Avoiding the iceberg: how ‘prestructuring’ can help Healthcare providers preserve value and mitigate financial distress risks

COVID-19 has significantly impacted healthcare providers’ operations and profitability, but the pandemic’s effects have been unevenly distributed. While some sub-sectors, such as essential services and protective equipment suppliers, have performed very strongly, other subsectors (such as elective surgeries) have fared much worse.

Now, leaders are seeking to swiftly adjust both cost structures and operating models, to better serve patients in the post-COVID-19 world and to rebuild long-term financial stability.

Organisations that can anticipate early signs of financial distress will be in the strongest positions to act and head off real turbulence. A&M’s ‘prestructuring’ approach aims to provide early warning of financial distress and the framework to rapidly address underlying issues before adverse effects materialise.

The journey ahead to mitigate financial risks and preserve business value

Many management teams have realised that preparing the business model for a post-COVID future will involve significant business transformations. Prestructuring ensures you move fast enough.

Working with industry management teams throughout the virus outbreak, we had the opportunity to appreciate how COVID-19 has triggered and accelerated initiatives regarding workforce management, back-office streamlining, digital transformations and supply chain optimisation.

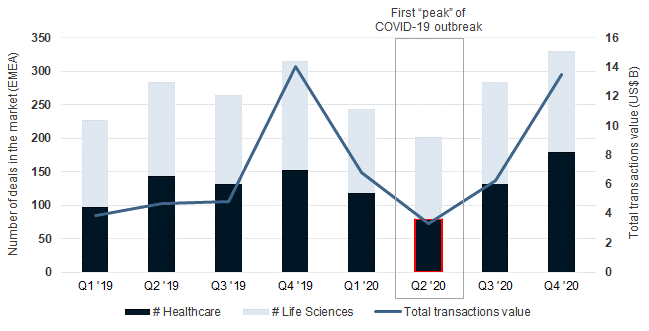

With elective treatments and surgeries being widely postponed, and healthcare providers seeing sharply lower hospitalisations for non-COVID-19-related conditions, some businesses are now confronting financial distress, potentially setting the scene for further market consolidation and roll-ups. Market data observed so far reveals a twofold trend, with consolidation partly happening through the integration of single players and small groups into larger provider groups, as well as a broader shift from ‘specialist care’ to ‘integrated care’.

Figure 1 highlights how EMEA healthcare deals (excluding pharma and life sciences) reduced in number and value in Q2 2020 before bouncing back strongly in the second half of 2020.

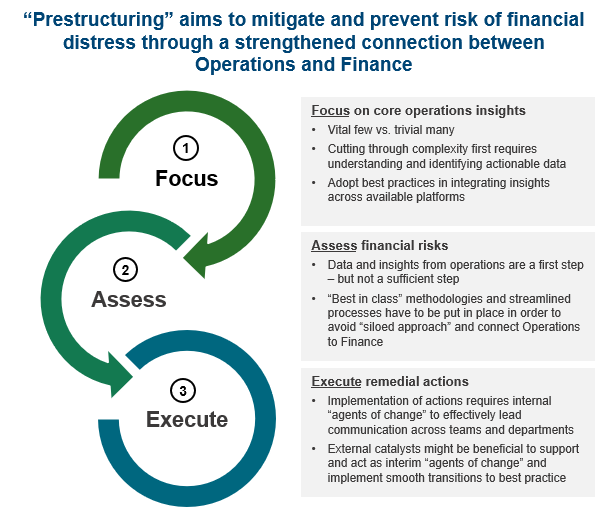

In such a rapidly changing environment, management teams and other stakeholders face challenges in reacting ahead of time to an industry environment that is rapidly changing as a result of financial distress. The main aim of prestructuring is to prevent financial distress from occurring at all, or to significantly mitigate its magnitude if it does occur. We apply a three-phase approach to prestructuring initiatives (Figure 2):

