What’s Next for Real Estate and Lawyers? Opportunities If the Big “R” and Other Trends Develop

As an industry, real estate is heavily dependent on lawyers. Law firms provide a variety of legal services to the real estate industry and such services are dependent on a multitude of factors; real estate needs lawyers when times are good or bad.

If the U.S. economy is headed for a recession over the next few years, is there evidence to suggest that the lessons learned from the Great Recession have been institutionalized in the real estate sector[1]? If not, is there evidence to suggest that future demand for real estate legal services will thus increase over the next few years?

The objective of this article is to highlight several critical real estate trends and provide law firms a roadmap to identify opportunities in the event such trends develop over the next few years. This article initially discusses the probability of a U.S. recession in the coming years, then moves on to an analysis of legal services, the economy and real estate before concluding with economic and real estate signals that may impact future demand for real estate legal services.

Big Question – Is a U.S Recession in the Cards?

Business cycles periodically experience times when market participants and prognosticators wonder if we are in a “calm before the storm” period. Such times generally occur when there is a growing consensus that the cycle has reached a peak with expectations of impending contractions or corrections. Trade wars, interest rate directions and geopolitical disputes challenge the sustainability of the current 10-year U.S. expansion, thus increasing the possibilities of slower future growth rates.

The World Bank’s current Global Economic Prospect report ominously describes, “the outlook for the global economy has darkened.”[2] Similar sentiment is expressed from numerous economists who have already downgraded U.S. economic forecasts for 2020 and 2021[3]. The April 2019 Federal Reserve Bank of Cleveland’s analysis of the yield curve predicted gross domestic product (“GDP”) growth rates which indicates the probability of a recession in one year is 31.0 percent[4]. An April 2019 survey of leading real estate economists also forecast lower economic growth rates through 2021[5].

There is a circle of life between the economy and real estate evidenced as residential and commercial real estate returns are significantly correlated with economic growth rates. As economic growth rates increase, so do real estate returns holding all else constant. Conversely, as economic growth rates decrease, real estate returns are negatively impacted resulting in demand for legal services in areas such as troubled loans, workouts, bankruptcies and litigations.

Legal Services, the Economy, and Real Estate

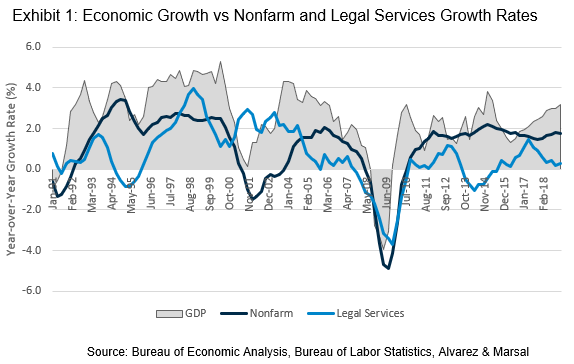

Unlike the correlations between the economy and real estate, patterns of economic growth and legal services employment growth are mixed. Using gross domestic product (“GDP”) growth rates to forecast legal services employment growth rates produces insignificant results. At times, legal services employment growth mirrors the economy while other times there is a lack of correlation. Exhibit 1, for example, compares year-over-year (“YoY”) growth rates for the economy, measured by GDP versus total nonfarm and legal services[6] YoY employment growth rates, 1991 to 2019.

- After the recession of 1991 and during the Resolution Trust Corporation period, legal employment outpaced nonfarm employment, but eventually declined through 1995 before regaining momentum through 1998.

- In the recession of 2001, legal employment remained in the 2.0 percent range while nonfarm declined before reaching positive rates in late 2003.

- The Great Recession produced negative employment growth rates for both legal services and nonfarm employment although legal services lagged nonfarm recovery through 2012, followed by similar decline in legal services in 2005.

- Apparently, legal service employment growth, when compared to the economy and total nonfarm growth rates, marches to the beat of its own drum.

