Retail Compensation Programs - Be Informed and Be Proactive

Many retail organizations are finding current operating conditions difficult. As retailers navigate these conditions, they need to ensure their people strategies and compensation programs are flexible and supportive, not rigid and dated.

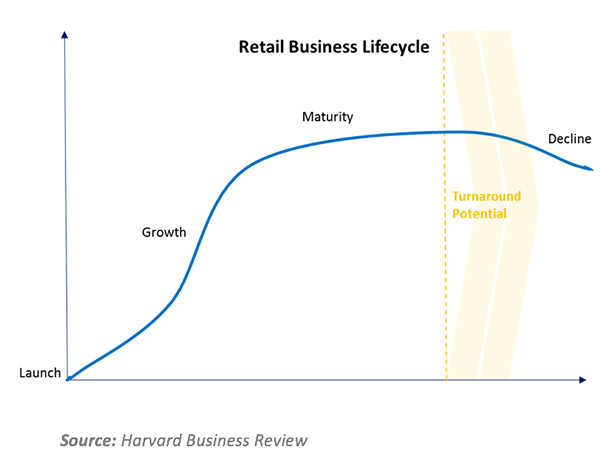

Historically, retailers have focused on building scale — more store locations — to drive top-line growth, spreading fixed costs over more locations and creating purchasing power. They may have focused too much on same-store sales and operating income growth, not strategic investment and operational efficiencies. Unfortunately, their compensation programs may have reinforced the wrong strategy and behavior (i.e., too pro-growth through same-store sales metrics and other designs). What follows are different approaches to working through some of the difficult, but necessary, steps to improving compensation programs to fit the remedial actions some retailers must now take.

Turnaround

If a retailer is in a turnaround, compensation should support the effort. Retailers tend to pay incentives deep into the organization, or broadly, without necessarily distinguishing pivotal roles, or the best talent. In a turnaround, it is necessary to be more efficient by identifying pivotal roles, i.e., high-potential employees and roles related to merchandising and store planning and allocation; in some retail models, where digital hasn’t been a strategic focus, the development of the digital platform may be pivotal.

In a restructuring, there is usually an effort to reduce costs. The blunt instrument for this has been store closings and workforce reductions. Store closings are a part of a broader dynamic, as store locations are affected by a range of variables. With respect to workforce reductions, it may be possible to find some cost savings in the compensation and benefit program that reduce the need or size of the workforce reduction. Some alternative cost reduction techniques short of workforce reduction to consider include the following:

- Manage merit pay carefully.

- Consider a limited furlough program.

- Restructure benefit programs to reduce or shift costs.

- Design incentive programs to drive needed, timely performance.

Of course, no one likes a compensation or benefit reduction, but most workers prefer having a job to not having one and look forward to completing the turnaround. For the incentive plans, it is critical to find metrics that reflect the time frame and tasks of the turnaround — urgency should be a guiding principle.

Balance Sheet Restructuring Ahead?

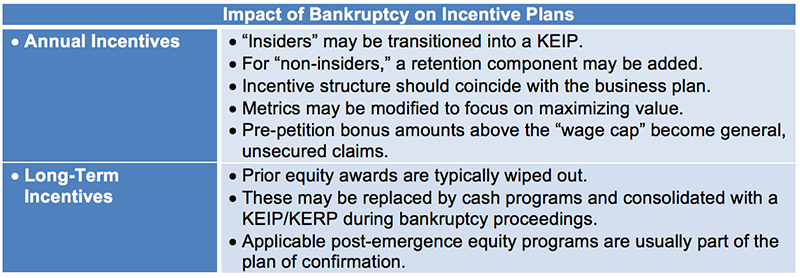

If a balance sheet restructuring or bankruptcy filing is on the horizon, certain immediate changes to the incentive plans should be considered. A common defensive approach is to collapse the annual and long-term incentive program into a single cash-based incentive program that pays out over shorter measurement periods based on hitting established performance metrics. This allows the annual incentive plan to be easily transitioned into a key employee incentive plan (KEIP) in the event of a filing, thus reducing disruption to the executive ranks.

Heading to a Bankruptcy Filing

In the event of a bankruptcy filing, the type and magnitude of the changes to the compensation plans will be influenced by the anticipated time frame to perform a restructuring or emergence from bankruptcy. Many bankruptcy filings fall somewhere between a “free fall” situation, where the compensation programs will be revamped, and a prepackaged bankruptcy, where there are generally fewer changes. No matter the type of bankruptcy, the annual and long-term incentive programs will need to be adjusted or overhauled.

During bankruptcy, the common treatment of the annual and long-term incentive plans is illustrated in the following table:

KEIP-ing Executives Engaged in the Recovery Process

Companies under financial stress want to retain key executives so industry and company knowledge isn’t lost and continued operational success is not made difficult. On the other hand, valuable executives may be reluctant to lend their discretionary efforts to remain on what may be perceived as a sinking ship, where job security and future incentive compensation opportunities may no longer be attractive to the executives.

Many companies today implement KEIPs, which are performance-based plans that are designed to fall outside of the bankruptcy code restrictions on the use of the broadly used KERPs. KEIPs are generally reserved for those executives deemed “insiders.” Conversely, retention plans — or KERPs — are generally used for “non-insiders.”

