Why a Tax Strategy Turns Obligations Into Opportunities

Tax functions are under pressure. Authorities regularly overhaul rules and tighten reporting requirements for global groups. Against this backdrop, the market is flooded with “solution-focused” offerings, all promising a quick fix for your latest compliance headache. But taking a purely reactive approach without a tax strategy can leave you disconnected, with processes and technology that do your tax function more harm than good.

A clear, cohesive tax strategy is the real answer. Rather than letting urgent obligations dictate investment, a robust strategy empowers you to orchestrate solutions holistically, preserve budget and momentum, and transform your tax function from a cost center into a genuine business asset.

Your tax strategy doesn’t just act as an internal playbook, it’s your window to the outside world. The tax authorities, external auditors and even investors now expect a strategy to be presented on request. In some jurisdictions, delivering on this holistic view isn’t optional – as many authorities across the world shift their focus to looking at tax in a wider context, publishing a tax strategy document is the law.

The Problem: Reactivity Breeds Inefficiency

As governments race toward digital globalization, tax teams can struggle simply to remain compliant. Under pressure to “do something now,” it’s easy to turn to the latest off-the-shelf tool, hoping for a quick fix. When solutions are driven by urgency rather than vision, data silos proliferate, processes overlap, and technology stacks fail to integrate. Months — or even years — later, these patchwork tax operations will be slower, less accurate and infinitely harder to govern.

The Answer: START With Strategy

Deploying a tax strategy is like drafting an architectural blueprint. It aligns stakeholders around a shared vision, ensures every investment contributes toward long-term goals, and enables prioritization of high-impact quick wins without losing sight of the final picture.

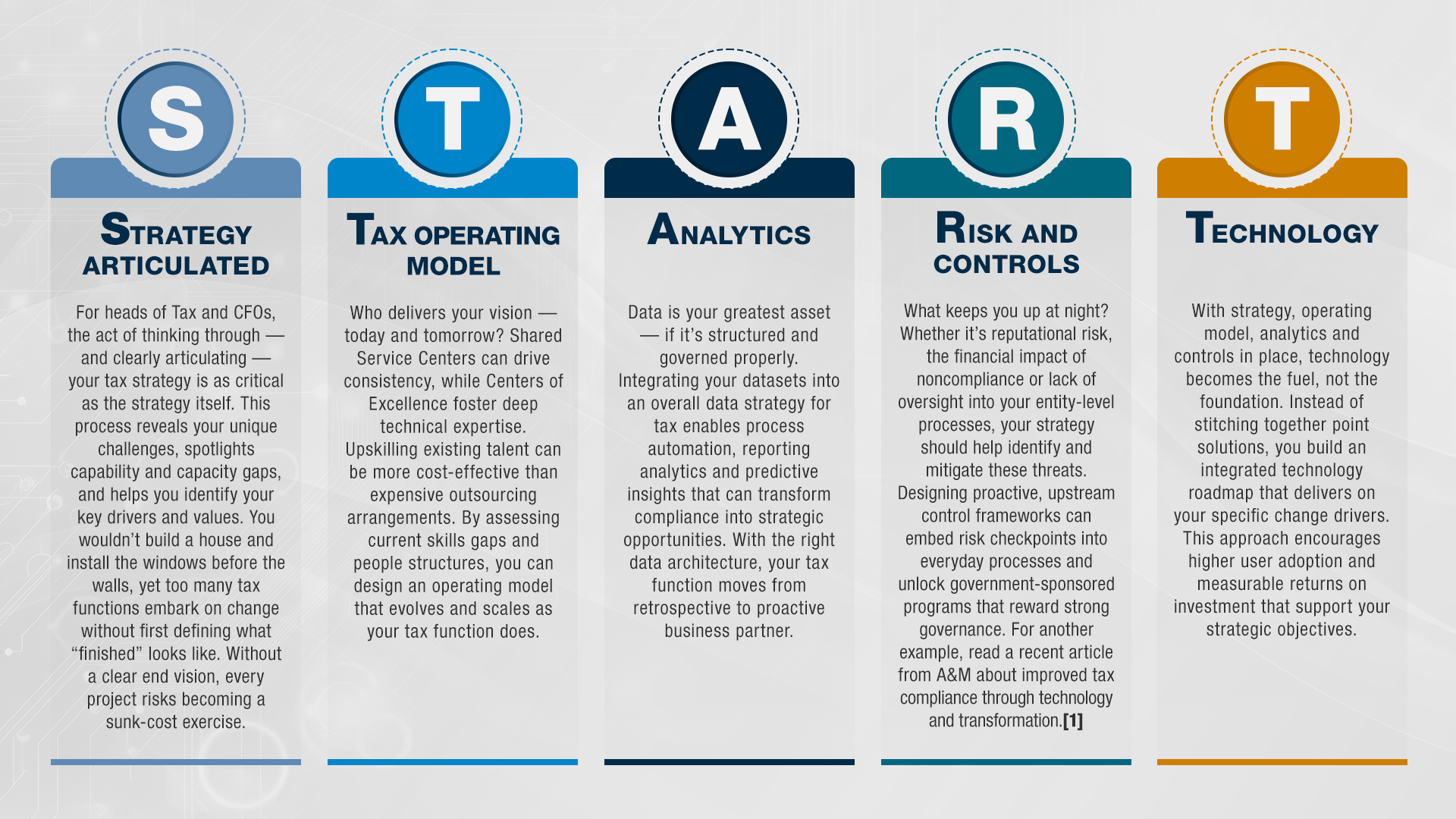

The START (Strategy, Tax Operating Model, Analytics, Risk and Controls, Technology) framework can be a useful way to make sure all aspects of a successful strategy are considered:

But Why Do It?

- From Cost Center to Asset. A deliberate tax strategy transforms your function from a compliance center into a value-generating partner.

- Unified Direction. Clear strategic goals give your team purpose and improve retention by showing everyone where they fit in the future organization.

- Technology Done Right. When incremental technology investments adhere to an overall architecture, you eliminate rework, minimize maintenance and encourage seamless integration.

- Holistic Solutions. Aligning data, risk, technology and people ensures you’re guided by strategic insights — not just the latest regulatory obligation.

How A&M Can Help

We don’t capitalize on your compliance burden to sell you the latest packaged solution. Instead, we partner with you to:

- Brainstorm Your Tax Strategy. From ideation workshops to executive alignment, we get the vision out of your head and onto paper.

- Fill In the Gaps. Whether you need support on assessing which operating model best suits your vision, advice on data-architecture design, or change-management support so your transformation sticks, we can provide guidance to create a strategy that is unique to you.

- Communicate and Execute. We help you build compelling investment cases, articulate your journey to your team, and deliver transformation with minimal disruption.

So why not embrace the power of purpose-driven tax strategy? Turn your obligations into opportunities, build a resilient tax function, and unlock new avenues for competitive advantage.

Contact A&M today to begin your journey from reactivity to strategic foresight.

[1] Sylvain Vivion, “Improved Tax Compliance Through Technology and Transformation,” Alvarez & Marsal, April 15, 2025, https://www.alvarezandmarsal.com/thought-leadership/improved-tax-compliance-through-technology-and-transformation