How Germany’s Chemical and Pharmaceutical Industry Is Competing Globally

The chemical and pharmaceutical industry in Germany is undergoing a profound shift. Competitive pressure from Asia continues to intensify, regulatory demands are rising, and long-established innovation models are proving less effective under current market conditions. Instead of relying on traditional strengths, many companies are now focusing on digital capabilities, strategic collaborations, and specialized customer solutions. The Alvarez & Marsal Competitiveness Study 2025 shows how these measures are shaping the sector’s trajectory, strengthening resilience, and positioning companies for future growth.

Why the Chemical and Pharmaceutical Industry Are Facing Intensifying Global Competition

Global competition has transformed the chemical and pharmaceutical industry’s operating environment. Asian producers have significantly expanded their manufacturing capacity and continue to benefit from lower labor costs and more flexible regulatory frameworks. These advantages allow them to offer chemical and pharmaceutical products at substantially lower prices, prompting intense price competition and putting pressure on Western manufacturers. At the same time, domestic regulation in Europe is slowing development timelines and increasing complexity across the value chain. For chemical producers, this pressure is amplified by highly standardised basic chemical segments, where global overcapacity intensifies price competition.

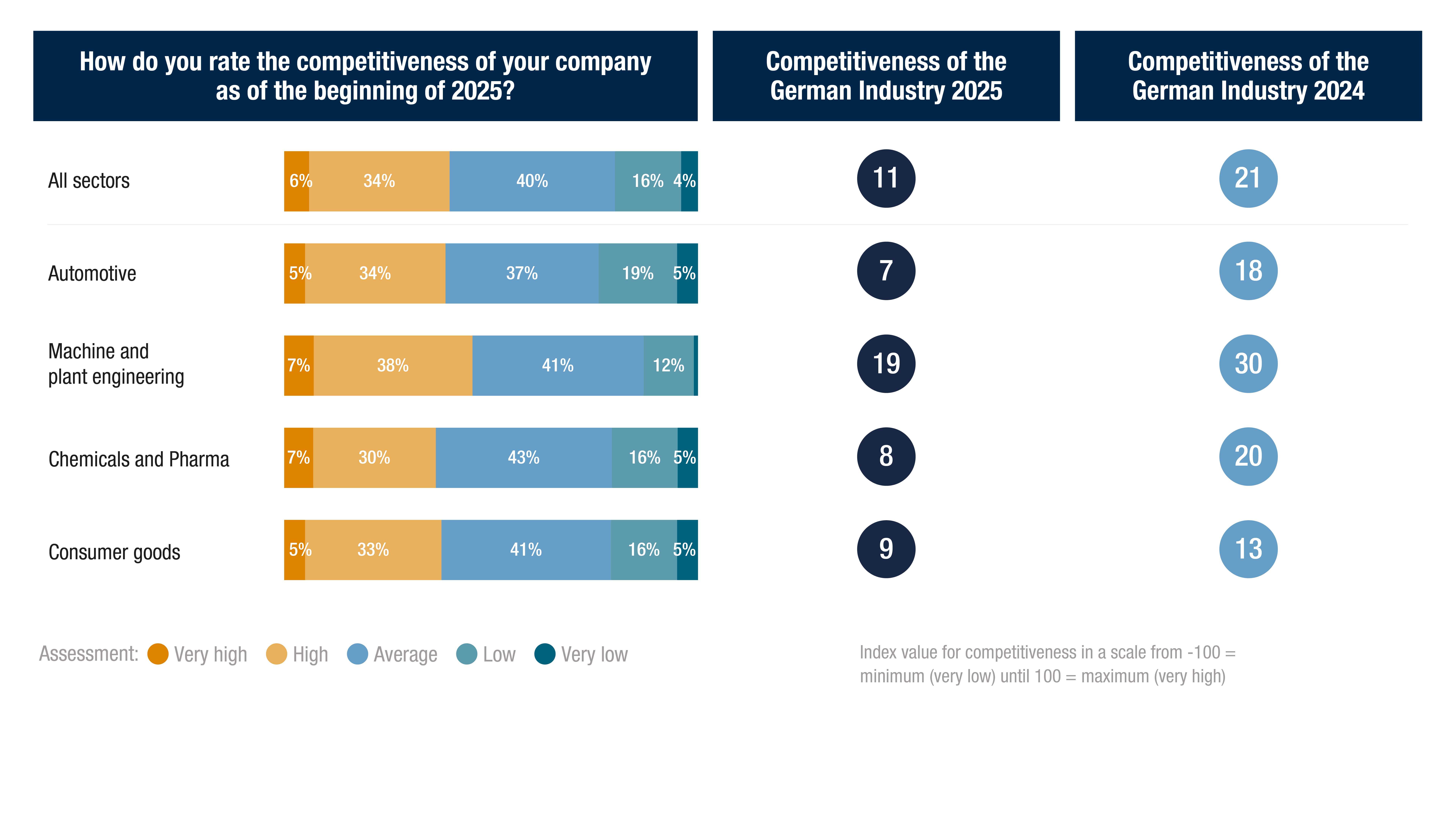

Key Data Point: 21% of companies in the sector now rate their competitive situation as “difficult” or “very difficult,” with the competitiveness index falling from 20 to 8.