KEIP Considerations for Retail Companies

Companies should consider various factors when implementing a KEIP. A KEIP covering “insider” participants should use pay for performance principles and not simply induce continued employment. Consequently, KEIPs should be designed with achievement of business objectives as guiding principles. Common performance metrics used by retail companies in bankruptcy include:

- Store closures or rent concessions;

- Other expense reductions such as inventory liquidation;

- Financial metrics (EBITDA, EBITDAR);

- Budget compliance;

- Confirmation of plan of reorganization/emergence from bankruptcy by a specified date; and/or

- Amount of proceeds realized from sale of company or designated assets.

Given board, creditor and bankruptcy court scrutiny, it is critical to choose the right metric(s) and to calibrate performance achievement levels so plan goals are not perceived as “lay-ups.”

Companies should consider the timing of payments and the length of the performance periods. Quarterly performance periods are common, as annual plans could be perceived as too long a performance period in uncertain financial times. The amount of potential payout is also a consideration, as it should be sufficiently motivating but also reasonable when compared to other similar payments made in bankruptcy.

Not surprisingly, bankruptcy courts have generally disapproved of KEIPs where most of the work required to earn the payments is performed prior to the court hearing date. However, some courts have approved KEIPs even though the sale of a company’s most valuable assets had already been approved and therefore most of the KEIP performance metric had been achieved by the time the motion for KEIP approval reached the court. If timing becomes a concern, it is important to give the creditors’ committee an opportunity to consider a KEIP and, if possible, obtain its support when seeking the court’s approval of the plan.

Timing of Implementation

Generally, it is recommended that an incentive plan with KEIP-like features be implemented as soon as possible to secure key talent for the future. Implementing such plans prior to entering bankruptcy is more efficient and can eliminate lengthy and often contested negotiations with the courts when employees may be contemplating leaving the company before the plan can be finalized.

Post-Emergence Incentive and Retention

Unfortunately, the battle to retain and motivate key employees does not end simply upon exit from bankruptcy. Upon emergence, executives have generally lost the value of their pre-bankruptcy stock and unvested equity awards, and the lack of meaningful equity ownership in the go-forward equity in the entity leads to retention difficulties. Consequently, emergence equity grants are a way to secure executive talent for vital post-emergence initiatives.

Some important considerations for emergence grants include:

- What percentage of the new company’s equity should be reserved for employee equity awards?

- What portion of the equity pool should be granted at emergence?

- Who should be eligible for emergence grants (officers, middle management, all employees)?

- How will the emergence grants be structured (i.e., size and type of award, vesting, etc.)?

Upon emergence, companies will reserve a portion of shares to provide equity to employees. The typical share reserve depends on the size of the company. Depending on the company’s needs post-emergence, awards can be structured as a retention vehicle (full-value equity vehicle with vesting based on time), an incentive vehicle (vesting based on performance) or a combination of the two.

Alvarez & Marsal Taxand Says:

Retail companies in an unhealthy financial condition are especially challenged with retaining and motivating key employees. Well thought out and implemented incentive programs can help bridge the compensation gap between the onset of financial ills and a healthy go-forward restructuring. In implementing a KEIP, it is vital to structure the plan so it properly incentivizes participants to achieve the desired results. Accordingly, it is most advantageous to develop an incentive plan with KEIP-like features during the pre-filing period. Like the retail saying “shop early,” compensation issues should be approached the same way — early.

Just as incentive plans may be effective tools prior to and during the bankruptcy process, equity granted by companies upon emergence from bankruptcy is useful in driving long-term organizational value necessary to maximize the retention program’s return after the bankruptcy process has concluded.

When a company’s financial health is not optimal, a general practitioner may not have the required expertise to guide the company through these issues during the recovery period, so retaining a qualified compensation specialist is critical. A properly developed executive compensation program is one of the most important levers in a restructuring.

Disclaimer

The information contained herein is of a general nature and based on authorities that are subject to change. Readers are reminded that they should not consider this publication to be a recommendation to undertake any tax position, nor consider the information contained herein to be complete. Before any item or treatment is reported or excluded from reporting on tax returns, financial statements or any other document, for any reason, readers should thoroughly evaluate their specific facts and circumstances, and obtain the advice and assistance of qualified tax advisors. The information reported in this publication may not continue to apply to a reader's situation as a result of changing laws and associated authoritative literature, and readers are reminded to consult with their tax or other professional advisors before determining if any information contained herein remains applicable to their facts and circumstances.

About Alvarez & Marsal Taxand

Alvarez & Marsal Taxand, an affiliate of Alvarez & Marsal (A&M), a leading global professional services firm, is an independent tax group made up of experienced tax professionals dedicated to providing customized tax advice to clients and investors across a broad range of industries. Its professionals extend A&M's commitment to offering clients a choice in advisors who are free from audit-based conflicts of interest, and bring an unyielding commitment to delivering responsive client service. A&M Taxand has offices in major metropolitan markets throughout the U.S., and serves the U.K. from its base in London.

Alvarez & Marsal Taxand is a founder of Taxand, the world's largest independent tax organization, which provides high quality, integrated tax advice worldwide. Taxand professionals, including almost 400 partners and more than 2,000 advisors in 50 countries, grasp both the fine points of tax and the broader strategic implications, helping you mitigate risk, manage your tax burden and drive the performance of your business.

To learn more, visit www.alvarezandmarsal.com or www.taxand.com