Alvarez & Marsal Releases UAE Banking Pulse Report for Q3 2020

Dubai – Leading global professional services firm Alvarez & Marsal (A&M) has released its latest UAE Banking Pulse for Q3 2020. The report reveals that the top 10 UAE banks’ total interest income continued to decline for the third consecutive quarter reporting, 7.7% quarter over quarter (QoQ), as lower interest rate environment continued to pressure banks’ asset yield. After a relatively stronger second quarter, net income declined by 3% QoQ due to lower interest and other operating income, which continued to impact profitability.

Challenging macroeconomic conditions, low oil prices and effects of COVID-19 have severely impacted overall asset quality and resulted in higher non-performing loan (NPL) reporting, at 3.6% QoQ increase. Lenders also reported that loans and advances (L&A) remained broadly flat during Q3’20, which was the slowest growth in the last six quarters, while deposit growth improved to 4.2% QoQ. Furthermore, cost to income ratio increased after improving in the last two quarters to reach 34.3% in Q3’20 as decline in operating income outplayed cost optimization.

Alvarez & Marsal’s UAE Banking Pulse examines the data of the 10 largest listed banks in the UAE, comparing the third quarter of 2020 (Q3 2020) against the previous quarter (Q2 2020).

The prevailing trends identified for Q3 2020 are as follows:

- Loans & advances (L&A) remained flat, while deposits increased by 4%. The challenging economic environment impacted credit uptake as L&A remained flat in Q3’20 compared to Q2’20. On the other hand, deposits increased 4.2% QoQ, largely on the back of 16% increase in FAB’s deposits. Consequently, loans to deposit ratio (LDR) decreased to 84.1% compared to 87.7% in Q2’20. Top 10 banks have provided borrowers access to AED 51.1billion at the end of Q3’20 under the UAE Central Bank’s TESS program.

- Operating income continued to decline for the third consecutive quarter. Persistent decline in net interest income (-6.7% QoQ) weighed on the operating income, which decreased 3.4% QoQ. Low interest rate environment continued to pressure asset yields among the banks and impacted net interest income. On the other hand, there was an increase in net fee income (+18% QoQ), which limited the decline in total operating income.

- Contraction in net interest margin (NIM) continued in Q3’20. Aggregate NIM fell by about 21 bps to 2.05% in Q3’20, on account of additional decline in interbank rates. NIM fell for the third consecutive quarter, as nine of the banks reported lower NIM during the period.

- Cost-to-income (C/I) ratio increased as reduced operating income more than offset cost efficiency measures. Cost-to-income ratio increased by 0.9% points to reach 34.3%. C/I ratio increased despite a 0.7% QoQ decline in operating expenses. The increase was on account of a drop in operating income, which fully offset the decline in operating expenses. Seven of the top 10 banks reported an increase in C/I ratio. ENBD, ADIB and SIB reported a decline in their CI ratios. ADIB’s C/I ratio declined as the bank was able to reduce its customer acquisition expenses, optimize branch network and introduce technologies to streamline processes.

- Provisioning declined further, however, challenging economic environment impacted overall asset quality. Total loan loss provisions decreased 7.2% QoQ, but they increased by about 37% YoY. Challenging market environment on account of COVID-19 headwinds resulted in higher NPLs (+3.6% QoQ). Cost of risk fell 11 bps YoY to 1.3%, while coverage ratio increased 1.1% to 90.3%. In terms of individual banks, MSQ reported the highest increase in cost of risk (about 55 bps QoQ to 333.8 bps), with the bank’s provisions rising about 17% QoQ / about 2.3 times YoY for the first nine months. On the other hand, FAB reported the lowest cost of risk (about 50 bps), as the bank reached a partial resolution for a large (unidentified) corporate account. Coverage ratio was the highest for RAK (131%), followed by ENBD (127%) and MSQ (117%).

- Banks are likely to see higher NPLs in the coming period. While the Central Bank’s recent announcement that it will extend the TESS scheme until June 30 next year should provide a temporary relief to certain sectors of the economy, banks’ balance sheets remain exposed to considerable credit risks. Once the deferral period ends, there could be a sizeable increase in NPLs for the banks, should the economy fail to recover.

- Profitability deteriorated as lower income stream weighed on return ratios. Aggregate net income dropped 3.0% QoQ as lower operating income more than offset lower operating expenses and provisioning. Consequently, profitability metrics (RoE: 8.8% [0.6% lower QoQ] and RoA: 1.0% [0.1% lower QoQ]) decreased compared to Q2’20.

- Comparison of total assets and L&A of top 10 banks: At the end of Q2’20, total assets and L&A of top 10 UAE banks (including the assets and L&A of foreign subsidiaries) comprised of about 88% of the total assets in the domestic banking system.

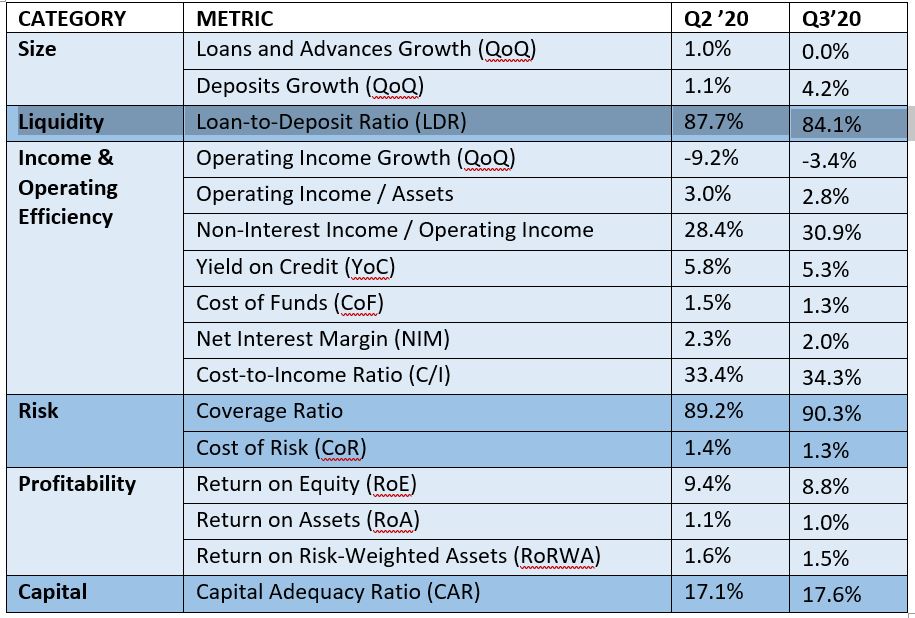

Alvarez & Marsal’s report uses independently sourced published market data and 16 different metrics to assess banks’ key performance areas, including size, liquidity, income, operating efficiency, risk, profitability and capital.

The country’s 10 largest listed banks analysed in A&M’s UAE Banking Pulse are First Abu Dhabi Bank (FAB), Emirates NBD (ENBD), Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB), Mashreq Bank (Mashreq), Abu Dhabi Islamic Bank (ADIB), Commercial Bank of Dubai (CBD), National Bank of Fujairah (NBF), National Bank of Ras Al-Khaimah (RAK) and Sharjah Islamic Bank (SIB).

OVERVIEW

The table below sets out the key metrics:

Dr. Saeeda Jaffar, A&M Managing Director and Head of Middle East, and Asad Ahmed, A&M Managing Director and Head of Middle East Financial Services, co-authored the report.

Mr. Ahmed commented: “After a rebound in performance in Q2’2020, profitability of the top 10 UAE banks in Q3’20 showed signs of vulnerability with declining interest income and increased provisioning weighing on the net profit. We expect the economic conditions in the UAE and the region generally to remain challenging in the near term, which would likely limit credit and earnings growth and also result in higher NPLs. When the TESS program expires in June 2021, there could be a sizeable increase in NPLs for the banks, should the economy fail to recover. However, we remain confident that this initiative will allow the economy to gradually recover from the effects of the pandemic.”

Mr. Ahmed further added: “It is likely that dirham interest rates would continue to track U.S. Dollar rates; these are not expected to show major increase in the near future, and hence NIMs will continue to be compressed. We note that ROA and ROE within the banking sector continue their downward trend; this may provide an opportunity for banks to look into further consolidation, and focus on integrating new technologies to rationalize costs.”

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) for leadership, action and results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services. When conventional approaches are not enough to create transformation and drive change, clients seek our deep expertise and ability to deliver practical solutions to their unique problems.

With over 5,000 people across four continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, leverage A&M’s restructuring heritage to help companies act decisively, catapult growth and accelerate results. We are experienced operators, world-class consultants, former regulators and industry authorities with a shared commitment to telling clients what’s really needed for turning change into a strategic business asset, managing risk and unlocking value at every stage of growth.

To learn more, visit: AlvarezandMarsal.com. Follow A&M on LinkedIn, Twitter, and Facebook.

###

CONTACT:

Faduma Muse, Hanover Middle East, +971 55 636 0426

Sandra Sokoloff, Senior Director of Global Public Relations, Alvarez & Marsal, +1 212 763 9853