2025: Infrastructure Investment Outlook in a World in Flux

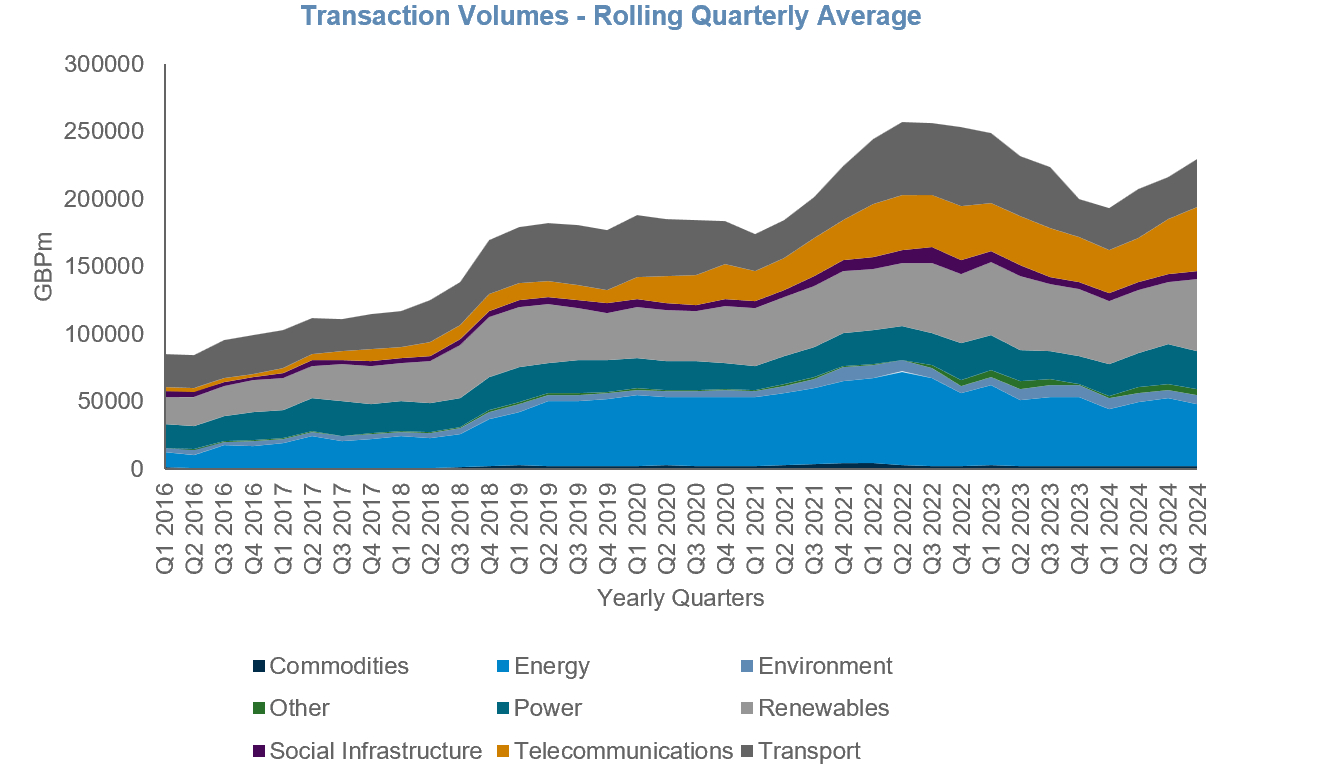

The past decade has seen significant shifts in infrastructure investment patterns globally. Following steady growth in the early 2010s, transaction activity surged toward the end of the decade, boosted by global trends such as digitalisation, electrification and deglobalisation that were later accelerated by the pandemic.

Since the peak in 2022, however, momentum has slowed, reflecting a new economic reality of higher interest rates, increased cost of capital, supply chains disruptions and economic uncertainty.

Figure 1. Infrastructure Transaction Volumes Global – Rolling Quarterly Average

Source: Infralogic

As some of these forces begin to reverse — even if slowly — the infrastructure investment landscape stands at a crossroads. On the one hand, financing conditions have stabilised as interest rates finally eased, and fundamentals remain strong, including the need for large-scale infrastructure investment given the tailwinds of AI and digitalisation.

