Malaysia Budget 2026: The Rakyat’s Budget

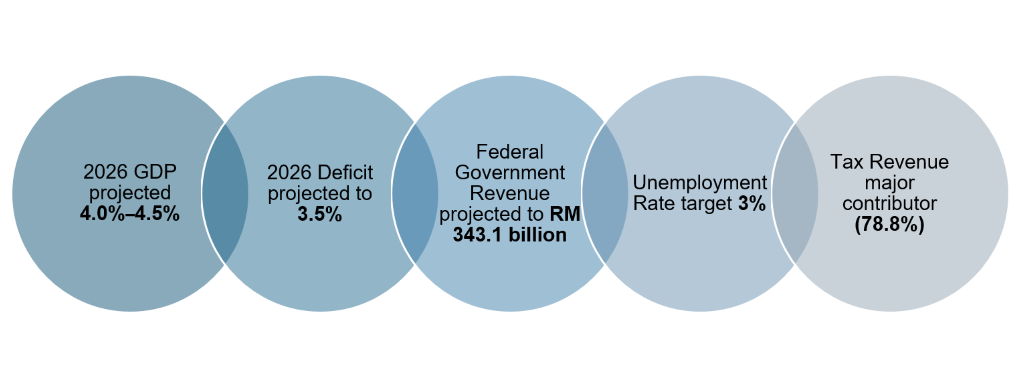

Prime Minister Anwar Ibrahim recently announced the Malaysia Budget 2026 on 10 October 2025 (the 2026 Budget),[1] with emphasis that the government continues its commitment toward building a high-value, innovation-driven, and fiscally disciplined economy, while maintaining an expansionary stance to sustain growth momentum, in alignment with the 13th Malaysia Plan.

We have seen the various tax changes announced in recent years, such as e-invoicing, the expansion of Sales and Service Tax (SST) scope, and the implementation of stamp duty self-assessment, which would support compliance and the growth of tax revenue.

Malaysia Budget 2026 signals a strategic shift toward industrial upgrading, digital transformation, and sustainable economic growth. Major allocations were channeled into high-value sectors such as semiconductors, artificial intelligence (AI), green energy, and the broader digital economy—steps clearly positioning Malaysia to capture the next wave of global supply chain realignments.

A few of the notable announcements in Malaysia Budget 2026 are discussed below:

|

|

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

To strengthen Malaysia’s role as a regional hub, the government introduced several facilitation tools, including the ABE framework, Investor Pass, and Residence Pass – Talent Fast Track. These initiatives are designed to ease cross-border investment, improve talent mobility, and attract multinational and high-technology players seeking a stable base in Southeast Asia.

It was also announced that the JS-SEZ has secured RM 37.1 billion in approved investments in just the first half of 2025, which accounts for 66% of Johor’s total. Moreover, it has already attracted an additional RM 29 billion in new investment commitments.

Under the Single-Family Office Incentive Scheme in the FCSFZ, six family offices with nearly RM 400 million in AUM have already been approved in under a year. A further 30 family offices have expressed interest, putting Malaysia on track to reach RM 2 billion in AUM by end-2026. The relevant tax statutory orders were gazetted on 3 October 2025 to provide attractive tax exemptions and reliefs with the aim to boost FCSFZ as a premier hub for SFOs, wealth management, and high-value investment activities.

Malaysia is positioning itself to be future-ready by making bold, strategic investments in high-value industries. Through the NIMP Industry Development Fund (NIDF), the government is funding industry development programmes in pharmaceuticals, semiconductors, AI, digitalisation, and sustainability, and thereby laying the foundation for higher productivity, technological leadership, and long-term competitiveness. Furthermore, Malaysia has secured investments in the field of AI and data centres from global technology giants, notably:

- Microsoft has developed the Western Malaysia Cloud Region and established the Microsoft National AI Innovation Centre.

- Google is building a new data centre in Selangor and hosting AI training for civil servants.

- AWS is supporting SME digitalisation through machine learning and big data analytics.

