Incentive Compensation at the Top 100 U.S. Oil and Gas E&P Companies

2015-Issue 3—Incentive compensation is an integral part of the total compensation package for executives at most large, publicly traded companies. To understand current annual and long-term incentive compensation pay practices in the oil and gas exploration & production (E&P) sector, Alvarez & Marsal Taxand, LLC’s Executive Compensation and Benefits Practice (A&M) examined the 100 largest E&P companies traded on a U.S. stock exchange. This edition of Tax Advisor Weekly summarizes our research, and the full report can be downloaded here.

Key Takeaways

Annual Incentive Plans

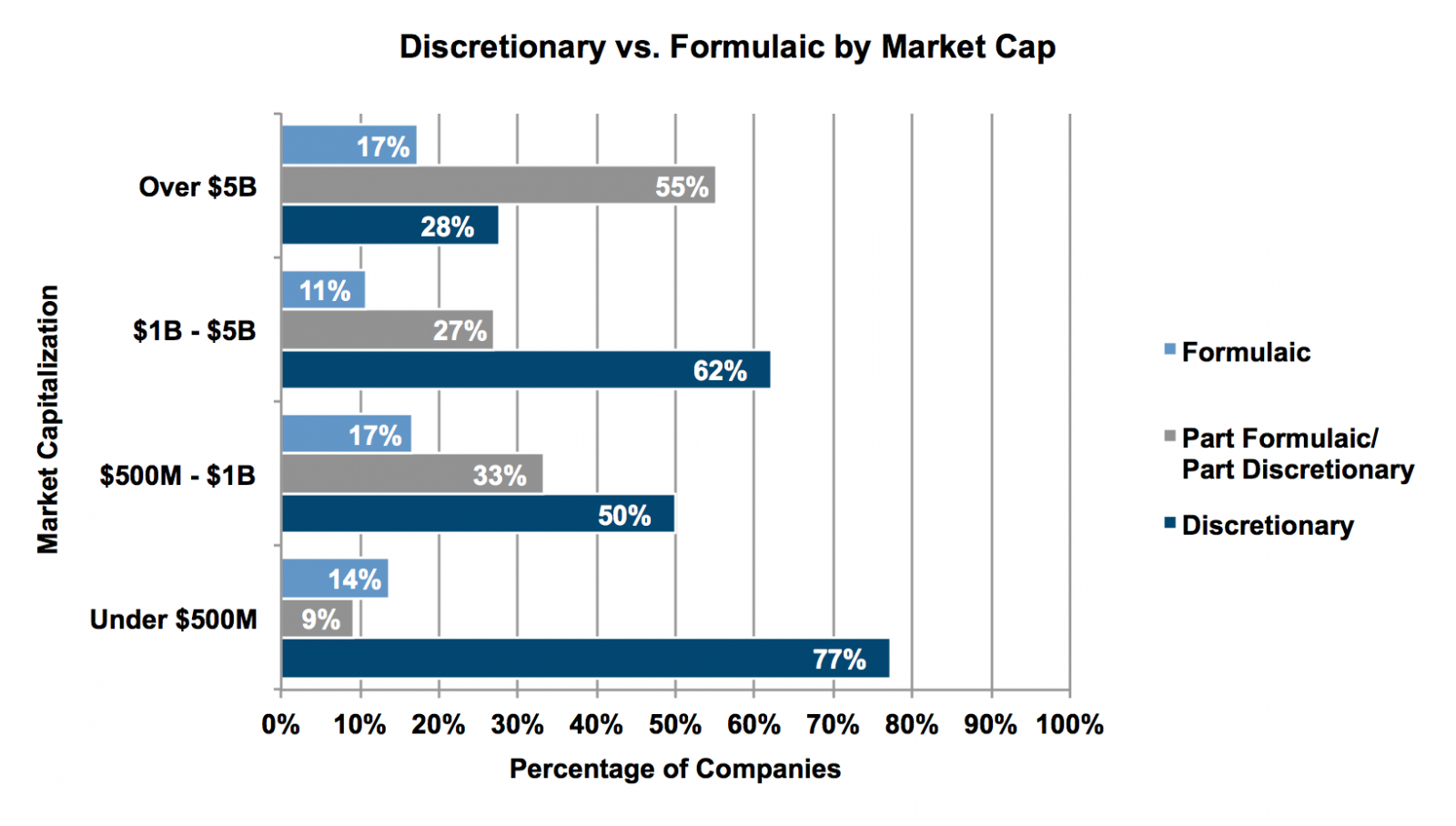

- 72 percent of companies with market capitalization over $5 billion utilize annual incentive plans where the payout is at least partially determined in a formulaic manner, while only 23 percent of companies with market capitalization smaller than $500 million utilize formulaic performance metrics.

- 83 percent of companies utilize one or more performance metrics in their annual incentive plan. Production, including production growth, is the most prevalent metric and is utilized by 87 percent of such companies.