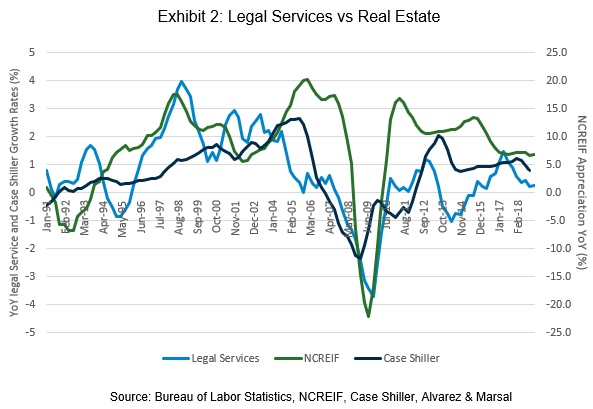

Recognizing that non-real estate related services are included in the overall legal services employment sector, it is still instructive to compare growth patterns with real estate indices, even if any inferences are spurious as shown in Exhibit 2.

The National Council of Real Estate Investment Fiduciaries (“NCREIF”) collects and reports U.S. commercial real estate returns from institutional investors’ portfolio holdings. The process is a proxy for the private equity real estate capital market. Case Shiller[7] is a well-respected source for various housing price indices. The NCREIF series includes all U.S. property types and YoY appreciation rates. The Case Shiller series represents YoY housing price changes for the U.S.

- There is a significant and negative correlation between legal services and NCREIF (-0.458). Implications are that as commercial real estate returns increase, demand for legal services decrease. Whereas when commercial real estate returns are declining, demand for legal services increase.

- Housing price changes and legal services employment growth rates also have a significant correlation (0.580). Between 2000 to 2012, legal services and house price changes are like two butterflies closely following each other. After 2012, however, the proximity between the series widens.

Economic growth rates do not directly and consistently explain changes in legal services employment growth rates. Real estate economic theories do offer insights into indirect linkages between the economy and legal services. Consider the following scenarios:

(a) The economy slows or even temporarily declines into recession territory.

(b) Nonfarm growth rates then decline due to the economic slowdown.

(c) Less people employed negatively impacts household income levels.

(d) As household income levels decline, economic demand decreases such as retail sales, consumer confidence, construction spending and business investment.

(e) As retail sales or business investments decrease, demand for commercial real estate space declines, increasing vacancy rates.

(f) As vacancy rates increase, rental rates decline, impacting net income and equity returns for various commercial real estate property types.

(g) As net income declines coupled with lower overall property demand, real estate values decline.

(h) Because real estate values decline, owners may default on loans seeking extensions/renegotiations of terms, and finally;

(i) Demand for legal services increase[8].

Real Estate Signals and Scenario Planning for Law Firms

What’s the purpose of a signal? There are rational economic, financial and real estate signals that provide guidance to law firms as they develop business strategies that quantify potential future demand for various legal services. According to Nate Silver, signals coexist with noise and the challenge is to “accept the things we cannot predict, the courage to predict the things we can, and the wisdom to know the difference…The signal is the truth. The noise is what distracts us from the truth”.[9]

There is a plethora of real estate industry articles, research and analysis produced by the minute. Inboxes are flooded with real estate information such as sale transactions, leases, new construction, new regulations, proposed changes of public policies and industry association newsfeeds and publications. How do lawyers step back from the barrage of information and data on current real estate markets (“noise”) and decipher what is critical for business strategies, existing clients and the pursuit of new clients (“signals”).

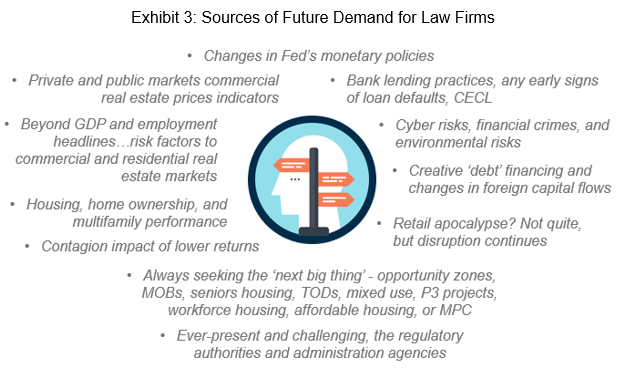

There are several signals emerging at the midpoint of 2019 that warrant discussions to determine potential demand for future real estate legal services. Examples of relevant signals are briefly listed below:

- Recent rise of interest only (“IO”) commercial-backed mortgage securities (“CMBS”) issuance is very similar to the pattern in 2006 and 2007 when IO issuance of CMBS reached 78.8 percent of all CMBS during the 1st quarter 2007. If interest rates increase coupled with lower economic growth, will there be an increase in loan workouts, restructurings and litigations?

