Global Trade and Customs

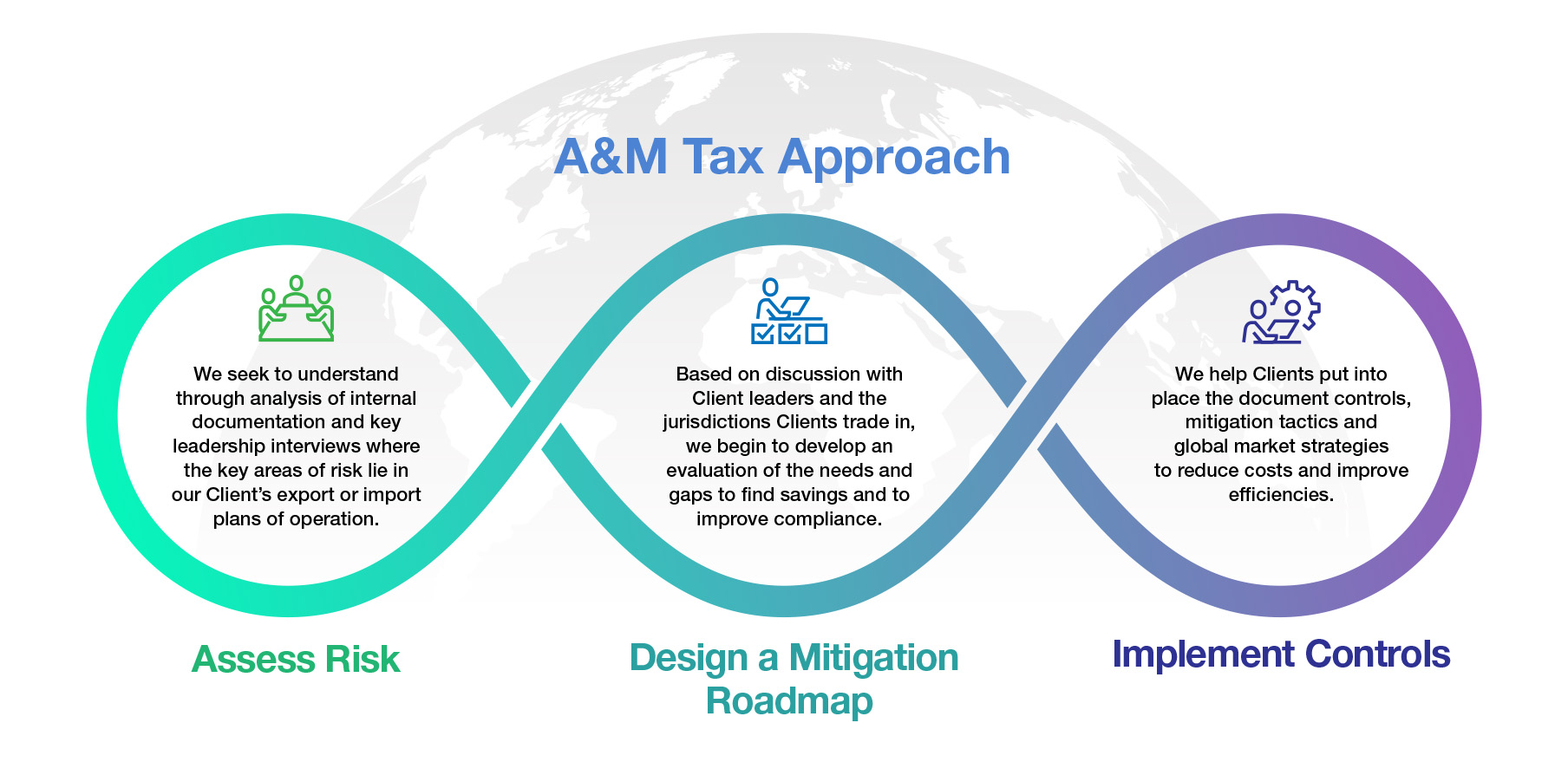

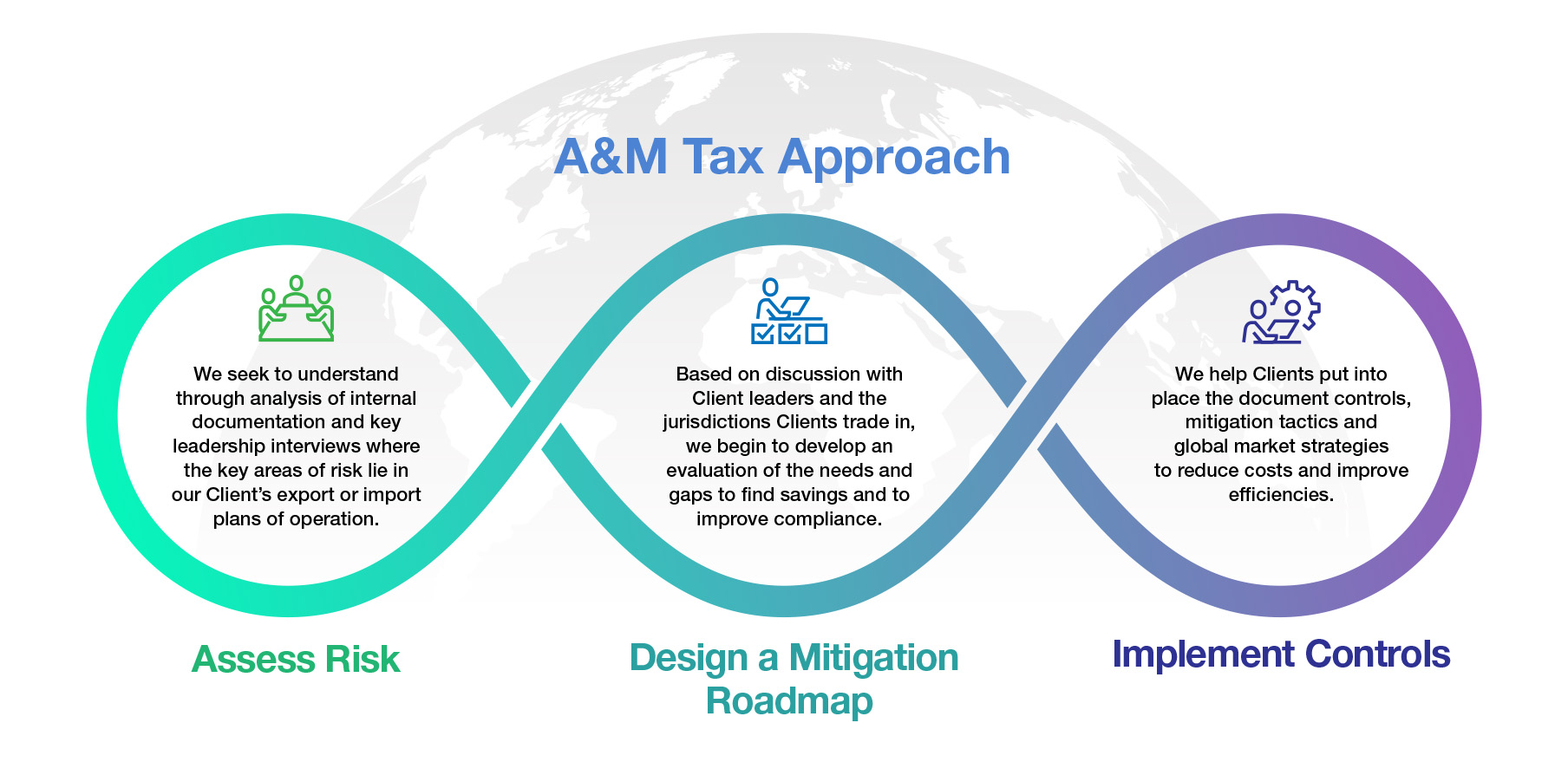

A&M’s Global Trade and Customs services help Clients manage and optimize their cross-border transactions. We focus on reducing tariff and tax liabilities and maintaining compliance across a complex spectrum of trade and customs requirements worldwide.

Goods that are subject to trade and customs legislation include more than just physical imports and exports. Trade sanctions and export controls also impact services and technology provided across borders. As part of our Trade and Customs services, Clients can take advantage of years of experience with complex and varying Trade legislation, to identify key areas of risk in our Client’s trade portfolio of exports of technology or services that may be prohibited or require licensing based on sanctions or export legislation.

Analyzing jurisdiction by jurisdiction, A&M can evaluate the Client’s tax savings needs as well as gaps in compliance to help them save money and mitigate risk. We assist the Client in establishing process controls, mitigation tactics, and global market strategies to reduce costs associated with trade and improve efficiencies.

