Value Creation through Technology Investments – Guidelines for Private Equity Firms to Maximize IT Benefits

1. Introduction

This article is the second piece in our series on Value in IT investment. In our previous article “The Right IT Investments to Speed Up Merger Integration and Unlock Value for Private Equity” we introduced the Alvarez & Marsal EBITDA approach to the valuation of IT investments. Here, having tackled and quantified the Why of investing, we dive deeper into the how.

2. A Quick Recap: Saying Goodbye to the IT Productivity Paradox

Earlier we introduced the Alvarez & Marsal EBITDA approach to measuring the value of IT investments. Why? In the 1980s, 90s, and even early 00s, investment seemed to vanish inside IT departments without ever being expected to re-appear. Nobel Prize-winning economist Robert Solow called it early, in 1987, and complained that the IT was nowhere to be seen in productivity statistics. Call this the IT productivity paradox. So, what to do? If there is no correlation whatsoever between expenditures for information technologies and any known measure of profitability, we fare best by cutting IT costs. IT departments are essentially cost centers. Makes sense, doesn’t it?

In 2023 the IT investment world looks completely different. That IT creates value is old news, digitalization and technology transformation are ubiquitous, and PE companies have long understood the importance of technology and essential digital capabilities. They might perhaps be a bit too fearful of big bets on novel technologies, but IT investments boosting scalability and smoothening IT architecture are in high demand.

So, we have the Why. And using the Alvarez & Marsal EBITDA approach we can even quantify it. This leaves the How. Let’s dive right in.

3. Be Stingy, Be Late, Be Safe?

Exactly 20 years ago, this was precisely the strategy Nicolas Carr suggested in the widely discussed HBR article “IT Doesn’t Matter.” Let’s briefly refresh our memories: Carr’s main argument for the strategy was the commoditization of IT. According to Carr, IT had become an infrastructural technology, easily replicable, and coming with a rapid price deflation. Naturally, you’d lose your competitive edge as soon as the technology was widely adopted and matured. Strategic resources need to be scarce, not ubiquitous.

Carr concluded that IT investment would need to follow a strategy consisting of three main moves:

- Be stingy? As the commoditization of IT continues, the penalties for wasteful spending will only grow larger. Carr reasons that it is very hard to achieve a competitive advantage through IT investment, but it is very easy to put your business at a cost disadvantage. Don’t spend too much on it.

- Be late? Moore’s Law guarantees that the longer you wait to make an IT purchase, the more value you will get for your money. Waiting will decrease your risk of buying something technologically flawed or doomed to rapid obsolescence. Thus, do not innovate – be a lateadopter.

- Be safe? It is unusual for a company to gain a competitive advantage through the distinctive use of a mature infrastructural technology, Carr continues, but even a brief disruption can be devastating. As corporations continue to cede control over their IT applications and networks to vendors and other third parties, the threats they face will proliferate. These corporations will need to prepare themselves for technical glitches, outages, and security breaches, and should thus shift their attention from opportunities to vulnerabilities.

Of course, Carr is right with some of his statements. IT has become a commodity, technology has become much cheaper and accessible for most businesses. But remember that he was writing at the time of web 1.0 – technology has evolved dramatically and profoundly changed the way we live and work since then. Carr couldn’t possibly have predicted the magnitude of this change:

- Dynamics & Momentum: Technology is not static anymore, it has transcended location. You do not leave it behind at your office, the information and utilities are always with you, and in real-time. There is no finished product that sits under your desk anymore. Every glitch is noted, apps constantly updated, add-ons added – the software never stops evolving.

- Synergies: Technology by itself may not matter – but the combination of technology and process and culture creates strong synergies. This is the true game changer. Just the way technological advances have changed our way of being in the world, apps are changing our way of doing business in the world. Just like our smartphone has become somewhat of an extension of us, IT ceases to be a tool – it becomes part of our business and the way we do business. IT is not about a fancy gadget anymore; it is not about renovating the house, so to say. IT investments have the potential to tear down part of your old house and set up a new one with an entirely new character in a matter of weeks.

- Old & New: The next tech revolution is just around the corner. Legacy IT systems are switched off and replaced by scalable cloud technologies. Business models become more data driven and customer centric. AI is not only on the move but accelerating, with a prime example being GPT. Natural language processing and advanced machine learning will increase levels of automation and decrease operating costs – we are starting to see it everywhere.