Long-Term Incentive Plans

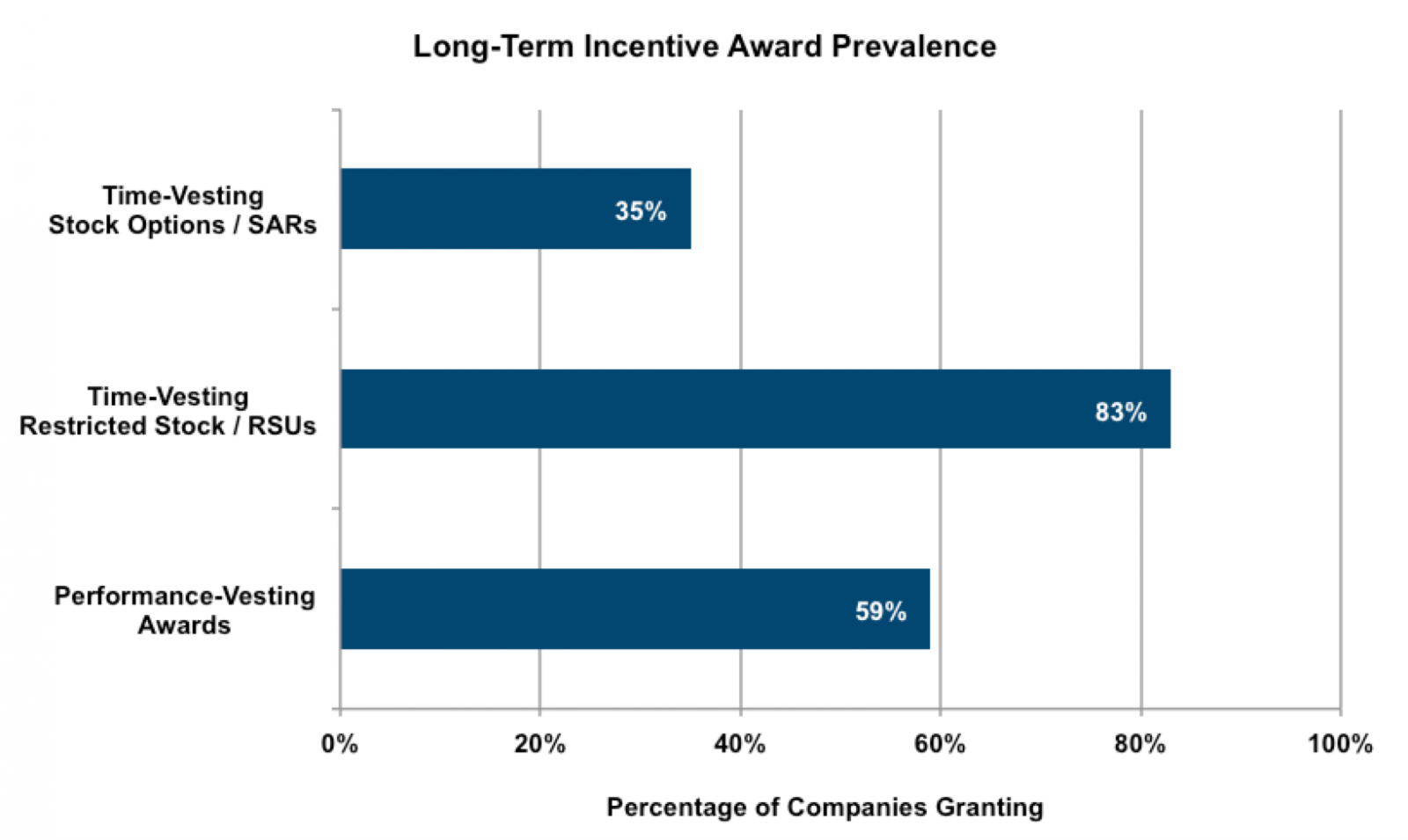

- 96 percent of companies grant at least one form of long-term incentive award. The prevalence of awards varies by company size, but time-vesting restricted stock and restricted stock units are the most common form of award granted (used by 83 percent of all companies).

- 59 percent of companies grant long-term incentive awards where vesting or payout is determined by one or more performance metrics. Relative total shareholder return, the most commonly used performance metric, is used in 76 percent of such awards.

Annual Incentive Plans

As is the case with most industries, companies in the E&P sector generally provide an opportunity for executives to participate in an annual incentive plan (AIP). AIPs utilize performance metrics that are generally measured over a one-year period.

Discretionary vs. Formulaic

For this analysis, we grouped annual incentive plans into the following three categories based on how the annual bonus payout is determined:

- Formulaic — The plan utilizes predetermined performance criteria with established targets that will determine payout, and the compensation committee does not have discretion to adjust payouts (other than negative discretion).

- Discretionary — The plan may or may not utilize specific, pre-established performance criteria, but the compensation committee maintains absolute discretion to adjust payout levels upward or downward.

- Part Formulaic/Part Discretionary — The plan utilizes certain metrics where payout is determined formulaically and others where payout is determined at the discretion of the compensation committee.

As shown in the chart below, the majority of E&P companies maintain some form of discretion with respect to their AIP. However, these companies tend to move away from purely discretionary plans as market capitalization increases, as shown below:

