UK AGM Season: Remuneration voting update

With over half the FTSE 350 AGMs now completed, analysis shows the season is turning out to be one of the toughest ever for companies.

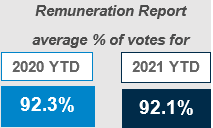

Data for AGMs up to the end of May shows that the average FTSE 350 remuneration report advisory vote remains broadly comparable to last year, at 92.1%.

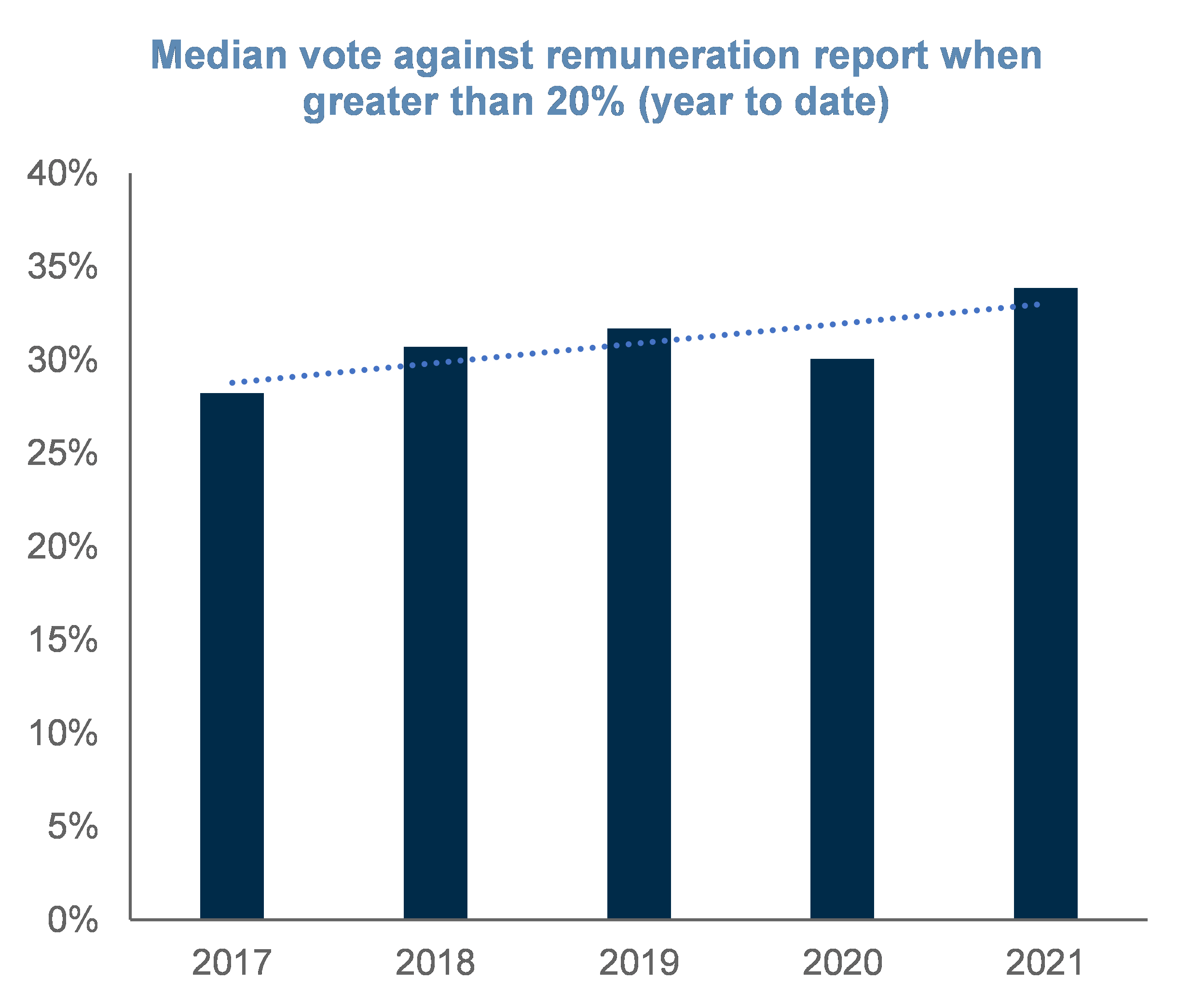

However, the number of companies receiving more than 20% of votes against their remuneration report by this stage of the AGM season is higher than the four years prior. The 2021 figure is already higher than 2020 with around 115 AGMs still to take place.