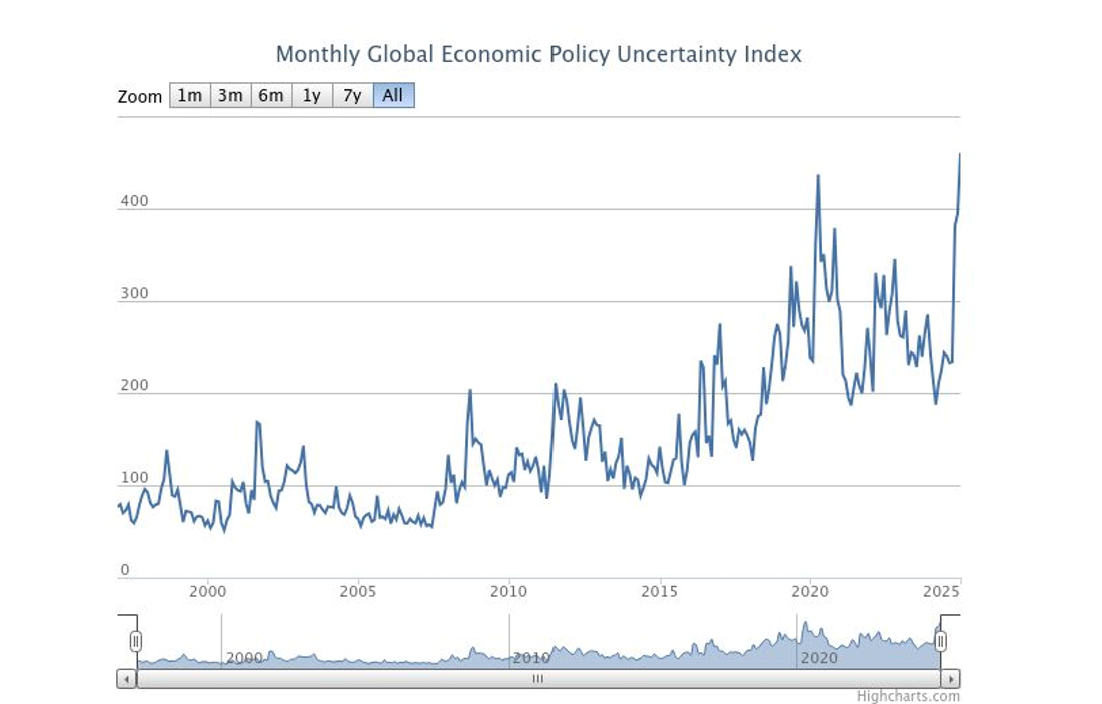

On the other hand, uncertainty still looms large. The start of Donald Trump’s second presidency, with its early pronouncements on trade tariffs and the war in Ukraine, has clouded the global outlook for inflation, growth and the decarbonisation agenda. In this volatile landscape, investment decisions — initially buoyed by the prospect of a more business-friendly U.S. administration — may now see a slowdown or partial pause.

Figure 2. Monthly Global Economic Policy Uncertainty Index

Source: Economic Policy Uncertainty

What investors are thinking

So how are investors responding to this ambiguity?

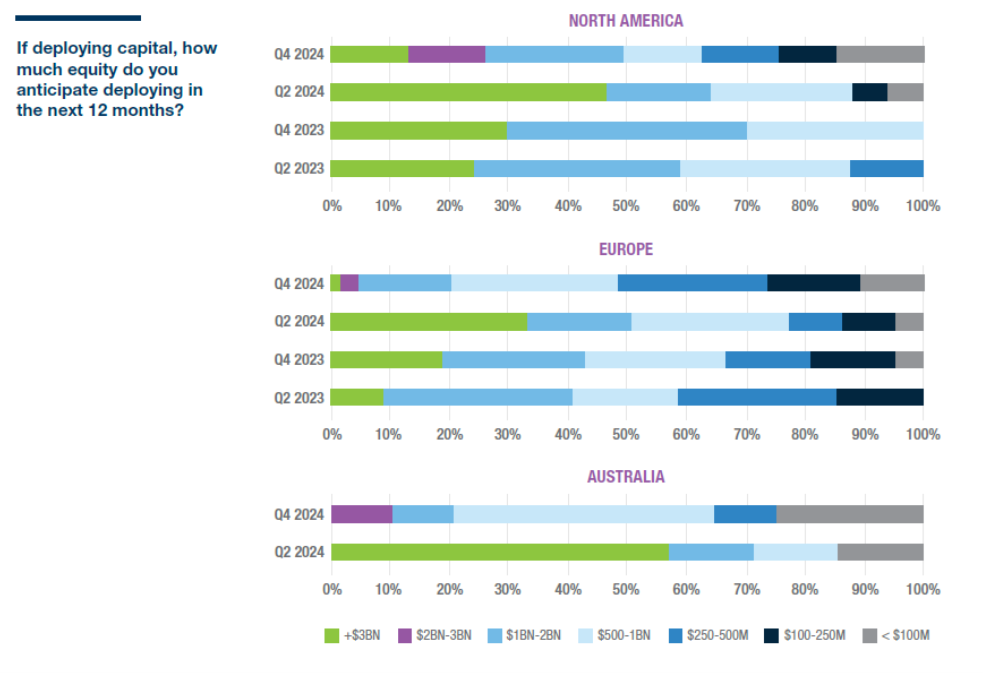

Our Infrastructure Pulse report[1] provides clues. Investors in the 2024 Q4 survey anticipated more cautious levels of deployment in the following 12 months, citing continuing valuation gaps, policy uncertainty and still-challenging fundraising.

The survey also revealed a decline in ESG investment sentiment as investors look to shift toward other infrastructure strategies. We are indeed seeing some early signs of renewed focus on core energy and core infrastructure assets, partly linked to some scaling back of energy transition ambitions. This is illustrated by major oil and gas players slashing investment in renewable energy to refocus on fossil fuels.[2]

Figure 3. Capital Deployment Intention

Source: A&M and GIIA Infrastructure Pulse Survey Q4 2024

While investors in the Q4 survey expressed a preference for U.S. investments over Europe, we have observed a potential shift in sentiment over the past few weeks. Preliminary results from our upcoming Q1 2025 survey indicate a cooling outlook for U.S. investment plans and some early signs of renewed confidence in Europe. This suggests investors may be reassessing new opportunities and weighing the prospect of major policy and regulatory shifts under new governments on both sides of the pond.

“Back to basics” investing

Looking ahead, we can see a return of the traditional link between investment, valuation and economic activity, which had temporarily decoupled during the era of ultra-low interest rates and cheap capital.

Now that interest rates have normalised at elevated levels, this relationship appears to be reasserting itself, driving a more disciplined, “back to basics” approach to investing. This includes:

- A renewed emphasis on quality assets with strong margin profiles

- A sharper focus on operational improvements and performance optimisation

- Preference for inflation-protected assets as inflation remains volatile

- Strategic positioning for resilience, ensuring assets can withstand economic uncertainty and frequent demand fluctuations

Furthermore, we see investors seeking out opportunities in distressed assets — high-quality investments facing liquidity pressures due to increased debt-servicing costs — alongside an acceleration of industry consolidation.

Core infrastructure returns

In a worst-case scenario of weak economic growth and sticky inflation, caused by escalating trade wars, core sectors like utilities could emerge as relative winners. Their inherent inflation-protection features offer upside potential for investors, especially as many such assets remain undervalued following a few lacklustre years. Transportation assets are also likely to show resilience, though their cyclical nature mean greater exposure to swings in passenger and freight demand if economic conditions deteriorate.

Capital deployment in AI and digital infrastructure will likely continue their strong momentum, while energy infrastructure investment is set to diversify across renewables, traditional networks, oil and gas, midstream assets and gas-powered plants. The EV sector and associated infrastructure will continue to attract capital, albeit with more caution than before.

Allocation adjustments

Uncertainty is surely still running high, but a more moderate outlook may emerge as the Trump administration clarifies its priorities after the first 100 days and the market adjusts to new policies.

Though tariffs may not reach the levels currently discussed, they are expected to be higher than historical levels, raising supply chain and overall costs for infrastructure projects. Short-term solutions to those that are likely to be more affected include supply chain partnership renegotiations, as well as further trade re-routes.

These short-term disruptions may not entirely derail the long-term development of U.S. and European clean technologies, and the build-up of infrastructure needed to power and service the digitisation of the economy, including AI integration, and to bolster domestic supply chains. The continuation of some (if not most) IRA tax credits, and the private sector’s responses to other major infrastructure legislations, such as the CHIPS Act in the U.S. and Fit for 55 in Europe, will be critical in accelerating this process.

More broadly, investors must be ready to promptly adjust resource allocation and timings of investments in this evolving climate, for example, by shifting resources toward sectors less exposed to supply chain disruptions or accelerating investments to take advantage of cliff-edge deadlines.

Looking further ahead, vigilance is essential to identify potential market stress points, particularly post-2026, when deteriorating fundamentals and waning confidence could trigger more substantial market adjustments.

[1] “Infrastructure Pulse Q4 2024: North America, Europe and Australia,” Alvarez & Marsal, December 19, 2024, https://giia.net/sites/default/files/2024-12/Infrastructure%20Pulse%20Survey%20Q4%202024.pdf

[2] Arunima Kumar, “BP cuts renewable investment and boosts oil and gas in strategy shift,” Reuters, February 27, 2025, https://www.reuters.com/markets/commodities/bp-ramps-up-oil-gas-spending-10-billion-ceo-rebuilds-confidence-2025-02-26/