IT being a commodity today first and foremost means keeping up with the way business is done. It is not about some nifty tool that everyone has or an uncertain competitive edge - it is about simply not being able to afford to do business the old way because the way we do business determines the market in which we do business. And even this new way will be the new old way once the dust has settled. There simply is no way around the invest. You cannot afford to be too stingy; you cannot afford to be too late. Also, people have started to catch on and IT safety has become a commodity itself, so there is no need to focus on safety only. We must let go of Carr’s assumptions.

But how? Renovating seems easy enough, but rebuilding part of your house seems scarier. Sometimes you need to tear down part of your old house. To be more precise: ancient software systems with monolithic IT architecture, out of maintenance for years and very unstable in operations, need replacement. Off-the-shelf systems with modular IT architecture, which are highly scalable and data-driven, are taking their place and will minimize technical debt. And importantly: tech is easy but people are hard iii.. Businesses must wrap their head around the fact that some tech investments will profoundly change the way their business is done. And they must build an investment strategy around this fact. New technologies do not fail – large IT projects fail due to miscommunication and negative user experience. A new way of doing things often seems scary at first, and can create apprehension, rejection, friction, conflict even. Being able to combine technology, processes and culture, on the other hand, creates the synergies that make transformations successful. Businesses must wrap their head around this fact and build their IT investment strategy around it. And: the professionals you hire to counsel and guide you along this path must also work with such a multidimensional approach.