Not only have more companies suffered significant dissent but where there was a significant vote against the remuneration report, the median vote against is higher than in the four previous years.

Ignoring 2020, when many companies adopted a cautious approach and many investors gave companies the benefit of the doubt, this chart highlights a trend of increasing shareholder dissent: put simply, more shareholders are now prepared to vote against remuneration reports when they believe there is an issue.

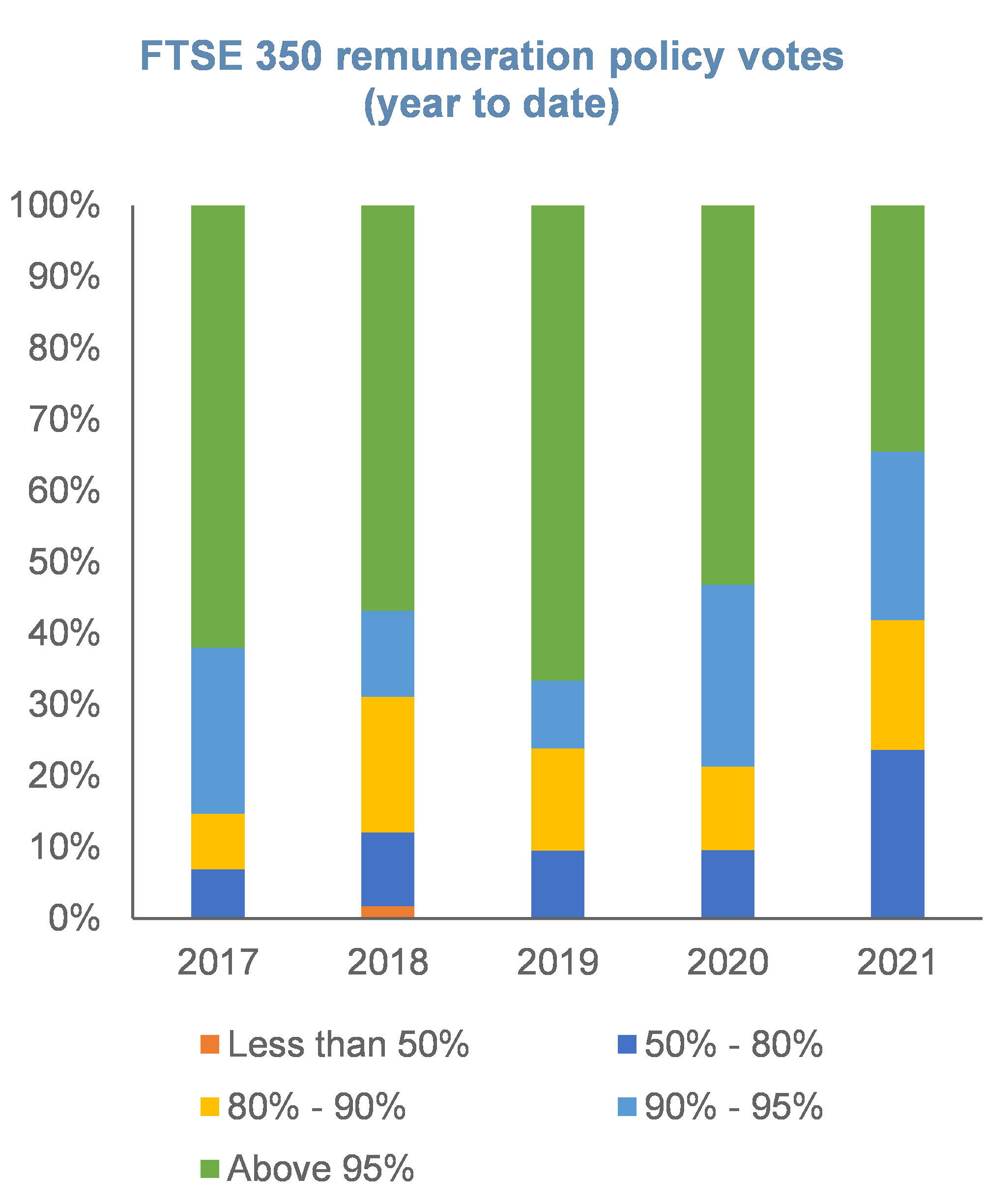

Nearly one-third of the FTSE 350 have put their remuneration policy to a binding vote (a similar level to 2018 and 2019 but lower than in 2020 when most companies reached the end of their three year policy cycle).

35% of these have put their policy to a vote earlier than the 3-year requirement. The two main reasons for an early vote were in order to obtain approval for an increase to incentive quantum and/or a change to the incentive structure. Some of these companies will be seeking approval to make changes to their policy that they may have originally planned for 2020 but delayed due to the pandemic.

This year nearly a quarter of policies received a vote of less than 80%.

The median vote against when greater than 20% is 24.7%, i.e. lower than a vote against the remuneration report. This may be due to the fact that companies will typically engage in extensive consultation prior to a policy vote and will have a good idea of the level of support for proposed changes before proceeding.

Unsurprisingly, a significant vote against the remuneration report or policy typically follows a vote against recommendation from ISS. Of those with a significant vote against their remuneration report in 2021, 88% received a vote against recommendation from ISS compared to only 25% who received a red-top from the Investment Association. Whilst a red-top isn’t directly comparable to an ISS vote against recommendation, this highlights how closely correlated an ISS vote against is with negative votes.

