CORPORATE TRANSFORMATION TAX

Businesses have limited investment capacity for growth and investment initiatives. A&M’s CTT professionals work seamlessly alongside consulting colleagues to deliver upfront liquidity and structural enhancements on each engagement. This integrated approach is unmatched by competitors.

Corporate Transformation Tax increases clients’ return on investment by:

- Reducing Cost, Increasing Capital Efficiency

For decision makers or buyers of commercial change and commercial spend, it is desirable to use tax savings as currency and take credit for the value and impact it can drive.

- Moving Cash Benefits to the Front of the Transformation

If structured correctly, operational change can be partially funded by the government via tax planning, trade and other incentives.

- Driving Long Term Performance Improvement for the Business

If tax accelerates the benefits on the front end of transformation, it will create liquidity. That liquidity can then be re-invested into the commercial change to drive performance improvement in the long term.

How Can A&M Add Value?

Is tax viewed as a value driver in the organization?

Is tax a proactive business partner for the C-suite and other stakeholders?

Is tax proactively at the table when business decisions are being made?

Commercial change is outpacing in-house tax and trade functionality, leaving organizations with inefficient strategies to tackle significant challenges. Whether full scale transformation or operational improvement, tax considerations should be front and center. There is a great risk of disruption to the business if executive leadership isn’t apprised of how these opportunities could influence organizational decisions.

Decisions affecting tax, trade and incentives:

What is A&M’s Corporate Transformation Tax approach?

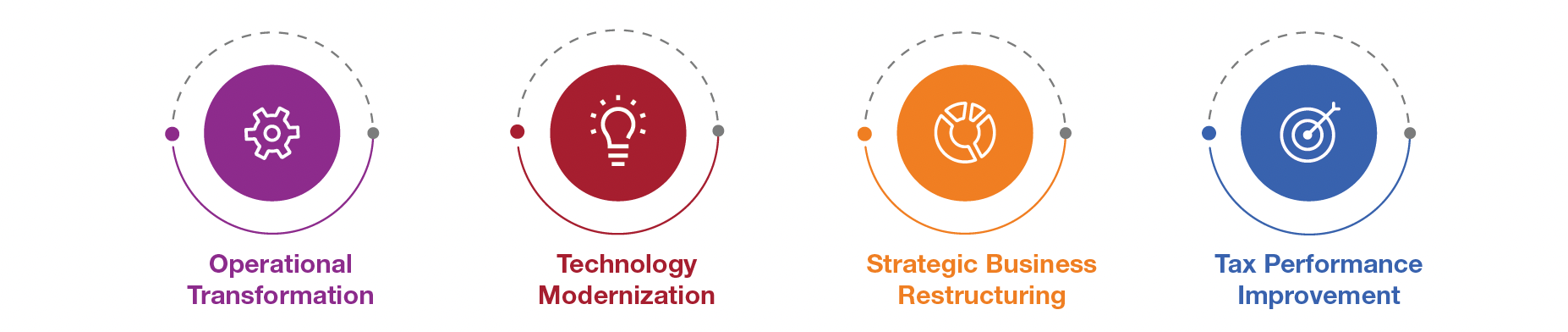

By way of Tax Planning, Tax Performance Improvement, Trade & Customs and Credits & Incentives:

- A&M technically and strategically supports corporate transformation and operational change.

- A&M professionals have a seat at the table with executive leadership to ensure tax strategies will help investments go further instead of being “bolted on” at a later date.