Why Your Business Needs to Pivot to a ‘Today’ Strategy in 2025

Introduction

2025 is shaping up to be a difficult year for French businesses. Domestic growth is predicted to slow in the first half of the year as the unresolved issue of the budget dents confidence and puts the brakes on activity. At a global level, weaker growth across Europe, China’s deceleration and the threat of U.S. protectionism are expected to directly impact the performance of many French firms.

Adding to these challenges is a new reality of higher capital costs. Investors are increasingly scrutinising capital allocation decisions and questioning whether existing assets are delivering maximum value. Boards and management teams must balance these pressures while transforming operations to meet evolving customer needs, embracing the AI-driven transformation sweeping across sectors, and continuing to invest in innovation.

This environment calls for business models to be evaluated with fresh eyes: what channels and products within the business portfolio should be prioritised as consumer preferences change? How can footprint be reconfigured to maximise cash generation rapidly despite declining demand in certain markets?

In our view, 2025 is the year to address those strategic questions. There is little time for deliberation – waiting another 12 months could prove too late for many companies, in particular for those competing for investors’ attention. Businesses must seize the moment to realign their assets to a new market reality, fuelling efficiency and growth, and unlocking value in the process.

This paper outlines our perspective on the urgent need for corporates to optimise asset and cost efficiency to unlock maximum value in today’s market. We focus on four critical areas for action: go-to-market (GTM) strategy, footprint, carve-outs and cost structure, presenting the best practices and potential outcomes within each lever.

Outlook worsens in 2025

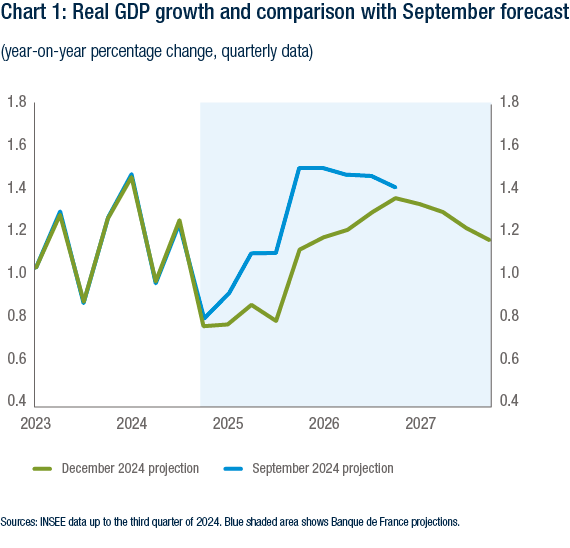

Following a likely stagnation in the last quarter of 2024, driven by a post-Olympics economic dip and a volatile political situation, growth expectations in France have moderated more recently. The Bank of France [1] has lowered its GDP growth forecast for 2025 to 0.9% from 1.2% previously, citing increased uncertainty both at home and abroad and related impacts on household consumption.

Goldman Sachs has also recently revised its GDP growth projection to 0.6%, attributing the downgrade to a more cautious stance on private consumption, potential policy uncertainty, labour market challenges, as well as the fragile balance of political and fiscal management in the country.

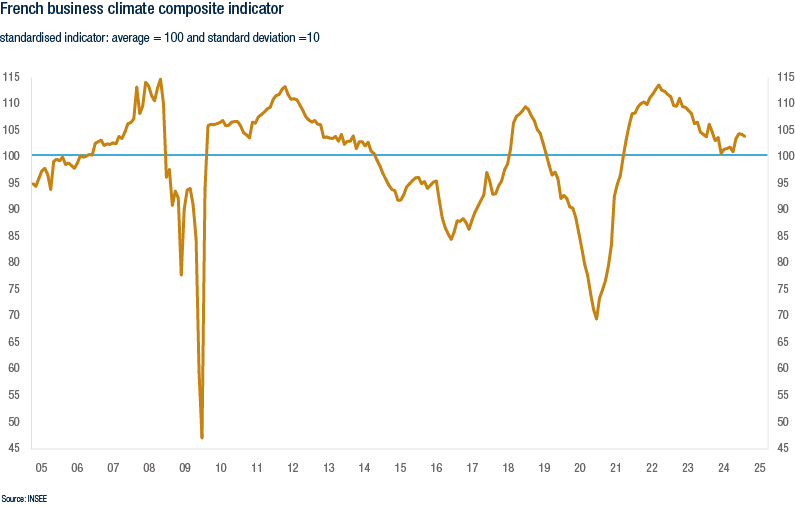

Business sentiment has declined too, with a S&P survey [2] in October revealing that French companies are among the least optimistic about their growth globally, only behind their German peers. French firms anticipated reduced investment, weaker profitability and subdued hiring plans in the year ahead. In January, business climate remained gloomy, according to INSEE data.

The mood is particularly bleak among manufacturers, which expect a much larger hit to their profitability in 2025 than services firms. This is likely to worsen an ongoing crisis in the sector, which saw production volumes shrink in December at the fastest pace in over four years. Fragile demand, particularly from overseas, continues to weigh on French factories, prompting many to make production cutbacks, reduce input purchasing, trim inventories and cut jobs [3].