The impact is evident in the latest competitiveness data. In the pharmaceutical and chemical sector, 21% of surveyed companies now describe their competitive situation as “difficult” or “very difficult,” resulting in a competitiveness index score of 8, down sharply from 20 the year before [1]. This decline underscores the urgency for companies to reassess their strategic positioning and operating models.

Market data reinforces the scale of change. German chemical output is expected to reach just under €150 billion in 2024, whereas China’s production surpasses €1.6 trillion, which is more than eleven times higher. The disparity is even greater when measured in value added. While Germany contributes roughly €50 billion, China generates nearly €380 billion [2]. Projections indicate that China could account for more than half of global chemical production before the end of the decade [2]. Against this backdrop, competing on volume is virtually impossible; sustainable competitiveness must therefore come from other sources.

Figure 2: Assessment of the Competitiveness of German Industrial Companies – Competitiveness Index of German Industry by Sector

How Partnerships and Innovation Are Shaping the Next Phase of Industry Competitiveness

Companies are responding by concentrating more heavily on their differentiated capabilities: specialized applications, technical precision, and high-value customer solutions. These strengths have always been present, but their importance is growing as the market becomes more fragmented and technologically driven.

Innovation Snapshot: 53% of companies participate in innovation partnership, and 22% more are joining by 2025.

