Now that the CARES Act Fixed the Retail Glitch … How Can You Prevent the Tax Return Glitch?

As part of the CARES Act (Pub. L. 116-136), improvements made by the taxpayer to the interior of a nonresidential building after the building was first placed in service (i.e., qualified improvement property or QIP) are classified as 15-year MACRS property and are eligible for 100% bonus depreciation. This corrects the so-called “Retail Glitch” resulting from a drafting error in the TCJA (Pub. L. 115-97) that reduced the incentive for retailers (among others) to implement operational improvements inside their facilities. The QIP correction is effective as if included in the TCJA and applies to all QIP placed in service after December 31, 2017.

In this alert, we discuss:

- The rules governing what is now QIP that were in effect before the TCJA, and the changes that the TCJA made to those rules;

- The QIP provisions of the CARES Act;

- IRS guidance on the manner of applying the new rules to property placed in service after December 31, 2017.

Relevant Provisions Pre-TCJA and Related TCJA Changes

Summary of relevant Pre-TCJA provisions

Before the TCJA, certain interior improvements to nonresidential buildings were depreciated under the straight-line method and were assigned a 15-year cost recovery period under the MACRS depreciation system, instead of the general 39-year recovery period for nonresidential buildings and their improvements. Specifically, the following improvement was given this favorable treatment:

- Qualified leasehold improvement property (QLIP);

- Qualified restaurant property (QRP); and

- Qualified retail improvement property (QRIP).

QLIP, QRP, and QRIP were specific types of improvements generally made under a lease or related to restaurant or retail facility (as applicable).

Taxpayers could elect instead to use the alternative depreciation system (ADS) under which nonresidential buildings and improvements and QLIP, QRP, and QRIP were depreciated under the straight-line method over 40 and 20 years, respectively. This ADS election allowed taxpayers to defer deductions, which could be beneficial if the deductions gave rise to no current cash tax benefit. For example, the ADS election prevented (or reduced) the conversion of depreciation deductions into net operating losses (NOLs), which would have been subject to a 20-year carryforward limit as well as other potential limitations (such as a section 382 limitation due to an ownership change).

Assets with cost recovery periods of 20 years or less (which includes QLIP, QRP, and QRIP if the taxpayer did not choose to use the ADS) or QIP, the original use of which commences with the taxpayer, were generally eligible for 50% bonus depreciation under section 168(k), at the taxpayer’s election. QIP generally included improvements made by the taxpayer to the interior of a commercial building after the building was first placed in service, such as new flooring, lighting fixtures, sprinkler systems, or other types of remodeling and interior improvements, but specifically excluded improvements attributable to the enlargement of a building, an elevator or escalator, or the internal structural framework of a building.

Summary of relevant TCJA changes

The TCJA made two key changes with respect to improvements to nonresidential buildings:

- It eliminated all references to QLIP, QRP, and QRIP and generally treated all nonresidential improvements as either QIP or nonresidential real property.

- It assigned all QIP a 39-year recovery period (or 40 years under the ADS), the same period as nonresidential real property.

The latter change was inconsistent with the committee reports on the TCJA, which clearly stated the congressional intention to assign a 15-year cost recovery period (and a 20-year period under the ADS) to QIP. As a result, the language that was enacted has been referred to as the “Retail Glitch.”

The TCJA modified bonus depreciation so that property that is placed in service after September 27, 2017, and before January 1, 2023, is eligible for 100% bonus depreciation (decreasing by 20% every year after 2022), regardless of whether the taxpayer is the original user of the property, so long as the property’s cost recovery period is 20 years or less under MACRS. As a result of the Retail Glitch, QIP was not eligible for bonus depreciation.

The TCJA also added a broad limitation (the section 163(j) limitation) on a taxpayer’s deduction for business interest expense (discussed in greater detail here). However, real property trades or businesses (RPTOBs) were allowed to elect out of section 163(j) limitation regime in exchange for depreciating their property using ADS and forgoing bonus depreciation. Due to the Retail Glitch, many RPTOBs made this election.

Summary of CARES Act provisions

The CARES Act made three changes to the Internal Revenue Code that are relevant to this alert.

