Administration of Tax Collection (Revised Draft for Comment) for Public Comment,” People’s Republic of China, 28 March 2025,

(《中华人民共和国税收征收管理法(修订征求意见稿)》公开征求意见),https://www.chinatax.gov.cn/chinatax/n810356/n810961/c5239263/content.html