Harmful Omissions: Tax Reform Impact on Business Value and Financial Statements

Here at A&M we see two important issues notably missing in the public discussion over the release of the Tax Cuts and Jobs Act. One issue pertains to investors and the other to tax leaders.

For Investors and Stakeholders: How Will Valuations Change?

There are at least two ways tax reform could significantly impact business valuations. Besides affecting future after-tax cash flows, tax reform means companies will also be immediately adjusting their financial statements.

Many companies have significant balance sheet items relating to tax, aka deferred tax accounts. For example, a net operating loss carryforward would be a typical large balance sheet asset. Companies value these deferred tax items using the income tax rate expected in the year of utilization. Hence, changes in enacted tax rates will consequently cause account values to change. If corporate rates decline, so will deferred tax asset and liability balances.

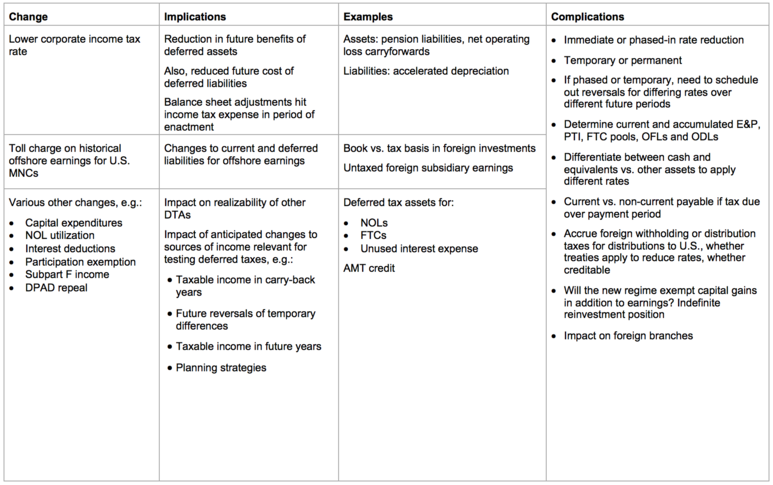

Besides shifts in tax rates, other changes in tax rules, such as taxation of foreign earnings, could also cause similar financial statement effects. (See the chart below for an example list of financial statement impact issues.)

Beyond affecting the size of an enterprise’s balance sheet and shareholder capital, these types of balance sheet adjustments will also affect many other important metrics, including...

- Leverage ratios,

- Bank covenant requirements,

- Regulated/statutory capital determinations,

…and perhaps most importantly:

- Equity/stock valuations.

Of course, tax reform would impact every organization differently depending on each company’s profile. This is especially true for the Tax Cuts and Jobs Act, which has business policy objectives behind it and hence affects different industries, operating models and ownership structures very differently.

While companies that disclose non-GAAP numbers might choose to omit the impact of reform from their press releases, stakeholders still need to know the implications in order to plan for potential valuation fluctuations based on GAAP earnings-per-share models.

For Tax Leaders: Will Financial Statements Be Ready?

Corporate tax teams have many responsibilities, but usually the most important task is calculating financial statement tax expense, both correctly and on time. Failure to accomplish either of those is typically a career-limiting move. When it comes to the Tax Cuts and Jobs Act, though, we are worried for our tax leader clients, as there may be insufficient time.

Any impact of changes in tax rules on financial statements needs to be reflected in the period that the new laws are enacted. This rule applies for both year-end reporting and interim reporting. In the case of a U.S. federal tax bill like the Tax Rate Cut and Jobs Act, enactment would be the date that the President signs the bill.

The Republican Party leaders overseeing the initiative are optimistically forecasting presidential signature for late December or early January. In the case Congress passes a bill and the President signs, companies will need immediate determinations of complex accounting implications. Any transition rules, phasing in or out rules, or temporary status rules will complicate the accounting even further. (See the chart below for examples of the complexities.) Given that most financial statement deadlines fall within weeks of books closing, in-house tax departments will have insufficient time to properly calculate tax expense.

Although passage of a bill is still far from certain, there would be no time to recover from guessing wrong in the case a bill is passed. This is likely true even if Congress passes a diluted or compromised version of the current House bill.

Note that even a late-enactment of tax reform (e.g., in 2018) could be problematic. If the President signs the bill after the first of the year but before financial statements are filed, companies will still (likely) have to disclose impacts in the current period, including estimated changes to deferred tax accounts for changes in laws or rates (and, for interim reporting, the impact on effective tax rates). In addition, companies must make valuation allowance decisions based on all available information as of the financial statement issuance date, which can occur well after the year-end.

Example Financial Statement Issues to Urgently Address

Here’s a non-exhaustive list of financial statement issues to consider. These are just a few that come to mind as examples; we of course recommend a full analysis.

Don’t forget:

- There are multiple state tax complexities and uncertainties, e.g., whether the states will follow federal changes.

- The tax law change could have an impact on previously recorded uncertain tax positions.

Alvarez & Marsal Taxand Says:

In A&M’s view, companies ought to be modeling the impact of potential reform immediately — first to determine the impact on valuations and second to avoid financial statement delays early in 2018. You need a trusted source of information and analysis to monitor and digest the constantly evolving tax reform environment in the coming months.

Disclaimer

The information contained herein is of a general nature and based on authorities that are subject to change. Readers are reminded that they should not consider this publication to be a recommendation to undertake any tax position, nor consider the information contained herein to be complete. Before any item or treatment is reported or excluded from reporting on tax returns, financial statements or any other document, for any reason, readers should thoroughly evaluate their specific facts and circumstances, and obtain the advice and assistance of qualified tax advisers. The information reported in this publication may not continue to apply to a reader's situation as a result of changing laws and associated authoritative literature, and readers are reminded to consult with their tax or other professional advisers before determining if any information contained herein remains applicable to their facts and circumstances.

About Alvarez & Marsal Taxand

Alvarez & Marsal Taxand, an affiliate of Alvarez & Marsal (A&M), a leading global professional services firm, is an independent tax group made up of experienced tax professionals dedicated to providing customized tax advice to clients and investors across a broad range of industries. Its professionals extend A&M's commitment to offering clients a choice in advisers who are free from audit-based conflicts of interest and bring an unyielding commitment to delivering responsive client service. A&M Taxand has offices in major metropolitan markets throughout the United States and serves the United Kingdom from its base in London.

Alvarez & Marsal Taxand is a founder of Taxand, the world's largest independent tax organization, which provides high quality, integrated tax advice worldwide. Taxand professionals, including almost 400 partners and more than 2,000 advisers in 50 countries, grasp both the fine points of tax and the broader strategic implications, helping you mitigate risk, manage your tax burden and drive the performance of your business.

To learn more, visit www.alvarezandmarsal.com or www.taxand.com