Companies may utilize formulaic compensation programs to provide clarity to executives and shareholders on how compensation will be determined and to benefit from favorable tax treatment under the “performance-based compensation” exemption under Internal Revenue Code (IRC) Section 162(m). Notwithstanding the favorable tax treatment afforded to formulaic AIPs, some companies maintain discretion over the payout of annual bonus plans in order to adjust for events that are unforeseen and/or out of the executive’s control.

Performance Metrics

Production, including production growth, is the most prevalent metric and is used by 87 percent of companies that utilize performance metrics. View the full report for a more comprehensive list of the most commonly used performance metrics.

Long-Term Incentives

Most E&P companies analyzed (96 percent) grant some form of long-term incentive award to executives. Long-term incentives generally consist of stock options, stock appreciation rights (SARs), time-vesting restricted stock or restricted stock units (RSUs), and performance-vesting awards (i.e., awards that vest upon satisfaction of some performance criteria rather that solely based on the passage of time). For this analysis, given the similarity between awards, we grouped awards into three categories: (1) time-vesting stock options and SARs; (2) time-vesting restricted stock and RSUs; and (3) performance-vesting awards.

Award Prevalence

The chart below shows the prevalence of stock options and SARs, time-vesting restricted stock and RSUs, and performance-vesting awards for all 100 E&P companies. See the full report for an analysis of how company size affects the award granting practices for long-term incentives.

Time-vesting restricted stock and RSUs are the most utilized award type, followed by performance-vesting awards. Not surprisingly, stock options and SARs are the least prevalent long-term incentive vehicle utilized by U.S. E&P companies. Stock options and SARs have declined in popularity due to a change in the accounting treatment for these awards, due to the overall market shift toward performance-vesting equity, and because of the view of proxy advisors that these types of awards are not “performance-based,” even though to receive value from a stock option or SAR, the underlying stock price generally must increase.

