Executive Incentive Plan Design Services

Attracting and retaining top-level executive talent is essential for success and begins with providing incentive opportunities that align executives with the interests of other stakeholders. The expert team at A&M can design customized incentive programs to help motivate executives to achieve their company’s goals.

Short-Term and Long-Term Incentive Plan Design

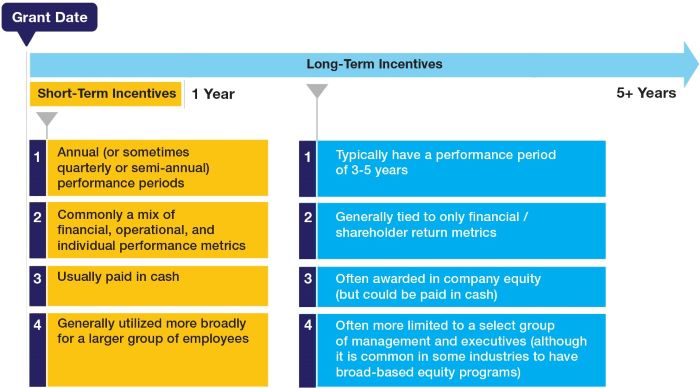

Companies often provide executives both a short-term incentive plan and a long-term incentive plan. While there are many variations of plan design, the table below illustrates some common characteristics of short- and long-term incentive plans.

A&M’s Compensation & Benefits professionals can help companies navigate the complexities of implementing short-term and long-term incentive plans, including the following:

Payout Levels and Mediums

It is critical to determine appropriate levels of incentive compensation for an individual as well as the ideal medium and vehicle given an organization’s specific industry and circumstances. When making these key decisions, it is best to take a holistic approach that balances market factors, a company’s strategic initiatives, and existing internal pay equity and structure. The amount of the potential payout under the program should be meaningful and aligned with market levels for the participant’s role. For more detail on the structure of different long-term incentive vehicles, click here.

Performance Metrics and Goal Setting

Determining the most appropriate incentive metrics is an important consideration in plan design. It’s critical to also ensure that incentive goals are achievable, but not so easy as to guarantee a payout. Otherwise, executives could be demotivated by overly aggressive goals, or not truly incentivized by goals that require too little effort.

Examples of common metrics for short-term incentive programs include goals tied to revenue such as EBITDA (earnings before interest, taxes, depreciation, and amortization), operational performance, and individual performance. For long-term incentive programs, relative total shareholder return (stock price appreciation versus peer companies) or return metrics (e.g., return on invested capital (ROIC)) are common. It is important to align pay and performance by implementing programs that are aligned with industry market practices and, most importantly, a company’s specific goals.

Statistical Modeling

Through modeling, organizations can look at multiple “what-if” scenarios to help determine which incentive metrics work best in their particular industry or environment. It is also important to understand how various decision points impact payouts before the plan is finalized to ensure the plan cost is affordable overall.

Accounting and Tax Considerations

It is crucial to consider the accounting and tax impact when designing and implementing an effective and efficient incentive plan, as the design and operation is often driven by Internal Revenue Code requirements and the accounting treatment. While some forms of incentives may appear to have straightforward tax and accounting implications, companies should ensure they understand the timing and amount of the tax deduction and the tax reporting requirements (e.g., Forms W-2, Form 1099, K-1, etc.) as well as the accounting expense and reporting.

Environmental, Social, and Governance (ESG) Analysis

The increasing focus on ESG performance has dramatic implications for human capital and how companies recruit, retain, and incentivize their workforce. Specifically, companies are taking a hard look at how investment in diversity and inclusion, pay equity, and human capital governance work to help companies not only function effectively, but thrive. Incentive plans can play a key role in attracting a diverse workforce and resolving pay equity issues (internal, gender, racial, etc.) if implemented appropriately.

Incentive Plan Administration and Communication

Effective administration of the incentive plan includes having proper governance controls, documentation of plans and agreements, and reporting for tax and accounting purposes. This requires a high level of coordination between various internal departments (human resources (HR), legal, tax, accounting, etc.) and external advisors. Clear and comprehensive communication to participants is essential to a successful program. This involves communicating the terms of the plan at the outset, and ongoing communication regarding goal achievement, payouts, and vesting events.

What Are the Benefits of A&M’s Executive Compensation Services?

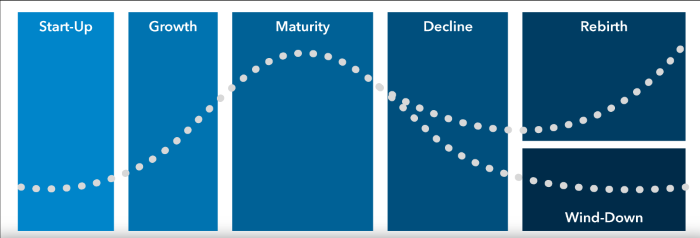

A&M’s broad expertise working with organizations in all phases of a company’s lifecycle – start-up, growth, maturity, decline, and rebirth or wind-down – coupled with our knowledge of market compensation trends, uniquely positions A&M to assist with designing and optimizing incentive plans that meet a company’s needs. A&M can help companies:

- Maximize value: Well-designed incentive plans help motivate executives to achieve key goals and drive organizational growth. A&M assists companies with designing incentive plans that align executives with the interests of other stakeholders ensuring the plans are driving the overall success of the company throughout the company’s lifecycle.

- Remain competitive: It is vital that compensation is aligned with the market in order to retain key employees, especially in today’s ultra-competitive job market. A&M analyzes the latest market compensation data to ensure programs are competitive in size and scope, improving the ability to attract and retain quality candidates in key positions within an organization.

- Mitigate risk during IPOs, mergers and acquisitions, restructurings, and other events: During transformative events, companies must navigate uncharted waters with unfamiliar regulations (e.g., Bankruptcy Code section 503, SEC regulations, Internal Revenue Code section 280G, etc.). A&M has significant expertise in these areas to ensure companies are compliant with these numerous regulatory hurdles while still retaining and incentivizing the necessary talent.

Did you know?

On average, incentive compensation — including annual and long-term incentives — comprises approximately 85 percent of an E&P and OFS executive's total compensation package.