Update on the Job Retention Scheme

We are pleased to let you know that HMRC is targeting 20th April for the Job Retention Scheme claims functionality to be up and running.

How will claims be made?

It is confirmed that, in line with many tax positions, it is a self-assessment and claims basis, via an online portal only. No telephone claims are to be allowed.

Some advisers are lobbying HMRC to use an alternative method than the company’s online portal, as not all employers have a portal in place and it can be a lengthy process to get one, involving passwords being sent by post.

What should I be doing now?

Employers should check if they have a company online portal in place. If they do have one, they should check who has the login and password details to access it, and if this also gives access to the PAYE option. It is through this login that most employers do their share scheme reporting and forms 42.

For those that do have an online site, they may not have registered and activated the PAYE/NIC part of the portal (It is more commonly used for Corporate Tax and VAT filing purposes).

How can I check?

To check you can access the log in page at:

https://www.gov.uk/log-in-register-hmrc-online-services

You will need your identification number, which is usually the company’s UTR number, along with the set password. This can be tricky, as it can mean that in practical terms the person who most regularly accesses the online portal has set the password. You will need to locate who that person within your organisation is and ask them to log on, or permit you to have access to the password.

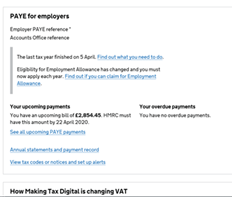

Once logged in, you should get to a landing site like this:

And within that page, there are options for Corporation Tax, PAYE and VAT:

We understand that the link to the online claim form will be hosted on the PAYE page, along with the drop down menus for forms P11D etc.

Is the form available yet?

HMRC have built their online form and have started to test this with some employers. HMRC anticipate that it should be able to handle 450,000 per day, and that the peak period will be in the initial few days. If you can therefore wait to make your submission, this is advisable.

What can I claim for?

HMRC have previously advised that claims can be made for 3 week periods at a time, back to 1 March 2020, so there will be a potential period of catch up for those initial weeks. However, other employers only formally furloughed staff from 1 April onwards, and the first claim will be able to be made after the April payroll has been processed and the Full Payment Submission (“FPS”) submitted to HMRC. We therefore anticipate another surge of claims to be made towards the end of the month.

Remember it is a reimbursement scheme, so you do need to have processed payroll before a claim can be made. Claims will be 80% of pay capped at a maximum of £2,500, plus the employer NIC on the JRS payment made, and the 3% employer minimum pension contribution due (if employees had not opted out of auto enrolment).

How do I calculate the claim?

To assist with computing claims and collating the necessary details for this, we have produced a spreadsheet which may assist with the collation and assessment tasks. As previously advised, if you can set up a dedicated payment type for JRS, this will help you, as you should be able to access reports from payroll identifying the values paid to employees under the scheme, separate from any top up or contractual payments also being made. Please remember that what you can claim under JRS may not be the full value of what you have paid.

I outsource my payroll, will they be able to claim for me?

The onus on making the claim will sit with each employer. Payroll bureaux and agents may not have access to the online portal, so would not be able to do this for you. HMRC has however written to certain agents and bureaux that have full client agent rights, to encourage them to assist clients where they can, accepting that HMRC does not have resources to be able to handle the anticipated level of queries themselves.

Representations are being made for a dedicated agent query/clearance email address to be made available, so that agents can assist HMRC to deliver the support needed and for unusual circumstances etc to be able to be “cleared” and FAQs regularly updated to help administer some of the more complex areas.

How can A&M Taxand Help?

In the meantime, we can assist with collating the records or calculating the values of JRS due to be paid, freeing up time from an already overstretched payroll team. We can provide the payroll input files in excel or CSV format, to help with the upload into the payroll system. Alternatively we can review files you have prepared and offer assistance on more complex areas such as averaging pay, whether payment types are discretionary or contractual etc.

Please contact Louise Jenkins or Tracey Norton from our Reward & Employment Tax Solutions Team if you require any assistance or have any questions.