Below are select findings from our analysis of long-term incentives. See the full report for additional information on each award type.

Stock Options and Stock Appreciation Rights

- Awards generally vest on a ratable basis rather than cliff vesting.

- The most prevalent vesting period for stock options and SARs is three years (69 percent of companies), followed by two years and four years (each used by 11 percent of companies).

Time-Vesting Restricted Stock and Restricted Stock Units

- Of companies that grant time-vesting restricted stock and RSUs, it is slightly more common for companies to grant restricted stock (58 percent of companies) than RSUs (42 percent of companies).

- A three-year vesting period is the most common vesting period (utilized by 72 percent of companies), while a four-year vesting period is the second most common (utilized by 15 percent of companies).

Performance-Vesting Awards

- Performance Metrics — The most prevalent performance metric is total shareholder return (TSR) relative to peer group, which is used for 76 percent of performance-vesting awards. Nearly one-half of performance-vesting awards (46 percent) utilize more than one performance metric.

- Performance Period — The performance period is the duration over which the applicable performance metrics are measured. The most prevalent performance period for performance-vesting awards, by a wide margin, is three years (62 percent of awards) followed by one year (21 percent of awards).

Alvarez & Marsal Taxand Says:

Incentive compensation can be structured to avoid the deduction limitations under Section 162(m). This can be accomplished for annual incentive plans by using a formulaic approach, but many companies still choose to maintain some discretion. In addition to annual incentives, most companies grant some form of long-term incentives that vest over time, which in the case of time-vesting restricted stock and RSUs would not meet the “performance-based compensation” exemption under Section 162(m). However, an increasing number of companies grant long-term incentives that vest based on achieving certain performance criteria, and such awards may be exempt from Section 162(m). Because incentive-based compensation makes up a significant portion of an executive’s total compensation package, it is important for compensation committees to understand how other companies in the industry are structuring their incentive programs in order to remain competitive.

Disclaimer

As provided in Treasury Department Circular 230, this publication is not intended or written by Alvarez & Marsal Taxand, LLC, (or any Taxand member firm) to be used, and cannot be used, by a client or any other person or entity for the purpose of avoiding tax penalties that may be imposed on any taxpayer.

The information contained herein is of a general nature and based on authorities that are subject to change. Readers are reminded that they should not consider this publication to be a recommendation to undertake any tax position, nor consider the information contained herein to be complete. Before any item or treatment is reported or excluded from reporting on tax returns, financial statements or any other document, for any reason, readers should thoroughly evaluate their specific facts and circumstances, and obtain the advice and assistance of qualified tax advisors. The information reported in this publication may not continue to apply to a reader's situation as a result of changing laws and associated authoritative literature, and readers are reminded to consult with their tax or other professional advisors before determining if any information contained herein remains applicable to their facts and circumstances.

About Alvarez & Marsal Taxand

Alvarez & Marsal Taxand, an affiliate of Alvarez & Marsal (A&M), a leading global professional services firm, is an independent tax group made up of experienced tax professionals dedicated to providing customized tax advice to clients and investors across a broad range of industries. Its professionals extend A&M's commitment to offering clients a choice in advisors who are free from audit-based conflicts of interest, and bring an unyielding commitment to delivering responsive client service. A&M Taxand has offices in major metropolitan markets throughout the U.S., and serves the U.K. from its base in London.

Alvarez & Marsal Taxand is a founder of Taxand, the world's largest independent tax organization, which provides high quality, integrated tax advice worldwide. Taxand professionals, including almost 400 partners and more than 2,000 advisors in 50 countries, grasp both the fine points of tax and the broader strategic implications, helping you mitigate risk, manage your tax burden and drive the performance of your business.

To learn more, visit www.alvarezandmarsal.com or www.taxand.com