Across sectors, French businesses – especially those exports-focused – will have to deal with another layer of uncertainty due to political shifts in the U.S. and Europe, especially around trade patterns and commitments to green targets. These can further dampen business investment both domestically and abroad, and compound longer-term challenges including supply chain disruptions and the energy transition.

Developments in China will also be key to the outlook for large parts of corporate France. Take luxury retailers, for example: their China sales plunged in 2024 as Chinese shoppers cut back on expensive purchases. Any deepening of the economic slowdown currently underway in the Asian country – particularly in light of the tariffs threatened by U.S. President Donald Trump – can create ripple effects for companies reliant on China demand.

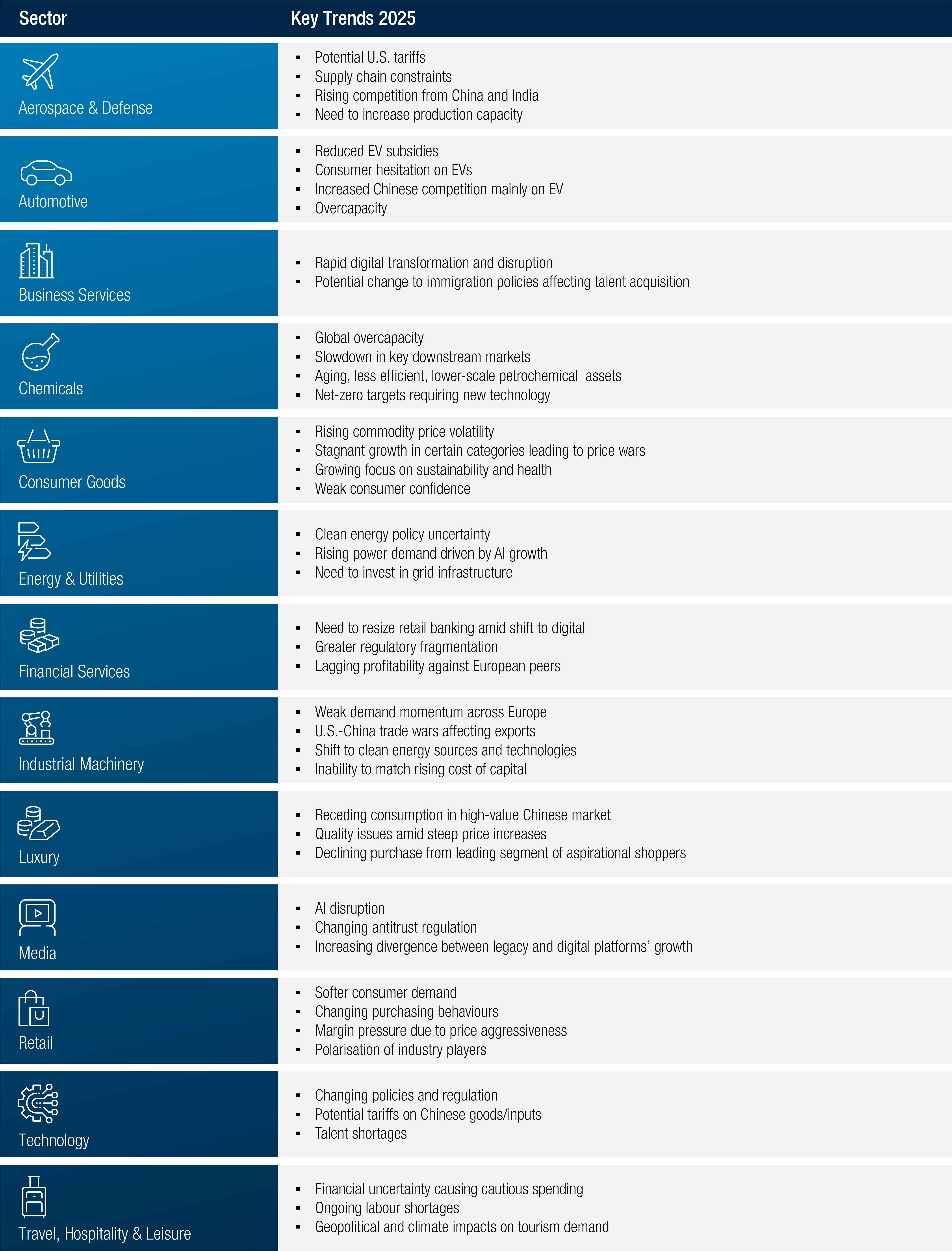

Sector Specific Trends

While macroeconomic developments such as tariffs and slowing growth are expected to affect French companies across the board, each sector is dealing with its distinct set of market challenges in 2025. These are summarised in the table below:

Strategy reset: Four immediate actions

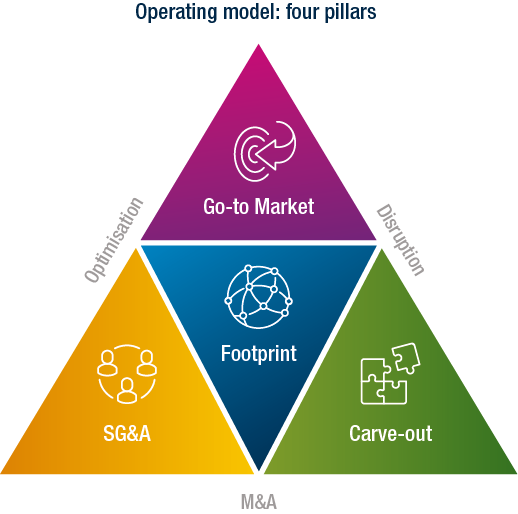

In our view, the scale and pace of the required transformations demand a bolder and immediate response. This is the time to seek rapid changes to operating models that will help business preserve value within what we see as a narrow time frame. These efforts should prioritise the following actions: refocus go-to-market, challenge footprint, consider carve-out options and right-size SG&A spend for the refocused business perimeter.

Refocus go-to-market: Today’s high cost of capital has placed renewed emphasis on asset efficiency, requiring companies and shareholders to think more tactically about their use of resources, footprint or market focus. In this context, a lack of focus on GTM strategy – be it underperforming product portfolios, an outdated channel focus, SKUs proliferation or reliance on low-growth or overcompetitive regions – risks not only locking up capital in unprofitable areas but also missing out on opportunities for more profitable growth.

As such, a GTM review seeks to recalibrate business priorities based on current market dynamics and consumer needs. It identifies which areas to prioritise, invest or divest to enhance asset efficiency and drive enterprise value. It also helps better position companies for growth, by allowing them to concentrate efforts and resources on the most promising areas.Based in our experience, companies can expect EBITDA drop-through of up to 500 bps on average through SKU optimisation, pricing and procurement improvements derived from GTM optimisation initiatives.

A GTM review exercise often serves as a foundation for broader operating model transformation, offering strategic direction for initiatives such as footprint optimisation and divestment considerations.Challenge your footprint: Footprint considerations naturally follow a GTM reset, aligning the production and logistics operations with the business’ updated priorities and needs. For example, the decision to reduce the number of SKUs creates opportunities to simplify supply chains, consolidate facilities or repurpose underutilised assets, delivering greater resilience, agility and cost-efficiency.

Our approach uses scenario planning to ensure the business’ footprint is future-proof against specific risks like trade barriers and energy constraints, in addition to cost-consolidation considerations. For example, we explore the potential of nearshoring and friendshoring to bolster supply reliability and trade compliance while taking advantage of tax incentives in key markets.

Our assessment is supported by digital tools like predictive analytics, which helps us model cost and efficiency scenarios before implementation. We also identify automation opportunities to make high-cost locations more viable. Based on our recent experience, footprint consolidation initiatives can deliver cost reductions of 15% to 30%.

Consider carve-out options: In a high-cost-of-capital environment, asset efficiency has come under even sharper scrutiny, with investors increasingly questioning past investments in activities that may be perceived as eroding shareholder value.

Carving-out non-strategic and non-performing assets – sometimes even if they are part of the core business – is a bold and efficient way to refocus resources in alignment with a sustainably accretive-value proposition, helping shape the equity story while future-proofing companies against upcoming headwinds. Our experience of strategic portfolio divestments and carve-outs has demonstrated up to a two-fold increase of share price for some of our clients within three years.

Right-size SG&A spend: A thorough review of SG&A expenses is critical to ensure that the business emerging from operating model transformation is cost-efficient and fit for future growth.

Techniques to optimise SG&A costs vary, ranging from business simplification (e.g. delayering), automation, zero-based budgeting, global business services implementation and right-sizing. To the extent they aim at sustainable cost savings, these measures can unlock substantial value, protecting and enhancing profitability in the short-term via quick wins, all while freeing up capital to reinvest and support growth in the long-run.

In our experience, companies that uncovered hidden efficiencies through sustainable cost-saving initiatives and operating model optimisation have achieved savings of 15% to 25% in their SG&A expenses, while doubling the productivity and quality of service of their indirect workforce.

How A&M Can Help

At A&M, we help clients deliver rapid returns by strengthening their operating models through targeted go-to-market, footprint, carve-out and SG&A initiatives.

Our global team of over 10,000 professionals bring together diverse capabilities: sales, marketing, logistics, operations, M&A, tax, and digital, combined with deep industry insights. Our approach is supported by the following pillars:

- Investor lens: we assess a company’s strengths and challenges through the eyes of shareholders, ensuring that performance improvement initiatives align with key drivers of value creation for the stakeholders.

- Urgency for action and results: we operate on a rapid-results principle, delivering quick wins upon initial phases of our intervention and consistently tracking and reporting progress on tangible results.

- End-to-end execution: we create value and drive change from boardroom to shopfloor, through a senior-staffing model that ensures deep technical expertise and operational focus to lead change, including through interim management capabilities where needed.

- Financial discipline: we thoroughly monitor tangible impacts and financial results of transformations through financial discipline to ensure successful, sustainable outcomes.