Global Transaction Tax Advisory Services

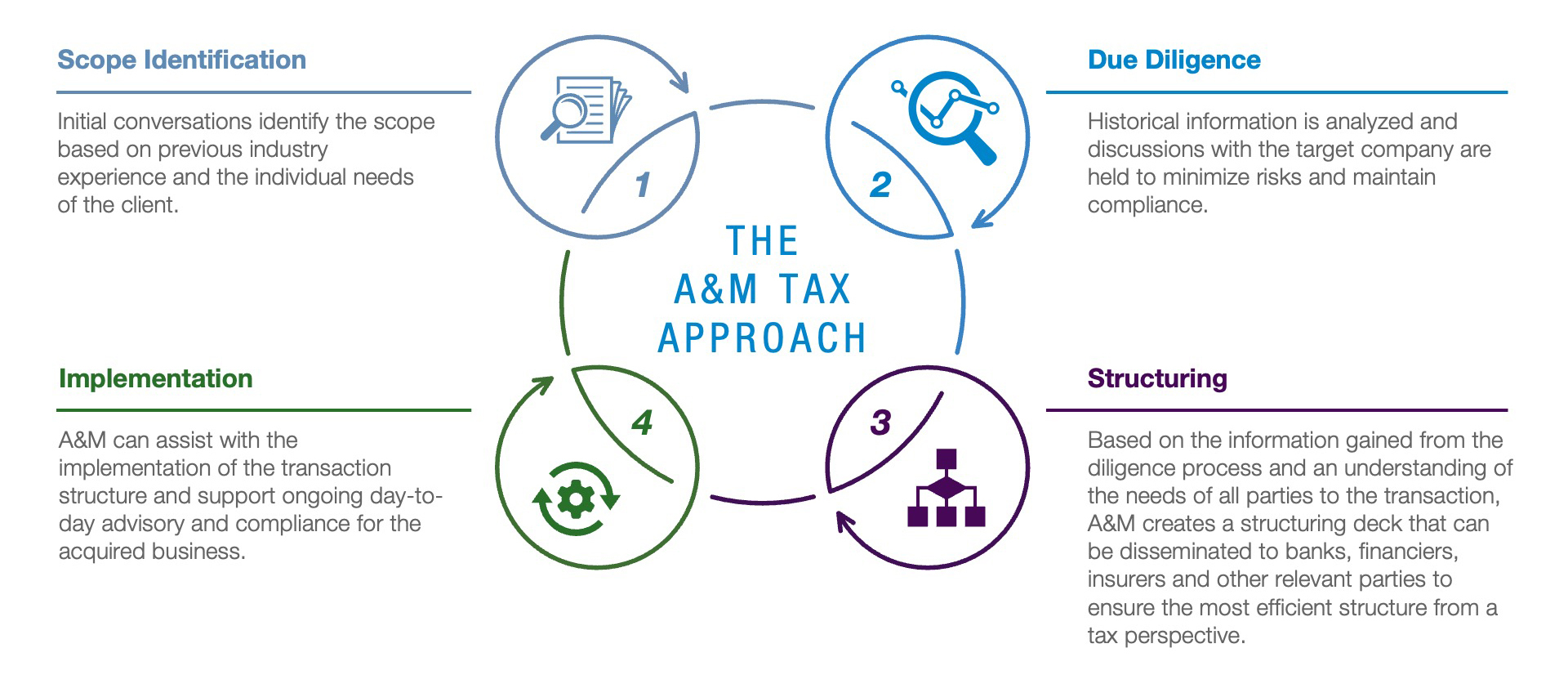

A&M’s Global Transaction Tax Advisory Services team supports clients through the domestic and cross-border tax consequences of making or disposing of investments. The team in Canada helps clients plan for efficient investment and divestment, providing expertise in tax structuring, tax due diligence, model review and transaction documentation review.

BENEFITS

- Reduce risks: Through due diligence and risk allocation, A&M can provide investors with peace of mind surrounding their transactions and investments.

- Create value: Due diligence processes and efficient tax structure designs can identify opportunities to drive value.

- Negotiate insurance: When making an investment in which the warranties and indemnities will be insured by a third party, A&M can assist with the negotiation of the policy from a tax perspective, advise on the tax implications of claims made under the policy and ensure the appropriate allocation of risks in the transaction documentation.

WHY A&M TAX FOR YOUR SOLUTION?

Our transaction and tax experience provides companies with a global perspective that helps them identify and create value throughout the entire investment life cycle .

- Senior-led team: A&M’s engagements are all directly led by senior leadership with cutting-edge thought leadership and technology. Through their hands-on approach, they provide industry experience to clients and deliver both operational and strategic solutions and resources.

- Expertise: We offer deep, global experience in transactions, which allows us to provide services that meet clients’ risk profile and structuring needs and prepare them for cross-border investment.

- Independence: A&M’s Global Transaction Tax Advisory Services team is not an audit firm, giving us the freedom to move nimbly.

- Holistic: We provide end-to-end custom services that span due diligence, structuring, purchase, integration and sale. As a part of the larger A&M group, our team can also connect clients with the right teams for day-to-day support.