Bankruptcy Compensation Survey - Post-BAPCPA

2013-Issue 13—Although the U.S. economy has been slowly but steadily improving over the last few years, many companies are still seeking bankruptcy protection during these difficult times. It is critical that organizations retain key executive talent in a distressed atmosphere. Retention of key executive talent is most important during corporate reorganizations, bankruptcies and liquidations.

To help companies design compensation programs while in bankruptcy, Alvarez & Marsal Taxand conducted a survey of companies that were recently in bankruptcy. This edition of Tax Advisor Weekly outlines the survey methodology, addresses the bankruptcy rules and presents our findings.

Bankruptcy Survey Overview

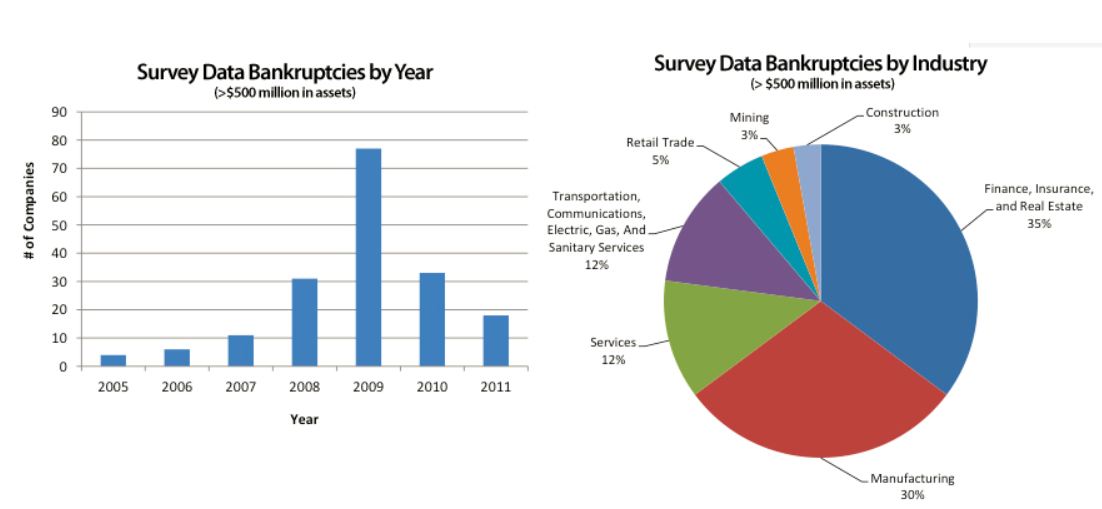

We reviewed the court documents of 180 of the largest bankruptcies filed between 2005 and 2011 to gather data on bankruptcy compensation plans (i.e., retention, incentive and severance plans). We limited our study to companies that had assets valued at $500 million or more at the time of bankruptcy. Below we provide general demographics of the bankruptcies reviewed.

In 2008, we witnessed the two largest bankruptcies in history (Lehman Brothers and Washington Mutual). In the following months and years, many other companies also suffered significant financial hardships due to the lingering recession. The charts show the breakout of bankruptcies reviewed by year and by industry:

Approximately 88 percent of the bankruptcies reviewed filed for Chapter 11 (reorganization) bankruptcy protection, 11 percent filed for Chapter 7 (liquidation) bankruptcy protection, and 1 percent converted from a Chapter 11 to a Chapter 7 bankruptcy filing.

Upon entering bankruptcy, 77 percent of the companies reviewed were publicly held, and the remaining 23 percent were private. Of the 89 companies that emerged from bankruptcy, approximately one-half emerged as publicly held companies.

Prepackaged or pre-negotiated bankruptcies were used by 16 percent of the companies reviewed. This expedited approach to bankruptcy proceedings can be used when a company and its creditors agree on all key terms of plan reorganization prior to filing for bankruptcy.

