280G Golden Parachute Payments: A Primer

One of the key concerns from a compensation & benefits perspective upon a change in control (CIC) is the tax impact of the Golden Parachute rules under Internal Revenue Code (IRC) Sections 280G and 4999.

It is common for a CIC to trigger payments to certain key employees under various compensation arrange-ments, which could subject both the employees and corporation to significant adverse tax consequences under the Golden Parachute rules.

What is a Golden Parachute payment?

Golden Parachute arrangements have become an effective way to attract qualified candidates and to reward top performers for their success. These arrangements are commonly put in place to ensure that executives evaluate every opportunity (including a merger or acquisition) with an eye toward maximizing shareholder value, without considering how such an event will affect their personal circumstances.

Golden Parachute payments can include severance payments, transaction bonuses, accelerated vesting and payment of equity awards (such as stock options or restricted stock), fringe benefits, and excise tax gross-up payments.

When do the Golden Parachute rules apply?

The 280G Golden Parachute rules will generally apply in the event that a corporation undergoes a CIC. Section 280G provides that a CIC is deemed to occur in the following scenarios:

- Change in the Corporation’s Ownership: Any one person (or more than one person acting as a group) acquires more than 50 percent of the total fair market value of the stock or total voting power of the stock of such corporation.

- Change in the Effective Control of the Corporation: On the earlier of either of the following situations:

- Any one person (or more than one person acting as a group) acquires ownership of stock of the corporation possessing 20 percent or more of the total voting power of the stock of such corporation over a 12-month period; or

- A majority of members of the corporation’s board of directors is replaced during any 12-month period by directors whose appointment or election is not endorsed by a majority of the members of the corporation’s board of directors prior to the date of the appointment or election.

- Change in the Ownership of a Substantial Portion of the Corporation’s Assets: Any one person (or more than one person acting as a group) acquires assets from the corporation that have a total gross fair market value equal to or more than one-third of the total gross fair market value of all of the assets of the corporation over a 12-month period.

Note: Private corporations are still subject to the 280G rules, but can “cleanse” Golden Parachute payments with a shareholder vote.

Who is subject to the Golden Parachute rules?

The Golden Parachute rules apply to the corporation’s Disqualified Individuals (DIs). A DI is anyone who (a) is an employee or independent contractor who performs personal services for a corporation and (b) is an officer, 1% shareholder or highly compensated individual.

- Officers: Any individual who is an officer of a corporation or any individual who has the duties of an officer, regardless of position, up to a maximum of 50 employees (or, if less, the greater of 3 employees or 10 percent of all employees).

- 1% Shareholders: Any individual who owns at least 1% of the corporation’s stock.

- Highly Compensated Individuals (HCIs): Anyone making over $130,000 per year (indexed to inflation) who is ranked in the top 1% of employees based on gross earnings, up to a maximum of 250 employees.

Are all parachute payments subject to the Golden Parachute excise tax?

