Indonesia’s PMK No. 112 of 2025: Procedures for Implementing Double Taxation Avoidance Agreements

Introduction

On December 30, 2025, Indonesia issued Minister of Finance Regulation No. 112 of 2025 (PMK 112/2025), which entered into force on the date of promulgation. The regulation sets out comprehensive procedures for the application of Double Taxation Avoidance Agreements (DTAAs) in Indonesia, including documentation, administrative processes, withholding obligations and compliance checks required to claim treaty benefits.

PMK 112/2025 builds on and supersedes the earlier procedural framework under Directorate General of Taxes (DGT) Regulations No. PER-25/PJ/2018 (PER 25/2018) and PER-28/PJ/2018 (PER 28/2018) which previously regulated treaty claims primarily through the use of the DGT Form and related documentary declarations. The new regulation reflects Indonesia’s shift from a form-driven treaty access model to a substance-based entitlement framework, in line with international developments under the OECD’s Base Erosion and Profit Shifting (BEPS) standard.

Key Substantive Changes Introduced by PMK 112 of 2025 Compared With PER 25/2018 and PER 28/2018

No. | Particulars | PER 25/2018 and PER 28/2018 | PMK 112/2025 |

|---|---|---|---|

| Implementing Tax Treaty by Domestic Taxpayer | |||

1. | Timeline and Deadlines for Special Form[1]

| PER 28/2018 prescribes a five working days decision period for Special Form approvals and provides rejection/acknowledgement specimen letters.

| The timeline has changed to 10 calendar days.

|

2. | The Certificate of Domicile (CoD) Format[2]

| Requires the name of the transaction counterparty or its Taxpayer Identification Number.

| No longer requires the name of the transaction counterparty or its Taxpayer Identification Number.

|

| Administrative procedures for implementing the Tax Treaty by Foreign Taxpayers | |||

3.

| CoD Validity Period[3]

| The validity follows as stated in the CoD form, maximum 12 months period. If no validity period is stated, it will be considered as invalid CoD.

| As stated in the CoD, maximum 12 months period. A CoD without a stated validity period is assumed to be valid only in the month it was issued.

|

4. | DGT Form Completeness Check[4]

| No requirement for the tax withholders/collectors to check the completeness of the DGT form and the entitlement of the tax treaty benefits.

| Withholders or collectors must not only verify the completeness of a DGT Form but also confirm that the foreign taxpayer is genuinely entitled to treaty relief, including verifying residency status and ensuring no treaty abuse is involved.