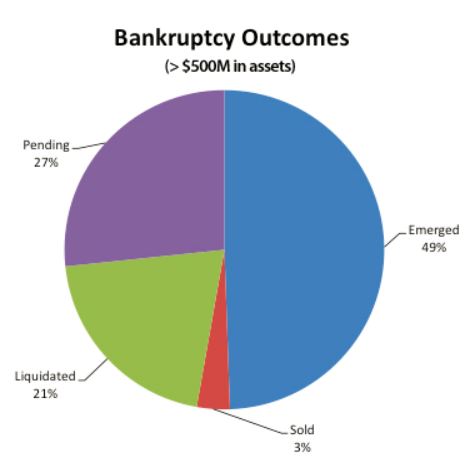

The chart below shows the outcomes of the bankruptcies reviewed:

Of the companies that have completed bankruptcy proceedings, the average time in bankruptcy was 385 days. The shortest amount of time in bankruptcy was one month, and the longest was three-and-a-half years. However, there are companies that have not yet emerged from bankruptcy and are in their fifth year.

Overview of Bankruptcy Law

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) brought sweeping changes to American bankruptcy law, affecting both consumer and business bankruptcies. Prior to BAPCPA, companies under bankruptcy protection would often use key employee retention plans, often referred to as KERPs, to retain top management.

Under the revised law, KERPs are subject to special restrictions set forth in Section 503(c)(1). That is, if the arrangement is not intended to provide incentive compensation (based on performance) and is only based on the employee remaining employed with the company, it is subject to 503(c)(1). This new section of the Bankruptcy Code significantly restricts the operation of KERPs. In particular, a bankruptcy court may not approve payments to an “insider” (as defined below) to induce the insider to remain with the company unless the court determines that the following three criteria have been met:

- The payment must be essential to the retention of the employee because he or she has a bona fide job offer from another business at the same or greater rate of compensation;

- The services provided by the employee must be essential to the survival of the business; and

- The amount of the payment may not be greater than 10 times the average payment of a similar kind given to nonmanagement employees during the same calendar year. If no similar payments are made to nonmanagement employees in the same calendar year, the amount of the payment may not be greater than 25 percent of the amount of any similar payment made to the insider during the previous calendar year.

BAPCPA treats severance payments in a similar way. Section 503(c)(2) of the Bankruptcy Code prohibits severance payments to insiders unless two requirements have been met:

- The severance payment must be part of a program that is generally available to all full-time employees; and

- The amount of the severance payment may not be greater than 10 times the average severance payment given to nonmanagement employees during the same calendar year.

Finally, Section 503(c)(3) serves as a catch-all provision that prohibits any other payments outside the ordinary course of business that are not justified by the facts and circumstances of the case.

It is important to note that BAPCPA’s restrictions on KERPs and severance payments apply only to insiders. Section 101(31)(B) of the Bankruptcy Code defines an insider as a director, officer or person in control of the corporation, or a relative of such person.

Bankruptcy Compensation Plans

In the face of a downturn, executives have very little incentive to stick around. Annual bonus plans may no longer offer the payouts they did in years past, and long-term incentive vehicles, generally granted in the form of equity (e.g., stock options, restricted stock), usually become meaningless as share prices tumble. Therefore, it is imperative that organizations find alternative methods to motivate and retain key executive talent.

Key Employee Retention Plans (KERPs)

At the backbone of KERPs are “stay” bonuses, designed to incent employees to stay with the company through a future date. The payment of stay bonuses is typically staggered throughout the expected duration of the corporate transition period, with the final (and usually the largest) payment linked to the completion of the process (e.g., emergence from bankruptcy, liquidation of assets). Stay bonuses are most often expressed as a percentage of the employee’s base salary. In most cases, remuneration under KERPs is in the form of cash offered to executives, key corporate function leaders and, in some cases, the broader employee population.

Prior to BAPCPA, KERPs were a great tool to help organizations motivate, reward and retain critical talent when the organizations were experiencing financial distress. BAPCPA has created a dilemma as to how companies can retain executive talent while operating under the constraints of Section 503(c), that is, restrictions on the amounts of retention payments to insiders.

Key Employee Incentive Plans (KEIPs)

Because of the changes that BAPCPA brought about and the extent to which those changes crippled KERPs, companies under bankruptcy protection have generally moved away from KERPs in favor of performance-based incentive plans known as key executive incentive plans (KEIPs). By taking this approach, companies are able to avoid the restrictive treatment of Section 503(c)(1). Instead, in determining whether or not the debtor company may adopt a KEIP, bankruptcy courts may apply more liberal business judgment standards (under which the plan may be approved based on business judgment and an analysis of the facts and circumstances of the case).