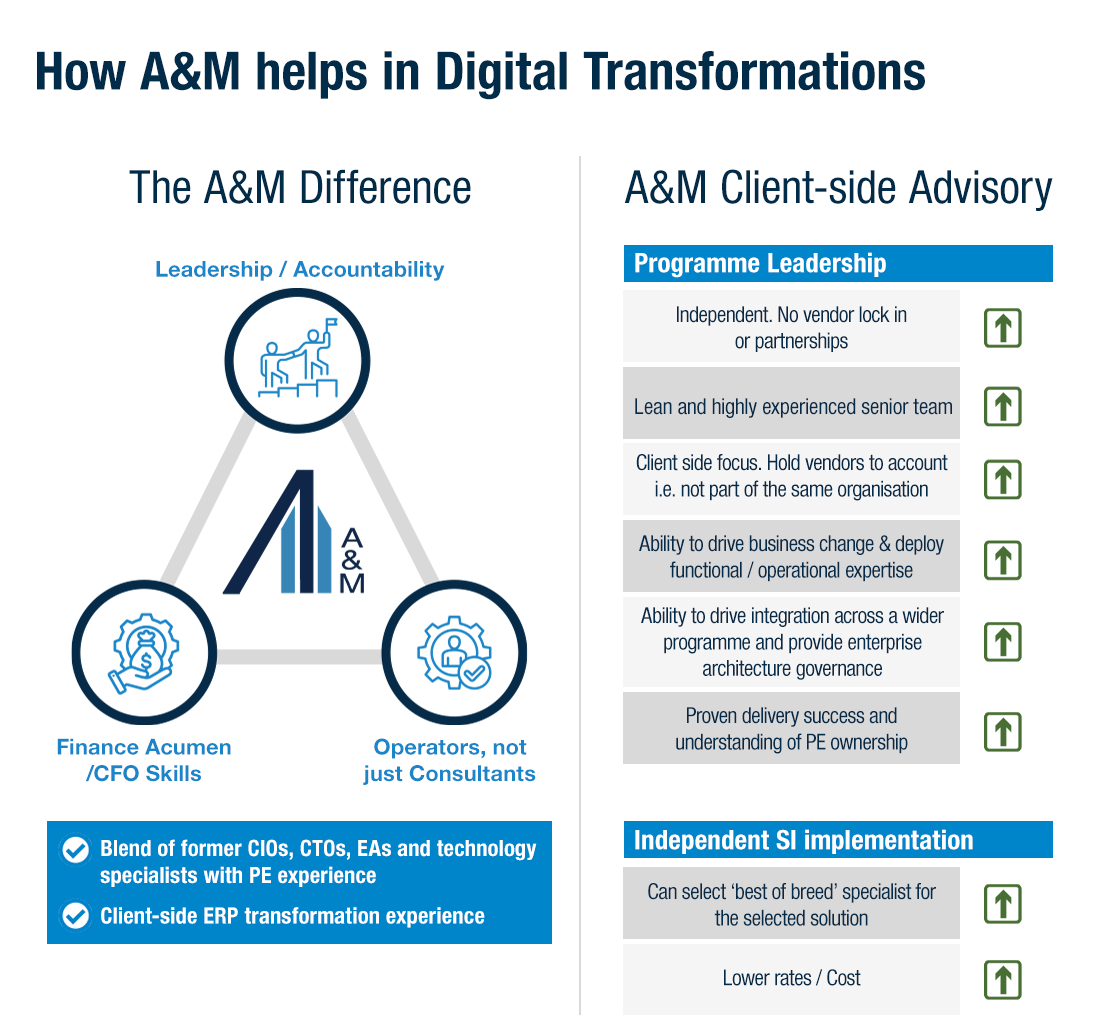

At Alvarez & Marsal, we have identified key levers and best practice examples that reflect these three dimensions. Below we have shared some of our insights into the How of IT investment.

4. The Overwhelm

More than 70 percent of digital transformations fail . Companies have been struggling with their large IT projects (e.g. ERP transformations) for thirty years now. Thus, typical mistakes we frequently come across on our engagements may provide the most useful starting point:

- Lack of skilled IT personnel (not up-to-date workforce)

- Missing CEO support (IT is not considered strategically important)

- Improper governance (working and communicating in silos)

- Missing project portfolio management (no stage gate process, no tracking)

- Long implementations (mostly done by IT-system integrators, no value tracking)

Small IT budgets are only sometimes a problem because capital expenditure dedicated to IT has been boosted for years. But demands, complexity and speed have increased tremendously so that the internal IT organization is simply overwhelmed. Add to this the multidimensionality of successful transformation projects we just outlined.

A good point of departure to tackle the overwhelm and to minimize transformation risks is to work on these eight key levers which reduce the risk of failure significantly:

Eight key levers:

First: Declutter. Clean up your data. This makes everyone’s life much easier. Look for missing values, malformed records, cranky formats and renew data governance. This will save you a lot of headaches.

Second: Declutter some more. Identify key business processes and reduce their number significantly. Do not get stuck at the pilot project level – in our engagements we saw blue chip companies who could play with all the latest technologies but were unable to scale.

Third: Plan to execute. Manage your project portfolio with an adequate stage gate process and focus on execution.

Fourth: Monitor from day one. Before you start the implementation, set-up an independent advisor – not the system integrator – to speed up implementation.

Five: Commit the boss. Convince the CEO to own technology transformation and communicate its importance to all employees in townhall meetings.

Six: Communicate. Make the digital transformation visible in your company. Avoid rumors and small circles; what people know they are less afraid of.

Seven: Start campaigning. Anticipate friction and aim to get and keep everyone on board. Do preemptive strikes to educate, expand and shift responsibilities. Be mindful and respectful of how scary these kinds of changes can be.

Eight: Investigate: Expect your investment to re-appear. Commit to a project over the complete lifecycle. Show responsibility; make sure forecasted value is achieved over the implementation period, and install effective value tracking.

5. The Alvarez & Marsal Digital Technology Approach: The Value Realization Unit

This last point we need to emphasize: Value tracking is tremendously important, so instead of saying goodbye to your investments, expect them to re-appear. To maximize IT benefits Alvarez & Marsal works in two phases: first, achieving the right level of IT maturity for your business and then topping this up with a fitting stage gate and lifecycle model. Think renovation vs. re-build: How big is that re-build going to be? Is this really an annex or are you going to be tearing down (load-bearing) walls? Does the re-build fit in with the character of your house or will you need to change the character of your house around it? Would you need to rebuild parts of it from scratch? And how does your house fit in with its neighborhood and how could you stand out a little? That’s phase one. As soon as you’ve made that decision, the job changes. It’s about project progress, deadlines, funding or being able to balance a checkbook. What if you could keep track of the benefits you are getting from the rebuild? Beyond knowing into which parts of the house or building process your money is flowing right now: how am I increasing the value of my house in real-time? Where could I put a little more money to see an even greater benefit? When it comes to businesses, it’s a bit more complicated than that, so let’s tackle it one phase at a time:

Phase 1: New IT projects and innovation activities need to be aligned with the goals of corporate strategy instead of being decentralized projects aimed at single department and/or business unit goals. To assess whether a company’s IT initiatives are aligned with corporate strategy, we at Alvarez & Marsal often work with what can be broken down to five maturity levels:

- Level 1 and 2 show project management in its infancy – new IT initiatives are not aligned to corporate strategy and implementation progress is not financially tracked.