|

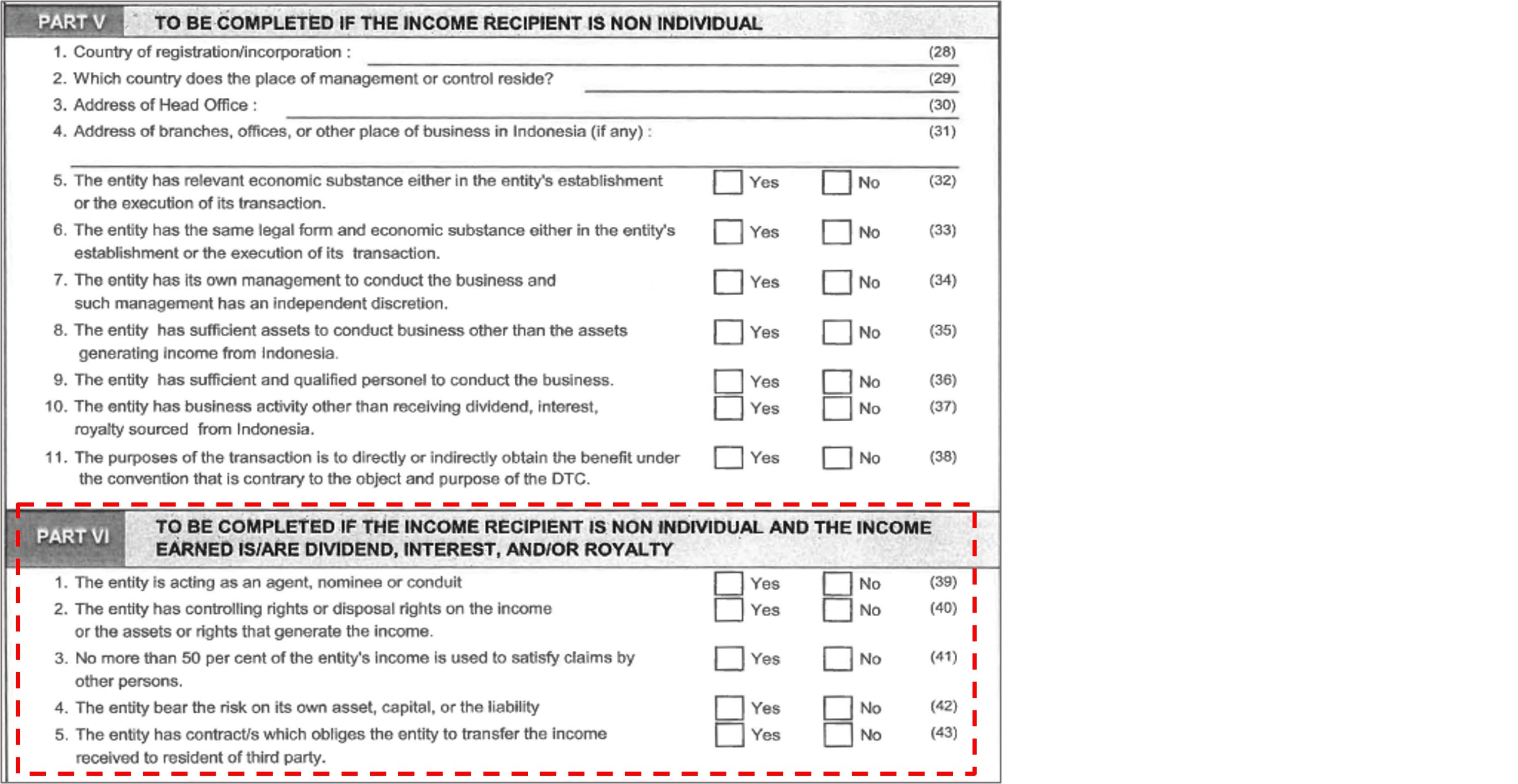

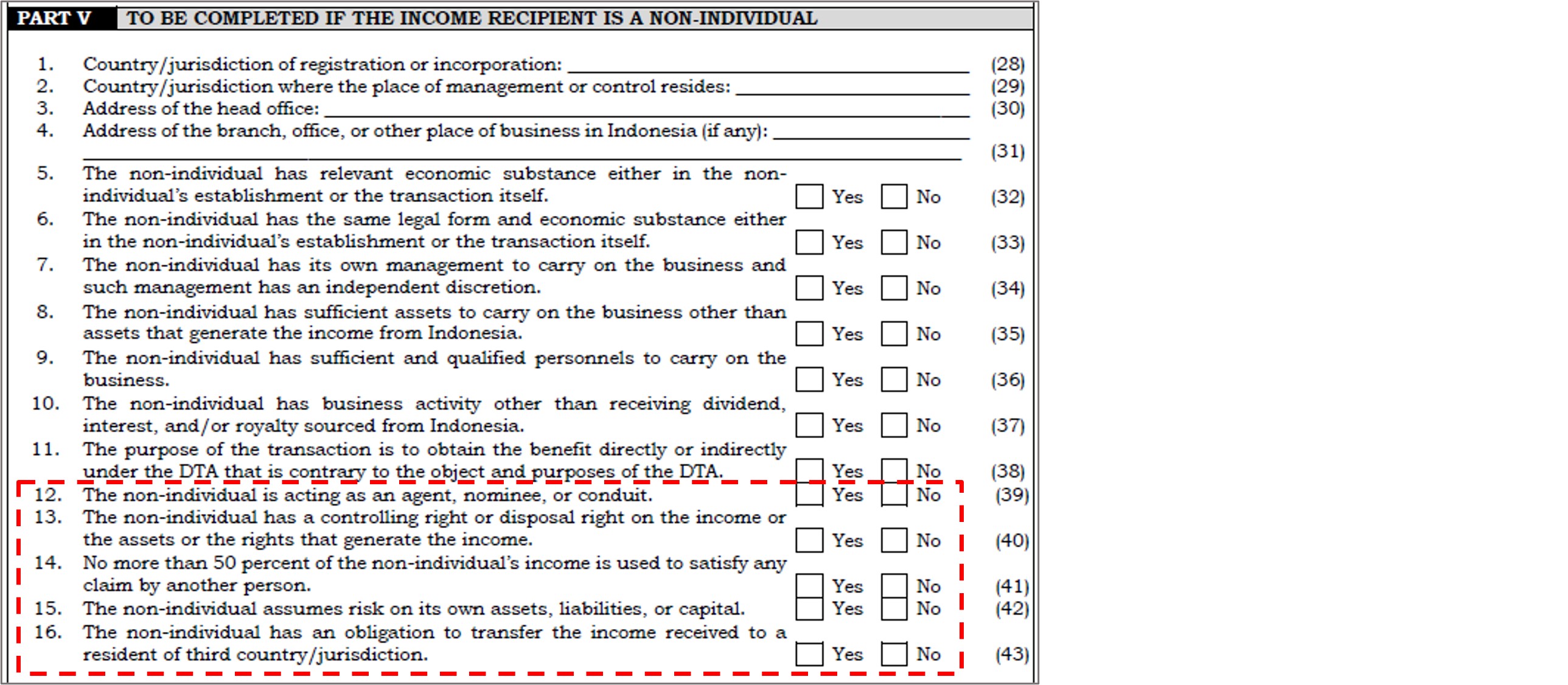

5. | DGT Form Section[5]

| The DGT Form has part VI (Beneficial Owner test), which was completed only by recipients of dividends, interest, and royalties.

| The former standalone Beneficial Ownership (“BO”) section (Part VI) in the new DGT Form has been removed and consolidated into Part V, which all foreign income recipients must now complete (please refer to Appendix 1). The previous requirement of BO questions to be answered in a specific manner no longer applies.

|

6. | DGT Form Submission[6]

| A foreign taxpayer was generally required to submit a valid DGT Form before the application of tax treaty benefits (i.e., prior to withholding/payment). Failure to submit the DGT Form within the prescribed timeframe could result in the denial of treaty benefits, even if the taxpayer was substantively entitled to such benefits.

| PMK 112 of 2025 allows treaty benefits to be granted even if the DGT Form is submitted during an audit, objection, or assessment‑related process, as long as the taxpayer meets substantive eligibility criteria.

|

| Prevention of Tax Treaty Abuse | |||

7. | Requirements to Apply Lower Withholding Tax (WHT) Rates on Dividends[7]

| There is no specific provision in PER 25/2018 on this point, as the applicable withholding tax rate generally follows the relevant tax treaty provisions. The 365-day holding period requirement would only be relevant where the applicable treaty has adopted (or been modified by) the Multilateral Instrument (MLI).

| Where a tax treaty prescribes two dividend WHT rates tied to the level of share ownership, the reduced rate may be used if the corporate WPLN is the beneficial owner of the dividend and satisfies both of the following conditions:

This approach aligns with the concepts reflected in Article 8 of the MLI and Article 10 of the OECD Model. If these criteria are not met, the dividend is subject to the higher treaty rate, assuming the WPLN remains the beneficial owner of the income. |

8. | Taxing Rights on Capital Gains on the Transfer of Shares of Entities With Significant Immovable Properties[8]