So the issue becomes: what constitutes a performance-based incentive plan? In 2012, Chapter 11 debtors Hawker Beechcraft, Inc. (Hawker) and Residential Capital, LLC (ResCap) filed motions seeking approval of KEIPs that were both denied on the basis that the KEIPs were essentially hidden retention programs.

In In re Hawker Beechcraft, Inc., 2012 WL 3637251 (Bankr. S.D.N.Y. Aug. 24, 2012), the proposed KEIP offered to pay bonuses of up to 200 percent of annual base salary (up to $5.3 million) to eight insider senior management employees upon the occurrence of a standalone restructuring or a third-party sale transaction. The judge concluded that while “the KEIP includes elements of incentive compensation, when viewed as a whole, it sets the minimum bonus bar too low to qualify as anything other than a retention program for insiders.” It was determined that the minimum financial targets set in the KEIP were based on the current business plan and did not constitute stretch goals. This finding was supported by testimony that noted Hawker should hit its business plan projections unless there is a “whoopsie.” Additionally, the court concluded that the time-based goals were not challenging, as the debtors were on track to achieve several of the deadlines and the deadlines could be extended with proper consent.

In In re Residential Capital, LLC, 2012 WL 3670700, Case No. 12-12020 (MG), Dkt. No. 1286 (Bankr. S.D.N.Y. Aug. 28, 2012), the proposed KEIP would pay up to $7 million in bonuses to 17 insider employees that made up the senior leadership team. The court denied approval of the KEIP because it saw the program as rewarding work that took place prior to the bankruptcy and was structured to reward employees to not leave the company instead of incentivizing them to meet performance goals. The judge noted that 63 percent of the KEIP bonuses were linked solely to closing the sale transactions that had been substantially negotiated pre-petition.

Bankruptcy Compensation Plans Survey Results

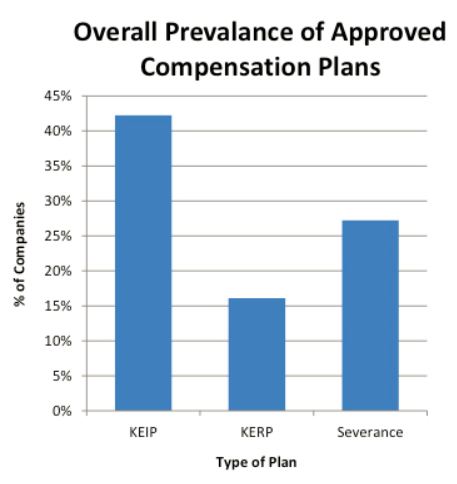

During our bankruptcy review, we focused on the compensation plans used to retain and incentivize executives. The chart below shows the prevalence of approved compensation plans for the bankruptcies reviewed:

The chart below shows the breakout of the bankruptcy compensation plans used by companies that emerged from bankruptcy as opposed to those that liquidated:

We also observed the breakout of compensation plans by industry:

- KEIPs: The industry with the most KEIPs was the retail industry, where 100 percent of the companies surveyed had KEIPs. The retail industry was followed by the manufacturing industry and the services industry, each with 55 percent.

- KERPs: The industry with the most KERPs was the retail industry at 44 percent, followed by the manufacturing industry at 21 percent.

- Severance: The industry with the most severance plans was again the retail industry at 89 percent, followed by the manufacturing industry at 38 percent.

- Across the board, the industry with the smallest percentage of approved compensation plans was the finance, insurance and real estate industry. This was primarily due to the entire sector being depressed and an over-abundant supply of qualified talent.

As indicated in the results above, a KEIP was the most common compensation plan implemented during bankruptcy. For companies that emerged from bankruptcy, the most common performance metrics for KEIPs were:

- Financial metrics (EBITDA, cash flow, operating income, liquidity);

- Sale of assets;

- Confirmation of plan of reorganization/emergence from bankruptcy (usually by a specified time);

- Creditor recovery; and

- Product sales.

For companies that liquidated, the most common performance metrics included in KEIPs were:

- Asset sales;

- Cost reduction/expense control; and

- Financial metrics.