In a global landscape defined by uncertainty and intensifying competition, Malaysia’s response is a forward-looking, resilience-driven growth strategy. The focus is on accelerating innovation, creating quality employment, embedding AI across sectors, deepening ASEAN integration, strengthening economic security, and revitalising tourism ahead of Visit Malaysia 2026 to spur services-led growth.

Therefore, Budget 2026 is clearly designed to deliver on the three pillars of Ekonomi MADANI:[2]

- Driving Reform, especially in governance, transparency, and institutional strength;

- Raising the Ceiling by driving national growth through high-tech and high-impact investments; and

- Raising the Floor by uplifting living standards and broadening economic participation.

Taken together, these initiatives signal a clear intention: Malaysia is not just preparing for the future—it is taking action to shape it.

Meanwhile, a summary of the key tax highlights announced in Malaysia Budget 2026 is outlined below:

Budget 2026 Tax Proposals | Proposed Changes | A&M Comments |

|---|---|---|

| Review of Tax Exemption on Income Received from Outside Malaysia (Foreign Sourced Income) |

| This gives policy certainty and long-term planning visibility for entities in Malaysia and will encourage repatriation of foreign income without concerns of facing punitive tax costs. |

| Expansion of income tax deduction for cost of listing on Bursa Malaysia |

| The extension and expansion of the listing cost tax deduction is a strong incentive for more Malaysian companies to go public, signaling long-term support for capital market development. |

| Accelerated Capital Allowance (ACA) on Capital Expenditure for Plant, Machinery and ICT Equipment |

| This is aligned with other ACAs to encourage companies to invest in upgrading, further promoting domestic investment. The push for digitalization will be beneficial for manufacturers, tech, and services sectors upgrading infrastructure. |

| Review of Wage Threshold for Stamp Duty Exemption on Employment Contracts |

| The government is aware of the administrative burden and costs for stamp duty compliance, and this proposal is especially beneficial for SMEs and sectors that hire large numbers of entry-level or lower-to-middle income employees. |

Tax Incentive for Training in AI

|

| This incentive will encourage AI upskilling and adoption, supporting workforce readiness in digital transformation. Together it is aligned with other AI developments in the country. |

Tax Incentive for Organising Meetings, Incentives, Conventions, and Exhibitions (MICE)

|

| In conjunction of the upcoming Visit Malaysia Year 2026, the government has introduced incentives to supports tourism, MICE, and service industries. |

| Tax Incentive for Food Security Projects |

| Malaysia remains a net food importer, and recent global supply chain disruptions have exposed vulnerabilities in food availability and price stability. The government is actively encouraging private sector participation, investment, and innovation in agriculture—ensuring national self-sufficiency. |

| Tax Incentive for Venture Capital |

| This reform is overdue for an update, and this incentive is intended to strengthen Malaysia’s VC ecosystem and Malaysia’s ability to attract and retain early-stage funding. |

Budget 2026 reinforces Malaysia’s commitment to fiscal discipline and long-term economic transformation, with a strong emphasis on high-value, innovation-driven, and sustainable growth. The government’s focus on advanced manufacturing, digitalisation, AI, green energy, and regional investment facilitation underscores its determination to position Malaysia as a leading hub for technology, talent, and investment. Additionally, Malaysia’s strategic location, skilled workforce, supportive government, and thriving tech ecosystem create exceptional business opportunities, positioning Malaysia as an ideal destination for businesses to thrive in the heart of Southeast Asia.

How A&M Can Help

If you need to deep dive on any aspects of the Malaysian Budget 2026 proposal or discuss opportunities of doing business in Malaysia, please contact us.

Important: The above is a discussion of the key tax measures announced in the Malaysia Budget 2026. These are subject to final legislation, the enactment of which may lead to a different outcome or result from the statements herein.

[1]Government of Malaysia, Budget Official Website, “Budget 2026 Documents,” proposal period ended September 30, 2025.

[2] Ministry of Finance Malaysia, Pre-Budget Statement 2026: Pre-Budget Statement 2026.