Going Public Positioned to Succeed

“Going public brings new compensation and benefits challenges. A&M can help companies avoid common pitfalls and implement programs that drive corporate performance.”

Whether through a traditional IPO, SPAC acquisition, or direct listing, the transition from private to public company comes with an entirely new set of challenges, including increased regulatory oversight, corporate governance issues and growing stakeholder demands for increased transparency and accountability. Establishing an executive compensation and benefits program specifically designed to address these challenges is critical for a successful transition from private to public ownership.

Alvarez & Marsal brings an experienced team of dedicated compensation and benefits specialists that can help your organization design and implement programs tailored for newly public companies, as well as guide the company’s tax, accounting and human resources functions through the complex transition process.

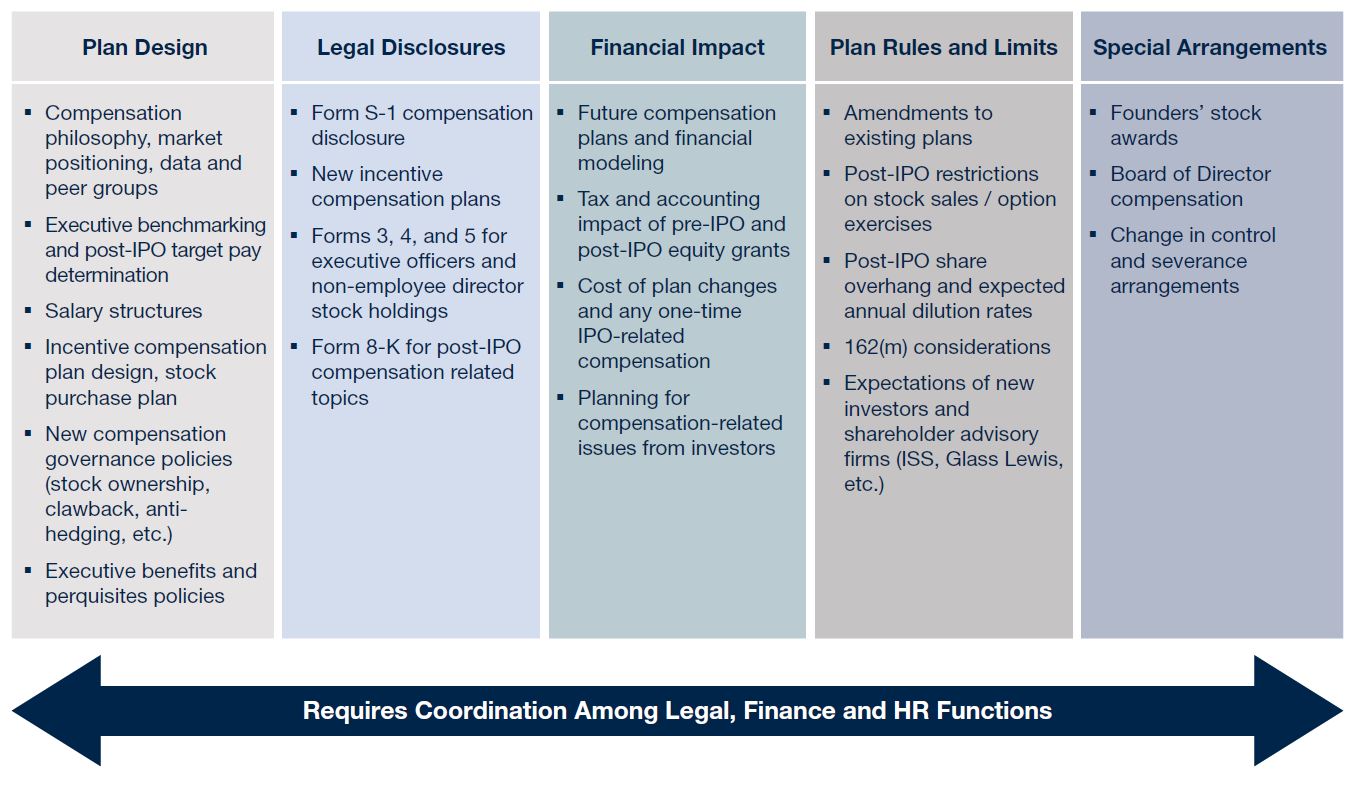

IPO Compensation & Benefits Considerations:

A&M’s IPO-focused compensation and benefits services include:

Executive Compensation Program Development

- Develop a peer group of public companies and a peer group of recent IPOs

- Conduct competitive market analysis of executive pay

- Review annual and long-term incentive programs, including individual grant levels, vehicle mix, vesting provisions and performance metrics

- Evaluate employment agreements including benchmarking of termination benefits such as severance and accelerated equity vesting

- Benchmark independent director compensation and pay structure

Employee Share Pool Considerations

- Determine size of employee share pool, potential equity dilution, initial IPO awards (if necessary) and share pool “burn rate”

- Design and implement ESPP programs

- Assist in drafting regulatory filings (S-1, S-8) and plan documents

Public Company Tax and Regulatory Review

- Assist with proxy disclosure requirements, including hypothetical Section 280G and termination scenario benefit calculations

- Review Section 162(m) deductibility of compensation paid to “covered employees”

- Calculate stock-based compensation expense under ASC 718

- Support payroll, HR and related functions

Download the full brochure here