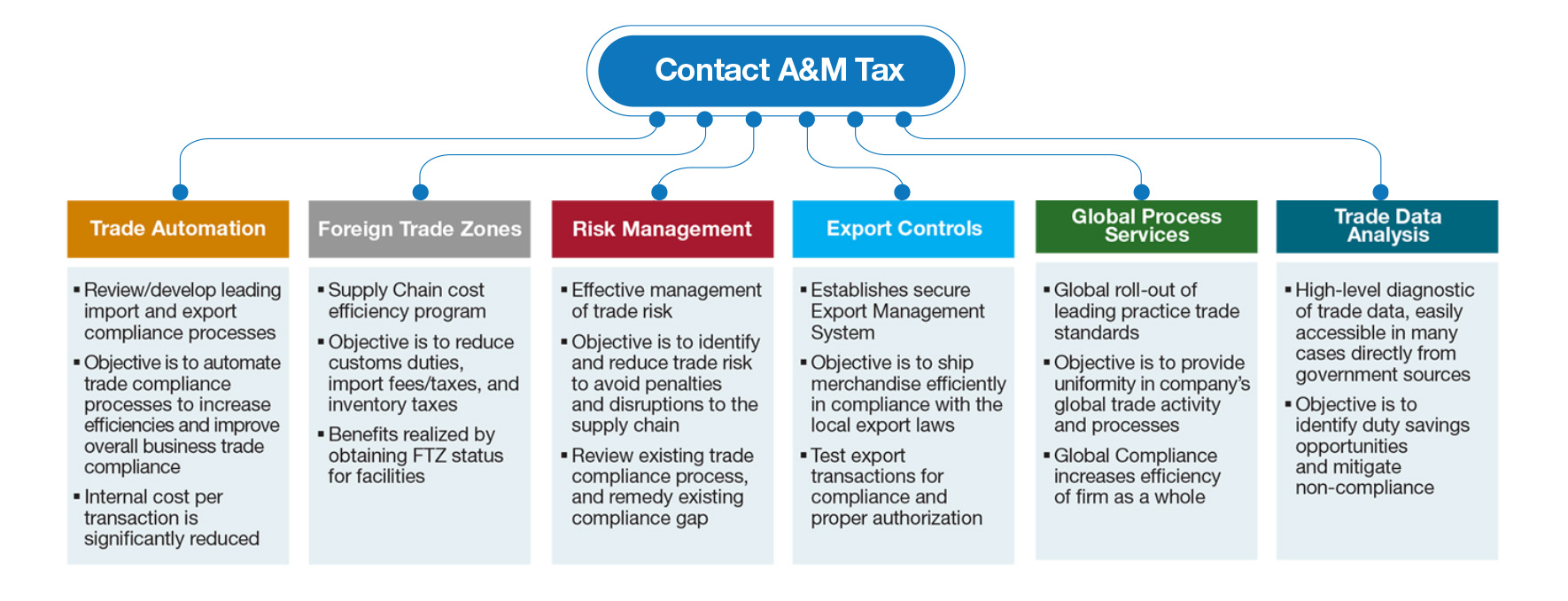

Gaining control of how you handle trade often requires automation that connects operations across the organization. Centralizing key repetitive functions such as classification, origin management, and restricted party screening can help streamline and enhance your global trade operations. A&M’s team can assist you with automating these systems at scale.

Who can benefit from A&M’s Global Trade and Customs solution?

Companies conducting international trade by exporting or importing goods, technology and services in any number of countries want to ensure they are meeting all compliance regulations while maximizing any savings in tax liability at the same time.

Often, organizations don’t have the expertise or internal capability to monitor trade and custom regulations globally or manage process controls to maintain compliance or to maximize tax savings. However, A&M can offer trade compliance managed services to meet your needs.

What are the benefits of using the Global Trade and Customs solution?

Why should you use A&M’s Global Trade and Customs service?

The global trade environment is complex and ever-changing. Our A&M professionals have solutions to navigate the complexity regardless of where you conduct business. We assist companies with a full-range of trade-related services regardless of size or cross border trade profile.

Rely on us for:

- Deep experience in import and export compliance and driving tax liability savings

- Broad resources: At A&M, we are able to pull from many disciplines to address a variety of complex cross-border trade issues that may crop up when conducting international trade

Learn More: