December 11, 2025

A&M Benefits Reference Guide

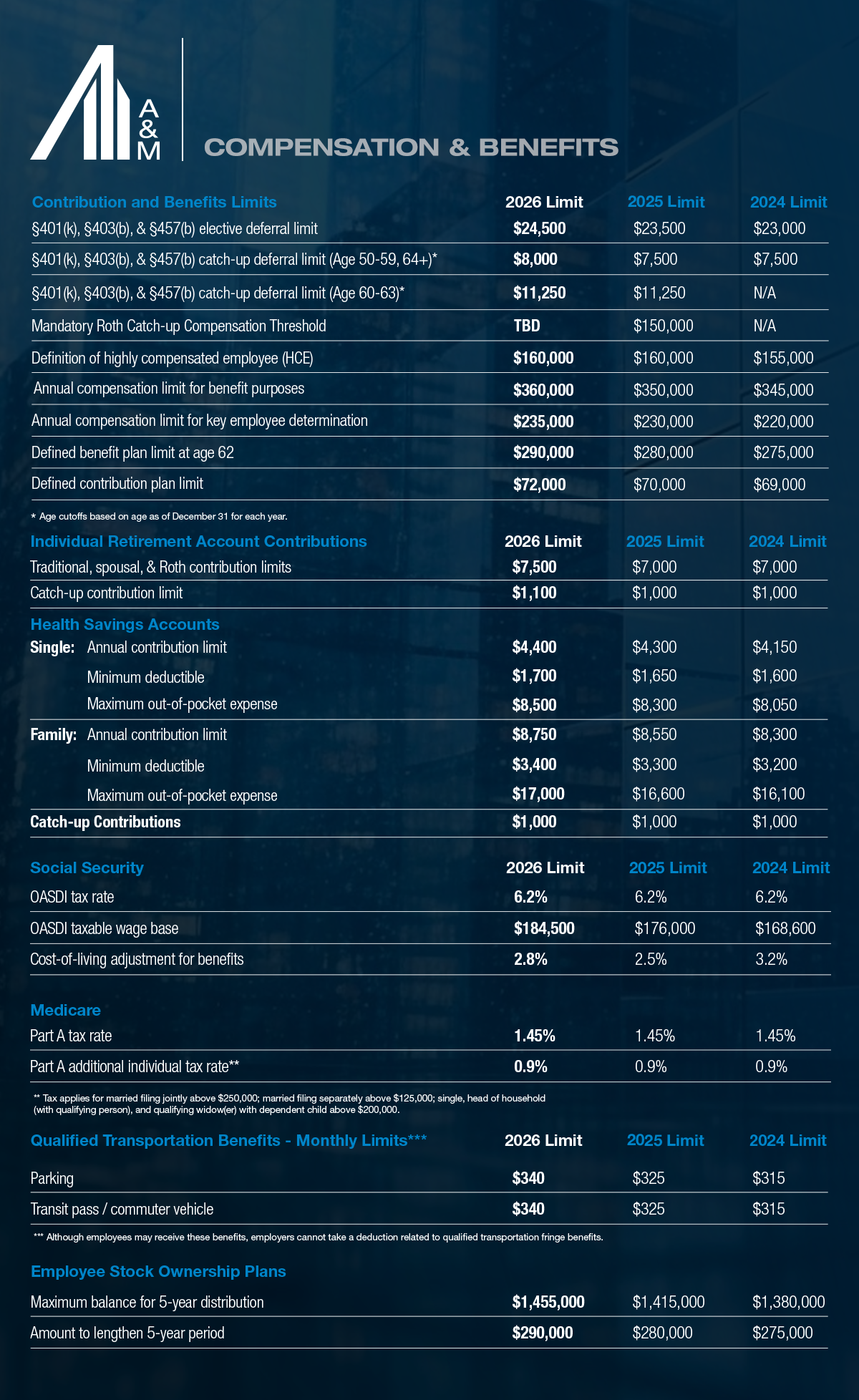

IRS Maximum Benefits and Contributions Limits

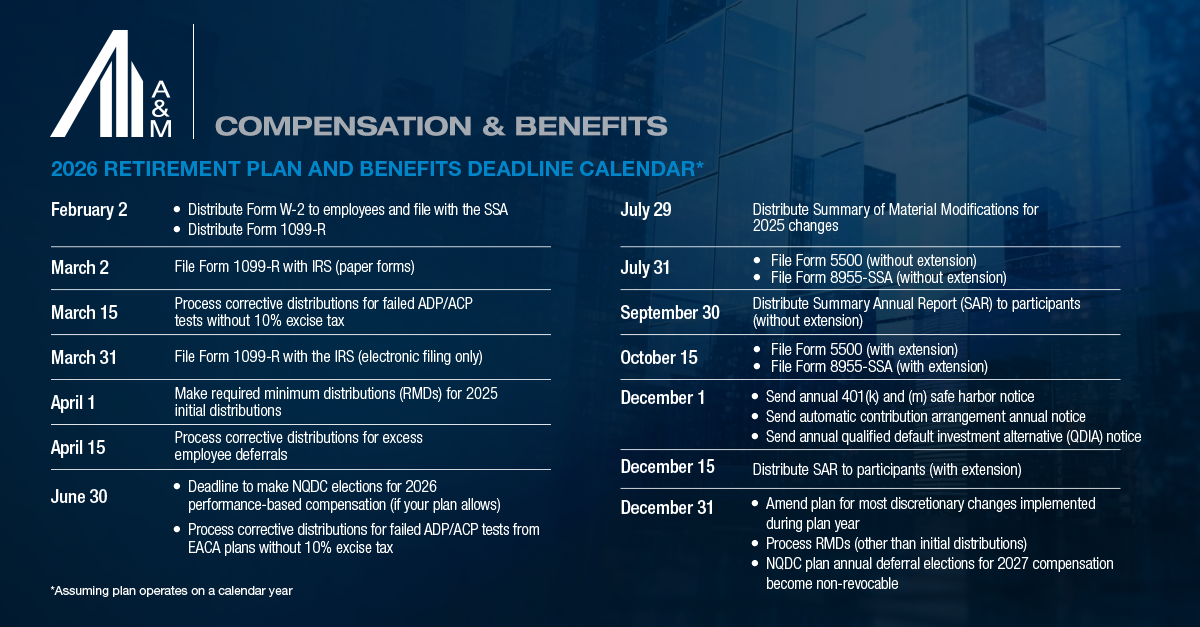

Many of the limits that pertain to qualified retirement plans and benefit plans are set by the Internal Revenue Service (IRS) and are subject to cost-of-living adjustments. In 2026, employees will be able to increase their retirement savings and contributions to health savings accounts as a result of the increased limits. The IRS limits for 2026 are summarized in the table below along with certain important compliance deadlines.

The 2026 limits have been included below and were published by the IRS in Notice 2025-67 on November 13, 2025.

View the 2026 Benefits Reference Guide

In Case You Missed It:

- Initial Public Offering Compensation Report Analysis of Compensation Arrangements Among Companies with Recent IPOs

- Energy Compensation Report Analysis of Compensation Arrangements Among the Largest U.S. Exploration & Production (E&P) and Oilfield Services (OFS) Companies, Including Trends in Clean Energy Compensation