A&M Taxand Shares Updates to the U.K. Job Support Scheme

On Thursday 22 October, further information has been released to the initial Job Support Scheme (JSS) fact sheet published.

A&M Taxand advises that further guidance is expected to be released, which has not been published at this time. We will continue to monitor updates and send information as it becomes available.

What JSS features are the same:

- CJRS is still coming to an end on 31 October 2020, claims must be made by 30 November 2020;

- The Job Support Scheme is coming in from 1 November 2020, and intended to last for 6 months;

- The original requirements as outlined in the first JSS factsheet are still in place (including the periods of employment up to 23 September);

- The large employer test is still to be met, and a financial impact test to be undertaken;

- The employer has to fund the time worked at normal pay, plus employer NIC and pension contributions on the total of gross wages paid;

- Flexible furloughing is still permitted, with a minimum furlough or short time period of 7 days;

- Employees cannot be on notice of termination or made redundant whilst on the scheme.

What JSS Open features have changed:

- Instead of requiring 33% minimum work requirement, this has reduced to 20% of “normal working hours”;

- The employer funding for time not worked, up to 80%, is limited to 5% of that cost capped at £125, instead of being 2/3rds of the 1/3rd unworked time (ie 22% where the employee worked 33%);

- Employers do have the ability to top up the pay differential between “normal pay” and the above funding, which is a positive move from JSS, if companies can afford a top up;

- Government support will cover up to 61.67% of the non-worked time, at an increased earnings cap of £1,541.75, from £692.72 (still capped overall at £37,500 earnings equivalent);

- Overall the gross pay to employees will be a minimum of 73% instead of 76% as originally announced, so if employers do not top up the earnings gap may be greater (making it a tougher decision for employees to agree to reduced working, but having to do less work).

There remains a number of areas where further clarity is required, including JSS Closed scheme guidance, how annual leave entitlement accrues during short working, the large employer test, evidence of working hours for salaried employees etc.

Examples

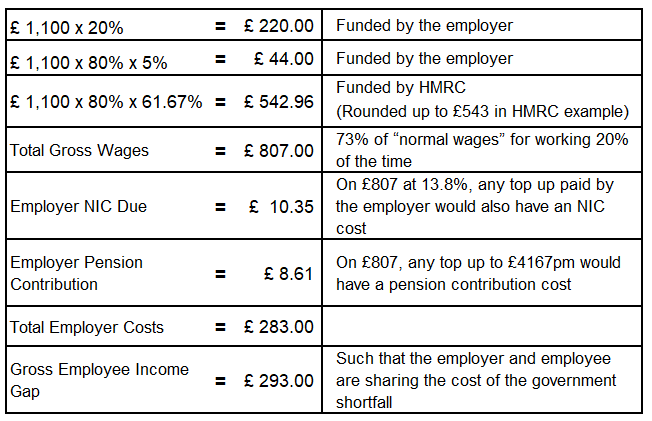

In an HMRC example, for an employee currently earning £1,100 gross per month, and who contractually agrees to work 20% of their time, their pay would be:

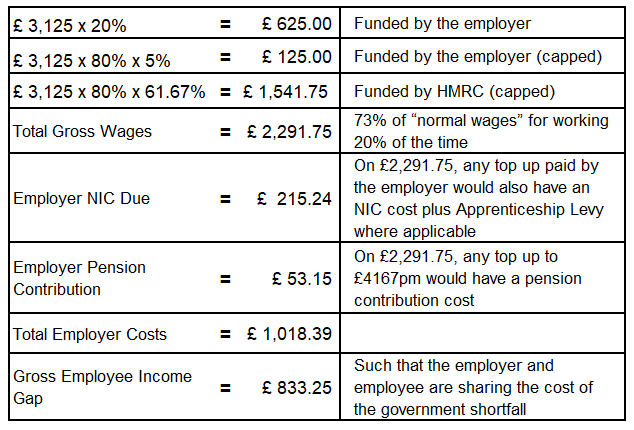

An example for someone at the earnings cap, their pay would be:

A&M Taxand will continue to monitor and share updates as they become available.

How can A&M Taxand help?

At A&M Taxand we can assist with the complex calculations of CJRS, JSS, future modelling of wage costs and the impact of the CJRS changes, provide wider support to businesses on managing cashflow and restructuring services, along with advice and support should you need to reduce headcount.

Please contact your A&M point of contact, or Louise Jenkins or Tracey Norton from our Reward & Employment Tax Solutions team, should you require any assistance with the points raised above.