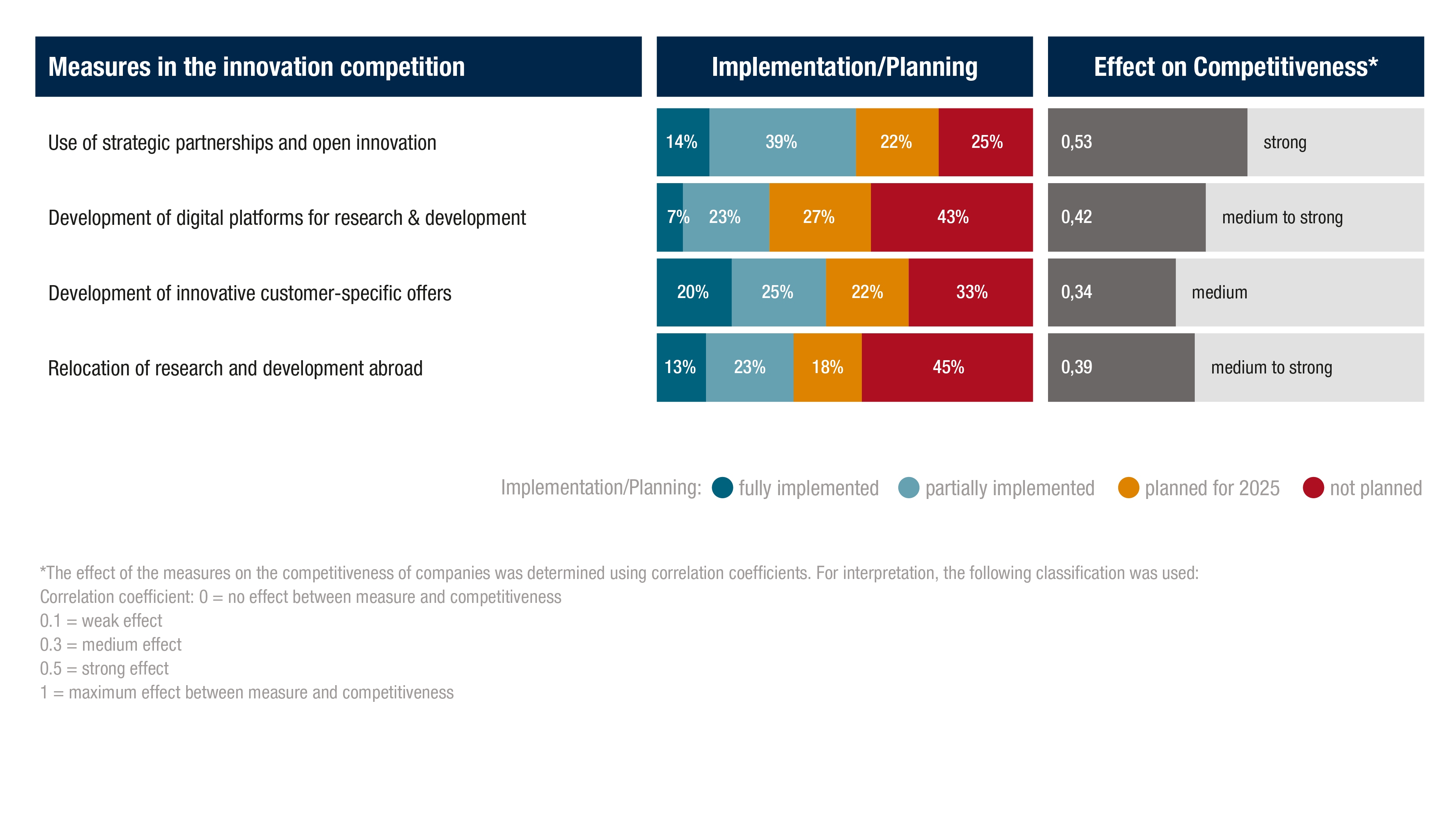

Figure 23: Implementation and Planning of Measures in Companies in the Chemical and Pharmaceutical Industry in Innovation Competition

Strategic partnerships and open-innovation models have become a core component of this shift. According to the Competitiveness Study, 53% of pharmaceutical and chemical companies already work within structured innovation networks, and a further 22% plan to adopt similar approaches by 2025 [1]. These collaborations allow companies to access new technologies earlier, identify relevant applications faster, and broaden their innovation pipeline. Within the chemical industry, these networks are especially important for developing technically precise formulations and niche applications, where competitive advantage often depends on specialist expertise shared across partners.

At the same time, demand trends are shifting. More companies are developing specialized chemical formulations alongside personalized pharmaceutical therapies that respond to specific customer or patient needs. Around 45% of companies already offer customized solutions in these areas, and 22% plan further expansion. This shift reinforces the broader movement away from mass-production models and toward value-added, specialized offerings.

Digital technologies are central to this transformation. Artificial intelligence, digital twins, and simulation models are helping organizations reduce development costs, shorten time-to-market, and improve the quality of decision-making. Early adopters show that digital ecosystem platforms do more than accelerate workflows, they improve transparency for investment decisions, support real-time adjustments during development, and allow companies to evaluate project risks and opportunities more effectively. Currently, 7% of companies have fully implemented digital development platforms, 23% are building them, and 27% plan to begin implementation this year [1].