- The Retail Glitch was fixed. The CARES Act fixed the Retail Glitch by providing that QIP is 15-year cost recovery property under the MACRS system (or 20-year property under ADS). In addition, QIP is eligible for bonus depreciation. The Retail Glitch fix was made effective as if included in the TCJA.

- The section 163(j) limitation was increased for taxable years beginning in 2019 and 2020. (This is discussed in greater detail here).

- The rules governing NOLs were modified (including allowing NOLs to be carried back) for losses arising in taxable years beginning after December 31, 2017, and before January 1, 2021. (This is discussed in greater detail here).

For information regarding other changes made by the CARES Act, see A&M’s prior Special Tax Alert here.

Planning Opportunities as a Result of the CARES Act

Adjustment to Depreciation Taken with Respect to QIP

Due to the CARES Act, taxpayers must change the categorization of their QIP to either 15-year or 20-year cost recovery property under the MACRS system and ADS, respectively (keeping the original TCJA rules is not an option). However, taxpayers can also:

- Make or revoke an election not to apply the bonus depreciation rules to any class of property.

- Make or withdraw an election to use ADS (instead of MACRS).

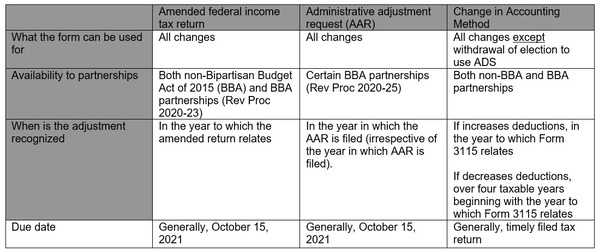

In general, a taxpayer is able to make these changes either by filing an amended return (e.g., a Form 1065X or 1120X) or by requesting a change in accounting method (on Form 3115 attached to an original return). However, if a taxpayer wishes to withdraw a previously filed election to use ADS, the withdrawal can only be accomplished by filing an amended return or administrative adjustment request for the taxable year in which the election to use ADS was made. The available filings, and their uses, are summarized below:

Timing is Always Key

As with many tax items, the time the adjustment is recognized should be considered when evaluating how a taxpayer addresses the Retail Glitch fix. For example, increased depreciation deductions may effectively reduce the benefit of other deductions that are based on a company’s taxable income (for example, the section 250 deduction for GILTI and FDII that was added by the TCJA) or subject the taxpayer to the base erosion and anti-abuse tax (BEAT), and the effect may depend upon the year in which the adjustments are recognized. Similarly, increased deductions may generate a net operating loss, the benefit of which may vary from year to year due to the CARES Act’s 5-year carryback provision.

RPTOBs

The IRS issued guidance that allows an eligible taxpayer to make a late election, or withdraw an election, to be treated as a RPTOB that is not subject to the Section 163(j) limitation. This is significant due to the number of changes made by the CARES Act which require a RPTOB to reexamine through new lenses the direct and collateral consequences of the election. For more information regarding this guidance, see A&M’s Special Tax Alert of April 14, 2020 discussing Rev. Proc. 2020-22 (IRS Provides Additional Relief for Fiscal Year Filers and Real Estate Businesses as Part of COVID-19 Response).

However, not all taxpayers are allowed to apply the new QIP provisions retroactively. Those who cannot include taxpayers that made a late election or withdrew an election to be treated as an RPTOB for the taxable year in which the QIP was placed in service, and certain taxpayers that deducted the cost or other basis of the QIP as an expense. When a taxpayer makes a late election or withdraws an election to be treated as an RPTOB under Rev. Proc. 2020-22, it is required to make any CARES Act-related changes to depreciation in accordance with the applicable provisions of Rev. Proc. 2020-22.

A&M Taxand Says

As with the other CARES Act provisions, the Retail Glitch Fix was designed to provide liquidity to taxpayers. However, in order to maximize potential liquidity, taxpayers must consider the ramifications of the form they choose to use, including the timing of the adjustment. This requires careful modeling to determine the effect of the new QIP provisions and following the prescribed procedure to promptly claim the associated tax benefits. Alvarez & Marsal Taxand is available to help you with this modeling exercise and your other tax matters as you work through this difficult time.