The 2026 Transformation Imperative- Integrated Strategies for Hospitals, Health Systems and Provider-Sponsored Health Plans

The next 12–18 months will be pivotal for hospitals and health systems as the current healthcare landscape is being shaped by regulatory, operational, and financial pressures that demand transformative strategies.

Successful organizations will treat 2026 as an inflection point—simplifying enterprise portfolios, restructuring operations, and determining how to continue serving communities in a financially sustainable manner. Health systems that embrace this moment as an opportunity will emerge stronger and more resilient, positioned to thrive in a changing market.

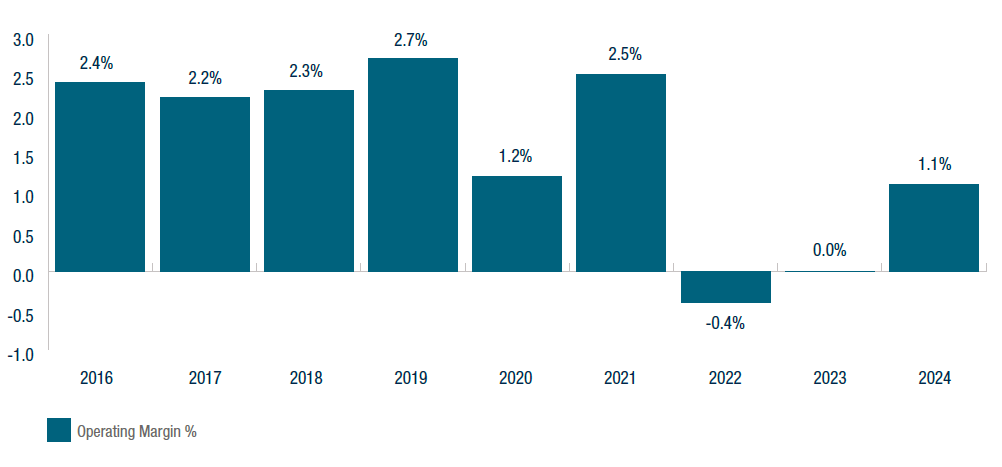

S&P US Not-for-profit Healthcare System Medians

“U.S. Not-For-Profit Health Care System Median Financial Ratios—2024,” S&P Global, August 7, 2025, accessed August 13, 2025.

Industry Pressures Setting the Strategic Agenda for 2026

The healthcare industry has been operating on razor thin margins in a challenging environment for many years, as illustrated above. Looking ahead to 2026, several powerful forces are emerging that demand heightened strategic focus and coordinated action:

Regulatory Landscape

The “Big Beautiful Bill” (BBB) is expected to increase the number of uninsured patients due to cuts to Medicaid and to the ACA Marketplace provisions forcing hospitals to absorb the costs of treating these patients. The BBB threatens to deepen financial instability and unleash major operational disruptions, pushing many hospitals and health systems beyond their capacity to absorb the impact.

Payer Dynamics

Expanding risk contracts, Medicare Advantage pressures, and rising denials necessitate stronger payer strategies. Changes to existing Medicaid programs will reshape funding and compliance requirements. Even historically favorable commercial contracts must be reexamined to determine whether they can withstand the mounting cost pressures facing hospitals and health systems.

Provider-Sponsored Health Plans (PSHPs)

Many health systems own or sponsor health plans with the intent of capturing premium dollars, diversifying revenue, and advancing integration. While a small handful of systems have achieved scale and stability, the majority of PSHPs have become financial anchors rather than strategic bridges. Reported losses at many health systems illustrate how subscale plans can drain liquidity, freeze hundreds of millions in reserves under risk-based capital rules, and weaken system credit outlooks. Rating agencies now routinely cite PSHP performance in negative reviews, recognizing that hospital and plan economics are not offsetting, but cumulative. The fundamental tension is structural: Hospitals generate margin from volume, while health plans seek to limit utilization. For most systems, PSHPs are consuming capital at the very moment hospitals face their greatest margin pressures in decades. Decisions about whether to double down, partner, consolidate, or exit are no longer optional—they are urgent capital allocation choices that will determine enterprise viability.

Margin Pressures

Hospitals and health systems are facing unprecedented margin pressures driven by a perfect storm of rising labor, drug, and supply costs. At the same time, access to capital has become increasingly limited, making it harder for organizations to invest in infrastructure, technology, or growth. These financial headwinds are compressing already thin margins and threatening the long-term viability of hospitals and health systems across the country. Additionally, care delivery is shifting from inpatient to outpatient settings, requiring hospitals to rethink traditional operating models and adapt to a lower-reimbursement environment particularly as site neutrality policies expand and drive down reimbursement in hospital outpatient departments.

Data and AI Inflection

While emerging technologies offer transformative potential—automating workflows, reducing care variation, and enhancing financial operations—the challenges lie in adopting them effectively as transformation enablers and in not creating additional organizational distractions. Organizations must integrate AI into clinical and administrative processes without disrupting care delivery and while ensuring data quality, interoperability, and compliance. The stakes could not be higher: Without effective use of data and AI, health systems will be challenged to keep up with rising operational complexities and risk negative impacts to both care delivery and financial performance. The reality is that effective data and AI adoption is a requirement to compete in an increasingly data-driven market.

Pillars of Transformation

To address these challenges, four major pillars of transformation will define success in 2026:

- Financial Resilience and Enterprise Management

- Payer Strategy and Consumer-Centric Innovation

- Care Delivery Optimization

- Digital Adoption and Operational Transformation

How A&M Can Help

Alvarez & Marsal’s Healthcare Industry Group partners with hospitals and health systems to navigate inflection points with clarity and speed. Our experienced operators and transformation specialists bring proven playbooks to strengthen enterprise resilience, redesign care delivery models, and drive measurable financial recovery. We work alongside boards and executives to align payer strategy, optimize cost structures, and embed digital and AI capabilities that unlock sustainable performance.

The time to act is now. Discover how your organization can turn today’s pressures into a strategic advantage—positioning to thrive in 2026 and beyond.