Why Efficiency and Automation Matter More Than Ever

Competitive strength is increasingly determined by the efficiency of core processes. In basic chemicals, where products are largely standardized and global overcapacity drives down prices, operating efficiency is critical. Rising energy costs, complex regulations, and consolidation on the customer side compound the pressure. This is especially true for the chemical industry, where global overcapacity and high location and energy costs reinforce the need for companies to reposition and sharpen their competitive focus. In contrast, specialty and fine chemicals, along with patent-protected pharmaceutical products, continue to benefit from higher margins and more stable demand due to their differentiated nature.

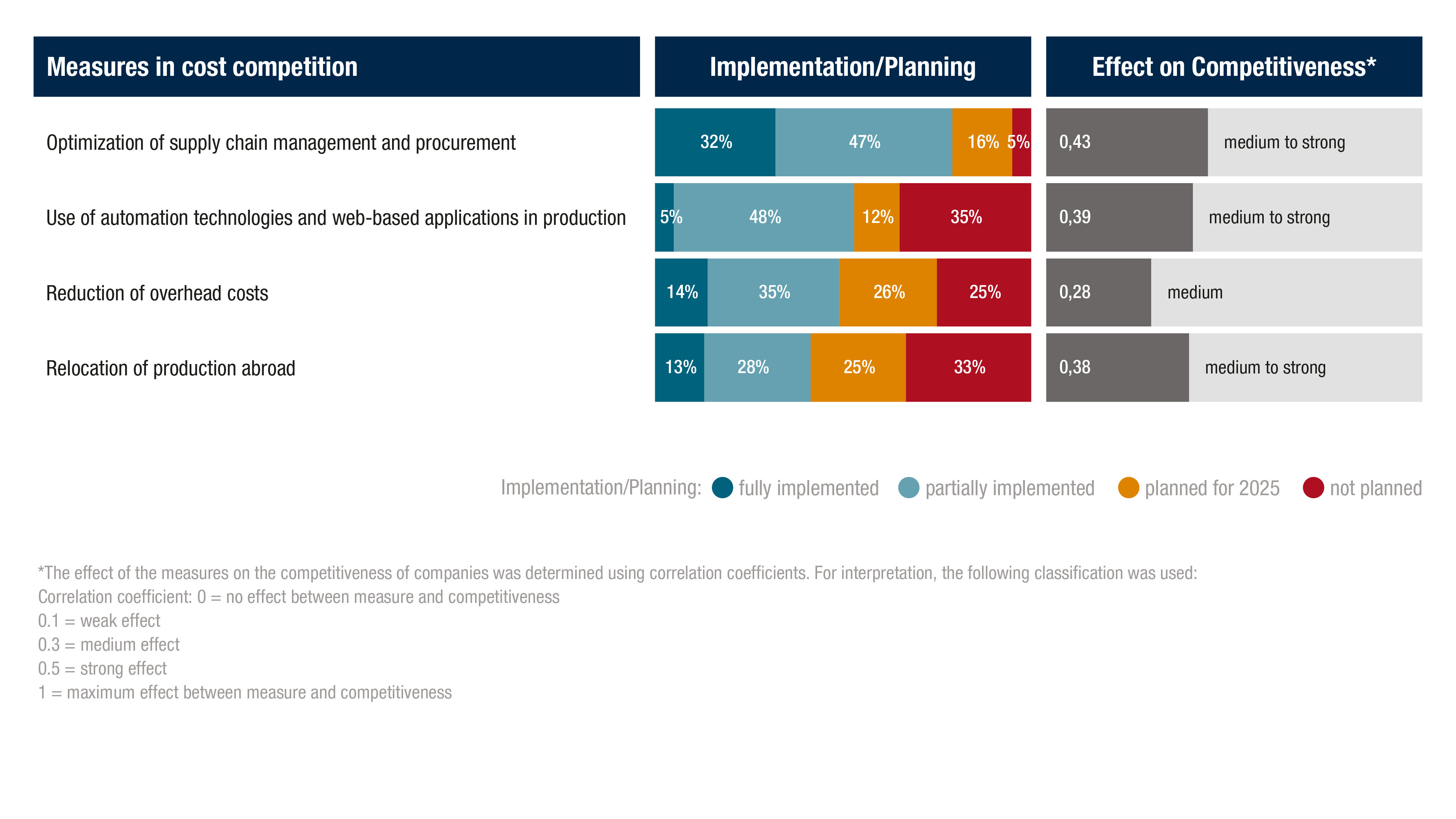

Cost and process optimization remain high on the corporate agenda.

Seventy-nine percent of companies in the chemical industry and pharmaceutical sector have already updated their supply-chain and raw-material procurement strategies to improve resilience and reduce costs. Automation is another significant focus area. Only 5% of companies currently operate fully automated production systems, but nearly half (48%) are investing in automation technologies with the aim of improving production efficiency [1].

Efficiency gains are not limited to physical operations. Many companies are restructuring their organizational models to simplify governance, streamline decision-making, and reduce overhead. About 49% have centralized key processes or adopted digital automation to improve internal functions, and 26% plan to follow by 2025. These shifts help organizations manage complexity while freeing up resources for innovation and growth initiatives.

Figure 24: Implementation and planning of measures by chemical and pharmaceutical companies in cost competition and their effects on competitiveness

Why Domestic Industrial Clusters Still Matter in a Globalized Market

As companies search for lower production costs, less regulatory pressure and better access to growth markets, many are relocating parts of their operations abroad. According to the study, 41% of chemical and pharmaceutical companies have already shifted elements of their manufacturing footprint to international locations. Research activities increasingly follow the same pattern: 36% have relocated some of their R&D operations, and another 18% are planning similar moves. This clear divide between basic and specialty chemicals reinforces why efficiency gains, technical precision, and niche applications continue to be central to competitiveness in the chemical industry.