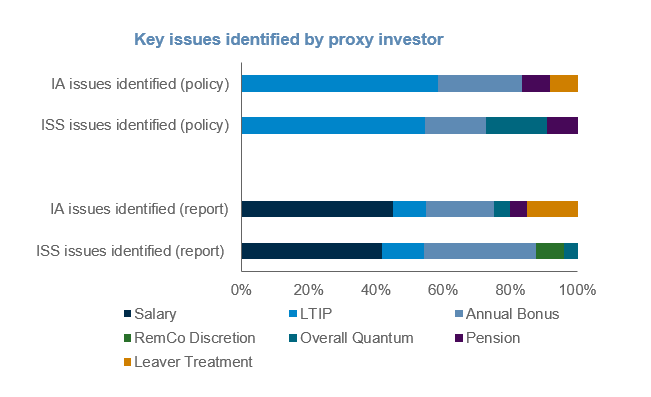

So far in 2021, for those companies that received a significant vote against their remuneration reports, proxy investors have been broadly aligned in terms of the key issues that have driven their voting recommendation/report colour. Where there was a vote against the remuneration report, salary was the main concern for both ISS and the IA (42% and 45%, respectively), followed by annual bonus (33% and 20%, respectively). Given the impact of the pandemic and desire for restraint, it is not surprising that these issues have been the most contentious this year.

Whilst there are a significant number of AGMs still to come, it seems clear that the executive pay environment has become significantly tougher for companies to navigate. Given the trend of increasing levels of dissent over a number of years, this may be a “new normal” for companies to consider as they plan for next year.

How can A&M's Executive Compensation team help?

A&M Executive Compensation Services is well-positioned to advise Remuneration Committees through this period. Engagements are led by a Managing Director who attends all meetings and is actively involved in all deliverables.

This ensures you always have access to the right level of advice, particularly when making critical decisions under time pressure. Our Managing Directors have a combined 80+ years of experience in advising on executive remuneration matters.

If you have any questions regarding the content in this report, please contact Jeremy Orbell or Amanda Stapleton.