- This changes at Level 3. This point is reached when portfolio management is established, and it becomes increasingly clear that project portfolio management pursues corporate goals.

- Level 4 extends basic value tracking – it comprises sophisticated financial KPIs and several qualitative tools.

- Level 5 is characterized by new project demand which is collected and approved in short and efficient process cycles. Projects are no longer “pushed.” Now, the organization “pulls” projects from different business units and geographies into business operations. The business is a leader in its sector and shapes the market.

At least up to level three this sounds like a walk in the park – or does it? Our experience has taught us to never underestimate how many businesses get stuck at level 2: a lot… It is fairly common to kick-off new projects which embrace the latest technologies without coordinating IT implementation at the strategy level. Particular departments then start attempting to fix their problems with new processes and software tools for them without looking beyond their department floors. A birds-eye view of the business and its strategic goals is needed. The role of an independent advisor can solve these issues and bring your company to a higher maturity level.

Already reached a maturity level 3 in which projects are centrally aligned and follow corporate strategy? Stage 3 maturity opens the door to value tracking – it is the pivotal point. Now on to the next step: appropriate stage gate and lifecycle. This isn’t completely new but it’s important to get it right. Doing so ensures that your business realizes its opportunities and that you are willing to let go when projects don’t work out.

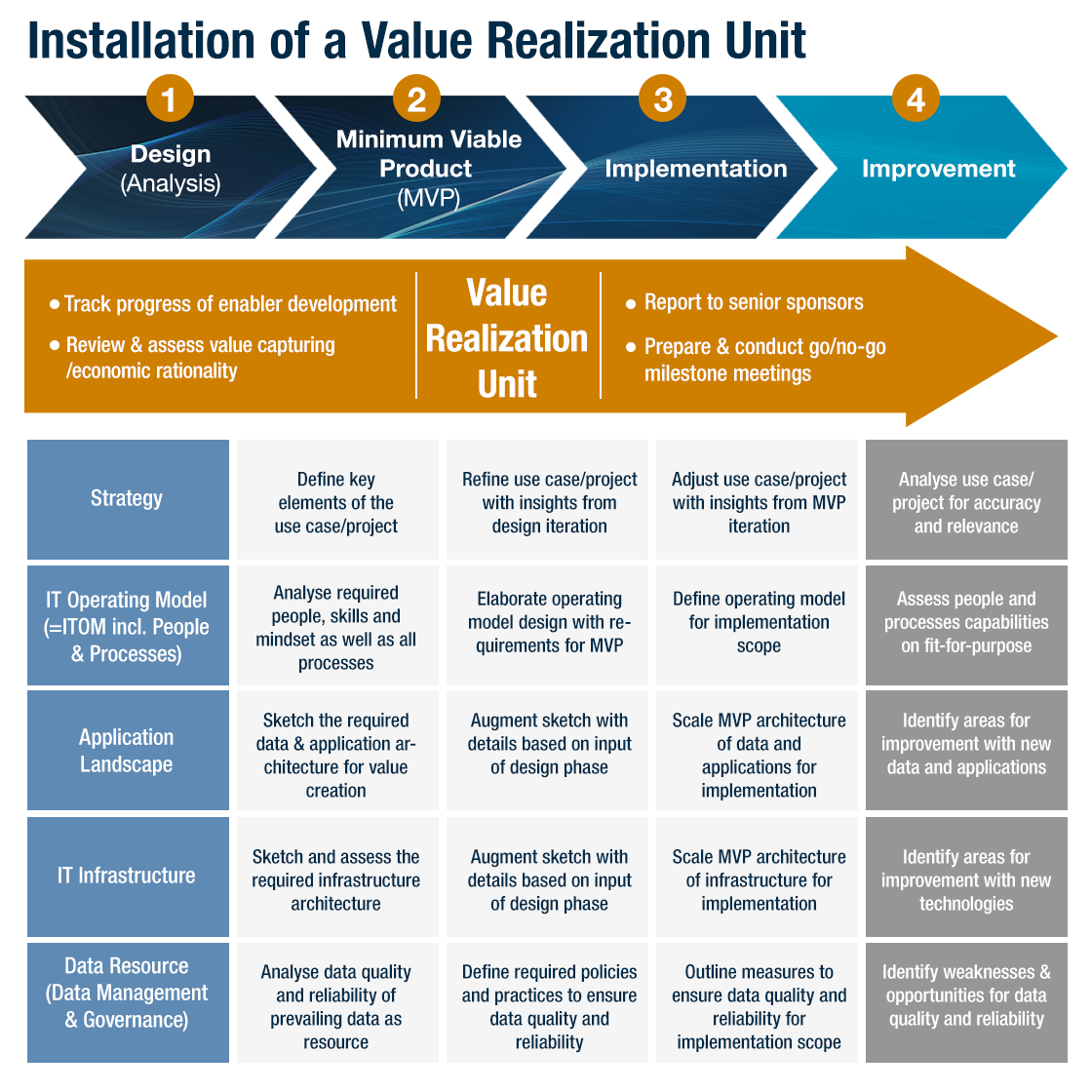

Phase 2: A state gate process increases the effectiveness of your projects. Projects are not static, they are dynamic and have life cycles, from the first idea until successful implementation and ramp-down of the project team. We at Alvarez & Marsal advise you to make this lifecycle aspect a central theme within your project portfolio management. Keep in mind that there are many complicating factors involved, but we use something like this: Let’s do a quick walk-through of the big picture considerations that go into this: At the analysis and design stage 1 we ask (once again) whether a project, let’s say a software solution, creates value, is aligned with corporate goals, and whether it is economically and feasible to implement in an acceptable timeframe. In stage 2, minimum viable product, we test the project, say our software solution, within a reduced environment. This could be a single business unit, a single geographic region, or a group of well-selected users – whatever suits your business best. Moving on, at the implementation stage 3 we roll out the idea at a bigger scale. This is the most important one for tracking. Because the decision to scale has already been made, a lot of money is in the air. A single month of delay in implementation could cause extra costs in the thousands or higher. Never lose focus at this stage. In fact, we always suggest to create or hire a unit that does nothing else – a value realization unit (VRU).