- Too much money sitting on the sidelines searching for investments. At a time of high prices and expectations of lower returns, private equity real estate dry powder has recently increased to $322 billion according to Preqin[10]. Will deployment of capital crowd out smaller investors and drive up prices? Are transacted values and returns sustainable if there is a recession, or will deployment focus on large portfolios, real estate operating companies and corporate real estate assets rather than smaller transactions?

- Outstanding commercial and multifamily loans reach $3.4 trillion as of the 4th quarter 2018 according to the Mortgage Bankers Association at a time when, according to the Federal Reserve, banks eased lending terms over the last year on commercial real estate loans.[11] Will banks seek to offload select commercial real estate loans due to Current Expected Credit Loss (“CECL”) and other bank regulations? What legal services are required to implement CECL?

- How will the economy impact public real estate values, M&A transactions or public-to-private opportunities in the coming years? An early 2019 podcast produced by National Association of Real Estate Investment Trust (“NAREIT”) discussed the outlook for continued M&A activity with real estate investment trusts (“REITs”) in 2019[12]. Will the likelihood of M&A with private regional or local real estate firms increase if regional economies decline?

- If commercial real estate property values decline over the next three years, will there be increased litigations involving property tax assessment appeals?

- What is the role of lawyers if entitlement durations are longer, as planning jurisdictions and city councils respond to citizen activism?

- Will the rapid rise of construction employment in select cities that experienced double-digit YoY construction employment growth rates eventually increase the potential for future construction-defect litigation?

- Will real estate partnership disputes increase if significant gaps between promised returns and actual returns develop as net operating income levels decrease due to increased vacancy rates?

- How will lawyers adapt to the practice of select clients who are searching for the next big thing? A segment of real estate investors, developers and lenders periodically seek out the next big thing such as opportunity zones, workforce housing, affordable housing, P3 projects, infrastructures, cell tower development or data centers. The pursuit of the next big thing most likely requires increased specializations of legal services.

- Will law firms implement new technologies and artificial intelligence (“AI”) to improve productivity and develop creative solutions for clients as economic and critical real estate trends unfold over the next three years?[13]

Signals are not always indicators of clear and present danger. Cries of ‘wolf’ or ‘gloom-and-doom’ are also not the intention of this article. Rather, the objective is to support law firms to rationally develop future scenarios, monitor critical signals and navigate the tenuous economic and real estate trends over the next few years.

To request more information or schedule an in-depth presentation on signals and future real estate related legal services, please contact Steven Laposa, PhD FRICS at slaposa@alvarezandmarsal.com.

[1] Laposa, Steven, and Andrew Mueller (2017), "The Great Recession and real estate cycles–challenges, opportunities, and lessons learned." Journal of Property Investment & Finance 35(3): 321-340.

[3] See Philadelphia Federal Reserve Second Quarter 2019 Survey of Professional Forecasters, click here [accessed May 19, 2019]

[4] Federal Reserve Bank of Cleveland, Yield Curve and Predicted GDP Growth, April 26, 2019, click here [accessed May 20, 2019].

[5] See Urban Land Institute, “ULI Real Estate Economic Forecast,” April 2019 click here [accessed May 20, 2019].

[6] According to the U.S. Bureau of Labor Statistics, legal services covers NAICS 541100 which includes offices of lawyers, offices of notaries, other legal services, title abstract and settlement offices, and other legal services; subsector of NAICS 54 – Professional, Scientific, and Technical Services.

[8] Conversely, the basic example also works in reverse, e.g., if demand increases with lagging new supply, vacancy rates decline causing rental rates and net operating incomes to increase and creating environment for increased property values.

[9] Silver, Nate. The signal and the noise: why so many predictions fail--but some don't. Penguin, 2012.

[10] Beth Mattson-Teig, “Scales Tip Towards Large Private Equity Firms as CRE Fundraising Slows,” National Real Estate Investor, February 20, 2019 click here [accessed May 22, 2019]

[11] Federal Reserve Board, “Senior Loan Officer Opinion Survey on Bank Lending Practices,” April 2019, page 2 click here