Alvarez & Marsal Releases UAE Banking Pulse Report for Q4 2018

Dubai – Leading global professional services firm Alvarez & Marsal (A&M) today released its latest UAE Banking Pulse for Q4 2018. Overall the data highlights slower growth in deposits, loans and advances than in Q3 2018, resulting in a marginal decrease in the loan-to-deposit (LDR) quarter-on-quarter. The interest income continued an upward trend on a year-on-year basis, with a 0.6 percent increase this quarter.

Alvarez & Marsal’s UAE Banking Pulse compares the data of the 10 largest listed banks in the UAE, looking at the fourth quarter of 2018 (Q4 2018) against the previous quarter (Q3 2018).

The prevailing trends identified for Q4 2018 were as follows:

- Loans and advances for the top 10 banks grew at a significantly slower rate (0.73 percent) than deposits (1.98 percent), leading to a reduction in the loan-to-deposit ratio of 100 basis points (bps). However, eight of the top 10 banks remained in the LDR “green zone” of between 80 percent and 100 percent, and liquidity was maintained at reasonable levels

- Operating income growth increased slightly for Q4 2018, for the third consecutive quarter, despite mixed results of interest and non-interest income. Operating income margin declined slightly, as a result of lower net interest margin (NIM) and lower net interest income (NII)

- NIM compressed by six basis points (bps), continuing the downward trend, despite an increase in yield on credit, which increased by 32 bps for the fifth quarter. Cost of funds increased by ~22 bps in Q4 2018 when compared to the previous quarter. Nine of the top 10 banks reported a decline in NIM

- Seven of the top 10 banks’ cost-to-income (C/I) ratio increased from 33.13 percent to 34.09 percent, which is a seasonal trend as banks increased their operating expenditures in the last quarter of the year and saw almost stagnant operating income

- Overall cost of risk increased, bucking the downward trend of the previous three quarters, as banks assumed a more cautious approach, and made higher loan loss provisions

- Return on equity (RoE) and return on assets (RoA) both decreased due to an increase in operating expenditure, lower income margin but also higher cost of risk

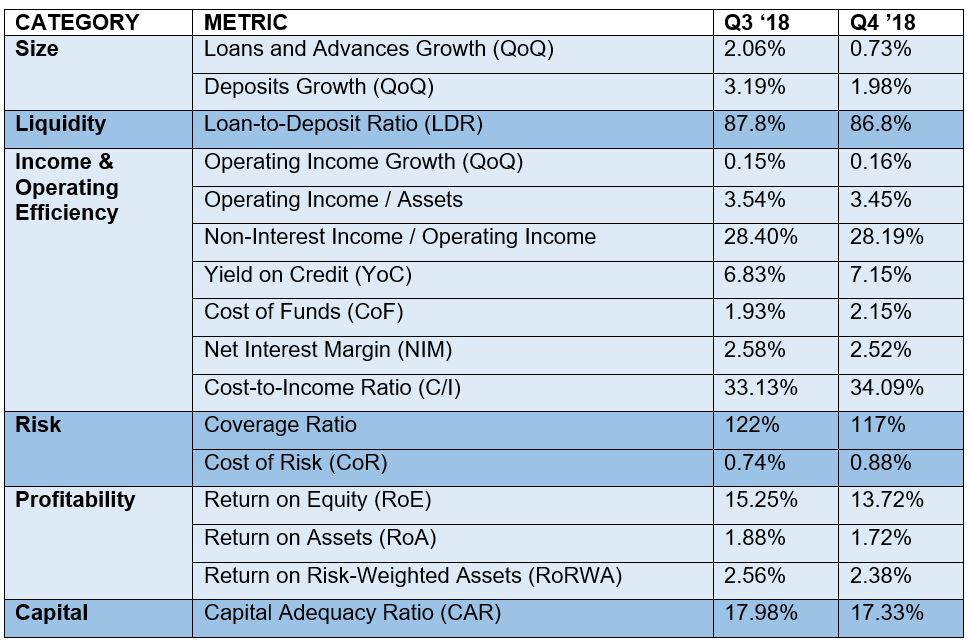

Alvarez & Marsal’s report uses independently-sourced published market data and 16 different metrics to assess the banks’ key performance areas, including size, liquidity, income, operating efficiency, risk, profitability and capital.

The country’s 10 largest listed banks analyzed in A&M’s UAE Banking Pulse are First Abu Dhabi Bank (FAB), Emirates NBD (ENBD), Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB), Mashreq Bank (Mashreq), Abu Dhabi Islamic Bank (ADIB), Union National Bank (UNB), Commercial Bank of Dubai (CBD), National Bank of Ras Al-Khaimah (RAK) and the National Bank of Fujairah (NBF).

OVERVIEW

The table below sets out the key metrics:

Source: Financial sta\tements, investor presentations, A&M analysis

A&M Managing Director and Middle East Office Co-Head in the firm’s Strategic Performance Improvement Practice, Dr. Saeeda Jaffar, was the lead author of the report. It was co-authored by A&M Head of Financial Services Asad Ahmed, along with Neil Hayward, Managing Director and Middle East Co-Head, who specializes in turnaround and restructuring.

Dr. Jaffar commented: “Comparing Q4 2018 to the previous quarter, the data shows that growth of deposits, loans and advances has slowed; however, we were pleased to see reasonable amounts of liquidity in the market and the majority of banks remaining in the green zone. Although there are still several good opportunities to capitalize on, banks this year will have to demonstrate a degree of discipline, as well as tighten their due diligence processes, as we still expect them to face headwinds.”

###

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) when conventional approaches are not enough to make change and achieve results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services.

With over 3,500 people across four continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, help organizations transform operations, catapult growth and accelerate results through decisive action. Comprised of experienced operators, world-class consultants, former regulators and industry authorities, A&M leverages its restructuring heritage to turn change into a strategic business asset, manage risk and unlock value at every stage of growth.

To learn more, visit: AlvarezandMarsal.com. Follow A&M on LinkedIn, Twitter and Facebook.

CONTACT:

Emily Hargreaves, Hanover Middle East, +971 5555 97391

Sandra Sokoloff, Senior Director of Global Public Relations, Alvarez & Marsal, +1 212 763 9853