However, internationalization brings risks. Companies that become too detached from their domestic market may lose access to the well-established networks that support innovation, commercialization, and long-term resilience. The domestic chemical market still represents roughly 40% of industry sales [3], and Europe’s strength continues to lie in its extensive network of industrial clusters, specialized infrastructure, and proximity to demanding end markets. These clusters, including more than 60 chemical parks across Europe, provide advantages that cannot easily be replicated elsewhere: rapid technology transfer, tightly integrated supply chains, and close collaboration between research, application, and manufacturing.

As new regulatory frameworks such as the CO₂ border adjustment mechanism and supply-chain compliance laws come into force, domestic production sites may regain strategic relevance. For many companies, the challenge is not simply choosing between global and local operations but determining how to balance both in a way that supports long-term competitiveness.

Why Capital Markets Are Prioritizing Agility and Strategic Adaptation

Recent developments illustrate how quickly companies can be penalized for delaying necessary changes. Several major corporates have experienced significant declines in market capitalization despite strong order books. Meanwhile, more specialized competitors, particularly those able to scale niche solutions or develop platform-based offerings, have achieved notable gains. Investor priorities are shifting: while patents and R&D pipelines remain important, greater emphasis is now placed on resilient business models, flexible supply chains, and the ability to convert innovation into revenue at pace.

Efficiency, location strategy, and digitalization are no longer operational considerations alone. They are becoming critical drivers of long-term valuation and fundamental components of corporate strategy.

Conclusion: What Will Define the Industry’s Winners?

The chemical industry in Germany, alongside the pharmaceutical sector, is now at a turning point that requires companies to evaluate the performance of their entire value chain. Key considerations include operational efficiency, innovation speed, and the structure of collaborative partnerships that support commercial success. How companies address these questions will determine which businesses build lasting competitive advantages, and which risk falling behind in the years ahead.

[1] A&M Wettbewerbsindex der deutschen Industrie 2025

[2] “Chemicals - Worldwide.” Statista

[3] Henrik Meincke, VCI in CHEManager 3/2025, page 4