The VRU: So, go and get your own VRU. We at Alvarez & Marsal have certainly done it in a task force type of format. You could do it in a governance layer setting. This unit’s sole purpose is to monitor and evaluate the VRU: So, go and get your own VRU. We at Alvarez & Marsal have certainly done it in a task force type of format. You could do it in a governance layer setting. This unit’s sole purpose is to monitor and evaluate the different stages described above. So, these are the people who will be able to tell you where your money is right now, where it is going, and where and when you will see it again – with the right tools. Usually, these people do not exist. In many, if not most cases, a business case is calculated and if the return on investment (ROI) is positive in a feasible time the project gets green-lighted. There is perhaps someone monitoring implementation goals. But – and this is a big BUT: nobody keeps checking if the initial cost-benefit calculations are still valid. This means that you are missing out on important information because this value is a moving target. The complexity of value tracking is changing continuously just as challenges and value drivers are changing continuously. Just think of something as minor as software updates and bug-fixes that can rattle the whole team and shake things up quite a bit. Or think conflicts of interests within system integrating partnerships which slow everything down and increases cost. You need someone to keep track of the moving target, which is where a task force comes in.

Even if value tracking seems very narrowly focused on cost and benefits, it is important to never lose sight of the multi-faceted aspects of IT projects. After all, it is about technology and process and culture. Always remember the baseline, the eight key levers we laid out above.

6. Conclusion and Key Takeaways

After we tackled in our previous article Why businesses and PEs should invest in IT, we covered the How of investing here more deeply. It starts with the right mindset. Executives need to have the right mindset to be successful and understand that IT investments, more often than not, are not about renovating the house. You will need to be open to tearing down part of your old house. This is not the extra mile – we are still talking about that first run. Technology investments are simply essential to reach planned EBITDA goals. Renovating your house seems easy enough to do – but if you’re rebuilding part of your house, you have got to have a plan and keep track of your investment’s value for money. This is a moving target. You’ll need someone to get a hold of it all the while not losing sight of the big picture – you need a VRU, a value realization unit. If you choose to work with us, we will be glad to assist you.