Off-Payroll Working: Reform of IR35 for the Private Sector

When the Chancellor of the Exchequer delivered the Government’s annual Budget statement on 29 October 2018, one of the most significant announcements for larger businesses concerned the future operation of the off-payroll working rules (IR35) for medium and large companies in the private sector. Smaller companies will continue to apply the existing rules. HMRC announced in December 2018 that the definition of a ‘small’ company will follow the provisions set out in Companies Act 2006 whereby a company qualifies as ‘small’ if two or more of the following requirements are met:

-

Turnover – not more than £10.2 million

-

Balance sheet total – not more than £5.1 million

-

Number of employees – not more than 50

Any company that does not fall within this definition of ‘small’ will be within scope of the new rules.

IR35 is relevant where services are provided to a company (the engager) by a worker’s own limited company or partnership (the contractor). Since 2000, in the private sector it has been the responsibility of the contractor to determine whether the worker would have been an employee of the engager were they to have provided their services directly and if so to subject the remuneration to PAYE and National Insurance Contributions (NIC).

The changes will see the payroll tax obligations shift from the contractor (the personal service company) to the engager, in the same way that has applied to the public sector since April 2017. This will signal a dramatic change to the way in which businesses arrange their resourcing requirements. Almost inevitably this will result in an increase in costs and a reduction in flexibility at a time of immense uncertainty for UK businesses.

Whilst the proposed changes will take place from 6 April 2020 (the government having opted to give businesses some additional time to prepare), their complexity should not be underestimated. Significant lead-time will be needed to prepare for the changes.

In this edition of Tax Adviser Update, Louise Jenkins takes a look at what the proposals will mean in practice for those businesses that engage workers via personal service companies.

So what is the point of IR35?

The rules were intended to ensure that individuals, who work effectively as employees, pay broadly the same employment taxes as actual employees, regardless of the legal structure they operate through. This is achieved by taxing the fees received by a personal service company (PSC) as if they were employment income in situations where had there been a direct contract between the individual and the engager this would have been viewed as an employment contract.

However, whether or not a contractor is self-employed or employed is often a grey area that is not specifically addressed by statute, which can lead to significant uncertainty.

Under the current rules, where an individual trades through a PSC it is for the contractor to self-assess whether or not the payments received for the worker’s services are caught by the IR35 rules. To overcome the uncertainty and the tax risks for the engager associated with getting the determination of an individual’s employment status wrong, the engager would typically prefer to engage with a PSC and may even insist on suppliers operating through such a medium if they wish to secure the business.

The identification of a particular contract as being within the IR35 rules is a matter for self-assessment for the PSC and accordingly as a result of either misinterpretation or basic lack of knowledge of the rules many contractors simply do not report any deemed income or pay-over the corresponding incremental taxes. The subjectivity in this area is perhaps best illustrated by the large number of cases that have been the subject of litigation since the rules were introduced.

HMRC has previously sought to close the tax gap by changing the dividend taxation rules for owner managed businesses meaning that the comparative tax take from contractors and employees is now quite closely aligned. However, these measures have not bucked the growing trend for the use of intermediary companies and HMRC remains concerned over the perceived loss of tax and social security revenues.

So, what next?

Due to the increasing concern about loss of revenue, the rules were changed from April 2017 for engagers in the public sector. From that date, responsibility for correctly determining whether a contractor is an IR35 business or not, and the withholding of income tax at source and NIC was shifted from the contractor to the public sector engager.

An engager taking on the services of an individual can ask their local HMRC Status Inspector for an opinion as to the employment status of the worker. Alternatively, the engager can obtain an HMRC status view by using the ‘Check employment status for tax’ service (CEST) on the HMRC website. So long as the information provided is accurate, HMRC will stand by the result given.

If found to be working in a similar way to employees, the engager is required to withhold tax and NIC at source on the payments it makes to the contractor, in addition to incurring the additional employer NIC cost. The changes were dramatic and a number of issues arose on implementation.