- Focus on core Operations insights

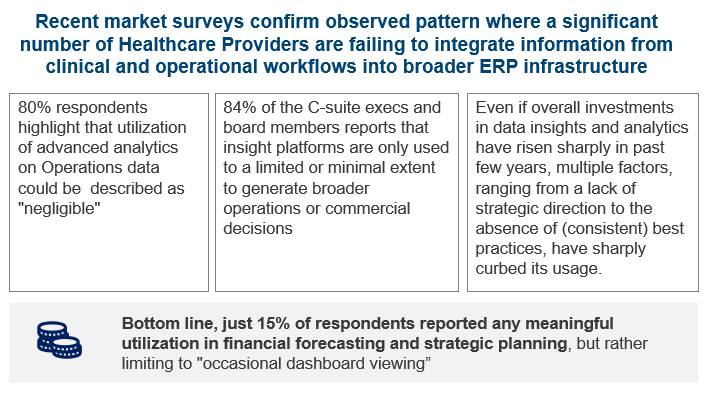

Our experience working with players across a number of sub-sectors (e.g. elderly care, diagnostic imaging, IVF clinics, ophthalmology) suggests that the Industry is often characterized by a common pattern of “legacy factors” resulting in limited or minimal operations insights and, ultimately, exacerbating poor financial forecasting and strategic planning:

a) Information overflow: recent years have seen most of Healthcare Operations dealing with a puzzling “overflow” of available operational data and information, often driven by a number of concurrent (digital) transformation initiatives that have been developed with a lack of common structure and/or consistency across the different part of the business.

b) Lack of connection between operations and finance: a common result from poorly managed or unsuccessful business transformations is an unreliable and insecure connection between the data coming from operations and from finance.In an ideal situation, operational processes would be represented and traceable within the broader business cash conversion cycle, with insights being analysed and leveraged to drive further improvements as and where necessary.

Our experience unfortunately suggests that in many cases, operations and finance are intentionally siloed, ultimately limiting the ability of decision-makers to identify and capitalise on improvement opportunities.

-

Assess financial risks

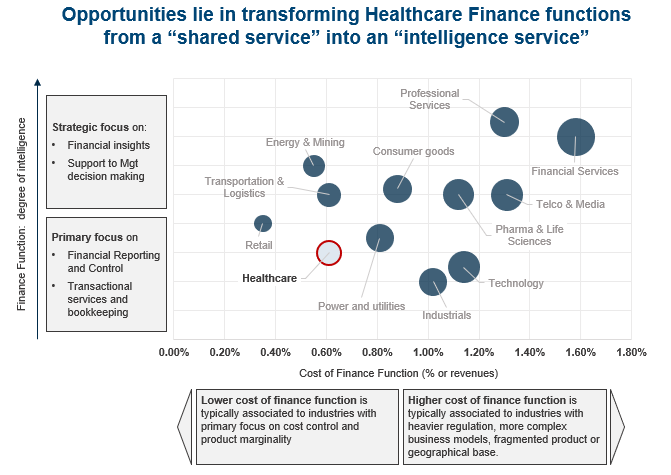

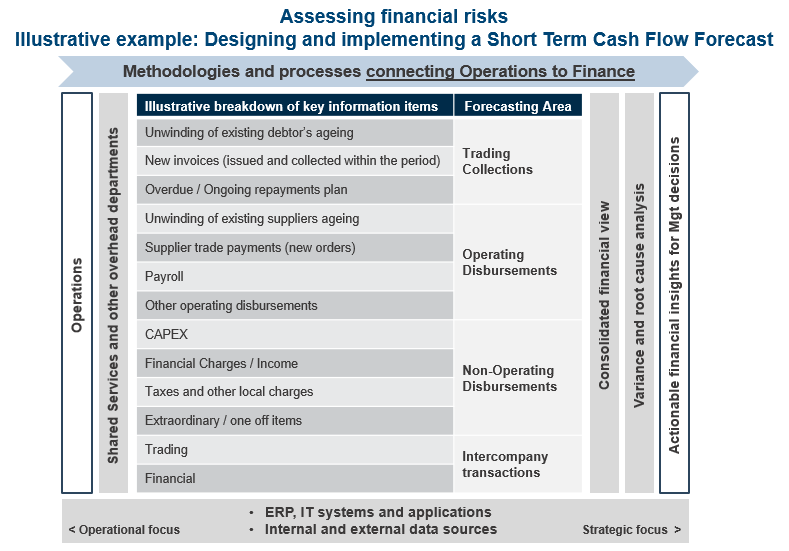

a) Understand the historical approach to business reporting and financial intelligence: it is still common to see financial reporting being set up to deal with just two factors: cost control and service profitability. As Figure 4 suggests, healthcare has historically lagged other sectors with respect to ‘smart’ financial intelligence that supports board-level decision-making.Organisations are increasingly willing to invest resources into improving the effectiveness and efficiency of the finance function. However, real-world examples suggest that efforts are often limited to buying technology tools and/or systems, rather than designing effective methodologies and processes first before investing in the supporting technology.

b) Methodologies, processes and implementation of best practices: a fair assessment of short-term financial and operational risks is only possible if the two areas are truly connected. While new technologies should be factored in, real value creation comes through underlying methodologies and processes. Technology certainly plays a fundamental role in process automation, but it is not enough on its own.

