PRIVATE CLIENT SERVICES

A&M’s Private Client Tax Services team in Australia provides bespoke advisory services to a wide range of privately held entities, closely held listed companies and the founders and investors who support them. The team provides upstream and downstream offerings with a keen focus on relevant tax issues that meet the unique needs of each Client, with a goal to maximise value for all stakeholders and develop succession plans. A&M expertly handles the often complex structure of private groups and offers an M&A focused pedigree for Clients seeking to expand through acquisition or to achieve an exit from their investments.

WHY OUR CLIENTS CHOOSE US

Holistic focus: A&M’s Private Client Services team has deep experience focusing on various levels, providing a holistic view of the challenges and opportunities available to private client groups across the broader business and family lifecycle. Our experience means we can advise in all areas of a private or founder-led business and private groups, easily pivoting from operational tax matters in the business, to asset protection planning, personal tax matters and transaction due diligence, structuring & advisory.

Expertise: We offer a breadth of business advisory experience with a deep expertise in both private client tax and M&A matters. This has allowed us to provide services that meet Clients’ varied needs and secure long-lasting value.

Agile and lean model: A&M doesn’t carry the typical overhead and structures that some advisors do, leading to a bias to action on behalf of our Clients. The team’s hybrid makeup allows us to turn a Client’s investment in A&M into direct value for their business.

Customizable approach: Private clients and high net worth individuals require bespoke offerings. A&M provides a custom approach with no set methodologies. From simple tax reporting to advising through an IPO, we meet the Client where they are.

Independence: A&M does not provide external financial audit services. This gives us the freedom to provide a full range of tax services and to manage key interdependencies of the finance function across deals without being impacted by requirements of audit firms.

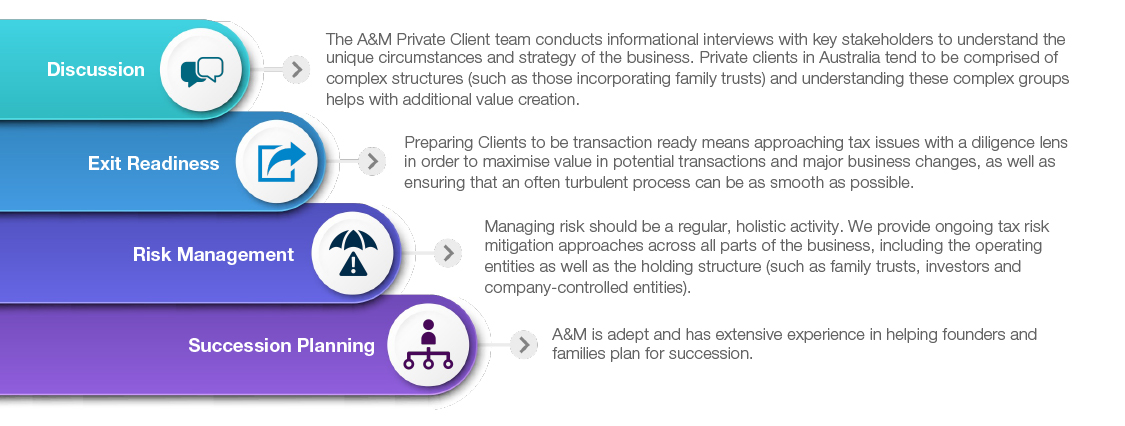

THE A&M TAX APPROACH

THE A&M DIFFERENCE

TRUST AND COMFORT

Private Clients often need someone looking across all the business’s assets, strategies and challenges. But getting an advisor’s “seal of approval” can set dangerous expectations. A&M puts in the time and effort to build trust with the key stakeholders in private groups, providing recommendations that build confidence as well as providing an independent eye to identify potential challenges. We ensure Clients are getting connected with the expertise necessary to help deal with any issue at hand.

SECURITY

We help Clients structure their business to preserve the wealth they’ve already created and to open up opportunities to create more value in the future. We do this through the implementation of various asset protection and tax risk management strategies with an overall focus on creating savings on tax inefficiencies and in the context of a transaction.

VALUE CREATION

A&M brings the right lens to identify appropriate value creation opportunities within an appropriate horizon, not just quick savings with short-sighted wins.