The U.S. Trustee program, a component of the Department of Justice responsible for overseeing the administration of bankruptcy cases, has increased its scrutiny of bankruptcy plans and has objected to various components of the compensation plans. The most common U.S. Trustee objections we observed were:

- Questioning whether the company “insiders” had been appropriately identified (making sure an insider was not a participant in a KERP);

- For KEIPs, was the plan actually performance based as opposed to a hidden retention plan (not a “lay-up”); and

- Was the plan’s potential payout scaled appropriately (i.e., was the plan too rich).

Alvarez & Marsal Taxand Says:

With a still uncertain economy, more and more companies may possibly find themselves in the position of having to motivate and retain employees in a distressed atmosphere. Companies should be aware of what plans they have in place and the repercussions those plans may have should the company enter bankruptcy protection. Companies should also carefully examine from all angles any retention plans instituted at or near the time the company files for bankruptcy.

Although legislation in recent years has created a structure by which bankruptcy courts can evaluate retention plans, the courts still have the authority to exercise discretion, especially for incentive plans designed to escape treatment under Section 503(c)(1).

Therefore, in designing incentive and retention plans, companies should make every effort to create plans that are “fair and reasonable.” Not only is it best practice, but doing so demonstrates the company’s commitment to management and its accountability to shareholders. A few questions to consider when designing these plans are:

- Is there a reasonable relationship between the proposed plan and the results to be obtained?

- Is the cost of the plan reasonable?

- Is the scope of the plan fair and reasonable? Does it apply to all employees?

- Is the plan or proposal consistent with industry standards?

- What were the due diligence efforts of the company in investigating the need for a plan?

- Did the company receive expert advice in performing due diligence and in creating and authorizing the incentive compensation?

Author

Brian Cumberland

Managing Director, Dallas

+1 214 438 1013

Sarah Crawford, Director, and Robert Casburn, Senior Associate, contributed to this article.

For More Information

J.D. Ivy

Managing Director, Dallas

+1 214 438 1028

Allison Hoeinghaus

Senior Director, Dallas

+1 214 438 1037

Senior Director, New York

+1 212 763 1878

Mark Spittell

Senior Director, Dallas

+1 214 438 1017

Related Issues

11/14/2012

New Taxes for a New Year? What to Do Now for 2013

10/23/2012

Warning: Employee Loans Could Have Adverse Tax Consequences

09/12/2012

Smartphone Confusion: Deciphering the Tax Rules Applicable to Mobile Device Policies

Disclaimer

As provided in Treasury Department Circular 230, this publication is not intended or written by Alvarez & Marsal Taxand, LLC, (or any Taxand member firm) to be used, and cannot be used, by a client or any other person or entity for the purpose of avoiding tax penalties that may be imposed on any taxpayer.

The information contained herein is of a general nature and based on authorities that are subject to change. Readers are reminded that they should not consider this publication to be a recommendation to undertake any tax position, nor consider the information contained herein to be complete. Before any item or treatment is reported or excluded from reporting on tax returns, financial statements or any other document, for any reason, readers should thoroughly evaluate their specific facts and circumstances, and obtain the advice and assistance of qualified tax advisors. The information reported in this publication may not continue to apply to a reader's situation as a result of changing laws and associated authoritative literature, and readers are reminded to consult with their tax or other professional advisors before determining if any information contained herein remains applicable to their facts and circumstances.

About Alvarez & Marsal Taxand

Alvarez & Marsal Taxand, an affiliate of Alvarez & Marsal (A&M), a leading global professional services firm, is an independent tax group made up of experienced tax professionals dedicated to providing customized tax advice to clients and investors across a broad range of industries. Its professionals extend A&M's commitment to offering clients a choice in advisors who are free from audit-based conflicts of interest, and bring an unyielding commitment to delivering responsive client service. A&M Taxand has offices in major metropolitan markets throughout the U.S., and serves the U.K. from its base in London.

Alvarez & Marsal Taxand is a founder of Taxand, the world's largest independent tax organization, which provides high quality, integrated tax advice worldwide. Taxand professionals, including almost 400 partners and more than 2,000 advisors in 50 countries, grasp both the fine points of tax and the broader strategic implications, helping you mitigate risk, manage your tax burden and drive the performance of your business.

To learn more, visit www.alvarezandmarsal.com or www.taxand.com