Employee Share Plan Implementation and Operation Services

Helping clients navigate a complex landscape

Share plans are a key part of remuneration policy, through annual bonus deferral, long-term incentives and all-employee plans in listed and many unlisted companies. The effective implementation and operation of share plans is critical to their success in delivering the desired benefits to executives and employees.

Our Objective

Successfully implementing and managing executive and employee share plans can deliver significant added value for businesses. A&M can assist, whether it is clearly documenting and communicating share plan rules and features so that participants understand their entitlements; ensuring that plans are compliant; measuring performance condition outcomes; valuing awards for accounting purposes; or handling share awards when there are events such as rights issues or a change of control.

Implementing and operating share plans requires careful consideration and planning across a number of areas including Company Secretariat, Finance, HR and Tax. We have the experience and expertise to provide a holistic service to deliver practical, commercial and comprehensive advice.

A&M’s Employee Share Plan Implementation and Operation service helps companies ensure that their executive and employee share plans operate smoothly.

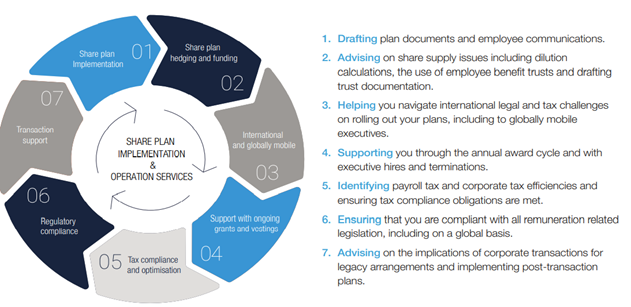

Our Services

Companies often look to establish or adjust share plans in planning for or reacting to corporate events such as:

- IPOs or Public Listings: when a business lists on the public markets, the share plan needs to evolve in line with the company’s new status.

- Executive Transitions: senior employees joining or leaving the business may need specific treatment through the equity plans.

- Broader Corporate Calendar: share plans may come under additional scrutiny before and after AGMs and annual results announcements.

- Regulatory Compliance: management teams and staff working in finance, legal and HR need to know that share plans are in line with regulations, mitigating risk.

- Required Documentation Updates: legislative changes or other developments may require a fresh look at technical documentation.

As well as one-off events, A&M can help clients navigate regular annual checks and updates. In addition, A&M’s practitioners can identify tax deductions and other efficiencies arising from executive compensation plans, helping companies manage shareholder funds and allocate capital more effectively.

Our Lifecycle

At A&M we provide implementation and operational support throughout the lifecycle of a share plan from the first grants, and through annual vestings and corporate events, for the benefit of U.K. employees, and by drawing on our global A&M Tax network, for non-U.K. based employees.

Our Approach

| 1. One service provider Working within our Executive Compensation practice, we have the experience and expertise to deliver a seamless full-service executive pay advisory and implementation offering, avoiding the need for you to manage multiple providers. | 3. Independent

| |

2. Integrated approach

| 4. Leadership. Action. Results.™ A&M’s leadership is about a bias towards action and the willingness to tell leadership what we think is needed. Our restructuring heritage sharpens our ability to act decisively whilst embracing the most complex problems in the most challenging environment alongside our clients. |

Our Clients

A&M works with private and public companies alike, listed and unlisted, most often engaging with Remuneration Committees, HR teams or Company Secretaries. The service is sector-agnostic.

Our Global Network

In addition to the services we provide from the U.K., our team is complemented by A&M’s U.S. Compensation & Benefits group.

Why A&M?

The Share Plan Implementation and Operation service is one part of a full-service executive compensation offer for clients. In addition, A&M’s freedom from audit conflicts means our experts can draw on decades of business consulting and restructuring expertise in providing strategic and practical advice to clients.

Learn More

| Additional Info | Contact Us |