Green Shoots: Is Europe on the Cusp of an Infrastructure Investment Super-Cycle?

Infrastructure investment in Europe is gaining momentum, with the Q2 2025 GIIA survey showing a decisive shift in investor sentiment, signalling a potential supercycle as investors seek stability amid global uncertainties. Global investors are having to navigate rather unprecedent markets due to U.S. market volatility and international trade policy uncertainty – leading investors to rebalance their U.S. asset exposure. The Trump administration’s unpredictable tariff policies, including the recent 30% import tariff on EU goods, coupled with stalled green transition ambitions under the ‘One Big Beautiful Bill,’ have further accelerated this shift. Concerns over the U.S. fiscal deficit (projected to exceed 7% of GDP), debt levels (surpassing 120% of GDP), and real interest rates above 2% are prompting investors to reassess U.S. market dominance.

This recalibration of investment strategies has resulted in significant capital reallocation towards Europe. In the first half of 2025, European equity funds attracted over $100 billion in inflows, tripling last year’s figures, while U.S. equity fund outflows doubled to $87 billion. European infrastructure deal values have also surged by over 25% in six months, supported by Europe’s stable legal frameworks, public-private partnerships, and sustainability-focused initiatives, offering a more attractive risk-reward profile.

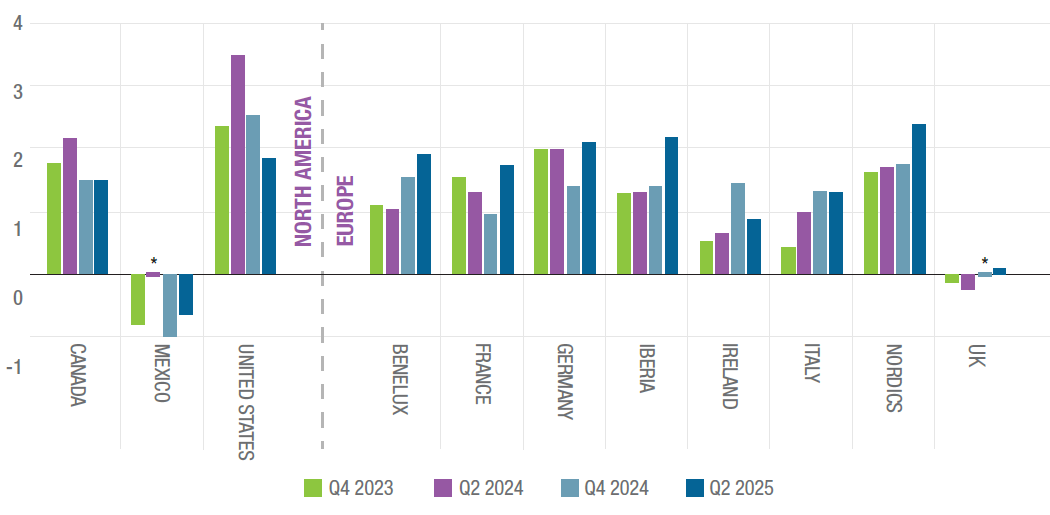

Looking to the future, Europe’s renewed focus on achieving the green energy transition, favourable monetary policy – such as the European Central Bank’s rate cuts from 4% to 2% and government prioritisation of economic security has bolstered growth. Northern (+3.4%), Southern (+2.2%), and Eastern (+1.6%) Europe have driven growth, making the region increasingly appealing to investors. These trends were underscored in the Q2 2025 GIIA Infrastructure Pulse Survey, which highlighted Europe’s growing appeal to global investors - Figure 1

Figure 1 - What is your outlook for the attractiveness of, and opportunities for, your fund(s) infrastructure investment in the following countries in the next quarter? (-5: extremely unfavourable, 0: neutral, 5: extremely favourable). Source Infrastructure Pulse Survey Q2 2025.

Germany’s macroeconomic reforms are set to sustain Europe’s investment momentum. The amended “debt brake” allows greater public borrowing, complemented by a €500 billion infrastructure fund, including €100 billion earmarked for energy projects Additionally, the updated Investment Ordinance Act permits regulated investors to allocate up to 5% of capital to infrastructure, signalling that Europe is open for infrastructure investment.

For Europe to utilise these favourable policy settings, attract and retain private investment it must overcome several structural challenges. It’s $12 trillion capital markets are dwarfed by the U.S.’s $60 trillion, its fragmented markets, lower R&D spending, and regulatory barriers are some of the major factors that leaves the EU’s 20% less productive than the U.S.

The European Commission is tackling these issues through initiatives such as the EU Green Deal, Clean Industrial Deal, and Circular Economy Act. Simplified sustainability reporting, alongside proposals for a single Savings and Investment Union, aim to mobilise EU savings into equity financing, support high-growth firms, and lower financing costs, paving the way for stronger economic performance.

If these market reforms are achieved, the common market could see greater integration, enhanced productivity, attract and retain even more private capital - solidifying its position as a leader in green and digital infrastructure; propelling the burgeoning supercycle in infrastructure investment.

Our new report, developed in collaboration with the GIIA and part of the Infrastructure Pulse survey, explores what’s behind signs of a rebound in Europe’s attractiveness – and whether it can be sustained. 'Green shoots: Is Europe on the cusp of an infrastructure investment ‘super-cycle’?' seeks to identify some key drivers for this rebalancing of investor portfolios, including a moderately positive macroeconomic outlook for Europe, and how the EU is prioritising its economic security via increased investment in infrastructure and defence.