Germany’s Legislative Push for E-Mobility: What Employers Need to Know

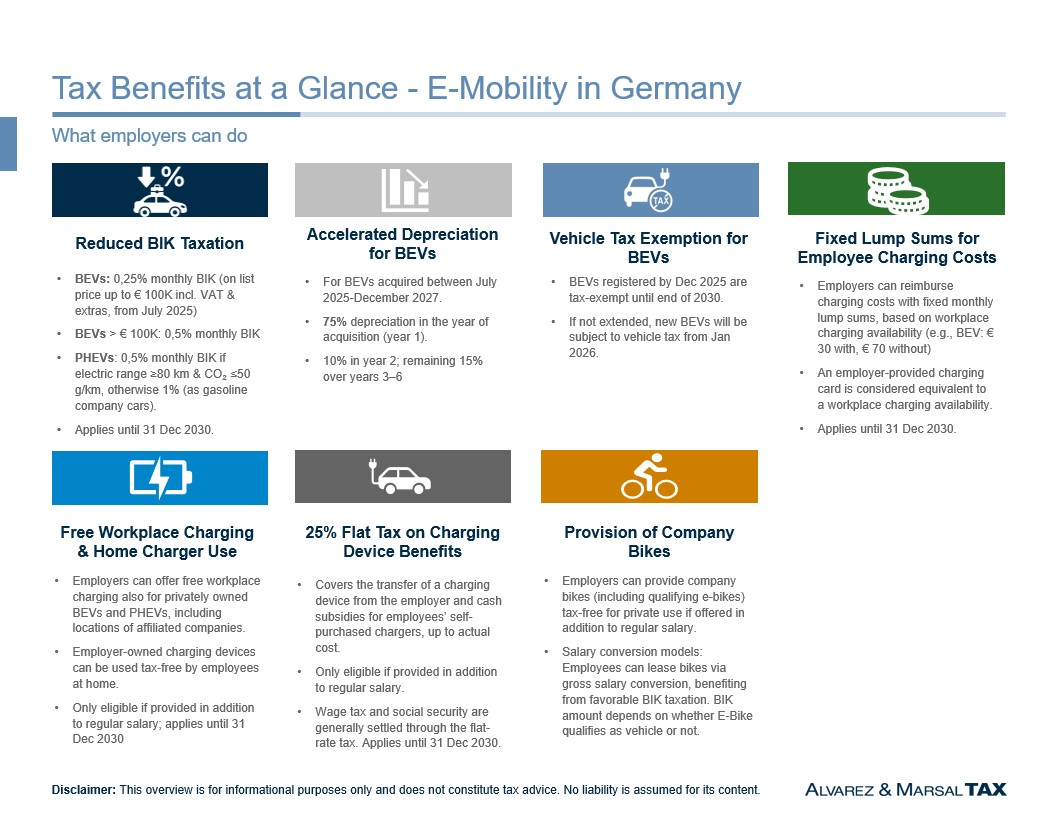

Germany’s Immediate Tax Investment Program introduces significant new tax incentives aimed at boosting corporate e-mobility. Notably, the gross list price threshold for the reduced 0.25 percent benefit-in-kind (“BIK”) taxation applicable to fully electric company cars (battery electric vehicles “BEVs”) has been raised to €100.000. Furthermore, employers can benefit from accelerated depreciation (degressive AfA) for BEVs, allowing them to write off 75 percent of the vehicle’s cost in the year of acquisition.

Our article provides a concise overview of both new and existing tax incentives related to e-mobility in Germany. Companies are advised to seek tailored professional advice to determine their eligibility for the benefits discussed.

1. Reduced BIK Taxation for BEVs as Company Car

In Germany, company cars provided for the employee’s private use are subject to BIK taxation. Typically, one percent of the car’s gross list price is taxed monthly. An additional employment tax charge generally applies if the company car is used for commuting to the workplace, as this is considered an additional taxable BIK. However, for BEVs, only 0.25 percent of the car’s gross list price is considered, provided that the vehicle’s list price does not exceed €70,000 (valid for BEVs registered until June 2025). As of July 2025, this threshold has been raised to €100,000, which includes optional extras and VAT. BEVs exceeding this value are taxed at 0.5 percent. Plug-in hybrid electric vehicles (PHEVs) are still taxed at 0.5 percent, provided they meet specific range and CO₂ emission criteria (for instance a minimum electric range of 80 km). The regulations currently apply until the end of 2030.

The following simplified comparison illustrates the wage tax effects for the three different vehicle categories, based on a € 90,000 company car that is also used for daily commuting (20 km one-way distance) and assuming a 42 percent marginal income tax rate:

| Vehicle Type | Monthly BIK Private Use | Monthly BIK Commuting | Total BIK Per Month | Wage Tax Monthly |

|---|---|---|---|---|

| Combustion engine | 900 € | 540 € | 1,440 € | 605 € |

| PHEV | 450 € | 270 € | 720 € | 302 € |

| BEV | 225 € | 135 € | 360 € | 151 € |

2. Accelerated Depreciation for BEVs

A further key element of the investment program is a special depreciation scheme for BEVs. Companies that purchase electric vehicles between July 1, 2025, and December 31, 2027, can benefit from accelerated tax write-offs, provided no other special depreciation is claimed:

- 75 percent of the purchase cost can be written off in year one (acquisition)

- 10 percent in year two

- The remaining 15 percent is spread over years three to six (five percent, five percent, three percent, two percent)

The new regulation does not impose a value threshold on the vehicle’s purchase price. The special depreciation for BEVs requires that the vehicle be purchased by the employer, i.e., leased vehicles do not qualify for this benefit at the employer level.