| There is no specific provision in PER 25/2018 on this point, as the applicable withholding tax rate generally follows the relevant tax treaty provisions. The 365-day holding period requirement would only be relevant where the applicable treaty has adopted (or been modified by) the MLI.

| PMK 112 of 2025 provides that Indonesia may tax capital gains arising from the transfer of shares or comparable interests in an entity where:

If these criteria are not met, the taxing right over such gains is allocated to the other Contracting State under the applicable treaty. This rule reflects the approach in Article 9 of the MLI and Article 13 of the OECD Model. |

9.

| Anti-Abuse Provisions[9]

| Limited Coverage of Anti-Abuse provisions in the DGT Form.

| PMK 112 of 2025 expanded and formalised anti-abuse regime as follows:

|

10. | PE Guidance[10]

| PER 25/2018 provided limited guidance on PEs.

| PMK 112 of 2025 provides detailed PE guidance and aggregation rules to prevent artificial avoidance of PE status, including:

|

Practical Implications and Operational Impact

- Digitalization of Treaty Claims

The shift to electronic submission and receipt tracking via the DGT portal streamlines compliance but requires system readiness and process updates by taxpayers and withholding agents. - Heightened Substantive Scrutiny

With formal Principal Purpose Test (“PPT”) and Limitation on Benefits (“LOB”) provisions, taxpayers must ensure genuine economic substance and beneficial ownership to avoid denial of treaty benefits. - New Obligations for Indonesian Taxpayers

Domestic taxpayers claiming treaty relief abroad must obtain a Domestic Taxpayer Certificate of Domicile (“SKD WPDN”) and, where applicable, seek Special Form validation adding a new layer of compliance. - Withholding Agent Accountability

Agents must verify eligibility, manage electronic submissions, and retain documentation. Failure to comply may result in tax exposure and penalties. - Audit and Enforcement Readiness

The DGT’s enhanced authority to test compliance post-filing increases the importance of robust documentation and internal treaty claim reviews.

