STAMP DUTY

Did you know that all states and territories in Australia impose stamp duty on various transactions, each with its unique rates? Navigating through the complexities of stamp duty regulations can be daunting, especially regarding real estate conveyances and share transfers involving unlisted entities. A&M Tax Australia has a team of experts to assist.

OUR SERVICES

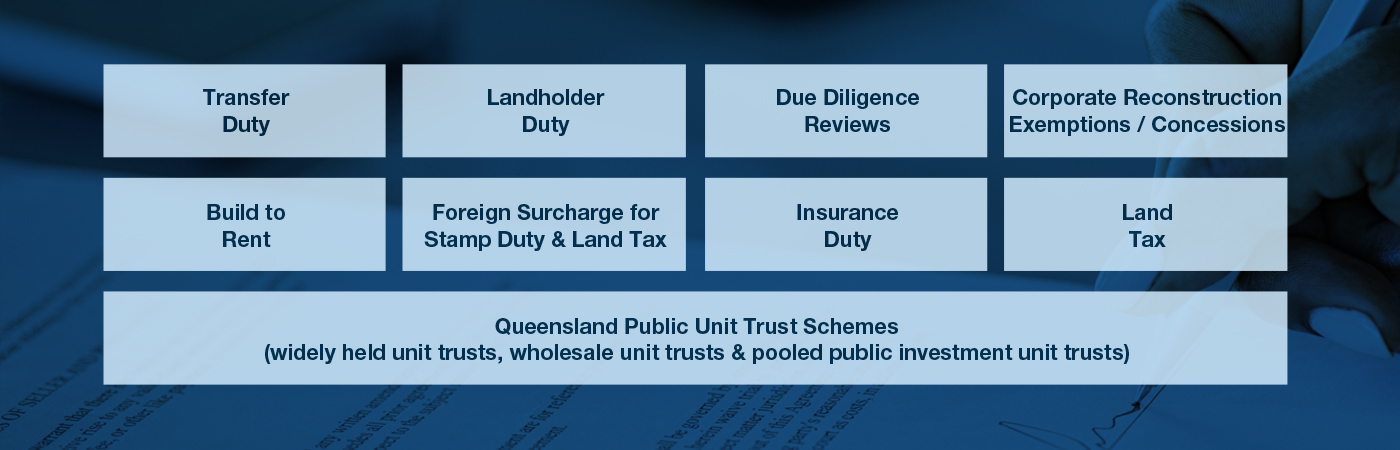

A&M can provide comprehensive Stamp Duty support across several areas including:

WHY OUR CLIENTS CHOOSE US

Expertise: The A&M Stamp Duty team has experience across all eight Australia States & Territories and understands the various nuances that exist between these jurisdictions. We are able to identify current and future Stamp Duty and Land Tax issues to help you manage any concerns that may arise. It is important that as Stamp Duty is triggered by transactions and instruments that advice is sought before executing any documents.

Holistic: The Stamp Duty team works with the rest of the A&M team to provide holistic solutions for clients.