3. Vehicle Tax Exemption for BEVs

BEVs are currently exempted from vehicle tax (Kfz-Steuer) in Germany until December 31, 2030, provided they were first registered by the end of 2025. The coalition agreement of the German government includes a planned extension of this exemption until 2035, but no law has been passed yet. If no extension is granted, BEVs registered from January 1, 2026 will be subject to vehicle tax calculated based on the vehicle’s gross weight (rather than emissions or engine size), with a 50 percent tax reduction applicable.

PHEVs are not exempt from vehicle tax. Their tax is calculated in the same way as gasoline cars, based on engine displacement and CO₂ emissions.

4. Fixed Monthly Reimbursement for Employee Charging Costs

For company cars, the reimbursement of electricity costs paid by employees for charging BEVs or PHEVs is generally considered a tax-free expense reimbursement (similar to fuel costs for combustion engines vehicles, which can also be reimbursed tax-free). However, in addition to the reimbursement of actual charging costs and to simplify administration, the German tax authorities allow employers to reimburse employees an additional amount (e.g., for charging at home at own costs) using fixed monthly lump sums, based on whether a charging option is available at the workplace:

| Vehicle Type | With workplace charging | Without workplace charging |

|---|---|---|

| BEV | 30 € | 70 € |

| PHEV | 15 € | 35 € |

A charging card provided by the employer, which can be used at third-party charging stations, is considered equivalent to having a charging facility at the workplace.

These lump sums are treated as tax-free and are intended to cover the employee's electricity costs for vehicle charging. Therefore, an additional reimbursement of actual electricity expenses incurred by the employee for charging the BEV at home cannot be granted as tax-free. This regulation currently applies through December 31, 2030.

For privately owned vehicles, electricity costs reimbursed by the employer for charging are generally treated as taxable employment income (except if the privately owned vehicle is charged at the workplace, please see below). When employees use their privately owned BEVs or PHEVs for business travel, the standard mileage reimbursement rates typically apply.

5. Tax-Free Workplace Charging and Provision of Charging Devices

Employers can grant their employees the following benefits tax-free, provided they are offered in addition to the regular salary (i.e., not through salary conversion).

- Workplace charging for privately owned BEVs and PHEVs can be offered at no cost to employees. This benefit also extends to locations of affiliated group companies. Charging is also possible for e-bikes that are classified as vehicles under traffic regulations (typically those with speeds over 25 km/h).

- Provision of a home charging device (wallbox), provided that the device remains the property of the employer (temporary use by the employee).

These benefits are currently available until the end of 2030.

6. 25 Percent Flat Taxation Option for Charging Devices

Employers can support their employees in acquiring charging infrastructure by applying a flat 25 percent wage tax on the benefit in kind that arises from the transfer of ownership of a subsidized charging device (either free of charge or at a reduced price). This flat-rate taxation also applies to employer cash subsidies for the employee’s expenses related to the purchase or use of a charging device. In the latter case, the flat-rate wage tax is limited to the employee’s actual expenses, excluding electricity costs. Employers are required to maintain records of the actual costs associated with the charging device.

Generally, when benefits are taxed under the 25 percent flat-rate wage tax, both income tax and social security contributions are considered settled, i.e., the benefit does not appear on the employee’s payslip.

The flat taxation is available until the end of 2030, provided that such benefit is granted in addition to regular salary (i.e., not via salary conversion).

7. Related: Tax Benefits for Company Bikes

In addition to traditional e-mobility measures, the legislator has introduced tax incentives for company bicycles, particularly for e-bikes. For example, employers can provide employees with company bikes for private use (including e-bikes that are not classified as vehicles under traffic regulations) tax-free, provided that the benefit is granted in addition to their regular salary.

In addition, salary conversion schemes for leased company bikes are very popular and also offer attractive tax benefits. Under these models, the employee typically converts a portion of their gross salary to cover the leasing rate of the chosen bicycle. However, the taxable benefit arising from the private use of the bike is usually taxed at only 0.25 percent of the bike’s list price (recommended retail price). The total taxable benefit depends on whether the e-bike is classified as a vehicle.

Our View

With both new and existing measures, the legislator has introduced a comprehensive package to effectively advance the mobility transition. The newly defined list price threshold is an important milestone for green company car fleets, as it now allows more premium models to benefit from the favorable 0.25 percent BIK taxation as well.

The introduction of accelerated depreciation is also expected to boost corporate investment in zero-emission vehicles by strengthening their economic attractiveness.

Looking ahead, it is to be hoped that the planned extension of the vehicle tax exemption for BEVs, as outlined in the coalition agreement, will still be implemented. In our view, this would represent a strong and lasting incentive to support the shift toward sustainable mobility. While the reduced 0.5 percent taxation for PHEVs also contributes to lower-emission driving, its effectiveness may be more limited, particularly in cases where electric range and actual electric usage remain modest.

Given the current fiscal constraints faced by the federal government and EU’s efforts to ban combustion engines for company fleets as of 2030, it remains uncertain whether the proposed extension will be realized. A purchase subsidy for electric vehicles, like the one that was in place until the end of 2023, is currently not in sight for private consumers.

A&M Contacts:

Simon-Alexander Kiene