Despite these issues, the much-anticipated announcement was made at the Budget declaring that the private sector is to be brought in line with the rules that currently apply for public sector contracts. This extension to the private sector will be brought into place in April 2020 but will not apply where the engager is considered to be a ‘small business’- the meaning of which is explained above.

Although April 2020 seems some way off, engagers will need to devise a plan, with appropriate controls and processes put in place to ensure compliance. Lessons learned from the rollout to the public sector indicate that this can typically take up to a year.

Engagers – why act now?

There are a number of actions to be implemented to ensure readiness for the new regime. Some of the key practical considerations are as follows:

-

Consideration of the cost implications arising from additional NICs and how this will impact the pricing of services obtained from contractors.

-

Availability of the resources required - it will be a labour intensive and time-consuming task to trawl through accounts payable ledgers to identify individuals and PSCs that may be caught by the rules and to then review the terms of individual contracts.

-

Determination of dispute resolution procedures - once potentially in-scope individuals are identified, what happens if they disagree? Policies will need to be drawn up to govern how these situations are handled and communication will be key.

-

What will the individual workers be offered instead? Whilst one solution might be to offer individuals employment contracts, this is typically the most expensive and least flexible option.

-

If workers are paid the same rate as their PSC they will likely see a reduction in net pay due to the PAYE and NIC that will be deducted from their gross pay. Will this be acceptable? How does an organisation handle this if employee peers are not on the same increased pay?

-

Administration of the regime – are systems in place that will enable an employer to pay via Accounts Payable whilst also calculating and deducting PAYE and NIC?

Six-step approach

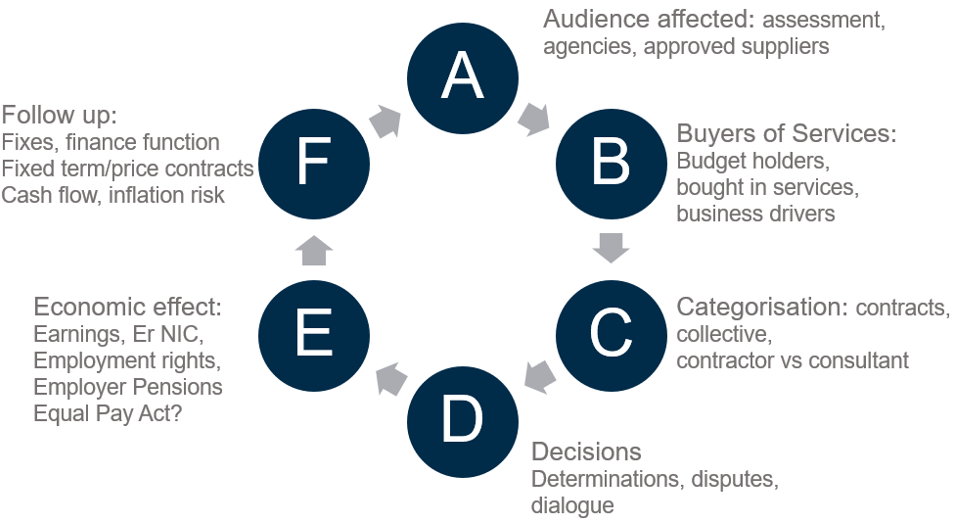

Businesses may find it useful to employ the following six-step diagnostic approach that we use to help clients with the evaluation of the impact that the changes will have on their business:

Final Thoughts

Businesses need to plan early and engage with their advisers to understand how any changes could affect them.

The key IR35 tests are control, personal service, and mutuality of obligation. Ideally, assessments will need to be undertaken for each contractor and repeated regularly (six monthly) including each time a new contract is entered into. Employers should consider not only working terms and conditions but the wider regulatory framework covering the sector that they operate in. There is likely to be enhanced HMRC scrutiny on those organisations operating in high-risk sectors.

Ultimately, HMRC expects to raise significant additional tax revenues as a result of these measures and, therefore, it is really a question of determining how this economic burden is shared between those employers that make use of contractors and the workers themselves.

Our six-step approach helps companies address the impact that the proposed IR35 changes will have on their business. Our Reward & Employment Tax team has extensive, practical experience in working with clients to prepare for these important changes.