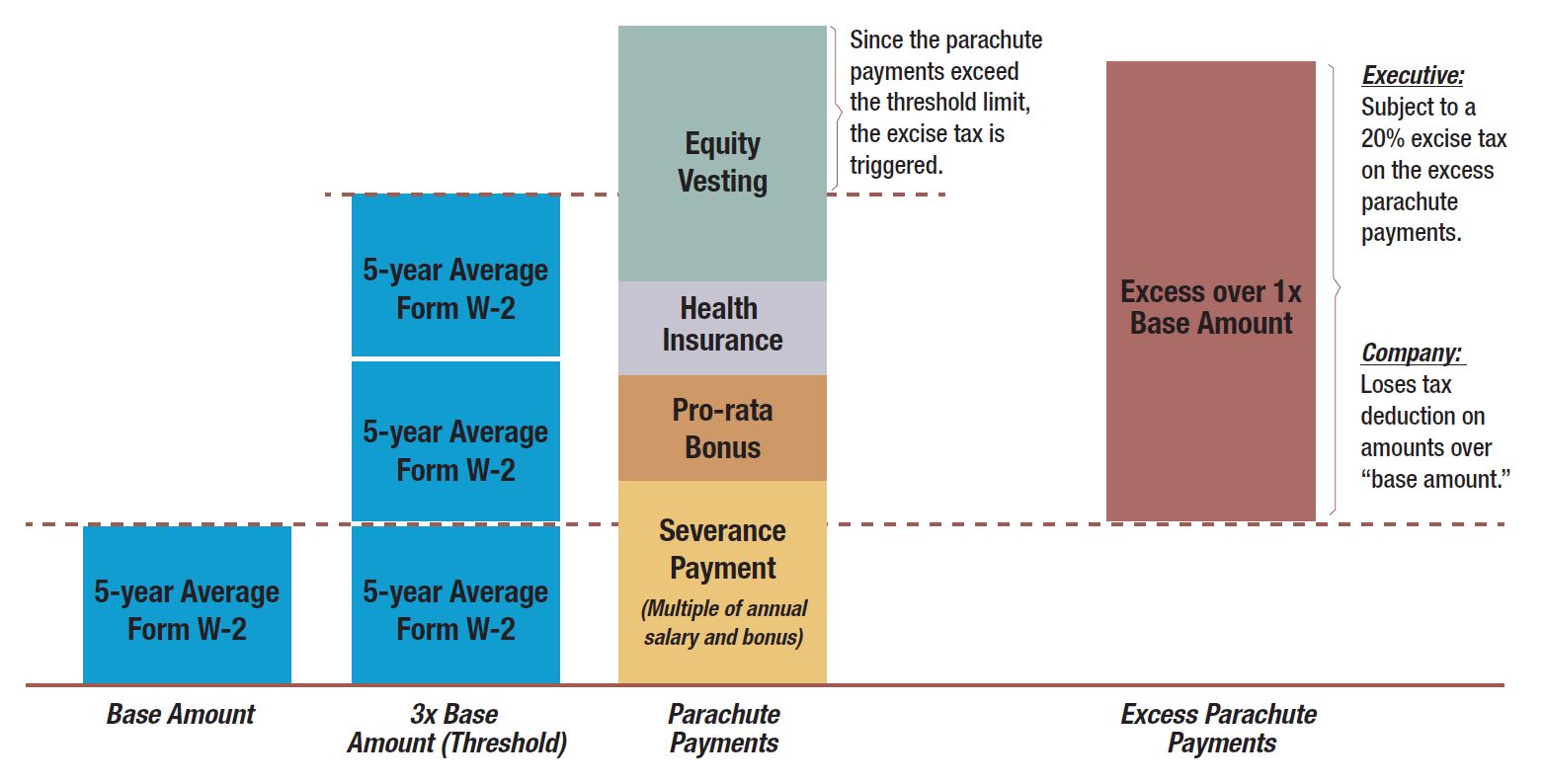

Parachute payments will be impacted by the Golden Parachute rules if they exceed a “safe harbor” limit, which is equal to 300% of the DI’s Base Amount.

- Base Amount is calculated as the average taxable compensation from the corporation over the 5 most recent calendar years ending before the CIC date.

When a DI receives payments exceeding the “safe harbor” limit, the Golden Parachute rules impose a 20% excise tax on the DI and disallow the related compensation deduction to the corporation.

- The excise tax and loss of deduction is imposed on any “excess parachute payments.” The excess parachute payments are determined based on the value of the DI’s parachute payments, less 100% of the DI’s Base Amount.

The graphic below shows how excess parachute payments are determined:

Can the impacts of the Golden Parachute rules be mitigated?

Yes, it is extremely important to consider excise tax mitigation alternatives. Some mitigation alternatives include increasing a DI’s Base Amount, performing a reasonable compensation analysis, or holding a shareholder vote to approve the payments (this is an option for private corporations only).

Although some excise tax mitigation alternatives can be implemented near the time of a CIC, it is prudent to ensure that CIC arrangements are set up for success. Many pitfalls can be avoided through compensation plan design that considers tax implications, regulatory hurdles, and shareholder concerns.

Moving Forward

When designing compensation programs, the potential impact of the Golden Parachute rules should be considered. As soon as it is determined that a CIC may be on the horizon, the company should take steps to understand the impact of the Golden Parachute rules to both the company and the potential DIs.

For additional information on the Golden Parachute rules, including excise tax mitigation alternatives, please reach out to A&M’s Compensation and Benefits Group:

Brian Cumberland

Managing Director

+1 214-438-1013

J.D. Ivy

Managing Director

+1 214-438-1028