Immediate Actions for Taxpayers and Withholding Agents

- Map all cross-border payments currently claiming treaty relief and assess whether updated documentation is required

- Review and update internal process workflows to ensure capability to receive, verify and store DGT Forms/Certificates of Domicile, including electronic receipts via the taxpayer portal.

- Update withholding procedures to incorporate enhanced verification steps and required electronic reporting.

- Reassess entity structures and routing arrangements for PE, conduit, and beneficial-owner risk; gather supporting substance evidence where treaty benefits are claimed.

- Prepare internal template responses and applications (Domestic Taxpayer Domicile Certificate; Special Form approval requests) consistent with the regulation’s attachment specimen formats.

- Train relevant teams on the new electronic submission process and portal usage.

A&M View

From A&M’s perspective, PMK 112/2025 represents a regulatory shift toward substance‑over‑form in determining treaty entitlement, strengthening Indonesia’s anti‑abuse safeguards through the integration of several anti-abuse measures and compliance testing (e.g., beneficial‑ownership analysis, LOB, PPT, PE guidance, conduit rules and detailed substance indicators). The regulation increases the DGT’s ability to test and deny treaty benefits where structures lack genuine commercial rationale, aligning domestic practice more closely with OECD BEPS standards.

At the same time, PMK 112/2025 appears to incorporate a number of MLI-style concepts in a manner that may extend beyond the text of certain bilateral treaties, including by introducing requirements or thresholds that are typically relevant only where a treaty has been modified by the MLI. Examples include:

- 365-Day Ownership Requirements: The regulation introduces a 365-day minimum holding period for accessing the reduced dividend rate and a 365-day lookback test for determining whether an entity is “immovable-property-rich” for capital gains purposes. While these concepts originate from MLI Article 8 and Article 9, PMK 112/2025 does not expressly limit their application to treaties covered by the MLI. This may create interpretive tension for treaties that are not MLI-modified and do not contain a 365-day ownership clause.

- “Closely Related Persons” Definition: PMK 112/2025 adopts a “closely related persons” concept based on control/ownership (more than 50%) or common control, which mirrors the MLI approach (including for the application of rules on specific activity exemptions and contract splitting).

- Contract Splitting Rule: PMK 112/2025 also reflects the MLI contract splitting concept by requiring aggregation of presence days across a WPLN and its closely related persons where each presence exceeds 30 days, if the projects are carried out at the same site, in determining whether the relevant time threshold is met.

These unilateral insertions may give rise to disputes as to whether Indonesia is applying treaty conditions beyond what is stipulated in the relevant bilateral treaty text. Accordingly, taxpayers should monitor the DGT’s implementation practice and ensure they are prepared to evidence treaty residence, beneficial ownership, and economic substance, alongside the commercial rationale for the arrangement.

How A&M Can Help

A&M is well positioned to support clients in navigating the new treaty relief framework under PMK 112/2025. Our team can assist with end-to-end treaty compliance diagnostics, including mapping cross-border payments, reviewing documentation workflows, and assessing beneficial ownership and substance risks. We help clients design robust processes for DGT Form preparation and electronic submission and support Indonesian taxpayers in obtaining WPDN CoD and Special Form approvals. In the event of audits or disputes, A&M offers strategic advisory and defence support to safeguard treaty positions and minimize exposure. Our goal is to ensure clients remain compliant, efficient, and well-prepared under the new regulatory regime.

Appendix 1 – Changes to the DGT Form

Under PER 25/2018 (old) – partial screenshot

Under PMK 112/2025 (new) – partial screenshot

[1]Article 7 of PMK 112/2025

[2]Article 4 of PMK 112/2025

[3]Article 9 of PMK 112/2025

[4]Article 10-14 of PMK 112/2025

[5]Article 8 of PMK 112/2025

[6]Article 17(2) of PMK 112/2025

[7]Article 20 of PMK 112/2025

[8]Article 21 of PMK 112/2025

[9]Article 27-29 of PMK 112/2025

[10]Article 22-26 of PMK 112/2025