Our key takeaways from working with clients - in recent period of lockdown - include the following:

- “One size does not fit all”: while frameworks and industry standards certainly help setting the groundwork, methodologies and processes have to be pragmatically designed around the specific business and its available data sources.

- Best in class processes do not have to necessarily be complex: common agile approaches aim to initially adopt an 80/20 rule and establish MVPs (Minimum Viable Products) in a matter of days or weeks, rather than months. If less time is required to run the process, leaders can allocate more resources to interpreting insights and driving follow-up actions.

- Sustainable processes should not be designed and driven exclusively by tools and technology: a successful rollout requires broad consensus and depends on effective cross-team collaboration. Clear ownership and accountability for each task is also essential to success. A great example of this is our core competency of short-term cash flow forecasting, where it is imperative that operations and finance processes are linked hand-in-hand and individual responsibilities be crystal clear.

-

Execute remedial actions

Mitigating risk will ultimately rely on the management team being able to execute remedial actions. In delivering these initiatives, external advisors can work side by side with management team to facilitate swift and efficient execution. Difference makers:- Reducing complexity: “simplification” does not necessarily mean to compromise on accuracy of actionable insights, but it has to be read within the broader learning process that will then progressively drive continuous improvement

- Leveraging existing assets (i.e. avoiding re-inventing the wheel): a process is more likely going to be successfully executed if it minimizes amount of “additional work” and is mainly built around existing data, systems, sub-processes and / or other business assets

- Enhancing communication and creating team consensus: execution often fails due to stakeholders not being fully aware about how their information is going to be used as part of the broader process or, equally sad, due to lack of Management feedback and overall visibility on process outcome

- Building a sustainable approach: enhancing financial visibility is not a one-off exercise. Promoting a long-term ‘cash culture’ across the entire organization makes all stakeholders aware of the financial implication of their business decisions.

The ‘Hemingway Law of Motion’ states that events happen “gradually, then suddenly”. This is often the case when it comes to financial distress: usually, little action is taken until a crisis happens! With prestructuring methodologies, though, management teams can take deliberate steps to head off crises and preserve long-term business value.

Recent case study

Background

-

A pan-European fertility clinics network – a leader in IVF treatments – experienced a number of challenges in completing a post-merger integration and progressing the overall transformation plan, with effects then exacerbated by the introduction of COVID-19 lockdown.

A&M role

-

Supported investors, management team and creditors in reviewing key operations insights and making it easier to deliver short-term financial projections.

-

Supported identifying and executing set of short-term remedial actions, including areas such as working capital optimisation and resource planning for both medical and overhead staff.

Outcome

- The business benefited from enhanced financial visibility across countries and local facilities, laying the groundwork for the company’s transformation to successfully continue.

A&M: Leadership. Action. Results.

A&M has worked with some of the largest European and global organisations to stabilise financial performance, transform operations and accelerate results. A&M’s Health and Life Sciences team brings decades of experience creating value and driving results for healthcare businesses. To learn more, reach out to our key contacts Ray Berglund, Diana Wong, Paul Richards and Maurizio Paolella.

List of references:

- https://www.ey.com/en_gl/ccb/health-mergers-acquisitions

- https://medium.com/@TopCFO/financial-controlling-vs-business-controlling-e51e7bb8dcf6

- https://blogs.deloitte.co.uk/assurance/2019/07/minimum-controls-how-much-is-enough-.html

- https://www.alixpartners.com/insights-impact/insights/maximizing-value-amid-uncertainty-in-the-healthcare-industry/

- https://www.pwc.co.uk/finance/assets/pdf/uk-finance-effectiveness-benchmarking-report-2019-2020.pdf

- https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Operations/Our%20Insights/Finance%202030%20Four%20imperatives%20for%20the%20next%20decade/finance-2030-four-imperatives-for-the-next-decade.pdf?shouldIndex=false

- https://assets.kpmg/content/dam/kpmg/pdf/2013/12/being-the-best-v2.pdf

- https://www.healthcareitnews.com/news/too-many-providers-are-failing-meaningfully-integrate-data-analytics

- https://blogs.oracle.com/modernfinance/five-reasons-to-connect-finance-operations-and-analytics-in-the-cloud

- https://blackbookmarketresearch.com/uploads/pdf/2019%20Black%20Book%20CFO%20&%20Financial%20Leadership%20Survey%20Report.pdf